[ad_1]

The final yr has been a gut-puncher for traders. All three main inventory market indexes — the S&P 500, the Dow Jones Industrial Common, and the Nasdaq — plunged into bear market turf in some unspecified time in the future in 2022. Although the market has bounced again a bit in 2023, banking failures and ongoing worries a few recession proceed including to investor jitters.

It is comprehensible in the event you’re involved {that a} bear market looms within the close to future. However most traders should not lose sleep over a bear market.

Picture supply: Getty Pictures.

The bear market lesson you’ll be able to’t afford to overlook

A bear market is a drop of no less than 20% from the market’s latest highs. A bull market happens when the inventory market rises by 20% or extra over a sustained time frame.

The large factor you might want to find out about bear markets, although, is that they are unbelievably brief in comparison with bull markets. That will come as a shock whenever you’re checking your funding account and really feel just like the losses won’t ever finish. However of the 27 bear markets the inventory market has skilled from 1929 to 2022 — as measured by an S&P 500 index drop of 20% or extra — the typical bear market has solely lasted about 9.7 months, in response to Hartford Funds analysis. By comparability, the typical bull market spanned an unimaginable 2.7 years.

The S&P 500 bear market of 2022 was pretty typical, lasting 282 days or simply over 9 months. The bear market that preceded it in 2020, when the pandemic triggered a worldwide meltdown, was the shortest in historical past, ending after simply 33 days. However within the run-up to the COVID-19 crash, the S&P 500 loved one of many longest bull markets in historical past, spanning from March 2009 to February 2020 — 3,999 days complete.

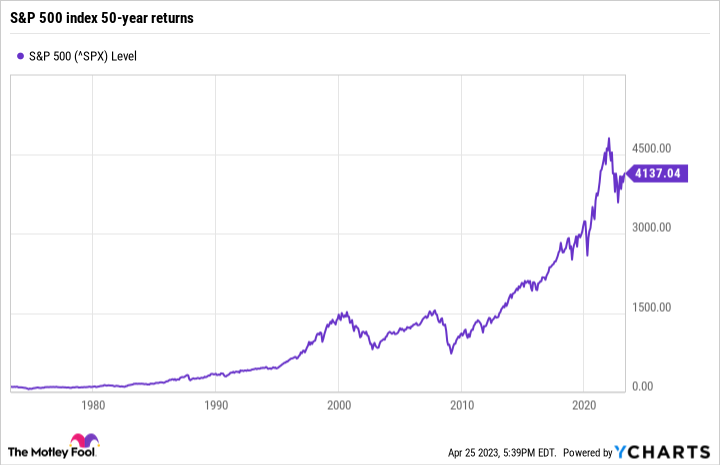

The U.S. inventory market has ultimately rebounded from each downturn in historical past. Even whenever you account for the inventory market’s most up-to-date dips, the S&P 500 has nonetheless produced returns of over 3,600% previously 50 years. Once you have a look at long-term efficiency, even longer bear markets seem like comparatively small blips.

How do you have to put together for a bear market?

Sustaining a diversified portfolio and training dollar-cost averaging are two of the most effective methods to organize for a bear market. A diversified portfolio reduces your threat of being over-invested in a hard-hit sector, i.e., tech shares in 2022 or actual property and financials in 2008. Greenback-cost averaging, which is whenever you often make investments the identical quantity at scheduled intervals no matter market efficiency, helps you lock in a few of these low bear-market costs.

Traders who’ve a methods to go till retirement might need to put aside extra cash to speculate much more when the market tanks. That is to not say you need to try and time the market, as we’ll solely know in hindsight when the market reached a backside. However you would possibly put aside extra money so you’ll be able to make investments extra, say if the S&P 500 dips beneath a sure degree or if a inventory falls under a predetermined value.

However there is not any method round the truth that a bear market is way extra painful for these nearing retirement than it’s for somebody with many years of investing forward. That is why older traders ought to revisit their portfolio allocation to verify they’re taking an acceptable degree of threat. Changing some high-growth investments with safer ones, like blue chip shares and bond ETFs, is usually a very good transfer when retirement is in sight.

For most individuals, although, the most effective response to a bear market is to easily hold investing as ordinary.

[ad_2]