[ad_1]

2022 was a yr that required a ton of persistence, ready out the cyclical bear market that unfolded – particularly through the first 5-6 months of the yr. However we noticed important energy in lots of areas through the fourth quarter and progress shares have powered the market ahead in January 2023. January efficiency has supplied us super clues about “stability of yr” efficiency (February by way of December). It has been amazingly correct. Contemplate that of the Prime 20 Januarys since 1950, which requires January efficiency above roughly 4%, 18 “stability of yr” returns have been optimistic and 14 has proven good points of not less than 10%. Now let’s examine the Backside 20 Januarys. The Backside 20 Januarys all produced month-to-month losses of two.5% or extra. The “stability of yr” efficiency noticed good points in simply 13 of 20 years. And solely 6 of 20 noticed “stability of yr” good points larger than 10%. January efficiency is positively correlated with “stability of yr” efficiency.

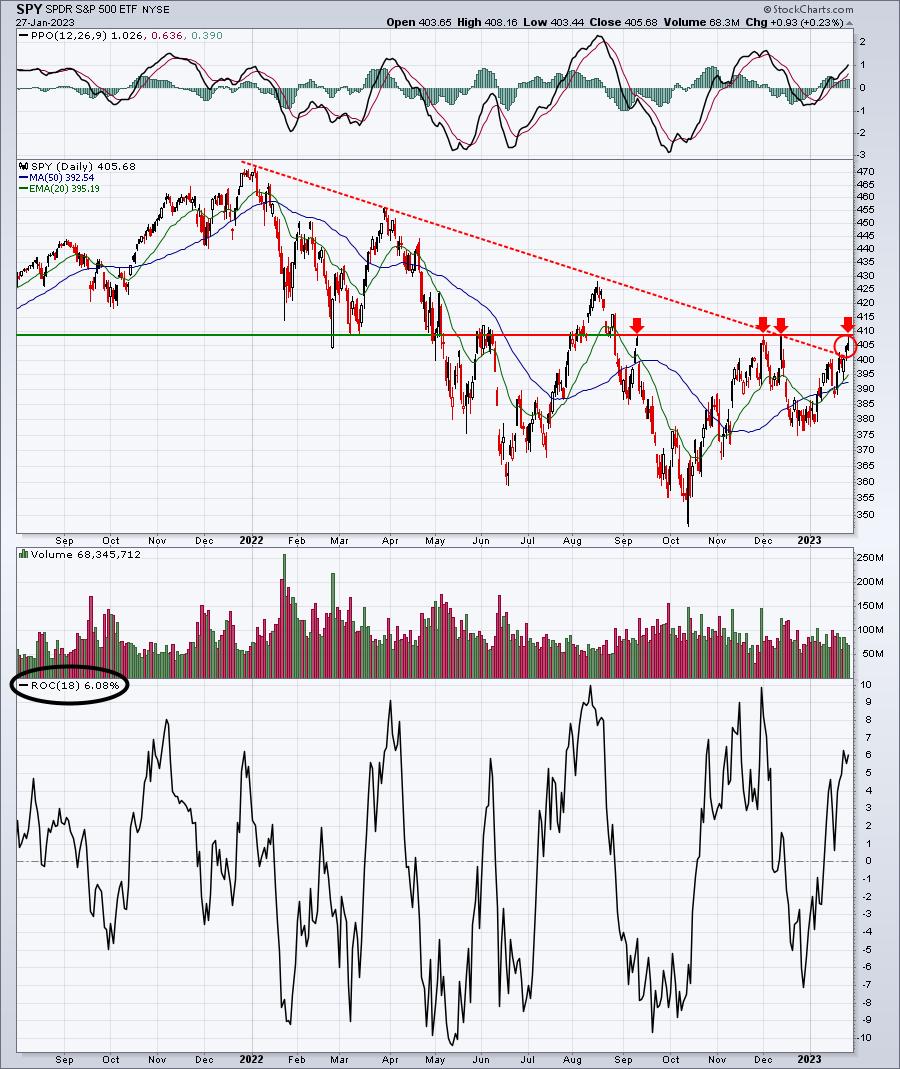

So let’s take a look at the present SPY (ETF that tracks the S&P 500) efficiency and technical outlook:

The underside panel represents the 18-day price of change (ROC). We have had 18 buying and selling days in 2023 so far, so this offers us our January-to-date efficiency. The January 2023 6.08% acquire, if it holds up by way of January thirty first, can be the tenth greatest January since 1950, inserting it simply throughout the Prime 20 Januarys over the previous 73 years. When taking a look at nothing however the worth development, I feel it is necessary to clear the down development that is been in place since early 2022. I additionally consider it is necessary to clear current worth highs within the 400-410 space. Friday’s excessive was 408.16. The downtrend line has been damaged, however we nonetheless have to see worth resistance eclipsed close to 410. That would be the bulls’ main aim this week.

As motion has turned rather more bullish in 2023, we have seen renewed shopping for in shares which might be closely shorted. I wrote about Wayfair (W) final Sunday after it broke out above worth resistance within the 42-43 vary. W gained greater than 36% final week as the massive variety of quick sellers (quick % of float is at the moment reported close to 35%) ran for canopy. Tomorrow morning, I will be unveiling a inventory with almost 40% of its float quick that simply broke out on Friday in a sample fairly just like W. I consider it has the potential for a major rally within the week forward. You possibly can CLICK HERE for those who’re not already a FREE EB Digest subscriber. Merely enter your identify and electronic mail handle and I am going to ship you that quick squeeze inventory round 8:30am ET. There is no such thing as a bank card required and you might unsubscribe at any time.

Comfortable buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Every day Market Report (DMR), offering steerage to EB.com members on daily basis that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as effectively, mixing a novel ability set to method the U.S. inventory market.

Subscribe to Do not Ignore This Chart! to be notified at any time when a brand new publish is added to this weblog!

[ad_2]