[ad_1]

After Jerome Powell raved in regards to the robust US labor market and oddly ignored the staggering crowding-out of US curiosity funds on its huge debt, the US Treasury’s 3-year debt public sale was … a Hinderburg second.

First, the excessive yield at at present’s public sale of 3-year Treasury notes was 4.073%. This occured because the allotment to brokers and sellers collapsed together with M2 Cash progress YoY.

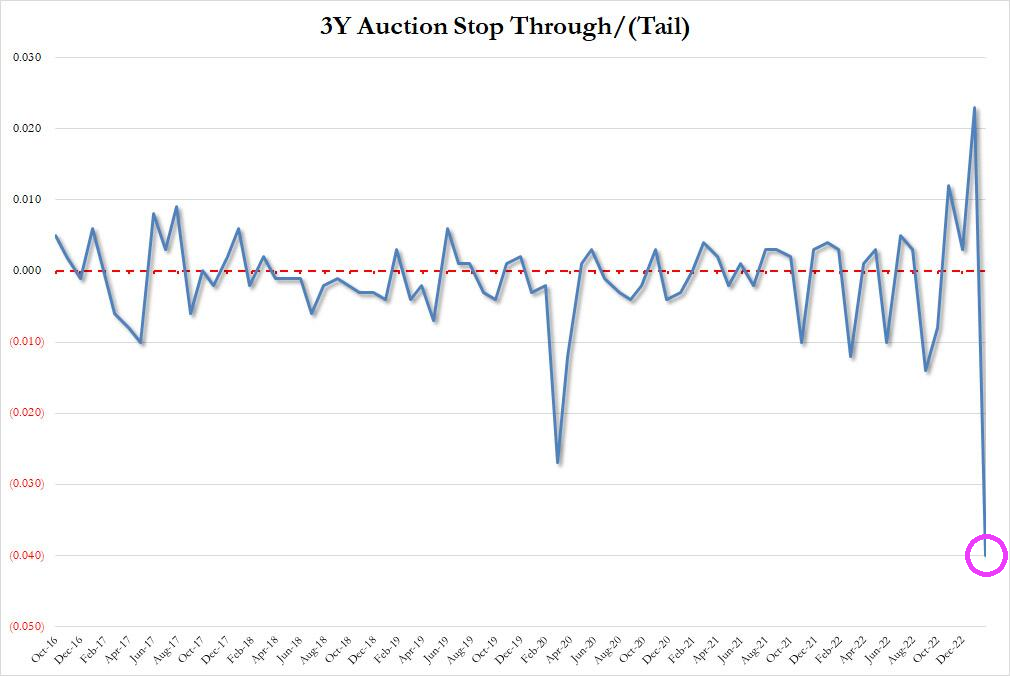

Then we’ve got this horrible chart of the 3Y public sale cease via, crashing into uncharted waters. A stop-through signifies when the best yield the Treasury offered within the public sale is beneath the best yield anticipated when the public sale started – the “when issued” stage.

Right here is the remainder of the public sale story.

[ad_2]