[ad_1]

For those who’ve filed an amended tax return, you’re most likely already nervous about the truth that you made a mistake. That nervousness could intensify over time as you marvel the place your amended return is, particularly in the event you’re ready for an amended tax return refund.

At TurboTax, we all know taxes might be worrying, and we all know that you simply need to get any errors corrected immediately, even when you find yourself owing cash. We’ve assembled all the things you want to learn about your amended return for you right here so you’ll be able to relaxation straightforward.

What’s an amended tax return?

An amended return refers to any tax return you file to right an error for that 12 months’s taxes. You might have three years from submitting your taxes to file an amended return.

Most People fear that making a mistake on their taxes will end in an audit and expensive penalties. However, in actuality, so long as you might be upfront and trustworthy with the IRS about any errors you made on a return, you’ll be capable of right them and not using a downside.

For instance, in the event you labored a number of jobs and forgot to incorporate a W-2 in your revenue complete, you would want to file an amended tax return to report the right revenue. When you’ve filed the amended return, the IRS will ship you a refund or a invoice for cost relying on the state of affairs.

The place’s my amended return?

Not like typical returns, amended returns can’t be filed on-line, in order that they take longer to course of. In response to the IRS, the amended tax return refund timeline is as much as 20 weeks to course of an amended return.

When you mail your return, it should take about three weeks for the IRS to obtain your return and enter it into the system so you’ll be able to observe it. As soon as it’s entered into the system, it will probably take as much as 16 weeks for the IRS to course of the return and concern a refund or ship you a tax invoice.

The best way to observe an amended tax return

Whereas it takes time for the amended tax return to be accomplished, checking the standing of your amended return is comparatively straightforward you probably have all the data at hand.

What you’ll want

To trace your amended tax return, you’ll want the next:

- Your social safety quantity

- Your date of delivery

- Your zip code

Methods to examine the standing of your amended return

After you have that info, you’ll be able to go to the IRS’ The place’s My Amended Return device to trace your amended return.

You may as well name the IRS straight at 1-866-464-2050 in the event you choose, however count on lengthy wait instances, particularly throughout tax season.

When to examine the standing of your amended return

Because it takes three weeks on your return to enter the IRS system, it’s finest to attend a couple of month earlier than you begin checking the standing of your amended return.

If it has been greater than 20 weeks because you submitted your return and also you’ve already checked the IRS on-line device, then you’ll be able to name the IRS straight at 1-866-464-2050 to investigate concerning the standing of your return.

Amended tax return statuses and what they imply

While you examine the standing of your amended return on-line, you’ll see three totally different statuses: obtained, adjusted, and accomplished.

In case your return is marked as a obtained, which means the IRS has obtained your return and it’s at the moment being processed.

In case your return is marked as adjusted, which means the IRS has made the requested change.

In case your return is marked as accomplished, which means follow-up info, corresponding to a tax refund or a tax invoice, is being mailed to you.

Often Requested Questions

Amended tax returns might be difficult. Listed here are some widespread Often Requested Questions and solutions from the TurboTax workforce.

When do I must file an amended tax return?

Typically, it is best to file an amended return for the next causes:

- An error in revenue reporting, corresponding to forgetting to incorporate revenue on W-2 or 1099 kind

- An error in your file standing, corresponding to submitting collectively once you meant to file singly

- Claiming or correcting deductions, corresponding to a toddler or new partner

- Claiming or correcting a credit score, corresponding to a toddler tax credit score

Don’t file an amended tax return if:

- You forgot to connect a W-2 to your return once you mailed it in

- You made a mathematical error (the IRS will catch it whereas processing and ship you a discover)

- The IRS rejects your unique e-return

- The IRS sends you a CP2000 discover

For extra details about when to file an amended tax return, see How Do I Know If I Ought to Amend My Tax Return?.

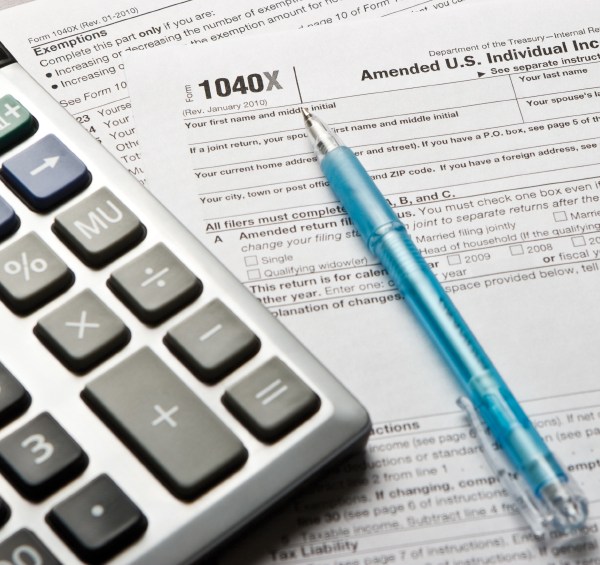

How do I file an amended tax return?

To file an amended return, you’ll want to finish kind 1040x. In Column A, you’ll want to present the data out of your unique return. Column B asks you to calculate the distinction between that return you filed initially and the amended return. Column C consists of all the data for the corrected return.

The shape will even ask you to clarify the rationale on your amended return. Be trustworthy but concise when explaining why you might be submitting an amended return and also you shouldn’t have any points.

While you mail in your amended return, embrace the unique tax return and proof that helps the modifications you made within the amended return, like lacking W-2s. For those who owe cash, embrace a examine for the corrected quantity within the envelope and ensure all the things is within the right order outlined on the again of the 1040x kind.

What occurs if the IRS rejects my amended return?

In some conditions, the IRS could reject your amended return, wherein case they may ship you a discover of declare disallowance, a proper denial letter. At this level, you’ll be able to settle for their rejection, file an enchantment, or file a declare in federal courtroom.

Do I must file an amended state tax return?

For those who discover an error in your federal tax return, you possible made the identical mistake in your state return. In that case, you would want to additionally file an amended tax return along with your state.

Discovering you’ve made a mistake on a tax return might be scary, however you don’t must navigate it alone. TurboTax Reside tax specialists can be found 24/7 that can assist you establish the error and file an amended tax return rapidly and precisely. They’ll additionally make it easier to higher perceive your discover of declare disallowance, that are notoriously obscure, and information you thru the enchantment course of to make sure you get any cash you might be due.

[ad_2]