[ad_1]

Welcome to a brand new publication of the Market’s Compass Developed Markets Nation (DMC) ETF Research. It continues to focus on the technical modifications of the 22 DMC ETFs that we monitor on a weekly foundation and share our technical opinion on, each three weeks. There are three ETF Research that embody the Market’s Compass US Index and Sector (USIS) ETF Research, the Developed Markets Nation (DMC) ETF Research and the Rising Markets Nation (EMC) ETF Research. The three Research will individually be revealed each three weeks and despatched to paid subscriber’s e mail. An excerpt shall be despatched to free subscribers. The EMC ETF Research shall be revealed subsequent week.

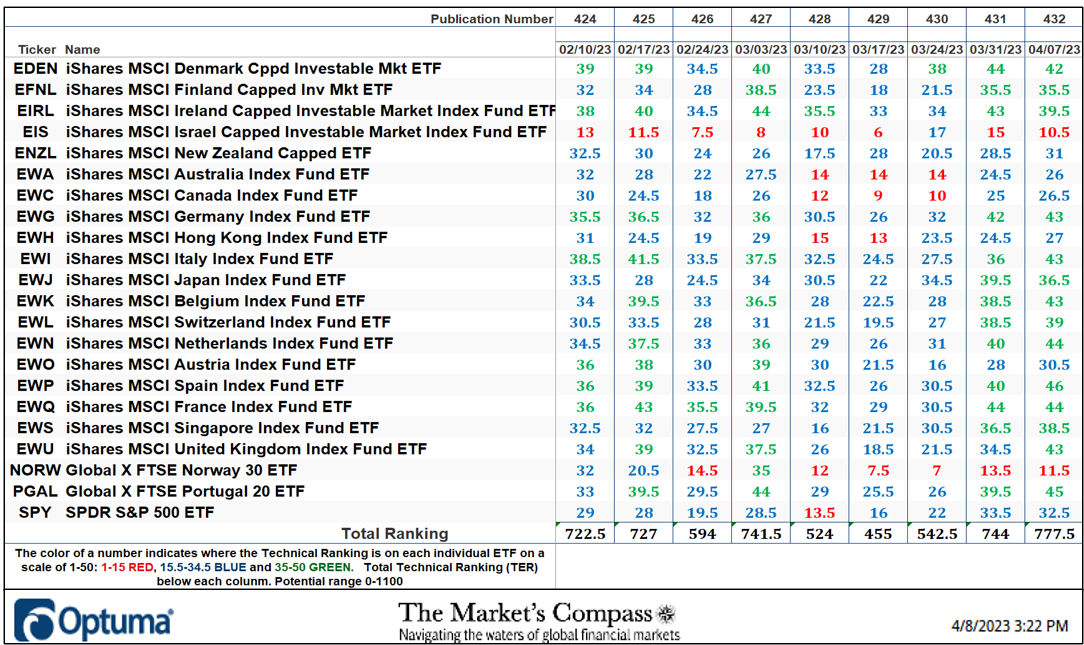

This Week’s and eight Week Trailing Technical Rankings of the 22 Particular person ETFs

The Excel spreadsheet under signifies the weekly change within the goal Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a wholly quantitative method that makes use of a number of technical issues that embody however aren’t restricted to development, momentum, measurements of accumulation/distribution and relative power. If a person ETFs technical situation improves the Technical Rating (“TR”) rises and conversely if the technical situation continues to deteriorate the “TR” falls. The “TR” of every particular person ETF ranges from 0 to 50. The first take-away from this unfold sheet needs to be the development of the person “TRs” both the continued enchancment or deterioration, in addition to a change in course. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity might be seen as an overbought situation however with due warning over bought situations can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply grow to be extra overbought. A sustained development change must unfold within the particular person TR for it to be actionable.

The regular enchancment in particular person TRs (in addition to the Complete ETF Rating) for the reason that Market’s Compass Developed Markets Nation ETF Research that I revealed on February twentieth (Publication #429) for the week ending February seventeenth, might be seen at a look within the unfold sheet above. That is allowed by the “warmth map” traits of the unfold sheet.

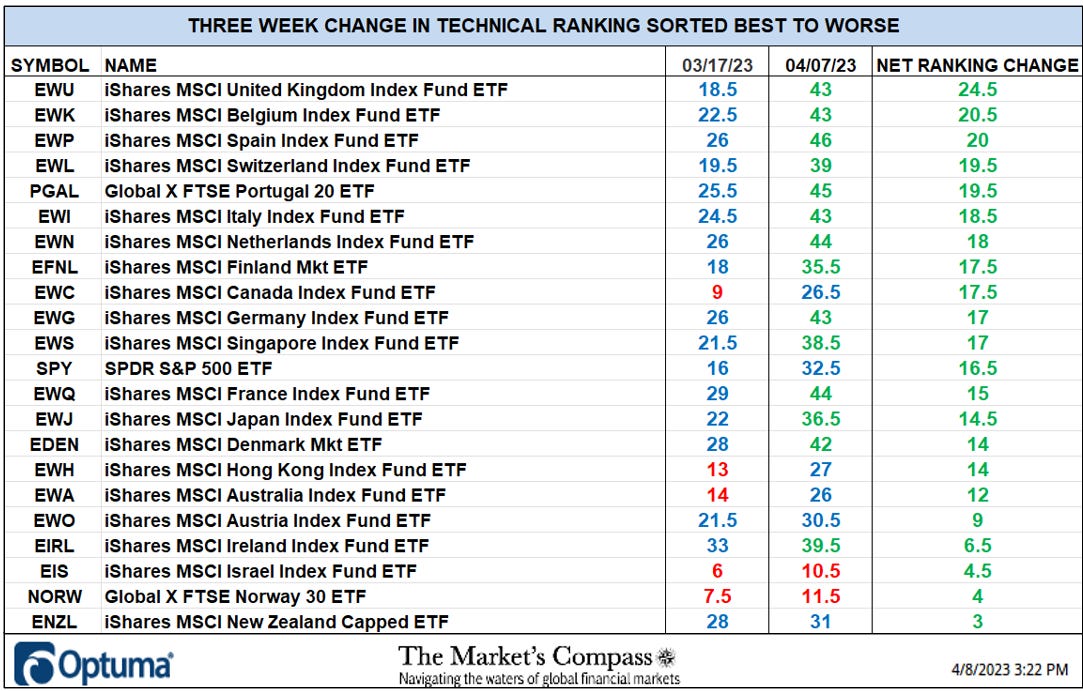

The broad based mostly enchancment in particular person TRs for the reason that week ending March seventeenth, might be seen at a look within the unfold sheet under with all TRs gaining floor, the iShares MSCI United Kingdom Index Fund ETF (EWU) gained essentially the most over the previous three weeks by rising +24.5 “handles” to 43 from 18.5. That acquire was adopted by the iShares MSCI Belgium Index Fund ETF (EWK) which jumped by +20.5 to 43 from 22.5 and the iShares MSCI Spain Index Fund ETF (EWP) which rose +20 to 46 from 26. The typical TR acquire over the previous three weeks was +14.65.

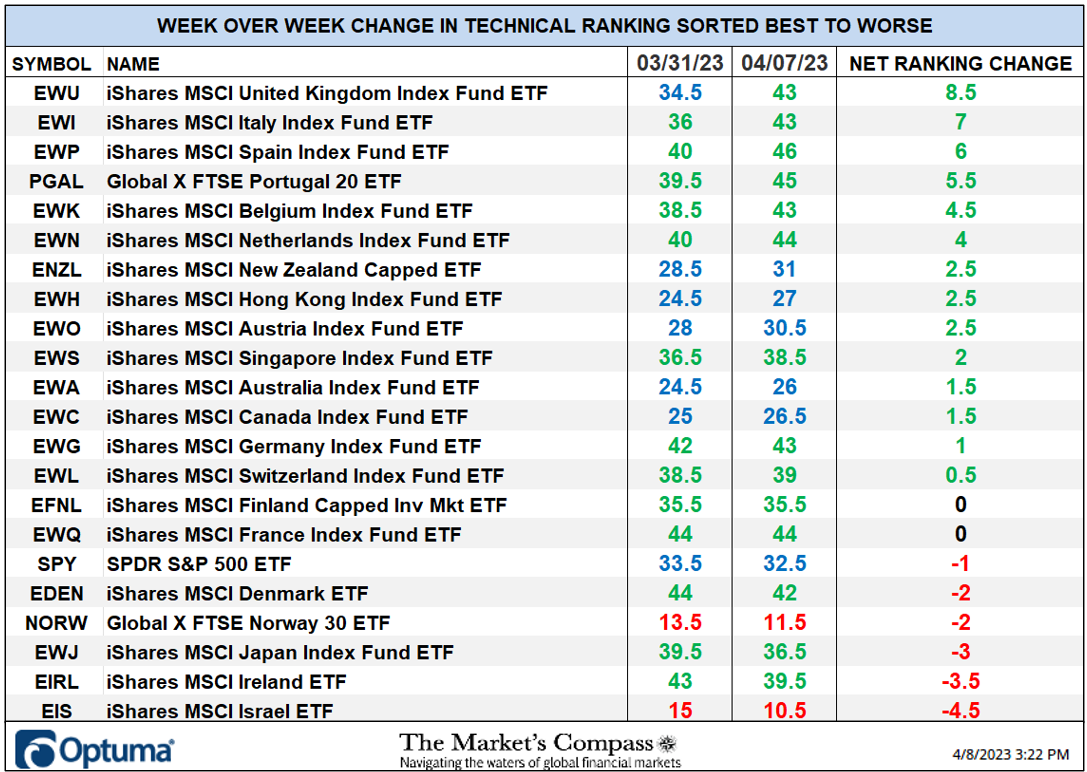

As might be seen under on the finish of final week there fourteen ETF TRs within the “inexperienced zone”, six ETFs have been within the “blue zone” (15.5 to 34.5) and two have been within the “crimson zone” (0 to fifteen). This was versus the week earlier than when 13 ETFs had TRs within the “inexperienced zone”, 7 have been within the “blue zone” and two have been within the “crimson zone”. The identical two ETF have been within the “crimson zone” two weeks in a row. The International X FTSE Norway 30 ETF (NORW) fell -2 “handles” to 11.5 from 13.5 and the iShares MSCI Israel ETF (EIS) fell -4.5 to 10.5 from 15. The WoW common TR acquire was +1.52

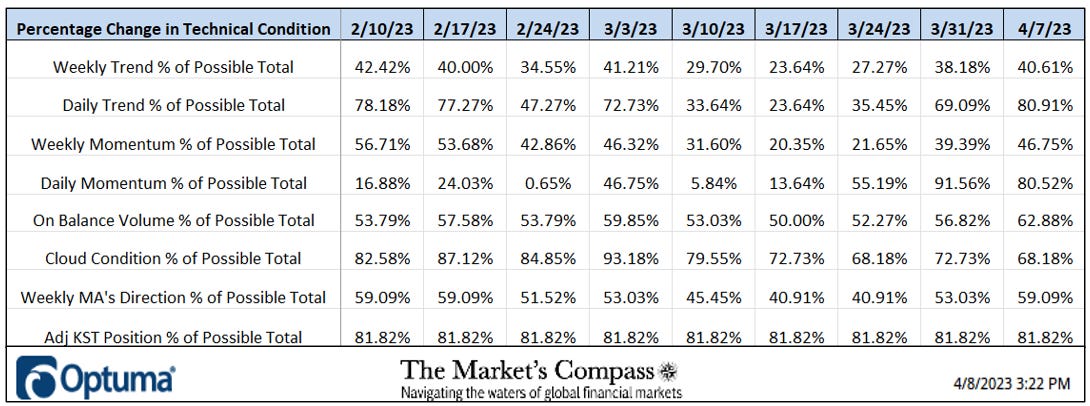

The Technical Situation Issue modifications over the previous week and former 8 weeks

There are eight Technical Situation Elements (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is constructive a further level is added to the person TR. Conversely if the technical query is destructive, it receives a “0”. A couple of TCFs carry extra weight than the others such because the Weekly Development Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 22 ETFs. Due to that, the excel sheet above calculates every issue’s weekly studying as a p.c of the doable whole. For instance, there are 7 issues (or questions) within the Every day Momentum Technical Situation Issue (“DMTCF”) of the 22 ETFs (or 7 X 22) for a doable vary of 0-154 if all 22 ETFs had fulfilled the DMTCF standards the studying can be 154 or 100%.

This previous week a 80.52% studying within the DMTCF was registered for the week ending April seventh, or 124 of a doable whole of 154 constructive factors. After we final revealed the DMTCF studying has simply recovered from a deeply oversold studying of 0.65% or 1 out of 154 constructive factors from the week ending February twenty fourth. It had since risen to 91.56% two weeks in the past leaving the DMTCF within the overbought vary between 85% and 100% earlier than final week’s pullback to 80.52%.

As a affirmation device, if all eight TCFs enhance on per week over week foundation, extra of the 22 ETFs are bettering internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the 22 TCFs fall on per week over week foundation, extra of the ETFs are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week 5 TCFs rose, two fell and one was unchanged.

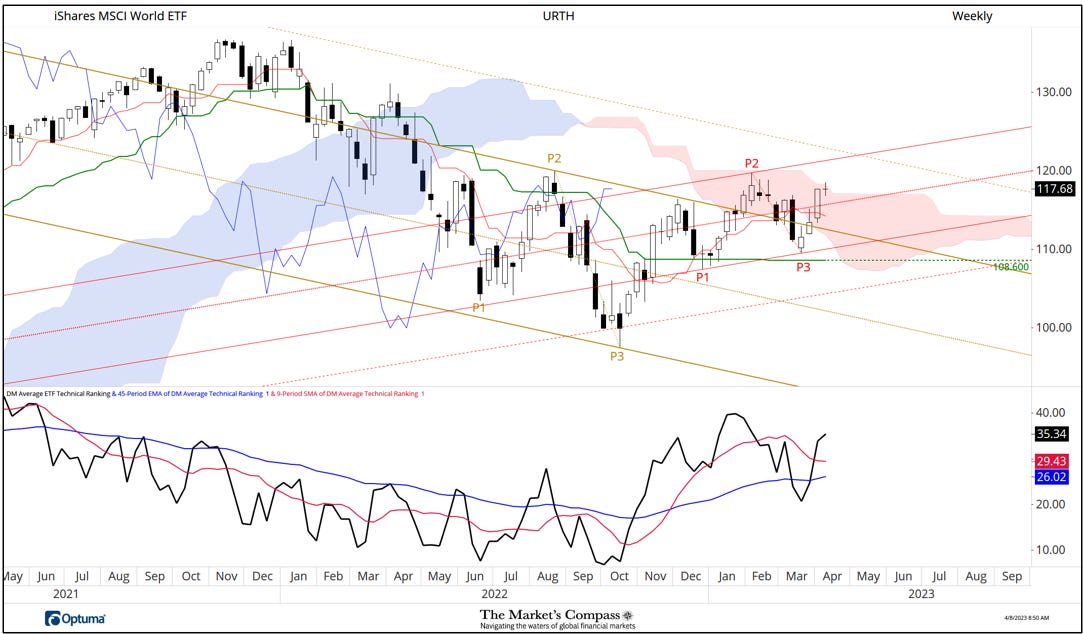

The URTH with This Week’s Complete ETF Rating “TER” Overlaid

The Complete Technical ETF Rating (“TER”) Indicator is a complete of all 22 ETF rankings and might be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence device: If the broader market as measured by the iShares MSCI World Index ETF (URTH) continues to rally with out a commensurate transfer or greater transfer within the TER the continued rally within the URTH turns into more and more in jeopardy. Conversely, if the URTH continues to print decrease lows and there’s little change or a constructing enchancment within the TER a constructive divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the TER will get to the 1100 stage (all 22 ETFs having a TR of fifty) “issues can’t get a lot better technically” and a rising quantity particular person ETFs have grow to be “stretched” the extra of an opportunity of a pullback within the URTH. On the flip facet the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential shifting common in Purple smooths the unstable TER readings and analytically is a greater indicator of development.

As was seen earlier on this Weblog there was a gradual enchancment within the TER because it reached a low at 455 on the finish of the week, March seventeenth. The URTH closed out final week simply shy of -0.50 factors of the February third weekly closing excessive at 118.17. If the ETF is ready to print a weekly shut above that stage I’ll to see a commiserate transfer to a brand new weekly closing excessive within the TER (above 875) to declare a affirmation of the worth transfer. That mentioned, if there’s a transfer above above that stage will place the TER within the space of “overbought territory”. The 13-Week Transferring Common of the TER (crimson line) had began to hook greater however has stalled giving nary a touch at future development.

The Common Technical Rating of the 30 US Index and Sector ETFs

The weekly Common Technical Rating (“ATR”) is the common Technical Rating of the 22 Developed Markets Nation ETFs we monitor. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator. It’s charted within the panel under the Weekly candle chart under.

After I final revealed the DMC ETF Research on March twentieth for the week ending March seventeenth, I introduced consideration to the worth break that violated help on the earlier overtaken resistance on the Higher Parallel (strong gold line) of the longer-term Schiff Pitchfork (gold P1 via P3). My concern on the time was that there can be observe via to that nasty week and that the Kijun Plot can be in jeopardy of being damaged however a value pivot developed above that stage and two weeks later the bottom above that Higher Parallel was retaken. That value pivot was the genesis of the brand new short-term Customary Pitchfork (crimson P1 via P3) whose Median Line (crimson dotted line) was promptly overtaken, however costs stalled on the prime of the Cloud final week, marking the second time this yr that the Higher Span of the Cloud capped costs this time with a traditional Doji candlestick sample, signaling market individuals momentary indecision.

One technical concern is that despite the fact that the ATR stays above each its shorter and long run shifting averages the indicator at 35.34 is greater than 11% under the current January greater excessive at 39.77. This whereas the URTH closed final week at a nominal greater excessive suggesting a budding non-confirmation. Extra on my ideas of the short-term technical situation of the URTH later within the Weblog, however first…

The Weekly Absolute and Relative Value % Change*

*Doesn’t embody dividends

Fifteen of the Developed Markets Nation ETFs we monitor in these pages have been up on an absolute foundation final week. The typical absolute acquire of all 22 ETFs was +0.70% versus a +0.01% acquire within the URTH. Due to the de minimis acquire within the URTH the 15 ETFs that outperformed on absolute foundation additionally outperformed on a relative foundation. On an absolute foundation the International X FTSE Portugal 20 ETF (PGAL) was on the prime of the “pack” gaining +4.10% adopted by its geographic neighbor the iShares MSCI Spain Index Fund ETF (EWP) which gained 2.80%.

Ideas on the short-term technical situation of the URTH*

*Of curiosity to scalpers, merchants, and technicians

Per week in the past final Wednesday the URTH overtook the Median Line (dotted crimson line) of the newly drawn Schiff Modified Pitchfork (crimson P1 via P3). The next day it overtook the Higher Parallel (strong purple line) of the long run Customary Pitchfork (purple P1 via P3). Final Friday costs accelerated greater however for all intents and functions failed on the Higher Parallel of the shorter-term Pitchfork throughout the vacation shortened buying and selling week.

As might be seen by the overbought stage reached by the DM Nation ETF Every day Momentum Oscillator (decrease panel) there was not sufficient upside “momentum gasoline within the tank” left to overhaul the Higher Parallel and unsurprisingly throughout the backing and filling that adopted upside momentum slowed as witnessed by MACD. Regardless of Thursday’s bounce on the Median Line (crimson dotted line) I don’t assume that the present brief time period consolidation/ retracement has run its course. Additional technical proof that this possible the case might be seen by wanting on the RRG chart that follows…

The Relative Rotation Graph, generally known as RRGs have been developed in 2004-2005 by Julius de Kempenaer. These charts are a novel visualization device for relative power evaluation. Chartists can use RRGs to investigate the relative power developments of a number of securities towards a standard benchmark, (on this case the URTH) and towards one another over any given time interval (within the case above weekly for the reason that center of March. The ability of RRG is its potential to plot relative efficiency on one graph and present true rotation. We all know that there’s rotation between Nation ETFs pushed by many elements together with however not restricted to underlying forex actions, particular person nation financial fundamentals, and political climates, however attempting to visualise that “rotation” on linear charts is sort of unattainable. All RRGs charts use 4 quadrants to outline the 4 phases of a relative development. The Optuma RRG charts makes use of, From Main (in inexperienced) to Weakening (in yellow) to Lagging (in pink) to Enhancing (in blue) and again to Main (in inexperienced). True rotations might be seen as securities transfer from one quadrant to the opposite over time. That is solely a quick rationalization of tips on how to interpret RRG charts. For many who have an curiosity and need to be taught extra, Mathew Verdouw at Optuma has two video tutorials that delve deeper into RRGs. I urge my Weblog readers to avail themselves of those. The hyperlinks to these movies are posted on the finish of this Weblog.

Though there are a couple of of the ETFs we monitor in these pages are starting to show and a few whose descent are slowing the vast majority of DMC ETFs are monitoring decrease within the Weakening Quadrant. The one one that’s persevering with to grudgingly attempt to enhance is the SPY. This could add credence to the thesis that extra brief time period consolidation and value retracement within the DMC ETFs is within the playing cards.

The iShares MSCI Spain Index Fund ETF has taken the pole place YTD relative to the URTH which is up +7.72% YTD, The EWP is up +10.77% YTD on a relative foundation from up+ 4.50% once we final revealed. The iShares MSCI Eire ETF (EIRL) has slipped on a relative foundation into the quantity two spot to being up +10.52% from +10.94% since we final revealed on March twentieth for the week ending March seventeenth.

Charts are courtesy of Optuma whose charting software program permits anybody to visualise any knowledge together with RRG Charts and our Goal Technical Rankings.

The next hyperlinks are an introduction and an in depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

tbrackett@themarketscompass.com

[ad_2]