[ad_1]

Holding firm inventory in 401(ok) plans – at all times a nasty thought – has declined sharply.

When a colleague and I wrote a ebook on 401(ok) plans in 2004, we devoted a complete chapter to the perils of investing 401(ok) property in firm inventory. And plenty of conferences round that point concerned impassioned pleas for Congress to restrict firm inventory funding. At one in every of these conferences, somebody prompt that the corporate inventory downside could also be one that may remedy itself, as goal date funds grew to become the default – diverting workers’ consideration from the inventory of their employers.

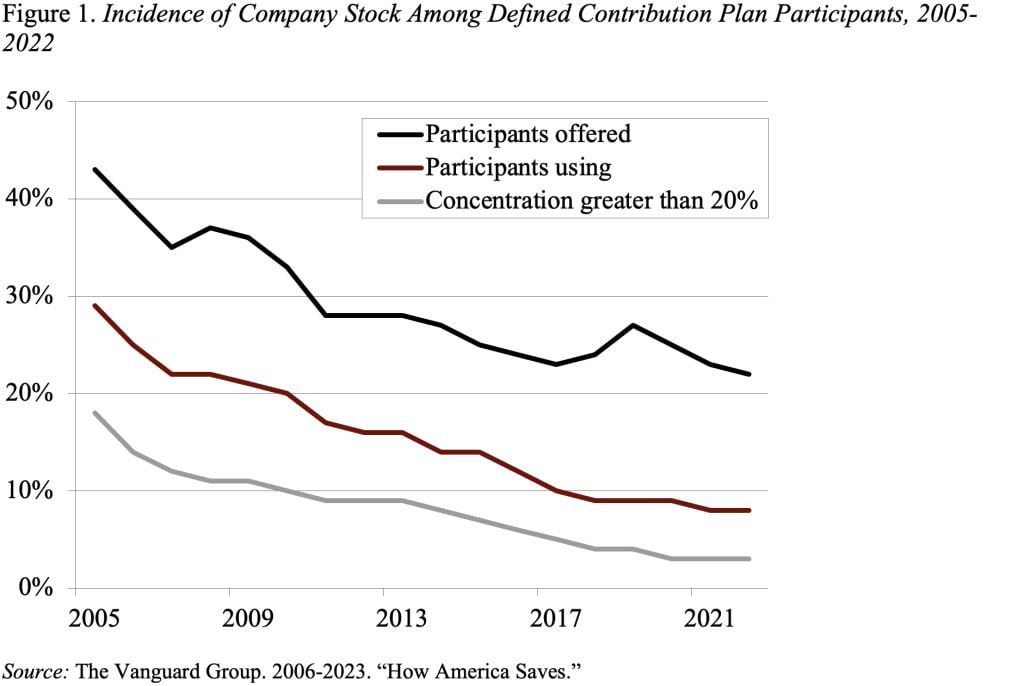

Certainly, Vanguard information present that this “squeezing-out” phenomenon, mixed with sponsor recognition of the dangers of single-stock funding, has resulted in a giant decline in each the share of plan sponsors actively providing firm inventory – from 12 p.c in 2005 to eight p.c in 2022 – and the share of contributors with firm inventory. The decline in contributors has been notably dramatic: the share supplied firm inventory has dropped from 43 p.c to 22 p.c, the share holding firm inventory from 29 p.c to eight p.c, and the share with concentrations of firm inventory over 20 p.c from 18 p.c to three p.c (see Determine 1).

General, three elements have contributed to the decline. First, goal date funds have elevated dramatically in reputation, in order that – when mixed with fairness index funds – they now account for nearly 80 p.c of outlined contribution plan property. Second, sponsors have come to appreciate that having their workers invested in firm inventory is dangerous for each events – suppose Enron. Because of this, a 2020 Vanguard examine discovered that greater than half of firms that had beforehand supplied firm inventory not do, and the majority that do provide it allow fast diversification. Third – most likely much less vital given worker inertia – the Pension Safety Act of 2006 expanded diversification rights for contributors in order that they might promote their very own firm inventory at any time and employer contributions of firm inventory after three years.

Whereas these elements have led to a dramatic decline in firm inventory, 3 p.c of contributors nonetheless maintain greater than 20 p.c of their property in it. That’s not good. Holding one inventory – as an alternative of, say, thirty – greater than doubles the riskiness of a portfolio, with no potential offset of upper returns. Furthermore, contributors with firm inventory personal an asset whose worth is intently correlated with their earnings; if the corporate will get into bother, they danger dropping not solely their job but additionally their retirement saving.

So, why do contributors maintain firm inventory? Typically, they don’t seem to be subtle traders and underestimate the danger of investing in a single inventory. Staff additionally like to purchase what they know; they see executives getting wealthy and wish to have an opportunity to swing for the fences. The issue is exacerbated when the employer matches in firm inventory, which is usually handled as an endorsement of the acquisition. Traditionally, employers have strongly valued the power to match in inventory quite than money, apparently as a result of it allowed them to hold onto their priceless money reserves. This desire, nonetheless, might have been diluted by a collection of lawsuits during the last 15 years.

The issue of extreme firm inventory holdings doesn’t come up with outlined profit plans, as a result of ERISA permits not more than 10 p.c of plan property to be held in firm inventory. After I was younger, I’d push for that restrict for outlined contribution plans. However given our loopy world, that combat is fairly low on my to-do listing. Let’s merely rejoice within the progress made thus far.

[ad_2]