[ad_1]

At a time after we are already effectively into the Fed’s tightening cycle, inflation is excessively excessive, the yield curve is inverted in a means it hasn’t been in virtually 50 years (an indication of recession) and a few company valuations will not be far off 2021 ranges, merchants could also be questioning what’s going to occur with the US500. A easy (and even shocking reply) is that traditionally, the US500 doesn’t go constantly down till the Jobless Claims go up.

After all issues are far more sophisticated than that: this might probably be certainly one of many elements concerned and relation doesn’t imply causation (and never even correlation). Nonetheless, traits need to be noticed; in any case, holding issues easy is among the greatest methods to actually perceive them.

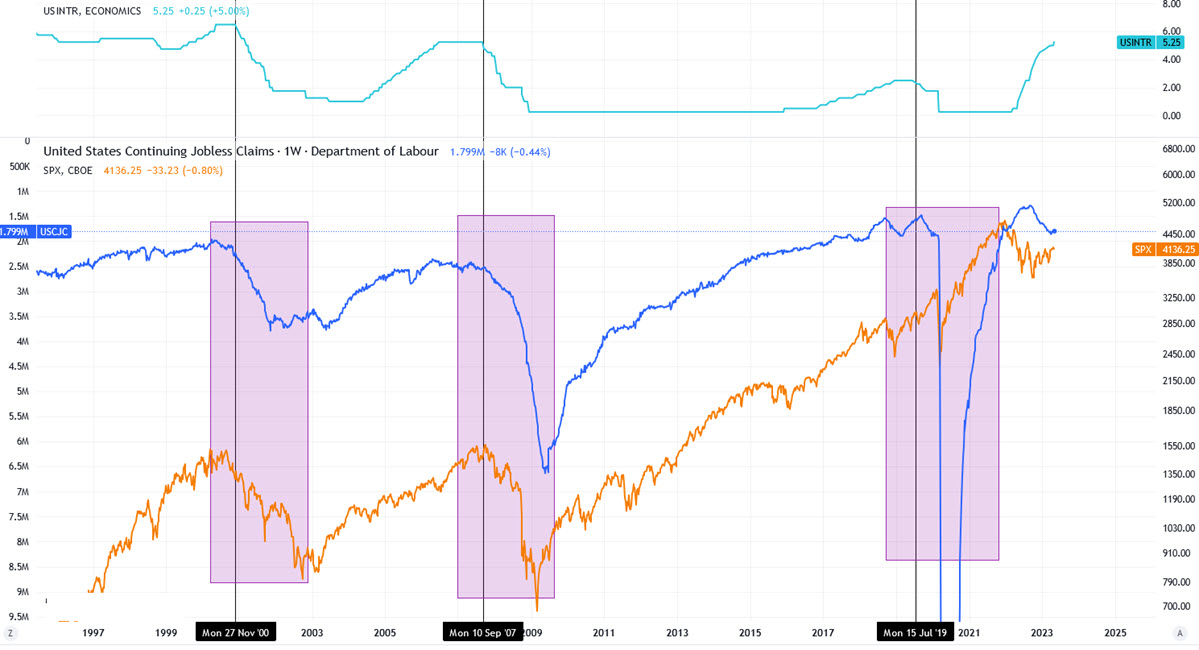

Persevering with Jobless Claims (inv.), US500, US Official Curiosity Charges (higher panel)

The chart above reveals 3 time sequence all collectively: within the higher panel, the official US rate of interest; within the decrease panel, the US500 (orange, logarithmic scale) and the Persevering with Jobless Claims (blue, inverted). Ranging from this latter panel, it’s shocking how precisely the US500 collapsed when steady claims had been rising strongly in Nov 2000, Aug 2007 and Fall 2019. Within the first 2 circumstances it’s also hanging how concurrently claims stabilised, so did the US500. If we appeared on the preliminary claims, they might be much more correct in indicating the beginning of a decline and would start to enhance earlier than the index would backside.

What’s equally fascinating is to take a look at the highest panel and the US official rate of interest. This, over the past 25 years not less than, has all the time reached a cycle high earlier than the financial and inventory market scenario worsened. On this sense we will draw one other helpful conclusion concerning the present atmosphere.

However the place is the labour scenario heading?

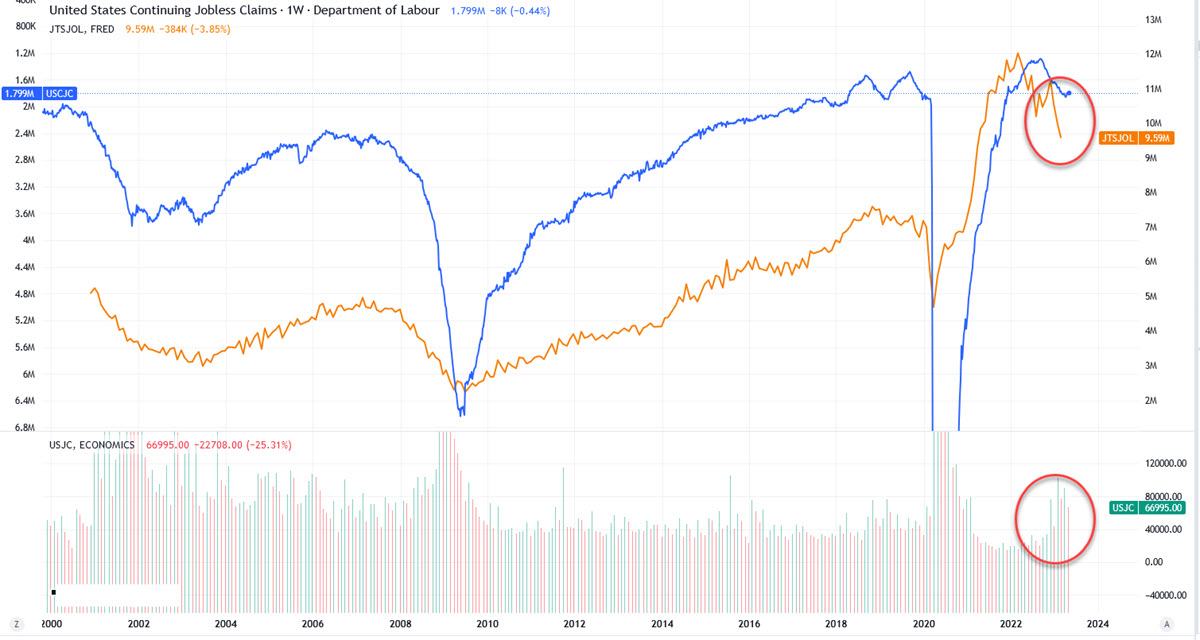

Persevering with Claims (inv.) , Job Openings, Job cuts (decrease panel)

This time we have now US job openings (in orange) and, within the decrease panel, US job cuts (Challenger Job Cuts) to the chart. Jobless Claims have remained secure in current months at round 1,800k after a small enhance within the quantity that began final autumn. That is the headline information. BUT each Job Openings have dropped by 384,000 to 9.6 million in March 2023 (constantly down from the 12 million print in early 2022) and US-based employers introduced 66.995K Job Cuts in April of 2023 (on the rise beginning late 2022).

Which means that all that glitters will not be gold: though the frequent narrative continues to be that of a really robust and tight labour market, issues are getting worse underground, an element that ought to be taken into consideration when defining a macro situation.

Persevering with Claims are anticipated to remain flat versus the earlier week, at 1.799k; preliminary consensus is for a 245k print, barely above final month’s quantity.

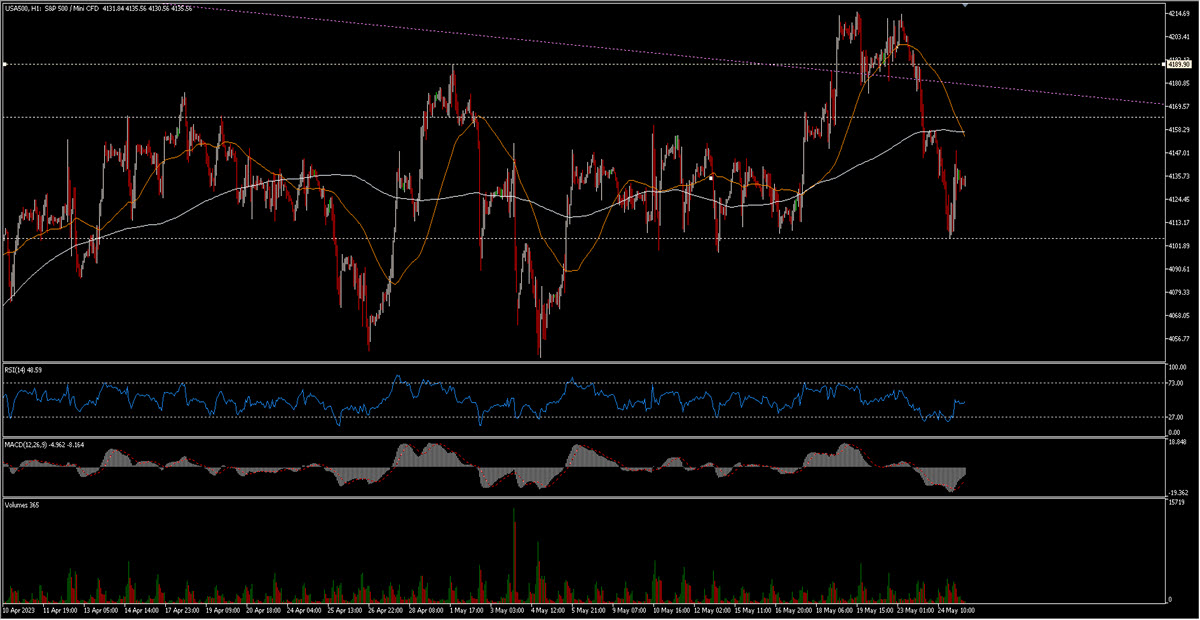

Technical Evaluation

A number of days in the past I wrote concerning the US500, the tighter 4100-4150 vary (the broader 4050–4175) and the final resistance at 4190 (with some free floor in direction of 4325 within the case it could be damaged). The value truly pushed above 4190 and even closed within the 4200 space for two days, earlier than being instantly rejected again into the vary. MM50 stays now at 4100, able to assist, however this might have been a false break to the upside (a bull lure). We are going to see.

US500, H1

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]