[ad_1]

Our analysis at EarningsBeats.com contains intensive seasonal research, working off the seasonality instrument right here at StockCharts.com. We have not too long ago ended the most effective historic interval of the yr, which runs from the shut on October twenty seventh via the shut on January 18th. However the bullishness does not come to an finish, it merely slows down. In case you’re searching for market sectors that traditionally carry out properly for the subsequent 3 months, control expertise (XLK) and supplies (XLB). These two have been probably the most constant outperforming sectors via Could since this secular bull market started.

However how about an trade group that loves this time of yr?

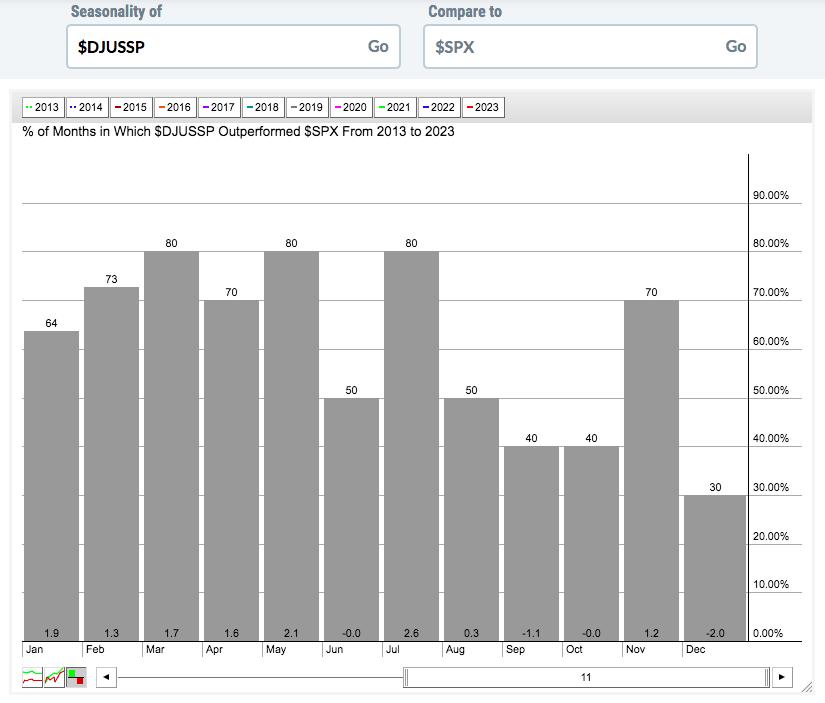

For my part, there isn’t a single trade group that loves March via Could fairly just like the specialty finance space ($DJUSSP). The next is the “relative” (vs. the benchmark S&P 500) seasonal efficiency by calendar month:

By including up the month-to-month outperformance averages for every calendar month, we will rapidly compute that the DJUSSP completely loves the primary 7 months of the yr. Here is the outperformance of this group for the reason that secular bull market started, damaged down between the next two intervals:

- January via July: +11.2%

- August via December: -1.6%

The candy spot for specialty finance is March via Could, nonetheless, as this 3-consecutive-month interval has been its finest, outperforming the S&P 500 by 5.4% on common since 2013!

Maybe the most effective information of all is that I see vital technical enchancment within the DJUSSP at the moment, as you possibly can see from the chart under:

Along with an apparent uptrend since October, relative power kicked in nearly instantly as the brand new yr started. Although your complete sample is not mirrored above, the February weak point might signify a bottoming proper shoulder in a reverse head & shoulders sample that started throughout the second half of 2022. Clearing overhead worth resistance at 520 on a closing foundation would verify the sample.

At EarningsBeats.com, we offer our members with 3 portfolios comprised of 10 equal-weighted shares, designed to outperform the S&P 500 over 1 / 4. Then we choose 10 extra equal-weighted shares for the subsequent 3 months and so forth and so forth. Our Mannequin Portfolio has crushed the benchmark S&P 500 for the reason that Portfolio’s inception in November 2018 (+130.31% vs. +51.60%). We chosen our newest portfolios at Friday’s shut and I included a specialty finance inventory as 1 of the ten equal-weighted shares in our Mannequin Portfolio.

This specialty finance inventory has outperformed the S&P 500, on common, by 17.2 proportion factors from January via July, together with 5.5 proportion factors from March via Could. I will be offering my technical view on this inventory in our subsequent EB Digest. To enroll in our FREE EB Digest e-newsletter and obtain this specialty finance inventory, merely CLICK HERE and supply us your identify and e-mail tackle. There is not any bank card required and you could unsubscribe at any time.

Completely satisfied buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Each day Market Report (DMR), offering steerage to EB.com members day-after-day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a singular talent set to method the U.S. inventory market.

Subscribe to Buying and selling Locations with Tom Bowley to be notified each time a brand new publish is added to this weblog!

[ad_2]