[ad_1]

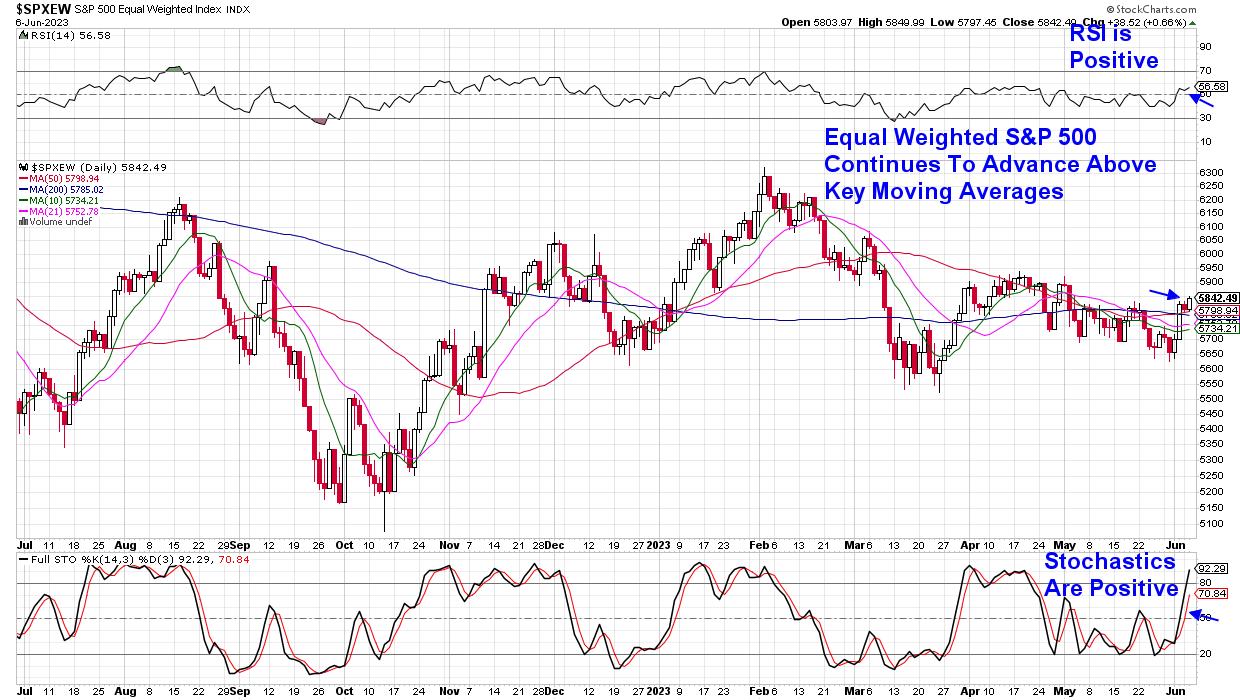

The equal-weighted S&P 500 ($SPXEW) continues to advance above its key 50-day transferring common which it broke above following final Friday’s broad primarily based rally within the markets. Friday’s downtrend reversal occurred after Could’s employment information delivered a optimistic report with job openings rising increased than anticipated whereas wage features had been modest. The report helped cut back fears of a recession amid indicators of company job progress whereas low wage features underscored the potential for a extra accommodative Fed.

Cyclical shares gained on the information, because the trace of doable financial enlargement pushed Supplies, Industrials and Discretionary shares increased whereas Small Caps gained essentially the most amid a rally in Financial institution shares. I highlighted this marked shift in my Sunday MEM Edge Report as a broadening out amongst participation could be very constructive for the potential for a extra sustained uptrend within the markets.

DAILY CHART OF S&P 500 EQUAL WEIGHTED INDEX ($SPXEW)

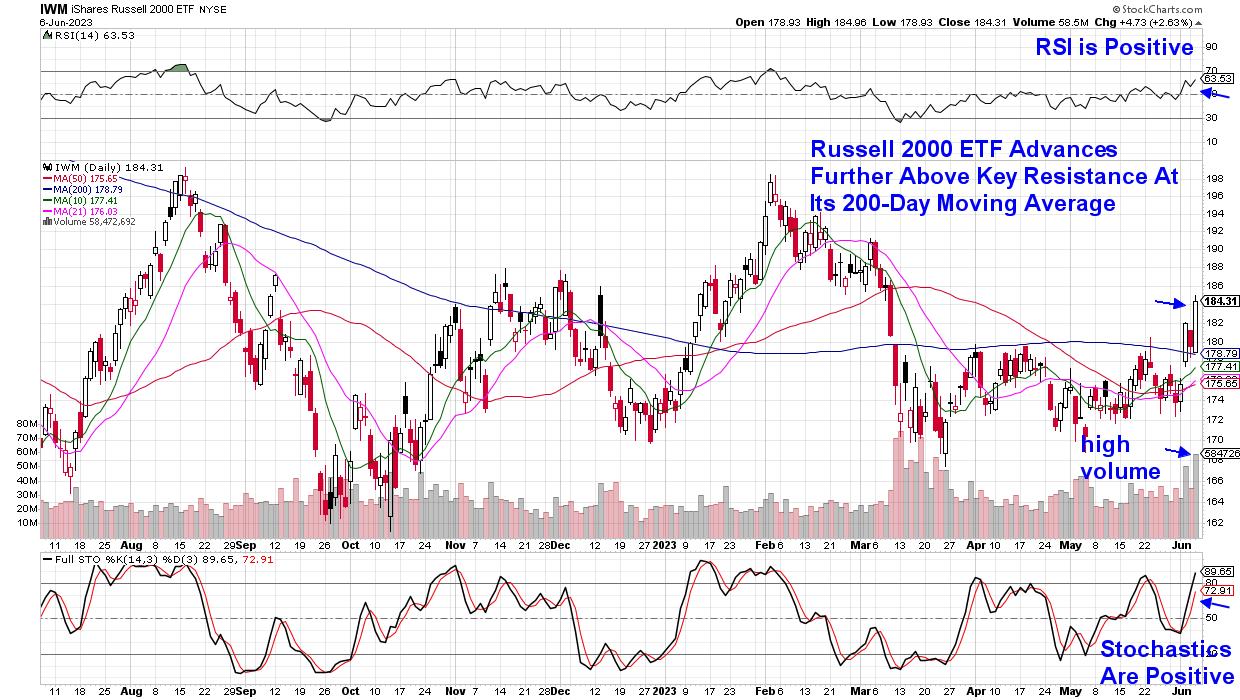

As we speak we have seen a continuation of final week’s broadening out into areas past Know-how and mega-cap FAANMG names. Most pronounced has been the continuation rally in Small Cap shares. Whereas a portion of the features may be attributed to the current rally in Financial institution shares – Monetary Service shares account for 13% the Russell 2000 – different areas in small cap shares are additionally on the transfer. The most important gainers right now had been overwhelmed down Retailers with different cyclical areas corresponding to Industrials not far behind.

DAILY CHART OF RUSSELL 2000 ETF (IWM)

One attribute of a transfer into Small Cap shares is that it indicators a risk-on urge for food amongst buyers which is a optimistic. Whereas these smaller shares can produce outsized returns when sparked, they’re extra unstable than bigger, extra liquid names so tight stops are strongly advisable on any new positions.

My twice weekly MEM Edge Report will likely be including a number of new shares to our already broad Urged Holdings Checklist tomorrow. These essentially sound firms with enticing charts may be accessed through the use of this hyperlink right here and trialling my report for a nominal payment. You will have fast entry to current experiences in addition to my Watch Checklist of shares on the point of transfer increased. I hope you will reap the benefits of my particular supply so you’ll be able to reap the benefits of the present rotation because it continues to take form.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra

Subscribe to The MEM Edge to be notified at any time when a brand new submit is added to this weblog!

[ad_2]