[ad_1]

The U.S. housing market is going through an affordability disaster. The mix of excessive dwelling costs, rising mortgage charges, and decreased spending energy has pushed housing affordability to its lowest degree in a long time. As such, it’s troublesome for buyers and homebuyers alike to establish cities the place they will afford to purchase property.

However, there are nonetheless nice alternatives to purchase actual property, even on a price range. I’ve completed the analysis and have recognized the eight most reasonably priced markets for actual property buyers. Beneath, I’ll clarify how we arrived on the present scenario, my standards for choosing these markets, after which provide you with some information concerning the cities. Take a look at the listing beneath and decide if any of those cities suit your investing targets.

How We Acquired Right here

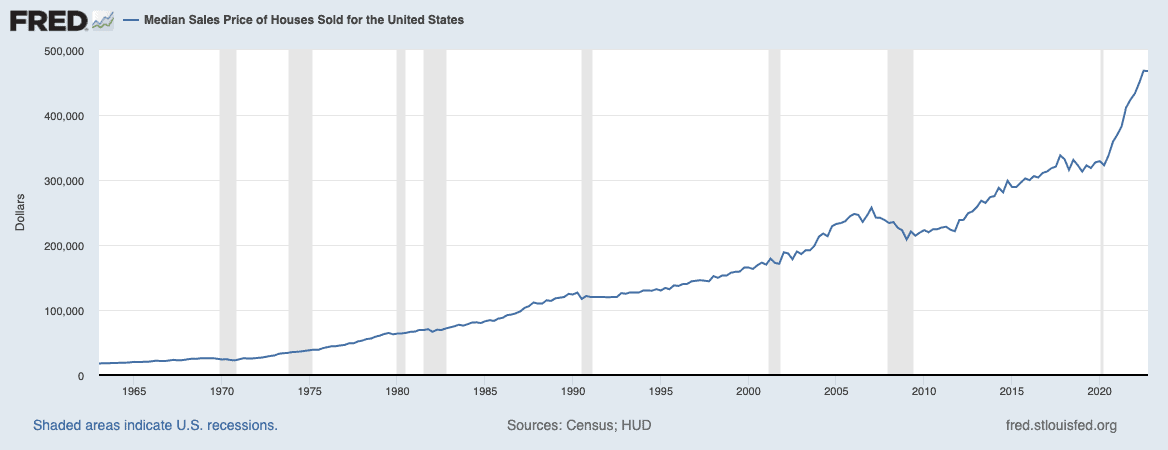

At this level, everybody is aware of what’s occurred to the housing market because the starting of 2020: it went up loads. Pushed by robust demographic demand, distant work, extremely low rates of interest, and a number of other different components, the housing market went on an unbelievable run of appreciation from the start of 2020 to the center of 2022.

For the reason that summer time of 2022, costs have began to come back down as mortgage charges have risen, however the appreciation we’ve seen remains to be staggering. From December 2019 to December 2022, costs grew 31% on a nationwide degree. In sure markets, costs have gone up even additional. Austin, Texas, for instance, has gone up 43% in that timeframe, regardless of seeing worth drops over the second half of 2022.

The rationale costs began to drop in the midst of 2022 is as a result of affordability eroded. Regardless of quickly rising costs, affordability within the housing market was nonetheless robust for years as a result of low mortgage charges. However in fact, when charges began to rise, actuality began to set in. The mix of excessive charges and super-high dwelling costs eroded affordability to the bottom level in a long time. Beneath you may see how dramatically the U.S. Fastened Housing Affordability Index declined.

After all, the story of how we obtained right here and the information I’ve proven is on a nationwide degree. In actuality, the housing market could be very regional, and there are nonetheless comparatively reasonably priced locations to purchase actual property in 2023.

Methodology

I chosen 4 standards to assist buyers perceive the place they will make reasonably priced investments with good long-term return potential. Town needed to meet my definition of reasonably priced and move some fundamental check of “investability.”

- Town has to have a median dwelling worth decrease than the median dwelling worth for the U.S. as a complete (which is round $400,000 as of this writing).

- Town needed to be giant sufficient to have good financial prospects and dependable information. I drew from a pool of the 100 largest metros within the U.S.

- Town has to have grown in inhabitants from 2021 to 2022, in line with the U.S. Census. Whereas there are numerous macroeconomic variables you wish to have a look at when choosing a market, inhabitants progress is probably crucial. Trace: numerous them are in Florida.

- Town has to have a rent-to-price ratio (RTP) above .6%. RTP is an efficient proxy for money move, and though you’ll probably wish to discover a cope with an RTP of .75% or greater, if a metropolis averages .6%, it normally means you’ll find solidly money flowing offers. After I was doing this evaluation, I discovered that the entire cities with greater RTPs than these on my listing had declining populations.

Collectively, this can be a listing of main metro areas which have dwelling costs beneath the nationwide common, are rising in inhabitants, and have an excellent alternative for money move. After all, I may contemplate many different standards to pick these markets, however this listing is straightforward, straightforward to know, and offers good path. In case you are severely contemplating investing in any of those markets, you need to do much more due diligence and perceive the market a lot deeper than this evaluation permits.

The Markets

Beneath you’ll discover a listing of the eight most reasonably priced markets for actual property buyers for 2023. Discover that whereas all of those markets have median dwelling costs not less than 15% beneath the nationwide common, there’s a large distinction in worth level even on this listing. For instance, the most cost effective market, Oklahoma Metropolis, has a median dwelling worth of about $165,000, which is sort of precisely half the worth level of Tampa, the costliest market on this listing.

I’ve offered some extra information right here so that you can evaluate: year-over-year gross sales worth, median lease, and lease progress, in addition to inhabitants progress.

Remaining Ideas

Once more, if you happen to’re contemplating investing in any of those markets, you want to do much more due diligence. It’s best to be taught extra concerning the financial scenario, regulatory local weather, and demographics of the world, simply to call a couple of key subjects. You additionally must discover a whole lot! Inside every of those cities, there can be offers with nice returns and offers with unhealthy returns. It’s your job to seek out the great ones.

Discover an Agent in Minutes

Match with an investor-friendly actual property agent who may also help you discover, analyze, and shut your subsequent deal.

- Streamline your search.

- Faucet right into a trusted community.

- Leverage market and technique experience.

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]