[ad_1]

Greenback bulls keep management of worth amid a broad risk-off temper midweek.

Greenback

The Dollar rolls into midweek on the entrance foot because it units a two-month excessive across the 103.50 stage. Elements driving this exuberance from buyers of the US forex could be attributed to a broad risk-off sentiment from the market at this midweek level. A number of the key influences of the ebb and circulate within the threat matrix are:

- Sustained hawkish rhetoric from FED officers, in help of upper rates of interest to struggle sticky inflation on the again of upbeat US PMI knowledge.

- Considerations in regards to the contents of the upcoming FOMC assembly minutes and what clues could possibly be buried in them in regards to the FED’s path on financial coverage.

- An incapacity to come back to an settlement on the looming debt ceiling disaster, which might result in the US defaulting on its debt obligations.

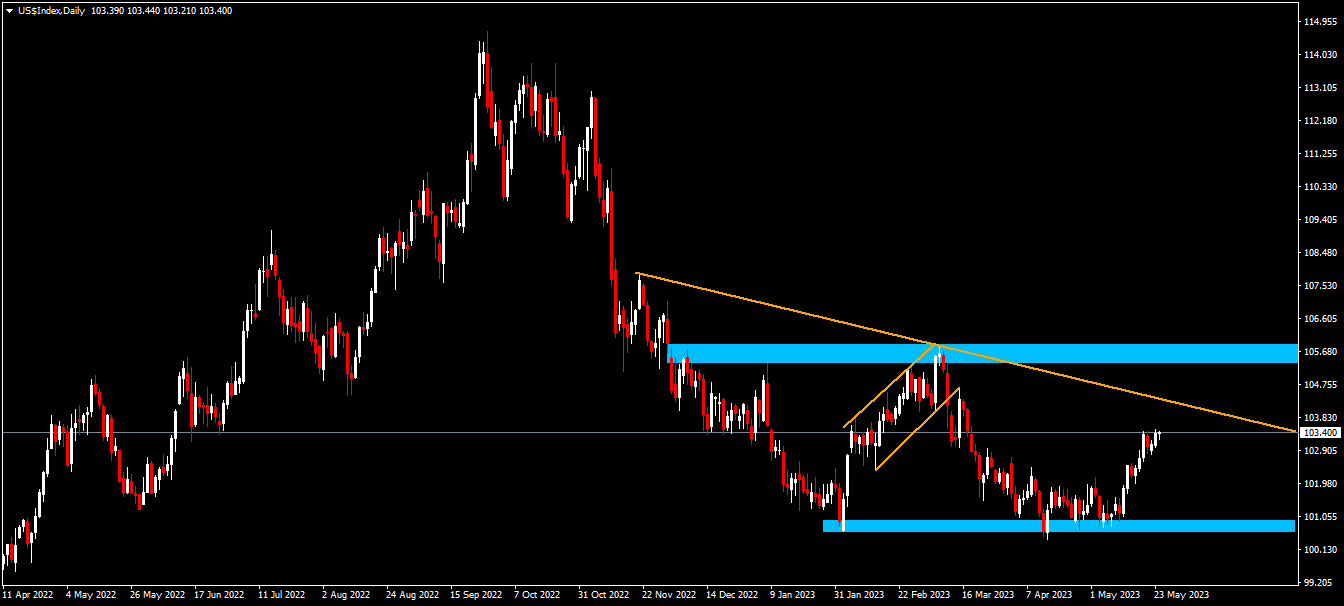

Technical Evaluation (D1)

When it comes to market construction, worth has been buying and selling inside a variety between the low of 100.36 and a excessive of 105.80. Present worth motion nonetheless suggests a dominant downtrend till the earlier lower-high is invalidated together with the downtrend. If sellers can defend the world and create a brand new lower-high, worth might revisit the low of the vary to doubtlessly create a brand new lower-low.

Euro

The European frequent forex heads into the center of the week with bears having the higher hand as worth trades at a two-month low. Elements driving this promoting strain could be attributed largely to greenback dynamics and the broad risk-off sentiment at this level within the week. A number of the Points driving this weak spot within the Euro are:

- The sustained and rising fears from buyers that the US might doubtlessly default after the 1st of June are making market individuals anxious.

- The upcoming FOMC minutes are making merchants maintain off on main bets as they await info that may shed some mild on the rationale behind the current 25bps price hike and provides clues in regards to the upcoming price hike in June.

- ECB President Lagarde’s speech later immediately (Wednesday) wherein she is predicted to shed some mild on June’s financial coverage, and doubtlessly broaden on her commentary that multiple price hike remains to be essential to tame cussed inflation.

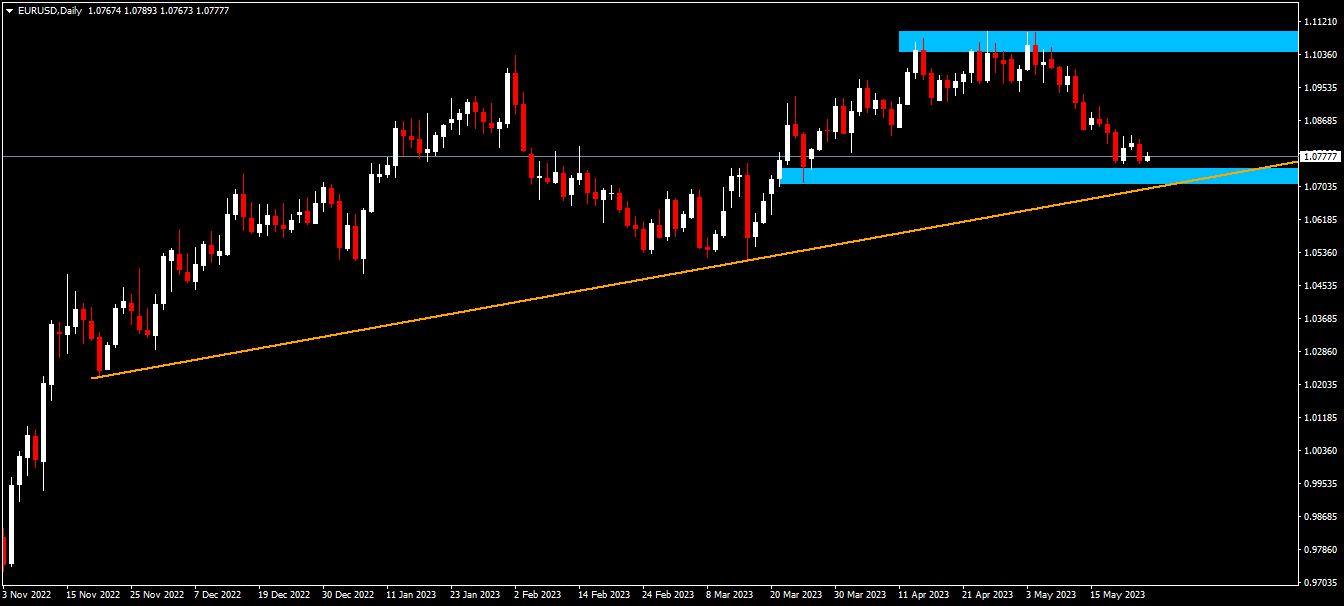

Technical Evaluation (D1)

When it comes to market construction, worth has been buying and selling inside a variety between the low of 1.070 and a excessive of 1.090. Present worth motion nonetheless suggests a dominant uptrend till the earlier higher-low is invalidated together with the uptrend. If patrons can defend the world and create a brand new higher-low or keep the present one, worth might revisit the excessive of the vary to doubtlessly create a brand new higher-high.

Pound

The Pound heads into the center of the week rebounding from a two-month low across the 1.237 stage. Elements driving this intraday resurgence from the British forex could be linked to optimistic inflation knowledge within the type of CPI coming in at 8.7% yoy in comparison with the earlier 10.1%. Different components driving present worth could be linked to:

- Constructive inflation knowledge which backs and justifies the BoE’s hawkish narrative and permits the Pound to brace for a possible upside acquire.

- Upside potential being capped by Greenback dynamics which might drive worth down within the brief time period as the danger sentiment advantages greenback inflows.

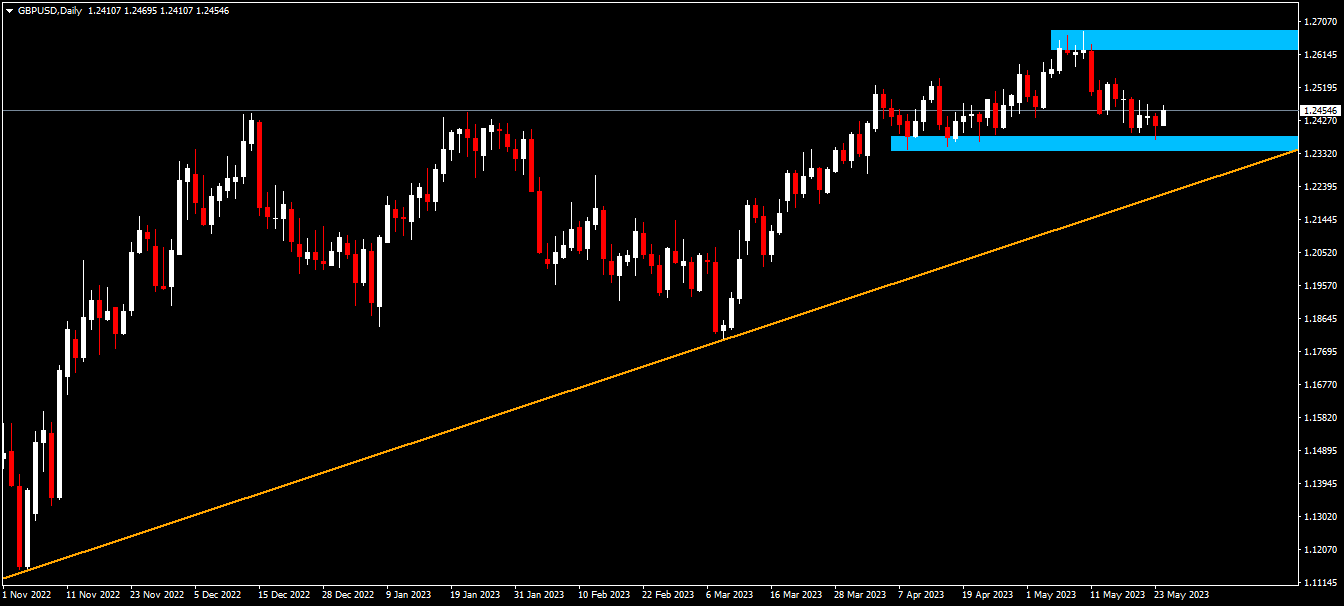

Technical Evaluation (D1)

When it comes to market construction, worth has been buying and selling inside a variety between the low of 1.234 and a excessive of 1.267. Present worth motion nonetheless suggests a dominant uptrend till the earlier higher-low is invalidated together with the uptrend. If patrons can defend the world and create a brand new higher-low or keep the present one, worth might revisit the excessive of the vary to doubtlessly create a brand new higher-high.

Gold

Gold heads into the center of the week below some important strain because it rebounds off a two month low on the $1 953 stage. Elements driving this promoting strain can largely be largely linked to greenback dynamics within the type of:

- Continued hawkish FED expectations inviting extra sellers to take part.

- Secure-Haven inflows to the Greenback persevering with to place a cap on gold bids amid debt ceiling fears.

- Recession dangers doubtlessly placing a ground beneath worth and welcoming new patrons at discounted costs.

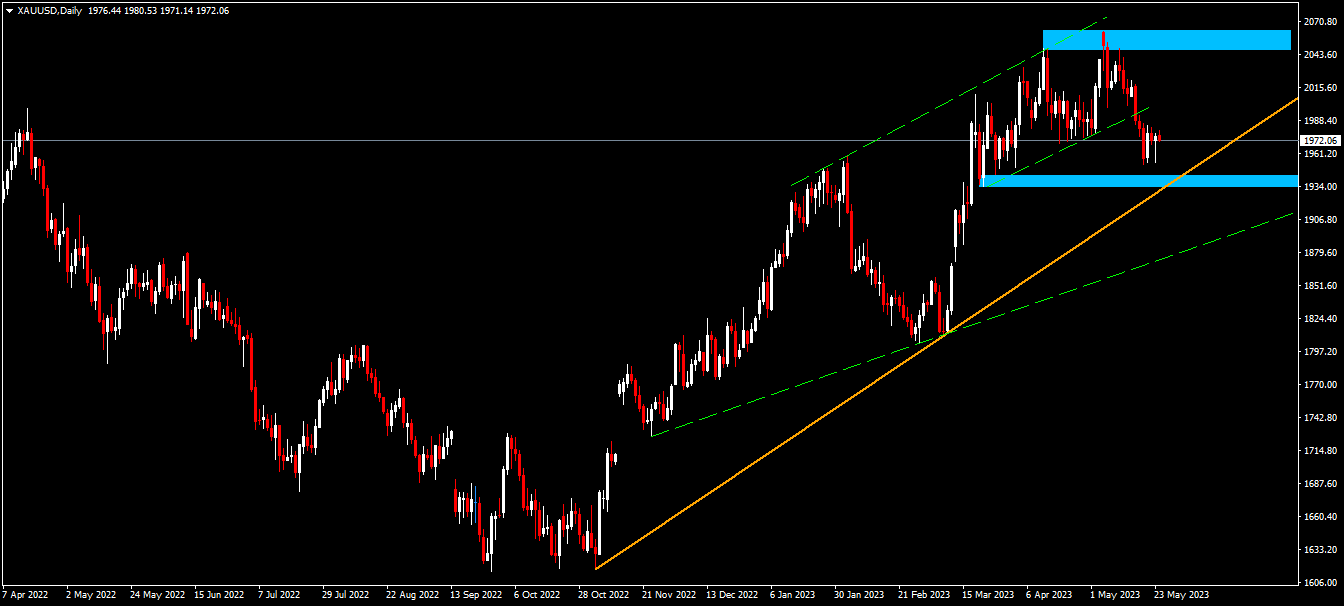

Technical Evaluation (D1)

When it comes to market construction, worth has been buying and selling inside a variety between the low of $1 930 and a excessive of $2 078. Present worth motion nonetheless suggests a dominant uptrend till the earlier higher-low is invalidated together with the uptrend. If patrons can defend the world and create a brand new higher-low or keep the present one, worth might revisit the excessive of the vary to doubtlessly create a brand new higher-high.

Click on right here to entry the Financial Calendar

Ofentse Waisi

Monetary Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for informational functions solely and never as unbiased funding analysis. This communication doesn’t comprise funding recommendation or suggestions or a solicitation with the intent to purchase or promote any monetary instrument. All info offered comes from dependable, respected sources. Any info that accommodates indications of previous efficiency will not be a assure or a dependable indicator of future efficiency. Customers must be conscious, that any funding in Leveraged Merchandise is topic to a sure diploma of uncertainty and that any funding of this type entails a excessive stage of threat for which the legal responsibility and duty is solely borne by the person. We aren’t chargeable for any losses arising from any funding made primarily based on the knowledge supplied on this communication. Replica or additional distribution of this communication is prohibited with out our prior written permission.

Threat Warning : Buying and selling Leveraged Merchandise similar to Foreign exchange and Derivatives might not be appropriate for all buyers because it carries a excessive stage of threat to your capital. Earlier than buying and selling, please be certain that you totally perceive the content material of the dangers concerned, making an allowance for your funding goals and stage of expertise and search unbiased recommendation and enter if essential.

[ad_2]