[ad_1]

Markets based mostly on tradeable devices corresponding to shares, bonds, foreign exchange, cryptocurrencies and commodities could sound very subtle. It might be due to these films exhibiting how stockbrokers appear so modern and sensible or perhaps due to the mere undeniable fact that these tradeable devices at the moment are traded on-line by way of a pc. Nonetheless, though these markets could appear very subtle, the truth is that the identical ideas buying and selling actual world exhausting gadgets additionally apply to such tradeable instrument markets.

The primary simplistic idea of buying and selling is just to purchase low and promote excessive. That’s what each clever dealer would at all times do, whether or not he’s dealing in bodily gadgets or in tradeable devices.

Let’s check out a jeweler coping with diamonds. This jeweler who may be very eager with the market would possibly discover that the market worth for diamonds is beginning to rise coming from an all time low. That is what we merchants would name a pattern reversal. Because the rising worth pattern for diamonds is established, the jeweler would possibly say he would need to earn cash on this market. He wouldn’t purchase immediately even when the worth may be very excessive. The smart jeweler would await alternatives whereby he might purchase diamonds at a worth decrease than the present market worth. This fashion as the worth for diamonds would rise, he might then make extra income.

The tactic that this diamond jeweler is doing buying and selling bodily diamonds is what we merchants would name a pattern following technique, whereby we’re shopping for on dips and promoting because the market would rally. The idea for this kind of buying and selling may be very easy. We search for a market, it could be a inventory, commodity or any foreign exchange pair, that has a longtime pattern. Assuming it’s an uptrend, we then await worth to retrace in the direction of the common worth. We then purchase as quickly as we see worth dipping. Then, we promote because the market worth spikes up.

On the flip facet, when the market is in a downtrend, we might additionally brief the market. That is achieved by first making a promote commerce, as worth retraces in the direction of the imply, then closing the commerce with a purchase as quickly as worth drops down.

The important thing to a pattern following technique is in clearly figuring out a pattern and coming into a commerce in the course of the retracement simply earlier than the market spikes within the course of the pattern as soon as once more.

Objectively figuring out a pattern could also be straightforward for seasoned merchants. Nonetheless, new merchants would possibly nonetheless discover it troublesome. For that reason we can be taking a look at how the Heiken Ashi Smoothed indicator can be utilized to assist us commerce with the pattern.

Heiken Ashi Smoothed Indicator

Heiken Ashi in Japanese actually interprets to common bars, which may be very becoming for the Heiken Ashi Smoothed indicator as it is usually based mostly on common worth actions.

The Heiken Ashi Smoothed indicator, also called Heiken Ashi Shifting Common or HAMA, is a pattern following technical indicator which is a variation of the Heiken Ashi Candlesticks. Though the Heiken Ashi Smoothed indicator is a variation of the Heiken Ashi Candlesticks, the 2 indicators are very totally different.

The Heiken Ashi Candlesticks resemble a candlestick with the identical highs and lows as a Japanese candlestick however solely modifications coloration at any time when its underlying mathematical computation detects a short-term pattern reversal.

The Heiken Ashi Smoothed indicator then again is derived from a modified transferring common computation based mostly on the highs, lows and shut of every candle. As such, the Heiken Ashi Smoothed indicator behaves rather more like a transferring common line displayed with candlesticks.

The Heiken Ashi Smoothed indicator plots bars which follows worth motion fairly intently. These bars symbolize the realm of the common worth, very like a transferring common line.

The colour of its bars signifies the course of the pattern it detects. On this setup, lime bars point out a bullish pattern bias, whereas pink bars point out a bearish pattern bias.

The Heiken Ashi Smoothed indicator is characteristically very easy, which makes its title very becoming. On the identical time, regardless of its smoothness, it nonetheless reacts to cost modifications fairly responsively, making it a dependable pattern following indicator.

As such, the Heiken Ashi Smoothed indicator is a wonderful pattern course filter indicator based mostly on the colour of the bars it plots. It will also be used as a pattern reversal entry sign based mostly on the altering of the colour of its bars.

For the reason that Heiken Ashi Smoothed indicator represents the realm of the common worth, it will also be used as a dynamic space of help or resistance the place worth can retrace and bounce from.

Dynamic Space of Assist or Resistance

Most merchants establish help or resistance as a static line based mostly on the connection of greater than two swing factors. These strains are thought of as areas the place worth could bounce from.

Some merchants use horizontal help based mostly on a previous swing low, and horizontal resistance ranges based mostly on a previous swing excessive.

Each these strategies are viable basic methods of figuring out help or resistance ranges. Nonetheless, there’s a third manner of taking a look at help and resistance ranges.

Dynamic areas of help and resistance are areas the place worth could bounce from as a help or resistance degree that are based mostly on a dynamic technical indicator. This may increasingly both be based mostly on transferring averages or band-based indicators.

Heiken Ashi Smoothed Dynamic Space of Assist or Resistance

The Heiken Ashi Smoothed indicator is a wonderful indicator for figuring out trending markets. It successfully identifies the course of trending markets and rapidly signifies at any time when the pattern is beginning to reverse.

Apart from this, the Heiken Ashi Smoothed indicator can be a wonderful dynamic space of help or resistance degree. Worth tends to retrace in the direction of this space in a trending market and rapidly reverses away from it after the retracement.

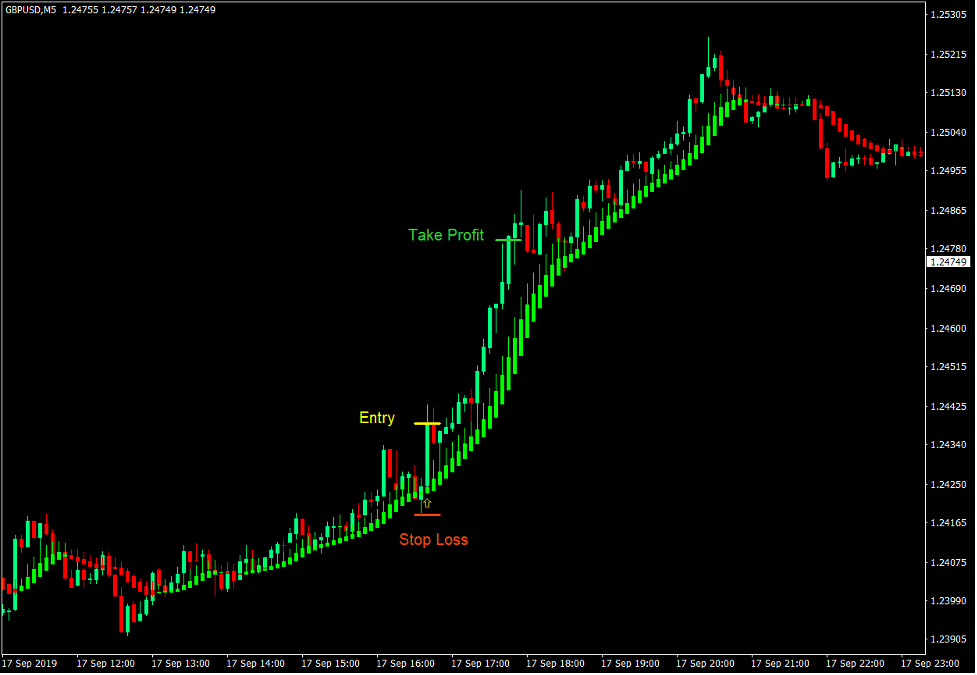

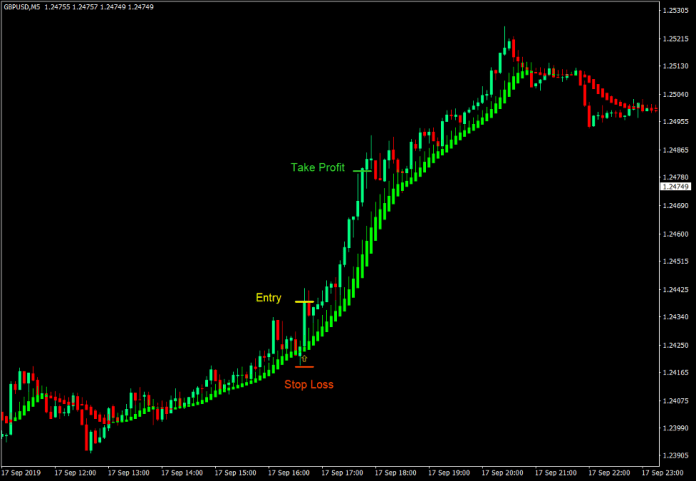

Uptrend Heiken Ashi Smoothed Dynamic Assist

- The Heiken Ashi Smoothed bars ought to be lime.

- Verify if the market is in an uptrend based mostly on the traits of worth motion swings.

- Await worth to retrace in the direction of the realm of the Heiken Ashi Smoothed indicator.

- Enter a purchase commerce as quickly as worth signifies worth rejection on the realm of the Heiken Ashi Smoothed indicator based mostly on both a bullish pin bar or engulfing sample.

- Set the cease loss beneath the entry candle.

- Set the take revenue goal at 2x the chance on the cease loss.

Downtrend Heiken Ashi Smoothed Dynamic Resistance

- The Heiken Ashi Smoothed bars ought to be pink.

- Verify if the market is in a downtrend based mostly on the traits of worth motion swings.

- Await worth to retrace in the direction of the realm of the Heiken Ashi Smoothed indicator.

- Enter a promote commerce as quickly as worth signifies worth rejection on the realm of the Heiken Ashi Smoothed indicator based mostly on both a bearish pin bar or engulfing sample.

- Set the cease loss above the entry candle.

- Set the take revenue goal at 2x the chance on the cease loss.

Conclusion

Development following methods are among the simplest methods to commerce the foreign exchange market. It might at instances be extra correct in comparison with pattern reversal setups as a result of we’re buying and selling towards an present pattern.

The important thing to buying and selling pattern continuation methods successfully is in accurately figuring out a trending market and figuring out when and the place to enter the market. That is the place the Heiken Ashi Smoothed indicator excels. As such, buying and selling pattern following methods utilizing the Heiken Ashi Smoothed indicator as a dynamic space of help or resistance is an efficient technique to commerce a trending market.

Foreign exchange Buying and selling Methods Set up Directions

The way to Commerce with Heiken Ashi Dynamic Assist and Resistance is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past knowledge and buying and selling indicators.

The way to Commerce with Heiken Ashi Dynamic Assist and Resistance gives a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

The way to set up The way to Commerce with Heiken Ashi Dynamic Assist and Resistance?

- Obtain The way to Commerce with Heiken Ashi Dynamic Assist and Resistance.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick The way to Commerce with Heiken Ashi Dynamic Assist and Resistance

- You will note The way to Commerce with Heiken Ashi Dynamic Assist and Resistance is offered in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]