[ad_1]

Chartists on the lookout for momentum leaders ought to take into account a couple of timeframe. A inventory could also be main during the last 200 days, however lagging during the last 100 days. Equally, a inventory may present massive features the final 100 days, however nonetheless be down during the last 200 days. Measuring efficiency over totally different timeframes permits us to establish shares which are persistently robust.

Chartists on the lookout for momentum leaders ought to take into account a couple of timeframe. A inventory could also be main during the last 200 days, however lagging during the last 100 days. Equally, a inventory may present massive features the final 100 days, however nonetheless be down during the last 200 days. Measuring efficiency over totally different timeframes permits us to establish shares which are persistently robust.

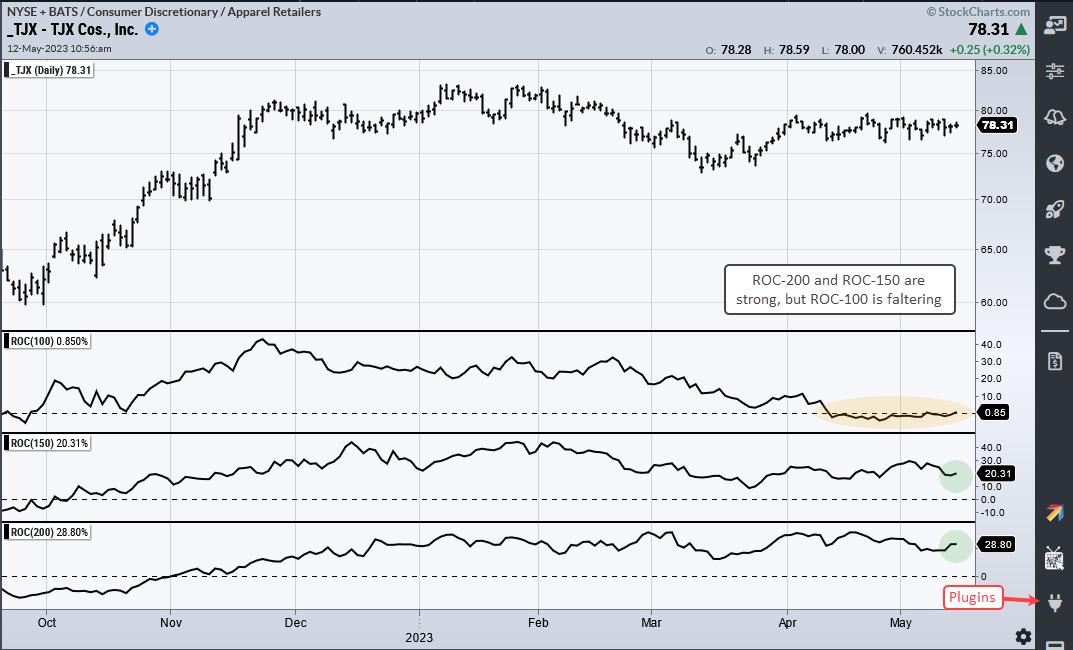

The primary chart exhibits TJX Cos (TJX) with the Fee-of-Change (ROC) indicator protecting 100, 150 and 200 days. Hench, the three ROCs. Fee-of-Change is solely the share change over the given timeframe. TJX is up round 29% during the last 200 days (backside window) and up round 20% during the last 150 days. Nevertheless, it’s flat during the last 100 days and is faltering on this timeframe (yellow shading). TJX is just not a constant and protracted chief as a result of it’s dragging its ft on the 100-day timeframe.

The subsequent chart exhibits HubSpot (HUBS) and the three ROCs inform a distinct story. All three are above 50% and displaying power over all three timeframes. HUBS is a constant and protracted chief proper now. This can be a title we went on our watch record for tradable pullbacks or in a portfolio of momentum leaders.

TrendInvestorPro develops and maintains quantified buying and selling methods for shares and ETFs. We at present have three lively ETF methods and a inventory technique within the beta stage. This inventory technique makes use of an Common Fee-of-Change indicator to rank shares and choose momentum leaders. Click on right here to study extra.

The Development Composite, ATR Trailing Cease and 9 different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to take your evaluation course of to the subsequent degree.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering alerts inside the development, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.

Subscribe to Artwork’s Charts to be notified every time a brand new put up is added to this weblog!

[ad_2]