[ad_1]

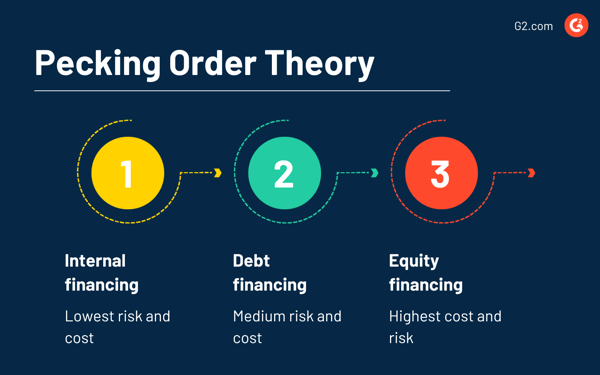

The pecking order principle or pecking order mannequin explains how firms prioritize financing sources for an optimum capital construction selection, whereas balancing long-term debt and fairness financing.

Managers following this company finance mannequin comply with a hierarchy whereas investing in alternatives. They prioritize utilizing inner funds or retained earnings earlier than exploring different choices. Debt is the subsequent possibility as soon as they exhaust inner financing.

Fairness financing is their final resort when debt does not appear viable anymore.

What’s the pecking order principle?

The pecking order principle of capital construction states that firm managers prioritize firms’ financing operations based mostly on a hierarchy the place they first use retained earnings (inner financing), then debt financing, and fairness financing ultimately.

Monetary evaluation software program and monetary threat administration software program play a major function in how firms analyze their money circulate and monetary economics to seek out sources of financing. Myers and Majluf popularized the pecking order principle to assist companies make sound financing selections.

Pecking order principle and capital construction defined

Inside financing is the primary selection within the pecking order principle as a result of there isn’t a further price related to utilizing it. Firms utilizing retained earnings for financing do not need to pay debt or fairness prices.

Debt financing is available in second due to the curiosity funds related to utilizing debt capital. Whether or not the corporate takes out enterprise loans or points company bonds, it should pay some curiosity, making the price of debt greater than the non-existent price of utilizing retained earnings.

Fairness financing comes final within the pecking order principle as a result of it impacts profitability and is the most costly possibility. The price of fairness capital—for instance, inventory shares—is increased than the price of debt financing.

Buyers typically see share issuance as a telltale signal of a better share valuation than the market worth. They deal with this sign as an indicator of soon-to-drop share costs.

This misunderstanding occurs due to uneven data, the core thought behind the pecking order principle. Uneven data or data failure takes place when one occasion or particular person has extra data than the opposite occasion or particular person.

Managers know extra about firm efficiency, prospects, future outlook, or dangers than collectors, buyers, debt holders, or shareholders. Due to this information imbalance, exterior customers demand the next price of capital to counterbalance the danger. When companies situation equities for financing, they find yourself paying extra due to this data asymmetry.

The last word objective is to make use of the trade-off principle to optimize the agency’s capital construction which creates the suitable stability between debt, fairness, and different determinants.

Instance of the pecking order principle

Think about you’re a firm supervisor deciding how you can finance an thrilling new venture. You’ve got calculated the prices, and you will want $15,000 to place this concept into motion. You have got three choices.

Choice 1: You probably have $15,000 retained earnings, you may finance this venture utilizing solely inner financing. Congrats! You needn’t hunt down any exterior funding.

When you do not have sufficient retained earnings, you search money owed.

Choice 2: In keeping with the pecking order principle, your subsequent transfer can be to hunt debt financing.

For those who go for a short-term mortgage of $15,000 with an rate of interest of 5%, you’ll pay $750 in curiosity or $15,750 in whole. Repaying the mortgage will likely be dearer than utilizing inner funds.

Choice 3: As an organization supervisor, you may conclude that debt financing isn’t superb as a result of lenders don’t have the debt capability otherwise you aren’t certain your organization may have sufficient web debt after paying the cash it borrows.

You might also wish to enhance the corporate’s debt ratios. Higher to catch these debt points beforehand—you would not wish to go bankrupt! Now, you need to use fairness financing and situation fairness to get that $15,000 you want.

If your organization’s inventory value is $30 per share, you’d must promote 500 shares to realize $15,000 in debt capital. Nevertheless, this decreases your share value by, for instance, $2 per share, making every share price $28. Meaning you are giving up an additional $2 per share (or $1,000 whole) once you promote these 500 shares.

You’ll get the $15,000 straight away however find yourself paying extra dividends ($16,000 in whole) when factoring in the price of new fairness.

Pecking order principle benefits

- Guides you in elevating funds for brand new initiatives

- Tells you ways data asymmetry impacts financing prices

How does uneven data have an effect on pecking order principle?

When you can clarify the pecking order principle by way of how a lot every kind of financing prices, to grasp it actually, you should perceive how uneven data causes the variations in price.

Retained earnings are the least uneven (or most symmetric) type of financing. There may be little room for differing data between an organization and itself, so there isn’t a threat in utilizing these inner funds.

Exterior financing comes subsequent—first, company debt financing, then fairness financing. Debt buyers do not know the whole lot that is happening behind the scenes, however they are often fairly certain about debt compensation. Thus, they’re at much less threat than fairness buyers (bear in mind, issuing further fairness offers a flawed impression because it makes firm inventory look overvalued).

Stockholders anticipate the next price of return based mostly on extra asymmetrical data. Much less data means the next threat, and when the danger is increased, the expectation is that the payoff is increased as nicely.

Pecking order principle disadvantages

- Limits varieties of funding out there

- Doesn’t take into account monetary fundraising strategies

- Fails to quantify how totally different variables have an effect on the financing price

Instruments for utilizing the pecking order principle

You’ll be able to solely use the pecking order principle once you perceive an organization’s funds. Gathering and analyzing monetary knowledge could be irritating with out the suitable device. Firms use monetary evaluation and threat administration options to trace, handle, and analyze funds.

Monetary evaluation software program options

Monetary evaluation instruments assist firms monitor monetary efficiency. These options collect and analyze monetary transactions and accounting knowledge that will help you keep on prime of key efficiency indicators (KPIs) and make sensible monetary selections. Accountants additionally use these methods for report technology and monetary compliance functions.

Monetary threat administration software program options

Monetary threat administration methods help monetary companies establishments in recognizing and mitigating funding dangers. These instruments play a key function in how firms simulate funding eventualities, conduct in-depth analyses, and discover appropriate funding alternatives.

Make sensible monetary selections

The pecking order principle explains how and why firms select between inner financing, debt, and fairness to finance their companies. The idea doesn’t information decision-making regardless of its usefulness in monetary administration based mostly on capital construction selections.

Plus, there’s no quantitative metric that reveals you how you can analyze or calculate financing sources. Think about using the pecking order principle with different instruments to drive sound capital market selections.

Leverage best-in-breed monetary predictive analytics software program options to drive funding technique with historic knowledge evaluation.

This text was initially printed in 2019. It has been up to date with new data.

[ad_2]