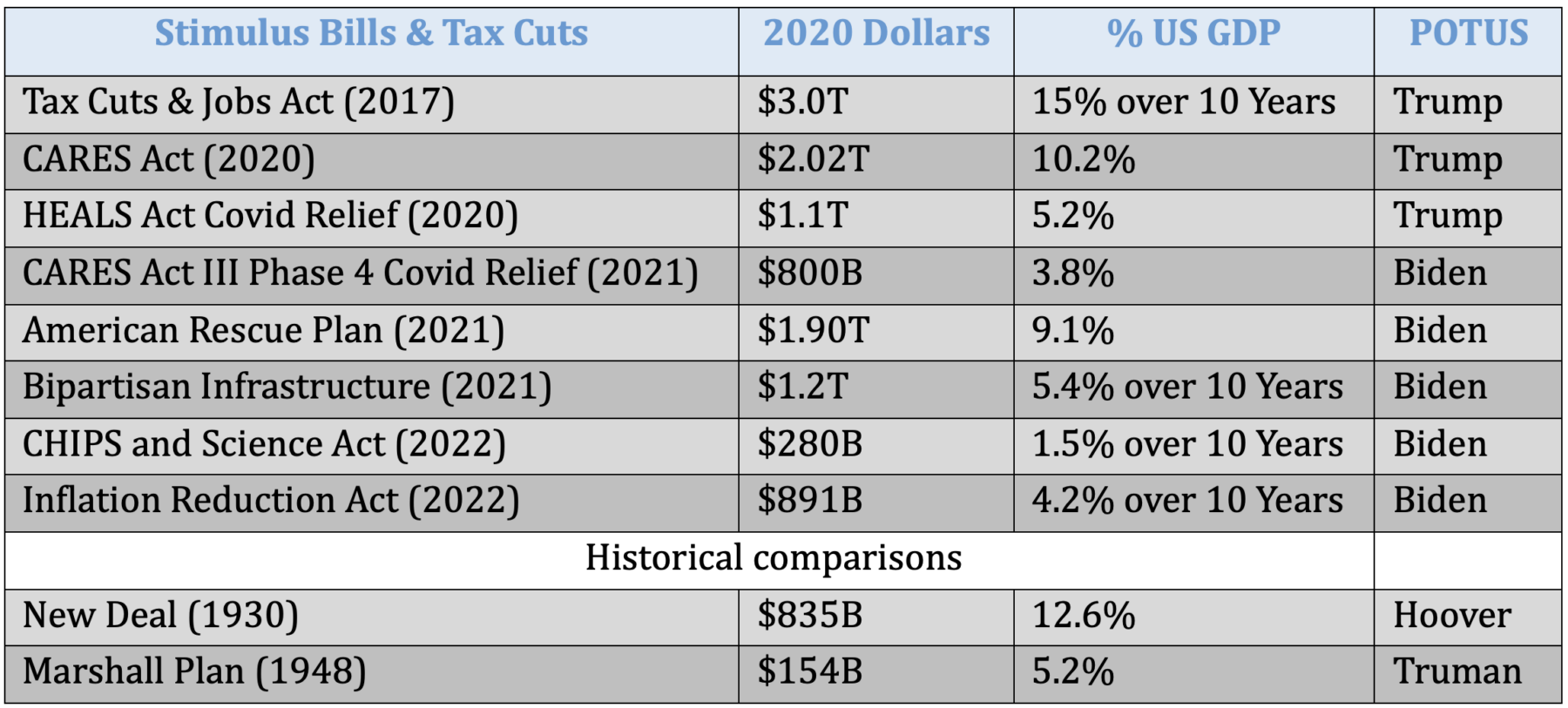

Final week, I talked about the quarterly convention calls I do for purchasers of RWM, which led to a broad dialogue of Sentiment. I need to briefly focus on the fiscal regime change desk I created for that decision (above).

The TLDR: For the previous few many years, the USA’ financial coverage has been one primarily pushed by ultra-low charges. Starting beneath Alan Greenspan, persevering with by means of the phrases of Ben Bernanke, Janet Yellen and now Jay Powell, low charges dominated every thing round me. It was the other of CREAM.

There’s a longer dialogue available on how Zero Curiosity Fee Coverage (ZIRP) impacted belongings priced in {dollars} or credit score, wealth inequality, and the rise of populism.1 The underside line is the primarily financial (not fiscal) stimulus responses to calamities such because the September eleventh terror assaults, or the Nice Monetary Disaster had unanticipated penalties.

That started to vary beneath President Trump. The Tax Cuts & Jobs Act of 2017 (TCJA) was ~$3 trillion unfold out throughout a decade. It was the most important fiscal stimulus to come back alongside for a while, and whereas it was biased in direction of the higher quarter of the financial strata, it was not considered broadly in the way in which we sometimes contemplate fiscal stimulus.

Lacking its fiscal element was a big financial misunderstanding.

Then got here Covid-19. The CARES Act 1 (2020) at ~10% of GDP, was the most important fiscal stimulus because the Nice Despair. It was adopted by the 2nd CARES Act, which added practically one other trillion {dollars} of stimulus. The three of those had a large stimulatory impression.

Then President Biden got here into workplace; he handed the third CARES Act, the American Rescue Plan, the Bipartisan Infrastructure Invoice, the Chips Act, and the Inflation Discount Act. (Knowledge within the desk are totals, however practically half of these allocations have been new cash 2). Regardless it was one other trillion and a half {dollars} in instant stimulus and some trillion {dollars} extra unfold out over 10 years.

On the similar time, federal funds charges went from zero to over 5%. The impression on shares and bonds was unmistakable.

The 2010s have been a decade of financial stimulus that noticed fairness markets acquire 14% yearly. Free cash! Not less than, low-cost capital, low-cost financing for client and industrial purchases, all of which led to greater company income.

It’s very affordable to presume that costlier cash means greater prices of financing these client and industrial purchases; this may in all probability crimp whole retail gross sales, and will negatively impression company income (ultimately).

Therefore, it’s best to decrease your expectations for future fairness good points within the period following ZIRP and QE. If we have been getting 12-14% beforehand, then the 2020s ought to anticipate one thing nearer to 5-7% in fairness returns.

However concurrent with that’s the mounted earnings portion of your portfolios. I’ll spend extra time in a future submit detailing why “Money is not trash,” however the backside line is far of what you lose on the fairness aspect, you acquire on the mounted earnings aspect. This bodes effectively for these searching for earnings, who make investments through a 60/40 portfolio, or are in any other case lower-risk buyers.

Most of what takes place within the day-to-day world of markets is noisy and meaningless; however the shift from financial to fiscal stimulus could be very, very vital.

Traders would do effectively in listening to this regime change.

Beforehand:

The Biggest Missed Alternative of Our Lifetimes (October 23, 2023)

What Else Is perhaps Driving Sentiment? (October 19, 2023)

Farewell, TINA (September 28, 2022)

__________

1. We are going to save that for an additional submit…

2. I defined throughout the name that a lot of these {dollars} had been already allotted in different payments and have been consolidated beneath every of those items of laws. Regardless, it was nonetheless trillions in fiscal stimulus.