[ad_1]

The Financial institution of England Financial Coverage Committee report issued yesterday makes grim studying. These charts are all from the primary chapter on the financial outlook:

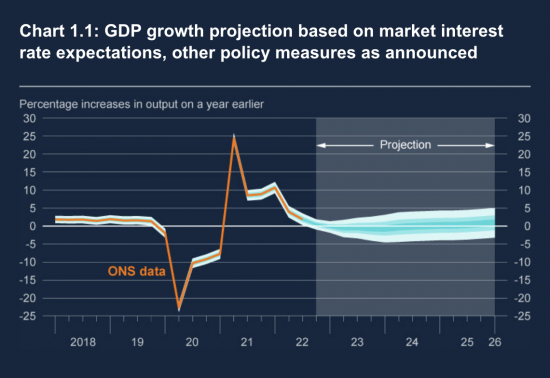

The Financial institution will not be anticipating development till 2026. You would possibly name that its personal mark by itself mismanagement of the financial system.

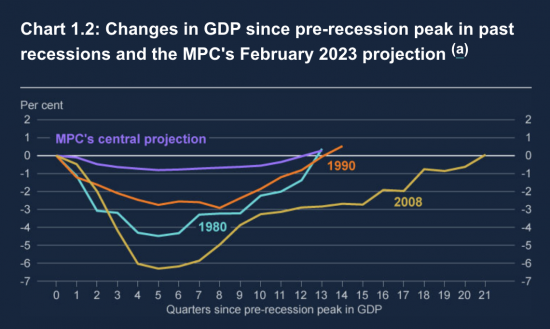

Because of this we, singularly within the G7, will take till 2026 to get well from Covid, assuming nothing else occurs within the meantime to knock us off beam (which is a mighty large assumption):

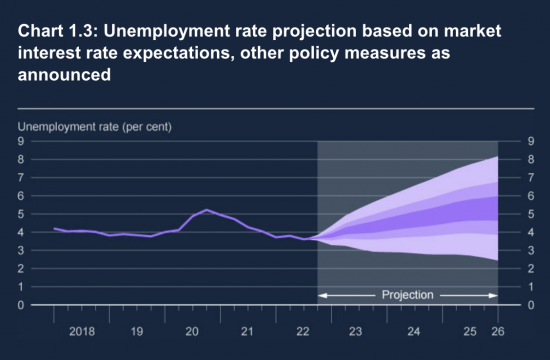

The worth of this incompetence is to be borne by individuals who shall be unemployed:

You’ll suppose they didn’t care, given the casualness with which they make such forecasts.

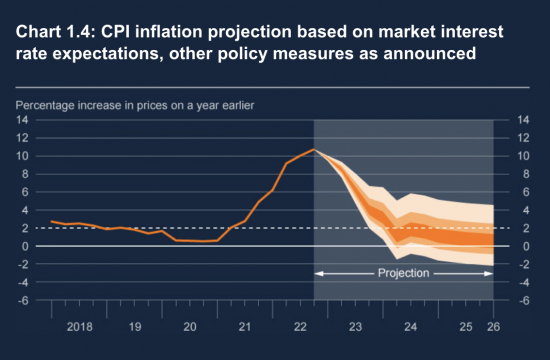

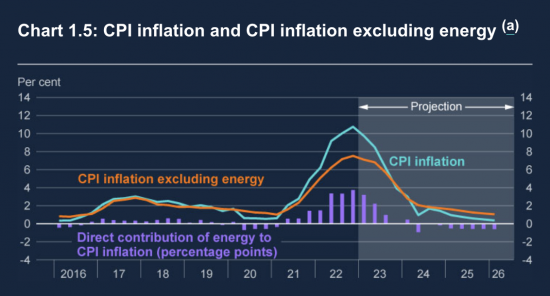

And what’s staggering is that they elevated rates of interest regardless that they admitted {that a}) there isn’t a means that the speed rises that they’ve already delivered have impacted inflation to any important diploma and b) there isn’t a situation through which they will think about inflation rising once more, as this chart reveals:

As they actually present, power prices are literally going to drag inflation down now:

However regardless that they know the underlying reason for inflation goes, they’re nonetheless eager to impose recession on the UK.

Why? The nice unstated cause is that outdoors the EU the UK financial system is principally unable to develop as a result of it has not acquired the folks to take action.

This might, in fact, be celebrated. We’d be the primary post-growth financial system. The difficulty is there isn’t a plan for that. All of the previous aims are nonetheless in place, with a shrugged-off recognition that there isn’t a likelihood of delivering in opposition to them.

That is financial failure on a grand scale, and the Financial institution of England is simply compounding it.

However so too are the whole political class that refuses to speak about Brexit. Hardly ever has politics been so totally irresponsible.

[ad_2]