[ad_1]

Hidden Reality: A Information to Evaluating Professional Advisors in Right now’s Market

The world of buying and selling is flooded with a myriad of promising Professional Advisors (EAs) vying for consideration. Each touts its distinctive qualities and strives to current itself in the absolute best gentle. But, for consumers looking for a dependable and worthwhile EA, the duty of evaluating and making an knowledgeable choice has change into more and more difficult.

The actual problem lies within the hid nature of an EA’s true reliability, as distributors typically hold very important data below wraps. Nonetheless, concern not, a breakthrough technique has emerged to uncover the real trustworthiness of every EA – an evaluation centered solely on its dwell buying and selling alerts.

On this article, we are going to delve into the perils of counting on martingale methods and the risks related to including new positions whereas costs proceed to plummet. Many merchants, after testing numerous EAs and methods, have come to a powerful conclusion: this method is extremely harmful and inevitably results in blown accounts over time.

To compound issues, EA authors have mastered the artwork of deception by cleverly disguising their methods. They swiftly delete blown alerts and substitute them with new ones. So long as the brand new account stays intact – be it for a month or perhaps a yr – they shamelessly market the EA, leaving unsuspecting consumers at midnight about its true dangers.

However how can we detect if an EA genuinely employs martingale and averaging strategies? And if it does, how harmful is its configuration? On this complete information, we are going to unravel these mysteries and equip you with two indispensable tips to precisely consider the true nature of an EA.

Put together to uncover the hidden reality as we embark on a journey to decode the intricacies of Professional Advisors and empower you to make knowledgeable selections in right now’s complicated buying and selling panorama.

Secret 1: The Many-At-As soon as-Shut Sample

The closing instances of positions present invaluable insights that may be discovered below the “Buying and selling Historical past” part of a sign. When a number of positions are closed concurrently, and a few of them lead to losses, it ought to function a purple alert.

This state of affairs signifies that the EA is using a harmful tactic of including funds to a dropping place so long as there can be found assets. Nonetheless, it’s essential to acknowledge that this technique holds a major danger. In depth analysis performed by quite a few scientists over time has led to a unanimous conclusion: if an EA makes use of such a technique, it’s inevitable that at some point, a novel market motion will emerge, finally resulting in the depletion of your invested funds.

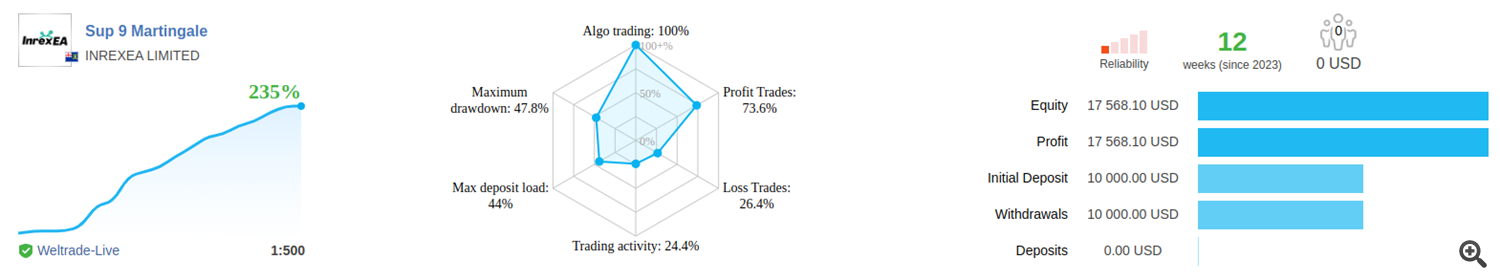

Instance: Sum 9 Martingale EA

You could find this EA right here and purchase it for 3250$.

Upon preliminary examination, this EA seems to be extremely worthwhile and succesful primarily based on its efficiency. Nonetheless, to realize a extra complete understanding, let’s delve deeper into its particulars.

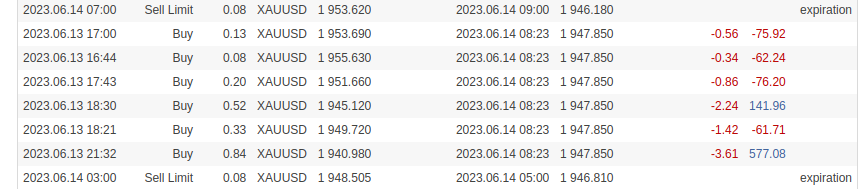

After we open the “Buying and selling Historical past” part, a noteworthy commentary emerges – a collection of positions exhibiting a recurring sample often known as Many-At-As soon as-Shut.

Analyzing this block of information reveals that the EA commenced with a place measurement of 0.08 tons and step by step elevated it to 0.84 tons. Whereas this scaling could also be acceptable for an account measurement of $17,000, it raises issues for smaller accounts.

It is very important contemplate the implications of such place sizing, because it might not be appropriate or viable for accounts with extra restricted capital. A prudent method entails assessing the compatibility of an EA’s buying and selling technique along with your particular account measurement to keep away from potential dangers and account depletion.

Secret 2: Cease Loss to Take Revenue Relation

When using a technique that goals to earn a mere $1 whereas tolerating a drawdown of as much as -$100, a misleading phenomenon happens. Such a technique will endlessly look ahead to positions to show worthwhile, misleadingly sustaining an upward steadiness curve that by no means declines.

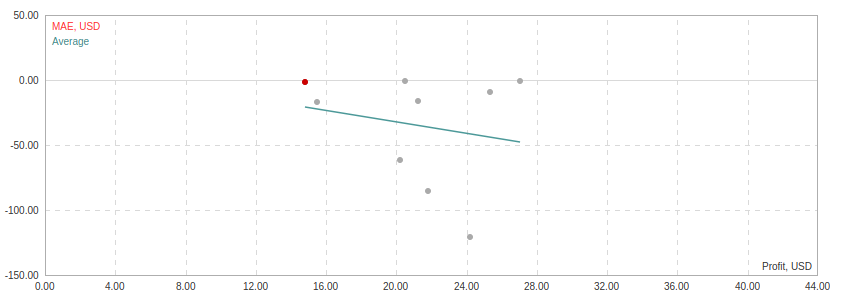

The query then arises: how can we uncover the true Cease Loss (SL) and Take Revenue (TP) ratio of an EA? Fortuitously, Stay alerts present a invaluable instrument often known as the Most Adversarial Tour (MAE) graph. Regardless of the shortage of official documentation on its interpretation, it holds immense significance for MQL customers like myself.

A nasty EA would shut a place with a revenue solely after it has endured important drawdown. This leads to the dots on the MAE graph showing on the suitable facet of the vertical axis, deeply descending into unfavorable territory.

Conversely, EA displays a extra favorable method. It closes positions earlier than they encounter substantial drawdown, guaranteeing that the revenue exceeds the vertical distance from the horizontal axis.

Instance: Prime Secret EA

You could find this EA right here and purchase it for 1250$

With a powerful observe document of no dropping trades over a span of 5 weeks, the EA definitely garners consideration. Nonetheless, it’s essential to delve deeper and study its Most Adversarial Tour (MAE) graph to realize a complete understanding of its danger profile. To entry this data, we click on on the “Dangers” tab and scroll down for evaluation.

Upon finding out the MAE graph, a regarding revelation involves gentle. With the intention to generate a revenue of $24, the EA accepted a considerable drawdown of -$120. Contemplating the present account measurement, this drawdown represents roughly 30% of all the account. Such a major danger publicity raises legitimate issues in regards to the EA’s long-term viability.

It turns into evident that there’s a chance, sooner or later, for the EA to both expertise a catastrophic blowup or incur excessive losses exceeding 30% !. Moreover, there’s a likelihood that the seller could create a brand new sign to hide such an occasion.

Whereas these assumptions could also be topic to interpretation, solely time will really reveal the validity of those issues. It’s essential to stay vigilant and monitor the EA’s efficiency intently to evaluate its potential to resist market fluctuations and ship constant profitability.

By understanding and analyzing these contrasting variants, we are able to acquire invaluable insights into an EA’s danger administration capabilities and make knowledgeable selections about its suitability for our buying and selling endeavors.

Supercharge your buying and selling reliability by subscribing to my articles and receiving automated updates straight to your inbox.

[ad_2]