[ad_1]

Over the weekend, I observed somebody was incorrect on the web.

Anthony Pompliano is a crypto fan who has amassed an enormous (1.6 million) following on Twitter. Because the Tweet (X?) above exhibits, he made a beginner error trying on the efficiency of the S&P500: He ignored dividends, thereby omitting a lot of the returns.

I replied1 to the tweet, politely declaring that my colleague Ben Carlson had beforehand defined that “since 1928, fairness market returns together with dividends are 70% larger than simply fairness value returns alone.” Certainly, dividends are a serious purpose why you maintain equities long-term. “The whole return is round 35x larger than the value return alone.” 2

However right here is the place issues get fascinating. Pomp factors out that:

“I’m, nonetheless, arguing that the overall return share historically quoted just isn’t what folks truly obtain of their brokerage account due to taxes. Additionally, given you need to flip DRIP on in most brokerage accounts, I ponder what share of buyers reinvest as effectively (have appeared however can’t appear to search out this quantity wherever).”

I’ve addressed Tax Alpha earlier than (see this and this); however Pomp not directly raised a really totally different situation: Why do folks underperform their very own property? Primarily, he was referring to your complete discipline of behavioral economics.

BeFin explains why folks underperform their very own holdings.

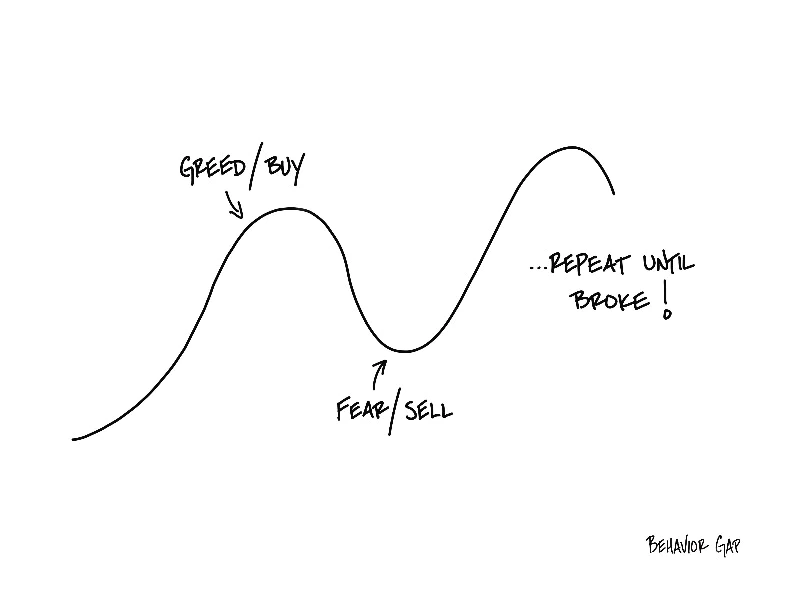

To be able to acquire returns that mirror your personal holdings over an prolonged time period, you need to 1) personal them for your complete interval; 2) made your buy throughout regular durations, not chasing them upwards and shopping for close to all-time highs; and three) not promote them prematurely, or commerce them, or in any other case intervene with compounding.

To be able to acquire returns that mirror your personal holdings over an prolonged time period, you need to 1) personal them for your complete interval; 2) made your buy throughout regular durations, not chasing them upwards and shopping for close to all-time highs; and three) not promote them prematurely, or commerce them, or in any other case intervene with compounding.

It’s easy in precept however tough to execute in the actual world. Most of us lack the understanding, self-discipline, and talent to do that. Carl Richards termed this the Conduct Hole, and that descriptor sums it up completely.

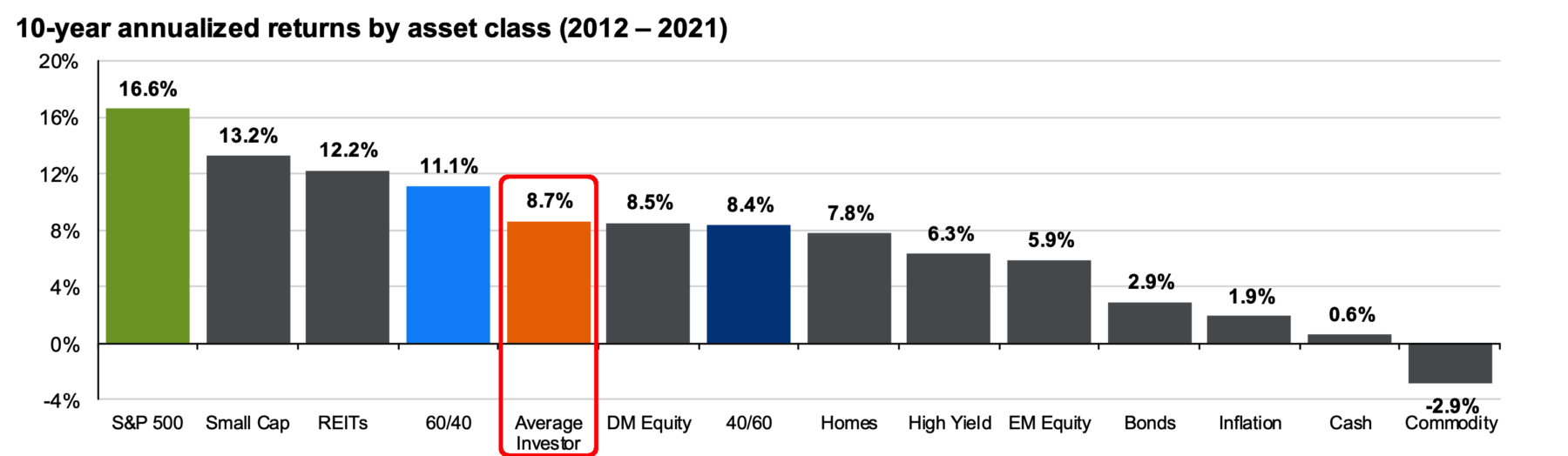

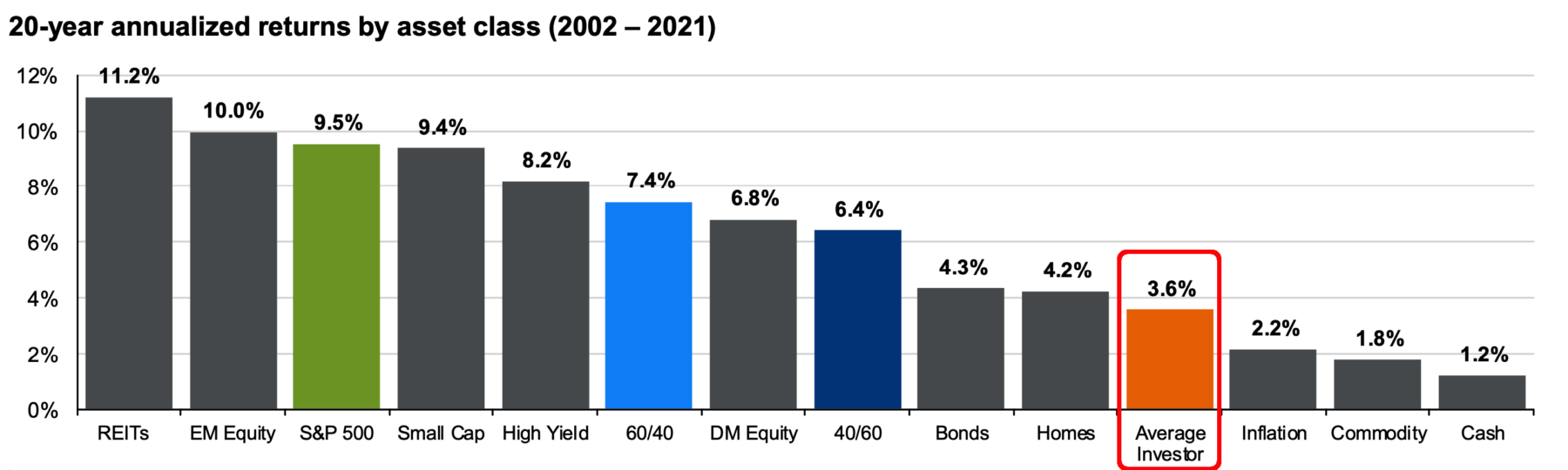

In case you are extra of a visible individual, then think about the 2 charts beneath, by way of JPM’s Quarterly Information to the Markets. They present simply how a lot the common investor’s lack of self-discipline prices them when it comes to returns. That underperformance between asset class returns and investor returns is the habits hole.

The ten-year returns for equities (2012-2021) when the SPX generated 16.6% annual returns, the common investor solely gained 8.7% per yr. Over that interval, the standard investor garnered about half of what the markets generated:

The place issues actually went off the rails had been the 20-year returns,w which included a lot of the dot com implosion, and all the Nice Monetary Disaster. Over that unstable period, the SPX returned 9.5% whereas buyers garnered about 3.6% — barely a 3rd of the index.

The longer the holding interval, the larger the influence of compounding error.

Beforehand:

Easy, However Onerous (January 30, 2023)

Tax Alpha (April 14, 2022)

Accessing Losses by way of Direct Indexing (April 14, 2021)

__________

1. On my backup account – I nonetheless don’t have entry to my precise account!

2. Carlson observes that from 1928 to 2022, the S&P500 returned 21,519%, which doesn’t appear too shabby, till you think about that with dividends re-invested, SPX returns shoot as much as 750,000%. That’s residence a lot larger compounding over practically a century is when you think about 5.8% annual returns versus 9.9%.

[ad_2]