![This is The best way to Worth a Firm [With Examples] This is The best way to Worth a Firm [With Examples]](https://bizagility.org/wp-content/uploads/https://blog.hubspot.com/hubfs/Value%20a%20Business%20fi%20(1).png#keepProtocol)

[ad_1]

What’s your organization value? It is an vital query for any entrepreneur, enterprise proprietor, or potential investor.

What’s extra, understanding worth your small business turns into more and more vital because it grows, particularly if you wish to elevate capital, promote a portion of the enterprise, or borrow cash.

Right here, we’ll check out various factors to think about when valuing your small business, widespread equations you need to use, and high-quality instruments that may enable you crunch the numbers.

Desk of Contents

The best way to Worth a Enterprise

Public vs. Non-public Valuations

Enterprise Valuation Strategies

Enterprise Valuation Calculators

What’s a enterprise valuation?

Because the title suggests, a enterprise valuation determines the worth of a enterprise or firm. In the course of the course of, all areas of a enterprise are fastidiously analyzed, together with its monetary efficiency, belongings and liabilities, market place, and future progress potential.

Finally, the purpose is to reach at a good and goal estimate which could be helpful in making enterprise selections and negotiating.

The best way to Worth a Enterprise

- Firm Dimension

- Profitability

- Market Traction and Development Fee

- Sustainable Aggressive Benefit

- Future Development Potential

1. Firm Dimension

Firm dimension is a generally used issue when valuing an organization. Sometimes, the bigger the enterprise, the upper the valuation might be. It’s because smaller firms have little market energy and are extra negatively impacted by the lack of key leaders. As well as, bigger companies probably have a well-developed services or products and, consequently, extra accessible capital.

2. Profitability

Is your organization incomes a revenue?

If that’s the case, this an excellent signal, as companies with greater revenue margins might be valued greater than these with low margins or revenue loss. The first technique for valuing your small business based mostly on profitability is thru understanding your gross sales and income knowledge.

Valuing a Firm Primarily based On Gross sales and Income

Valuing a enterprise based mostly on gross sales and income makes use of your totals earlier than subtracting working bills and multiplying that quantity by an trade a number of. Your trade a number of is a median of what companies usually promote for in your trade so, in case your a number of is 2, firms normally promote for 2x their annual gross sales and income.

3. Market Traction and Development Fee

When valuing an organization based mostly on market traction and progress price, your small business is in comparison with your rivals. Buyers need to know the way massive your trade market share is, how a lot of it you management, and the way rapidly you possibly can seize a share of the market. The faster you attain the market, the upper your small business’ valuation might be.

4. Sustainable Aggressive Benefit

What units your product, service, or answer other than rivals?

With this methodology, the way in which you present worth to prospects must differentiate you from the competitors. If this aggressive benefit is just too troublesome to take care of over time, this might negatively impression your small business’ valuation.

A sustainable aggressive benefit helps your small business construct and keep an edge over rivals or copycats sooner or later, pricing you greater than your rivals as a result of you’ve gotten one thing distinctive to supply.

5. Future Development Potential

Is your market or trade anticipated to develop? Or is there a possibility to increase the enterprise’ product line sooner or later? Elements like these will enhance the valuation of your small business. If buyers know your small business will develop sooner or later, the corporate valuation might be greater.

The monetary trade is constructed on attempting to precisely outline present progress potential and future valuation. All of the traits listed above should be thought of, however the important thing to understanding future worth is figuring out which components weigh extra closely than others.

Relying in your sort of enterprise, there are totally different metrics used to worth private and non-private firms.

Public Versus Non-public Valuation

.png?width=2000&height=900&name=How%20to%20Value%20a%20Business%20Public%20vs%20Private%20valuation%20(1).png)

Public Firm Valuation

For public firms, valuation is known as market capitalization (which we’ll talk about under) — the place the worth of the corporate equals the entire variety of excellent shares multiplied by the worth of the shares.

Public firms may commerce on e-book worth, which is the entire quantity of belongings minus liabilities in your firm steadiness sheet. The worth relies on the asset’s unique value much less any depreciation, amortization, or impairment prices made towards the asset.

Non-public Firm Valuation

Non-public firms are sometimes more durable to worth as a result of there’s much less public data, a restricted monitor document of efficiency, and monetary outcomes are both unavailable or won’t be audited for accuracy.

Let’s check out the valuations of firms in three levels of entrepreneurial progress.

1. Ideation Stage

Startups within the ideation stage are firms with an thought, a marketing strategy, or an idea of acquire prospects, however they’re within the early levels of implementing a course of. With none monetary outcomes, the valuation relies on both the monitor document of the founders or the extent of innovation that potential buyers see within the thought.

A startup and not using a monetary monitor document is valued at an quantity that may be negotiated. Most startups I’ve reviewed created by a first-time entrepreneur begin with a valuation between $1.5 and $6 million.

All the worth relies on the expectation of future progress. It isn’t at all times within the entrepreneur’s greatest curiosity to maximise its worth at this stage if the purpose is to have a number of funding rounds. The valuation of early-stage firms could be difficult as a result of these components.

2. Proof of Idea

Subsequent is the proof of idea stage. That is when an organization has a handful of workers and precise working outcomes. At this stage, the speed of sustainable progress turns into probably the most essential consider valuation. Execution of the enterprise course of is confirmed, and comparisons are simpler due to obtainable monetary data.

Firms that attain this stage are both valued based mostly on their income progress price or the remainder of the trade. Further components are evaluating peer efficiency and the way nicely the enterprise is executing compared to its plan. Relying on the corporate and the trade, the corporate will commerce as a a number of of income or EBITDA (earnings earlier than curiosity, taxed, depreciation, and amortization).

3. Proof of Enterprise Mannequin

The third stage of startup valuation is the proof of the enterprise mannequin. That is when an organization has confirmed its idea and begins scaling as a result of it has a sustainable enterprise mannequin.

At this level, the corporate has a number of years of precise monetary outcomes, a number of merchandise transport, statistics on how nicely the merchandise are promoting, and product retention numbers.

Relying in your firm, there are a selection of equations to make use of to worth your small business.

Firm Valuation Strategies

Let’s check out among the formulation for enterprise valuation.

Market Capitalization Formulation

Market Worth Capitalization is a measure of an organization’s worth based mostly on inventory value and shares excellent. Right here is the system you’d use based mostly on your small business’ particular numbers:

Multiplier Methodology Formulation

You’d use this methodology if you happen to’re hoping to worth your small business based mostly on particular figures like income and gross sales. Right here is the system:

.png?width=2345&name=Blue_Opt01%20(2).png)

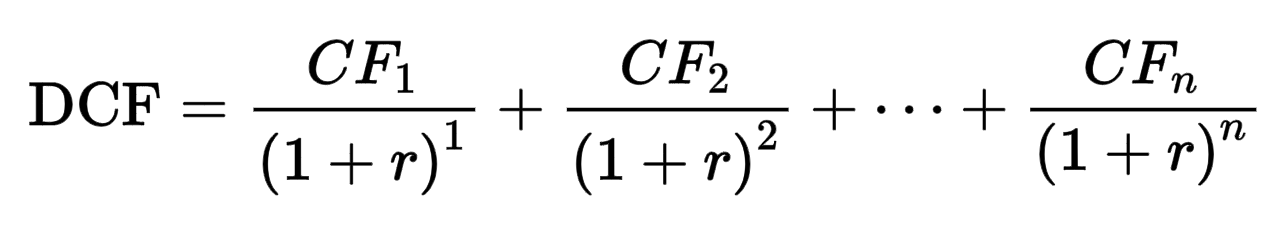

Discounted Money Move Methodology

Discounted Money Move (DCF) is a valuation approach based mostly on future progress potential. This technique predicts how a lot return can come from an funding in your organization. It’s the most complex mathematical system on this listing, as there are a lot of variables required. Right here is the system:

Listed here are what the variables imply:

- CF = Money circulate throughout a given 12 months (can embrace as a few years as you’d like, merely comply with the identical construction).

- r = low cost price, typically known as weighted common value of capital (WACC). That is the speed {that a} enterprise expects to pay for its belongings.

This methodology, together with others on this listing, requires correct math calculations. To make sure you’re heading in the right direction, it could be useful to make use of a calculator device. Beneath we’ll suggest some high-quality choices.

Enterprise Valuation Calculators

Beneath are enterprise valuation calculators you need to use to estimate your firms worth.

1. CalcXML

This calculator appears to be like at your small business’ present earnings and anticipated future earnings to find out a valuation. Different enterprise parts the calculator considers are the degrees of danger concerned (e.g., enterprise, monetary, and trade danger) and the way marketable the corporate is.

2. EquityNet

EquityNet’s enterprise valuation calculator appears to be like at numerous components to create an estimate of your small business’s worth. These components embrace:

- Odds of the enterprise’ survival

- Business the enterprise operates in

- Property and liabilities

- Predicted future income

- Estimated revenue or loss

3. ExitAdviser

ExitAdviser’s calculator makes use of the discounted money circulate (DCF) methodology to find out a enterprise’s worth. To find out the valuation, “it takes the anticipated future money flows and ‘reductions’ them again to the current day.”

Firm Valuation Instance

It might be useful to have an instance of firm valuation, so we’ll go over one utilizing the market capitalization system displayed under:

Shares Excellent x Present Inventory Worth = Market Capitalization

For this equation, I must know my enterprise’s present inventory value and the variety of excellent shares. Listed here are some pattern numbers:

Shares Excellent: $250,000

Present Inventory Worth: $11

Here’s what my system would appear to be once I plug within the numbers:

250,000 x 11

Primarily based on my calculations, my firm’s market worth is 2,750,000.

Again to You

Whether or not you’re trying to borrow cash, promote a portion of your organization, or just perceive your market worth, understanding how a lot your small business is value is vital for your small business’ progress.

[ad_2]