[ad_1]

US jobs development slowed for a fifth consecutive month in December after the Federal Reserve’s aggressive rate of interest rises squeezed financial exercise even because the US labour market remained traditionally tight.

The world’s largest economic system added 223,000 jobs within the last month of 2022, decrease than the downwardly-revised 256,000 improve registered in November and properly under final yr’s peak of 714,000 in February. Most economists had anticipated a 200,000 improve.

Following December’s improve, month-to-month jobs development averaged 375,000 in 2022. The variety of jobs added has fallen each month since August.

Regardless of the slowing of the tempo of jobs development, the labour market nonetheless exhibits a resilience that may most likely compel the Fed to proceed elevating rates of interest this yr.

The unemployment price unexpectedly fell to three.5 per cent, reverting to a historic low, knowledge launched by the Bureau of Labor Statistics confirmed.

“That is nonetheless a really tight labour market,” mentioned Veronica Clark, an economist at Citigroup. “For an economist, a low unemployment price [is] future upside dangers for wages.”

Nonetheless slowing wage development in December helped to ignite a inventory market rally as buyers guess the Fed wouldn’t have to be as aggressive with its coverage tightening in the long run. Shares had been additional buoyed by a pointy drop in companies exercise, in line with ISM knowledge launched on Friday. The S&P 500 was up 1.6 per cent in late-morning buying and selling in New York, whereas the Nasdaq Composite was up 1.4 per cent.

The 2-year Treasury yield, which is delicate to modifications in rate of interest expectations, slid 0.19 proportion factors to 4.26 per cent, marking a pointy rise within the worth of the debt instrument. The yield on the benchmark 10-year Treasury notice, seen as a proxy for borrowing prices worldwide, fell 0.14 proportion factors to three.58 per cent.

The US central financial institution is actively making an attempt to chill down the labour market and curb demand for brand new hires because it seeks to alleviate worth pressures which have pushed inflation to multi-decade highs. Since March, the Fed has raised its benchmark coverage price from near-zero to only under 4.5 per cent in one of the crucial aggressive campaigns in its historical past.

Whereas the worst of the inflation shock seems to have handed, worth pressures have taken maintain within the companies sector of the economic system. In an interview with the Monetary Occasions this week, Gita Gopinath, the primary deputy managing director on the IMF, urged the Fed to “keep the course” by way of tightening, arguing that inflation within the US has not “turned the nook but”.

In remarks delivered on Friday, Lisa Cook dinner, a Fed governor, cautioned in opposition to “placing an excessive amount of weight” on current inflation knowledge she mentioned regarded “beneficial”. She mentioned she is “preserving shut tabs” on labour prices, which she mentioned are essential to the long run trajectory of inflation.

Amid a employee scarcity that Fed officers warn won’t be simply reversed, wage development remains to be working at a tempo far out of step with the Fed’s 2 per cent inflation goal.

In December, common hourly earnings climbed one other 0.3 per cent, lower than anticipated and slower than the earlier interval, which was revised decrease. On an annual foundation, it’s up 4.6 per cent. The labour pressure participation price, which tracks the share of Individuals both employed or on the lookout for a job, was little modified at 62.3 per cent.

Peter Williams at Evercore mentioned the wage knowledge ought to give the Fed “consolation that inflationary pressures have peaked”.

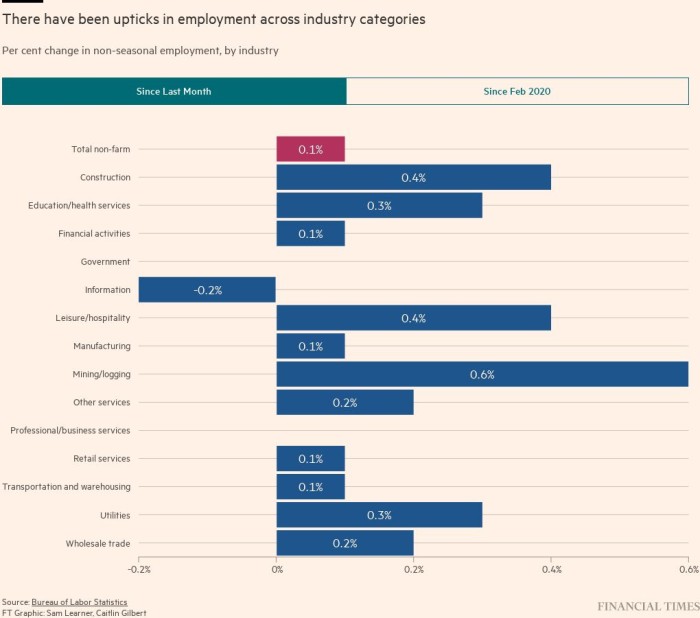

The biggest job features occurred within the leisure and hospitality sector, with 67,000 positions added in December. Healthcare employment rose by 55,000, whereas the development business gained 28,000 jobs.

Among the many sectors with minimal employment features had been retail, manufacturing and transportation and warehousing.

In an announcement launched after the report, president Joe Biden mentioned the newest jobs features replicate “a transition to regular and secure development”.

“These historic jobs and unemployment features are giving staff extra energy and American households extra respiration room,” the US president mentioned, amid a “cost-of-living squeeze”.

Policymakers on the Fed have acknowledged that stamping out inflation would require job losses and in flip the next unemployment price. In accordance with the newest particular person projections revealed by the Fed, most officers see the unemployment price rising as excessive as 4.6 per cent this yr and subsequent because the benchmark coverage price surpasses 5 per cent and is held there for an prolonged interval.

“Holding [above 5 per cent] till we get proof that inflation is definitely coming down is actually the message we’re making an attempt to place on the market,” Esther George, the outgoing president of the Kansas Metropolis Fed, mentioned on Thursday.

Placing an analogous tone this week, Neel Kashkari of the Minneapolis Fed mentioned he expects the central financial institution to lift the federal funds price by one other proportion level over the approaching months. He can be a voting member on the policy-setting Federal Open Market Committee this yr.

Merchants in federal funds futures broadly anticipate the Fed to advance in direction of that so-called “terminal” stage in smaller increments than the half-point and 0.75 proportion level rises it has used all through this tightening marketing campaign. In accordance with CME Group, the percentages of a quarter-point price rise on the February assembly presently stand at 65 per cent.

Ought to the Fed comply with by means of with its plans, economists warn extra materials job losses could possibly be on the horizon. These polled final month in a joint survey by the FT and the Initiative on International Markets on the College of Chicago Sales space Faculty of Enterprise forecast the unemployment price reaching at the very least 5.5 per cent subsequent yr because the economic system suggestions right into a recession.

Extra reporting by Harriet Clarfelt in New York

[ad_2]