[ad_1]

This was 2022 in a nutshell: extra individuals are saving for retirement however they’re not saving practically sufficient.

Yearly, Vanguard releases its report on the state of the nation’s habits round saving for retirement. Participation amongst staff with entry to 401(ok) plans has jumped over the previous 5 years from 72 % to 83 % in 2022, in accordance with the latest report on the 401(ok) plans in Vanguard’s giant consumer base.

Some credit score goes to the rising reputation amongst employers of mechanically enrolling staff of their plans. Underneath this company coverage, worker participation in 401(ok)-style plans is 93 %, versus simply 70 % after they don’t get that nudge and are left on their very own to resolve whether or not to save lots of. Extra states are additionally requiring employers to both arrange an in-house 401(ok) plan or mechanically enroll their staff in a state-sponsored IRA, which can even be giving a very small increase to saving.

However a more in-depth take a look at Vanguard’s knowledge reveals a cut up between the haves and have-nots. Folks incomes excessive incomes have very excessive participation charges however it’s lagging for low-income staff. Analysis does present that the state IRA applications are reaching extra low-wage staff. Nonetheless, in accordance with Vanguard, solely about half of the individuals incomes lower than $30,000 had been saving final yr, in contrast with greater than 90 % of individuals incomes over $100,000.

However even the employees who do repeatedly deposit cash into their 401(ok) accounts aren’t saving sufficient, and the drop within the inventory market final yr did lots of injury.

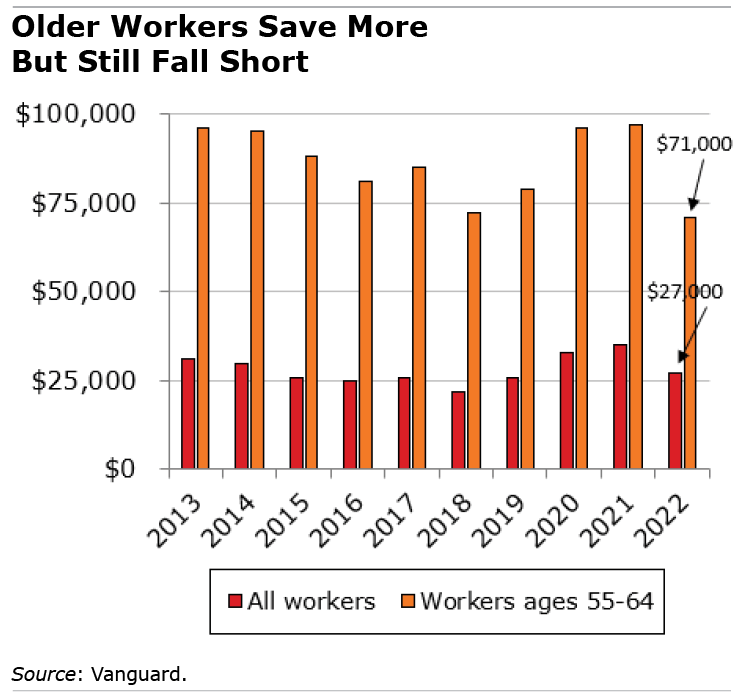

The Commonplace & Poor’s 500 market index misplaced practically 20 % in 2022, lowering the everyday employee’s 401(ok) steadiness to a paltry $27,400. That was down from an already-low $35,300 in 2021. A decade in the past, the comparable steadiness was $2,000 extra!

To be truthful, the inventory market has rebounded neatly this yr. And the small 2022 balances are an imprecise gauge of how People are doing, as a result of they embrace staff who’re simply beginning their careers or have solely not too long ago began saving in a state IRA program and nonetheless have small account balances. The employees in Vanguard’s knowledge additionally may need cash in a IRA or former employer’s 401(ok), or their partner may need a 401(ok).

So let’s see how issues are going for the older labor pressure who ought to, by now, have hefty quantities of their retirement plans. The standard employee between 55- and 64-years-old, who’s on the runway to retirement, has simply $71,000 in a 401(ok). That’s the lowest degree in that age group in additional than 10 years of Vanguard knowledge, and it received’t generate quite a lot of hundred {dollars} a month in retirement earnings.

Let’s hope Vanguard’s 2023 report can be higher – and it may be. 4 in 10 staff are placing a bigger share of their paychecks into their 401(ok)s, in accordance with Vanguard, and the inventory market rise will buoy staff’ balances.

It’d be robust to do a lot worse than 2022.

Squared Away author Kim Blanton invitations you to comply with us on Twitter @SquaredAwayBC. To remain present on our weblog, please be a part of our free e-mail record. You’ll obtain only one e-mail every week – with hyperlinks to the 2 new posts for that week – if you join right here. This weblog is supported by the Heart for Retirement Analysis at Boston Faculty.

[ad_2]