[ad_1]

Martin Wolf wrote an article for the FT that started by saying:

At this stage within the inflationary course of, a central financial institution wants to point out ethical fibre. Final week’s 0.5 proportion level rise within the Financial institution of England‘s intervention fee was unquestionably mandatory. It might even be that the ensuing 5 per cent fee is not going to be the height. However, doing no matter it takes to deliver inflation to focus on is greater than merely fascinating, it’s the financial institution’s authorized responsibility. No person on the Financial Coverage Committee is free to disregard this obligation.

He goes on to demand a recession.

Each from time to time Wolf writes one thing I can agree with. I used to be starting to suppose he acquired the importance of local weather change, for instance. He additionally appreciates the price of high-interest charges on creating nations. Often, I might nearly think about that there was someplace deep inside him a human being struggling to get out and even present regret for his previous neoliberal failings. However I used to be clearly incorrect. It takes appreciable indifference to human struggling on the altar or financial orthodoxy to jot down one thing as detached to human wellbeing as that paragraph.

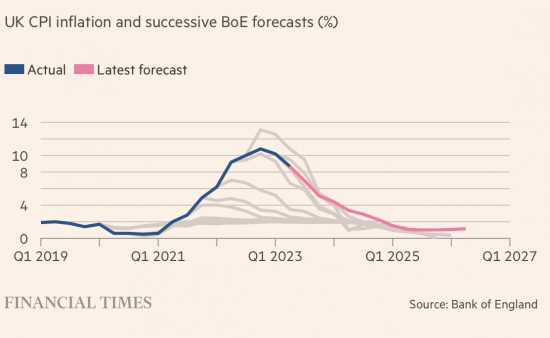

The remainder of the article was as dangerous. I might even accuse it of spreading misinformation. This chart is an instance:

I don’t maintain again in my criticism of the Financial institution of England, however to incorporate forecasts of inflation from early 2020, after we had no purpose to suppose inflation would rise, on this chart is deceptive. It is also deceptive to incorporate a forecast of inflation with out power value help when it was recognized that was going to occur. This chart is disingenuous because of this.

However so is Wolf. His declare that the Financial institution of England have a authorized responsibility to chop inflation is crass. The federal government creates huge numbers of authorized duties which are in actuality not more than statements of goal. Smart individuals know that. Smart individuals additionally know that within the face of fixing circumstances, compromise and reappraisal are required, with new aims being set. To fake {that a} regulation that was itself not more than a whimsy of a passing politician, now dropping faraway from energy, is justification for the imposition of human distress of the sort Wolf calls for is a sign of what would possibly, if I’m being sort, be referred to as mental poverty.

And let’s be clear about what Wolf’s weasel phrases actually imply. He’s saying ‘there is no such thing as a different’. He is again to his very worst Thatcherism.

However he’s incorrect, in fact. Two members of the Financial institution of England Financial Coverage Committee final week disagreed with him, or on the very least thought that their authorized responsibility was finest exercised by taking no motion proper now on rates of interest.

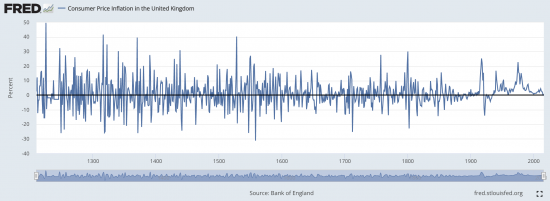

And he’s incorrect as a result of, as I’ve famous earlier than, the truth is that inflation all the time goes away anyway. Take, for instance, this St Louis Fed chart which summarises information from the Financial institution of England on inflation tendencies in first England after which the Uk over a interval of greater than 800 years:

After a interval of inflation there has, traditionally, all the time been deflation, and even when the latter has been uncommon of late, there may be all the time a return to extra regular charges. The easy reality is that regardless of what politicians and the Financial institution of England declare, inflation doesn’t persist. The coverage measures put in place to supposedly sort out typically solely make issues worse.

However individuals have been persuaded in any other case by the likes of Martin Wolf and people whose job they suppose it to be to help the worth of the forex rather than the energy of the economic system, the individuals on whose wellbeing the nation rests, and proof. They’re out in power within the FT this morning, demanding a protracted interval of constructive actual rates of interest and a declining central financial institution stability sheet, each of which will likely be disastrous for the nation, however which is able to serve the pursuits of these selling inequality very properly.

The fact is that there’s a alternative obtainable now.

The Financial institution might, and may, have accomplished nothing final week.

The Financial institution might, and may, have ended quantitative tightening.

The Financial institution might, and may, have stated it’ll wait and see the affect of earlier fee rises.

The Financial institution might, and may, have stated that as inflation falls (as it can) so will charges.

It did none of these issues.

It simply selected to impose distress, stress, hurt and destruction on the economic system, in response to which the prime minister stated ‘we must always maintain our nerve’, with out as soon as explaining how a family going through unattainable will increase in housing price and a authorities that’s doing all it will possibly to cut back its actual internet revenue is supposed to ‘maintain our nerve’. And Wolf has the temerity to counsel that imposing this distress is proof of ‘ethical fibre’.

I will not describe my anger about individuals who write articles of the sort Wolf has accomplished. They’re wedded to outdated and clearly false dogma (indicated by the truth that it has failed so typically) and but they demand extra fairly literal human sacrifice to their cult of steady cash. To say I despise them for his or her utter callousness is to understate issues. Hell could be too good for individuals who will impose a lot distress with out justification as a result of it’s hell on earth that they need for others, and I believe that’s unforgivable, most particularly when that hell on earth is all to avoid wasting money on the purchasing invoice which might be extra compensated for with truthful pay rises which are solely inside the present of presidency.

[ad_2]