[ad_1]

Did you obtain a 1099-Ok tax type this 12 months? For those who’ve by no means seen this manner earlier than and are uncertain what to do with it, don’t freak out — we may also help you perceive your Kind 1099-Ok and information you thru reporting any crucial earnings.

How do I take advantage of my 1099-Ok when submitting my tax return?

TaxAct® takes correct tax reporting significantly. That’s why we’ve spent a lot time and care optimizing our 1099-Ok reporting this 12 months. We’ve added extra detailed questions on what your 1099-Ok was for thus we may also help pull the correct tax varieties for you.

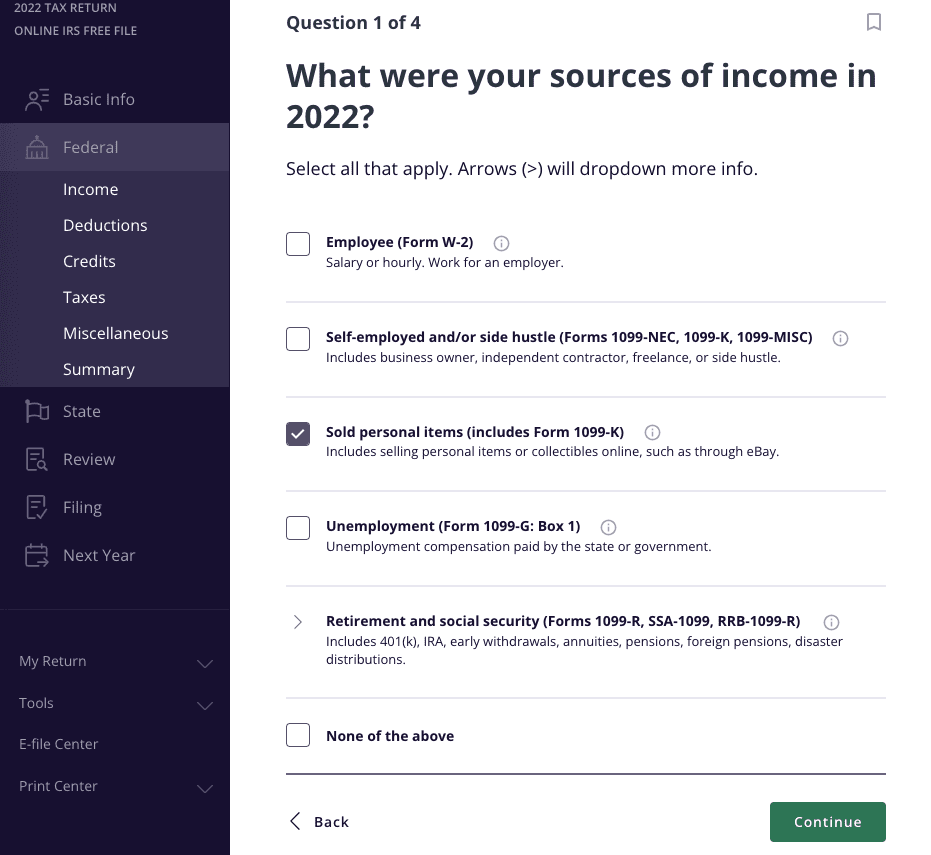

First, we’ll ask you for details about what varieties of earnings you’ve earned this 12 months:

As you’ll be able to see from the screenshot above, Kind 1099-Ok seems in a couple of place — usually, this manner is used for individuals who are self-employed, function a facet hustle, or promote private gadgets on-line. You can additionally obtain a 1099-Ok for actual property leases and royalties or farming.

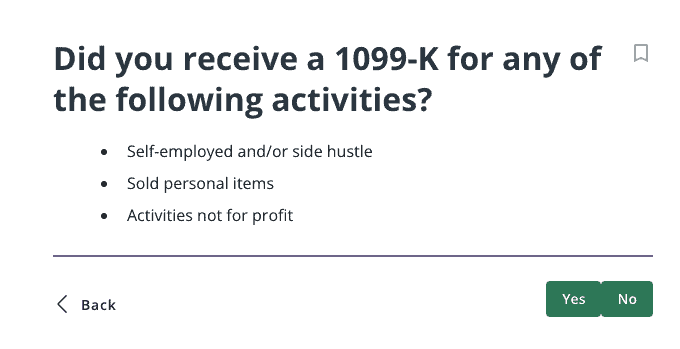

For those who obtained a 1099-Ok for items you bought as a passion, there may be additionally a 3rd possibility, “actions not for revenue,” as proven under.

As you undergo our 1099-Ok reporting course of, we’ll ask you complete questions on your fee transactions and who despatched you the 1099-Ok. When you’ve got a couple of 1099-Ok, we’ll undergo them one by one. It’s attainable you could possibly even have a number of companies on a single 1099-Ok — if that’s the case, we may also help stroll you thru that course of as effectively.

Realizing what the funds have been for helps us decide whether or not you owe taxes on that earnings. Based mostly in your solutions, we’ll make it easier to accurately report the earnings and enter any bills to scale back your quantity of taxable earnings, if relevant.

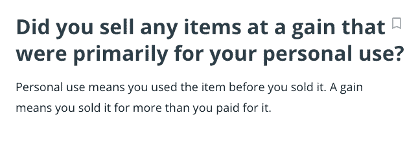

Right here’s an instance query:

This could be a very good time to say that not all of the transactions in your 1099-Ok are essentially taxable earnings. Kind 1099-Ok solely reveals the gross quantity of all of your fee transactions, whilst you solely owe taxes in your web earnings. For example, for those who bought a private merchandise at a loss, no earnings can be acknowledged on the sale, and, due to this fact, no earnings taxes are owed.

TaxAct will make it easier to determine which transactions are taxable and which aren’t based mostly on the knowledge you present.

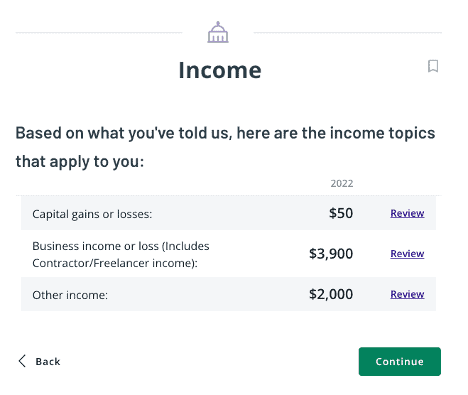

After you’ve entered all of the relevant transactions out of your 1099-Ok, we’ll evaluation what you informed us (proven under). At this level, you’ll be capable of return in and edit or add to every part if crucial.

After that, you’re achieved along with your 1099-Ok!

Most important takeaways

If you’re a facet hustler, self-employed, passion vendor, or somebody who sells used private gadgets on-line, you could possibly obtain your first 1099-Ok this 12 months. If that’s the case, figuring out what this manner is and how you can use it’s important.

TaxAct makes the reporting course of as easy as attainable. If you file with us, you’ll be able to relaxation straightforward figuring out we’ll information you thru it step-by-step.

All TaxAct affords, services and products are topic to relevant phrases and situations.

This text is for informational functions solely and never authorized or monetary recommendation.

[ad_2]