[ad_1]

The issues with Warren Mosler’s description of fashionable financial principle (MMT)

Richard Murphy[1]

April 2023

Printed by Tax Analysis LLP[2]

Objective of this be aware

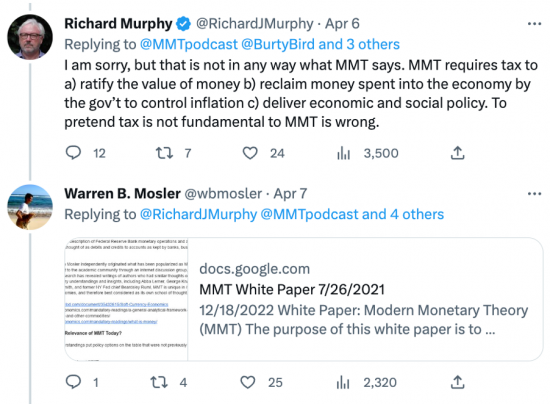

This be aware critiques a be aware revealed by Warren Mosler on Twitter on 7 April 2023 in response to a remark from Richard Murphy.

TLDR (Too lengthy: did not learn)

On 7 April Warren Mosler posted a paper on Twitter which he claimed offered the basics of MMT. I disagreed with him on that problem on Twitter at the moment and was challenged to supply a response.

On this be aware I argue that:

- Mosler didn’t current a coherent argument as to what MMT could be in his paper.

- He did, for my part, current an argument suggesting {that a} jurisdiction with no authorities could be higher off than one with a authorities working MMT.

- Mosler’s description of an financial system fails to consider the existence of business banks and their capability to create cash.

- Mosler incorrectly represents that the first objective of taxation is to create unemployment when this isn’t the case.

- To take action he and Invoice Mitchell additionally seem to argue that MMT requires {that a} authorities tax earlier than it spends and that tax revenues should equate to spending, each of which claims contradict traditional understandings of MMT.

- Mosler additionally, for my part, misrepresents the reason for inflation by suggesting that it’s all the time created by authorities motion.

- The argument Mosler makes for a job assure are consequently primarily based on what I feel to be false premises.

Another view of MMT that doesn’t depend on these arguments is offered.

A PDF model of this publish is obtainable right here.

A PDF of the paper from Warren Mosler to which I’m replying is right here.

The change that led to this be aware being written

The change was as follows:

Mosler’s claims on the character of MMT

Mosler says within the introduction to his be aware, initially revealed on 7/26/2021 however apparently republished on 12/18/2022, that:

The aim of this white paper is to publicly current the basics of MMT.

I take that to imply that that is the definitive assertion of his views. It’s definitely offered as such within the be aware, the place he says:

In 1992 Warren Mosler independently originated what has been popularized as MMT. In 1996 he launched it to the educational group by means of an web dialogue group, and whereas subsequent analysis has revealed writings of authors who had comparable ideas on a few of MMT’s financial understandings and insights, together with Abba Lerner, George Knapp, Mitchell Innes, Adam Smith, and former NY Fed chief Beardsley Ruml.

Mosler portrays his personal function in MMT as pivotal.

Mosler’s view of MMT seems to be summarised on this assertion:

MMT is exclusive in its evaluation of financial economies, and due to this fact greatest thought of as its personal faculty of thought.

It’s in that case unlucky that it’s onerous to search out out exactly what Mosler means from studying this paper.

For instance, beneath the heading *What’s MMT? he says:

MMT started as an outline of Federal Reserve Financial institution financial operations and accounting, that are greatest considered debits and credit to accounts as saved by banks, companies, and people.

No additional clarification is provided. The reader is left questioning what Mosler is referring to in consequence, even when they’re conscious of the importance of double entry accounting in banking and the cash creation course of, which few individuals are.

Mosler’s subsequent heading is *What’s the Relevance of MMT At present? In response he says:

The MMT understandings put coverage choices on the desk that weren’t beforehand thought of viable.

Once more, no additional clarification is provided, which as soon as once more leaves the query he has posed unanswered.

As an alternative Mosler strikes on to counsel that *What’s completely different about MMT. He’s barely extra fulsome in response, saying:

SEQUENCE:

MMT alone acknowledges that the US Authorities and its brokers are the only real provider of that which it calls for for cost of taxes

That’s, the foreign money itself is an easy public monopoly.

The US authorities levies taxes payable in US {dollars}.

The US {dollars} to pay these taxes or buy US Treasury securities can solely originate from

the US authorities and its brokers. [Formatting from the original]

The financial system has to promote items, providers or property to the US authorities (or borrow from the US authorities, which is functionally a monetary asset sale) or it will be unable to pay its taxes or buy US Treasury securities.

This, it’s burdened, is the primary remark of substance Mosler makes with regard to MMT. The message seems to be, for my part, that:

- MMT is a matter that’s solely of concern within the USA. That isn’t true. MMT has a much wider and doubtlessly common software.

- Authorities is a malign pressure, demanding cost of tax in a foreign money that solely it creates. This isn’t true. In actuality the US authorities solely calls for cost of tax as a result of it has already, primarily benignly, spent cash into existence within the financial system. The demand for cost just isn’t, in consequence, malign. In any case, this declare is incorrect. The US authorities may create what are known as base cash {dollars}. However US industrial banks can and do additionally create {dollars} by means of their lending. As such tax just isn’t solely payable utilizing the cash created by the US authorities; it can be paid utilizing {dollars} created by the US industrial banking system, which {dollars} are indistinguishable in use from these created by the US authorities.

- The US financial system doesn’t need to promote providers or property to the US authorities to pay taxes. In the event that they refused to purchase these items and providers the federal government has to promote, as is their collective proper inside that financial system, then the tax legal responsibility to the US authorities wouldn’t exist. The logic within the declare on the contrary by Mosler seems, in any case, to be confused. It essentially assumes that the duty to tax precedes expenditure by the US authorities, when the entire level of MMT is to elucidate that this isn’t the case. It additionally assumes that the US authorities has the ability in mixture to impose tax when there isn’t any justification, or the means, to take action. That is, once more not true. US democracy has, to this point, ensured that this doesn’t occur. The declare would seem like incorrect in that case.

Mosler then claims that there are Ramifications of his claims on the character of MMT the primary of which he says is:

- The US authorities and its brokers, from inception, essentially spend (or lend) first, and solely then can taxes be paid or US Treasury securities bought.

That is in direct distinction with mainstream financial fashions and the rhetoric that states the US authorities should tax to get US {dollars} to spend, and what it does not tax it should borrow from the likes of China and go away the debt to our grandchildren.

MMT due to this fact acknowledges that it isn’t the US authorities that should get {dollars} to spend, however as an alternative, the driving pressure is that taxpayers want the US authorities’s {dollars} to have the ability to pay taxes and buy US Treasury securities.

The highlighted part is indisputably what MMT says, however I don’t assume that it follows from the declare that Mosler made within the previous part, for causes already famous. I feel that there’s a logical error within the movement of the argument right here.

That is compounded by an extra error. The assertion Mosler makes that the US authorities doesn’t must get {dollars} to spend is true, as a result of it could possibly create them. But it surely doesn’t comply with that taxpayers must take particular motion to safe {dollars} to pay taxes. As a matter of truth, the {dollars} required to pay these taxes are already circulating within the US financial system on the time that these taxes fall due for 4 causes:

- They’ve been spent there earlier than taxes fall due by the US authorities.

- The greenback is the one authorized foreign money within the USA, which means that it’s the solely foreign money used for different transactions, not involving the federal government. This isn’t the results of taxation legislation, however due to statute declaring the greenback to be authorized tender.

- As a result of the greenback is the one authorized tender within the USA that nation’s banks lend extra of {dollars} into existence than the US authorities spends into existence.

- US taxpayers could make settlement of their tax liabilities utilizing both US authorities created {dollars} or US financial institution created {dollars}, the 2 being inseparable in use.

In abstract, as a result of the US greenback is the authorized tender of that nation it’s the solely foreign money most US residents will ever use, no less than for his or her home transactions. One other sensible possibility just isn’t out there to them. To counsel that {dollars} solely exist for the cost of taxes or that there could be a scarcity of them for this objective does due to this fact, as a consequence, seem like incorrect. In actual fact, it’s totally believable that US banks may mortgage {dollars} for this objective, creating new foreign money as a consequence.

The implication inside Mosler’s assertion that there’s some issue in securing {dollars} to make tax cost does, due to this fact, seem like incorrect. The declare that follows from that assertion is, due to this fact, for my part additionally incorrect.

The second ramification of Mosler’s declare that the US Authorities and its brokers are the only real provider of that which it calls for for cost of taxes is, apparently:

- Crowding out non-public spending or non-public borrowing, driving up rates of interest, federal funding necessities and solvency points usually are not relevant for a authorities that, just like the US, from inception spends first, after which borrows. http://moslereconomics.com/mandatory-readings/a-general-analytical-framework-for-the-analysis-of-currencies-and-other-commodities/

No additional clarification is provided. The paper referred to is outdated, badly formatted in order that the tables not work. Oddly, it additionally concludes that cash is a commodity identical to some other as soon as imbued with worth from taxation. If, nonetheless, this was the case we’d not have to be discussing MMT as a result of cash could be of no particular curiosity: any commodity may in that case be utilized in change. Nor would monetary flows in {dollars} be of concern, not to mention rates of interest. I’m certain that Mosler can see the hyperlink in his arguments: I admit that I can not.

That’s as a result of I counsel that cash just isn’t like some other commodity. It could be that MMT says that “driving up rates of interest, federal funding necessities and solvency points usually are not relevant for a authorities that, just like the US, from inception spends first, after which borrows” (saying which I clarify that I’m not satisfied concerning the declare on crowding out, for causes already famous, above, and so have excluded it right here) however that does on the very least require clarification, and Mosler doesn’t present one.

His claims on ‘How are you going to pay for it?‘ are as unhelpful. Right here he says:

The US authorities, for all sensible functions, spends as follows:

After spending is allowed by Congress, the Treasury instructs the Federal Reserve Financial institution to credit score the recipient’s checking account (change the quantity to the next quantity) on the Fed’s books. <Word: The accounts of Fed member banks are known as reserve accounts and balances in these accounts are known as reserves.>

So far as I can inform (and I could also be incorrect right here due to the anomaly in what Mosler says) the one reply required to ‘how are you going to pay for it?’ is, in Mosler’s opinion, to say ‘by crediting folks’s financial institution accounts.’ That’s true: mechanically it’s, in reality, indeniable. It additionally fails to reply nearly any of the questions that anybody may ask of MMT. Double entry data transactions. It doesn’t clarify their causes or penalties. For that motive Mosler doesn’t reply the query he poses.

The identical downside is present in Mosler’s subsequent part, the place he says:

How is the Public Debt Repaid?

When US Treasury securities mature, the Fed debits the securities accounts and credit the suitable reserve accounts. Curiosity on the general public debt accrues to the securities accounts and the Fed credit reserve accounts to pay that curiosity.

There are not any taxpayers or grandchildren in sight when that occurs.

Once more, that’s true: mechanically it’s, in reality, indeniable. However as soon as extra this reply fails to reply the query that anybody may ask of MMT. Explaining double entry requires greater than a proof as to what the debits and credit are. Figuring out them is helpful, however they do have penalties and Mosler goes nowhere close to explaining what these penalties are. I presume Mosler is aware of, though the likelihood that he doesn’t is left on the desk. Most notably, what he by no means says is that the federal government didn’t need to borrow within the first place because it already had a mortgage in place from its central financial institution. Lacking that truth out makes this a completely unsatisfactory reply.

Mosler’s declare on taxation

Offering an unsatisfactory reply is, nonetheless, completely different from offering what I feel to be a incorrect one, which Mosler does subsequent on the subject of taxation. On this he says:

THE CAUSE OF UNEMPLOYMENT:

MMT acknowledges that taxation, by design, is the reason for unemployment, outlined as folks searching for paid work, presumably for the additional objective of the US Authorities hiring people who its tax liabilities prompted to change into unemployed.

That’s it. That is what Mosler has to say on tax. Its objective is to, apparently, create unemployment. The explanation for doing so is to make sure that these made redundant could be employed by the federal government. I’ve just one description for this clarification, and that’s that it’s for my part incorrect.

Mosler says no extra on this problem. His assertion is, in itself, apparently adequate clarification on this problem. I’ve due to this fact investigated the origin of this declare which is, I feel, to be present in Prof Invoice Mitchell’s pondering. He stated[3] in 2016:

[O]ne of the actions of a currency-issuing authorities is to create idle actual assets within the non-government sector there may be subsequently deployed by that authorities in pursuit of its electoral mandate.

Fashionable Financial Idea (MMT) exhibits that this is without doubt one of the main roles of taxation – to create unemployed actual assets that may then be utilized by the general public sector.

The general public sector then deploys these assets by means of spending. We must always be aware that the necessity to deprive the non-government sector of spending capability by way of taxation is to make sure that complete spending is commensurate with the out there actual assets within the financial system.

He has additionally stated[4]:

MMT exhibits that taxation capabilities to advertise provides from non-public people to authorities of products and providers in return for the mandatory funds to extinguish the tax liabilities.

So taxation is a method that the federal government can elicit assets from the non-government sector as a result of the latter need to get $s to pay their tax payments. The place else can they get the $s until the federal government spends them on items and providers supplied by the non-government sector?

He repeats the declare right here[5]:

One other method of seeing that’s to grasp that on condition that the non-government sector requires the federal government’s fiat foreign money to pay its taxation liabilities, the imposition of a tax legal responsibility (with no concomitant injection of spending) by design creates unemployment (folks searching for paid work) within the non-government sector.

I provide three variations of this narrative from Invoice Mitchell simply to clarify that I’ve not misinterpreted this declare: it’s what Mitchell and Mosler are saying.

Every of those claims by Mitchell, and the one which Mosler makes primarily based on them, must be incorrect if the important declare that MMT makes, which is that authorities spending precedes taxation, is to be true.

Mosler and Mitchell contradict that declare by saying that until taxation to start with compelled assets within the non-public sector into unemployment then authorities spending to amass these assets wouldn’t be potential. What they’re essentially saying in consequence is that tax should precede spending. If it didn’t then, of their very clear opinion, there could be no useful resource for the state to amass. Their claims do, in that case, seem to flatly contradict the noticed undeniable fact that MMT exists to advertise, and which Mosler claims is its distinctive proposition, which is that authorities spending precedes taxation.

As a matter of truth, logically Mosler and Mitchell’s claims should, for my part, be incorrect. The fact is {that a} state can, utilizing cash it has created, act as a purchaser out there inside a jurisdiction, identical to anybody else. Simply as different market individuals safe the products and providers that they require by paying the going fee for them in at present prevailing market circumstances, so too does the federal government. If the worth that the federal government provides for no matter it seeks to purchase is adequate to draw sellers then these sellers voluntarily make a sale to the federal government, whether or not of products or their labour. The state then taxes to withdraw the surplus cash provide it has created when making this buy to manage the ensuing danger of inflation which might in any other case come up. If it will get the judgement on the sum of money to withdraw from the market proper then there might be no ensuing inflation and the mixed market and state sectors will, collectively, ship full employment.

That is what MMT really appears to say when describing the operation of a authorities in a market financial system. It describes how a authorities behaves in a combined market-based financial system. I can not reconcile that with the Mosler and Mitchell view. That’s as a result of Mosler and Mitchell say one thing very completely different. As Mitchell famous within the first paragraph of his 2016 article, the idea that they make is that if assets weren’t utilized by the state they’d be utilized by the non-public sector. In different phrases, each he and Mosler seem to imagine that there exists a parallel world by which all assets out there inside an financial system by which there was no state are the identical as these out there when there’s a state. As well as, they seem to imagine that these assets could possibly be utilised with out the existence of the state and full employment would comply with in its absence.

Terribly, what this implies is that they seem to imagine that Say’s Regulation applies. What Jean-Baptiste Say stated in 1803 was that the manufacturing of a very good creates the demand for it. He did, due to this fact, argue that markets will all the time ‘clear’ i.e. they may create the demand for all the products that may be provided leading to an optimum financial final result. Mitchell and Mosler seem to imagine that such a state exists and that capabilities as Say suggests it could, delivering financial equilibrium with out authorities interference.

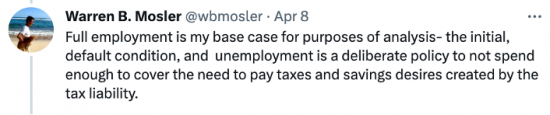

It could seem that this should be the case due to one other declare made by Mosler. He says when discussing the job assure, later in his doc, that:

Residual unemployment is brought on by the federal government not hiring all of people who its tax liabilities have prompted to change into unemployed.

Mosler repeated this in barely completely different type in Twitter exchanges with me on April 8, saying:

The implication couldn’t be clearer: unemployment is in Mosler’s view the deliberate creation of a authorities. The market – the creator of Mosler’s default assumed state of full employment – doesn’t create unemployment; it’s the state that he says does so, and he says that it does so by alternative.

The logical movement by means of this argument should be as follows, for my part:

a. Earlier than the intervention of a authorities there’s a market that’s in equilibrium, i.e. it delivers full employment with out state intervention.

b. That market leaves no spare assets unused.

c. If the state needs to spend it does in consequence need to tax to pressure assets in that market financial system out of use.

d. How that tax is paid when there was no authorities foreign money spent into existence just isn’t clear: there should be an alternate foreign money in use, however that isn’t made clear.

e. The worth of the tax charged is the worth of the assets compelled out of use.

f. If the federal government doesn’t spend the quantity it has taxed then not all these assets that it has made unemployed by imposing taxation might be put again into use.

g. Tax should then all the time equal the quantity that the federal government spends if unemployment is to be prevented: balanced budgets are required by Mitchell and Mosler’s pondering.

h. If the quantity that the federal government does spend is lower than the quantity taxed then unemployment will consequence on the sole alternative of the federal government.

The next are additionally implied:

i. The market clears by itself till there may be authorities intervention.

j. That market can perform with out authorities foreign money.

okay. The state creates imperfect markets.

l. One logical consequence of that imperfection is unemployment, which might not in any other case occur.

m. This unemployment outcomes from the state not supplying adequate cash provide to the financial system, by which it’s the solely creator of that foreign money, having compelled the beforehand environment friendly market created foreign money out of use.

n. All financial imbalance is, due to this fact, the consequence of presidency intervention out there.

It’s apparent to what conclusions this ideas lead, which I counsel are as follows:

o. The federal government mustn’t intervene out there.

p. The federal government ought to both not tax, or achieve this as little as potential.

q. The federal government mustn’t search to impose the usage of its self-declared authorized foreign money available on the market as a result of the financial system behaved optimally with out it.

It’s exceptionally troublesome for me to see what else the argument Mitchell and Mosler make implies.

To be candid, it could be onerous to search out an Austrian economist – which faculty of thought most despises authorities intervention in markets – who might provide you with an argument fairly as anti-government as this, and but this argument is seemingly on the core of MMT if my interpretation of what Mitchell and Mosler say is to be believed.

Nevertheless, I feel that Mosler and Mitchell are incorrect for these causes:

a. There isn’t any parallel financial system that exists within the type that Mosler and Mitchell assume.

b. Nobody has to pressure financial assets out of use within the financial system in order that they may purchase them: as an alternative, the standard guidelines of market change apply.

c. Folks work for the federal government and items and providers are bought to it voluntarily: besides in these states the place conscription nonetheless applies nobody has to work for a authorities. To assert that providing such employment is the one approach to remedy unemployment created by taxation is solely not true.

d. Neither is it true to say that taxation is raised for the needs of making unemployment. That is by no means the case. There are six causes to tax:

1) To ratify the worth of the foreign money: which means the cost of tax within the foreign money {that a} authorities has created supplies that foreign money with a worth in change in a jurisdiction;

2) To reclaim the cash the federal government has spent into the financial system in fulfilment of its democratic mandate as a way to stop inflation;

3) To redistribute revenue and wealth;

4) To reprice items and providers whether or not upward as within the case of carbon or downward as within the case of schooling and medical providers;

5) To lift democratic illustration as a result of individuals who pay tax vote;

6) To reorganise the financial system i.e. by means of the help tax provides to fiscal, financial and social coverage.

As is clear, the creation of unemployment just isn’t in that record.

e. There isn’t any parallel foreign money which could possibly be used within the absence of a authorities created foreign money.

f. Markets don’t clear at full employment, whether or not with or with out authorities intervention. The declare that this may occur was debunked by Lord Keynes and nothing since he wrote has advised that he was incorrect. Say’s Regulation is incorrect.

g. Governments usually are not the only real creator of cash, though they’re the only real creator of a foreign money and the only real curator of the worth of that foreign money.

h. That implies that tax needn’t solely be paid utilizing the foreign money injected by a authorities into an financial system as a consequence of it spending: it can be paid utilizing cash created by a industrial financial institution.

i. Governments don’t intentionally create unemployment, though they’ll tolerate a stage of unemployment created as a consequence of the inefficiencies discovered inside any financial system due to failures to speak and consequent timing variations in required actions arising between the state and personal sectors, each of which sectors can as a consequence contribute to the creation of that unemployment on account of the inevitably imperfect actions of every of them.

j. There isn’t any requirement {that a} authorities tax the quantity that it has spent, as implied by Mosler and Mitchell. In actual fact the other is almost certainly to be true.

okay. The chance that full employment would be the identical with or with out the motion of a authorities is distant within the excessive. The proof that authorities has a benign impact is to be present in information suggesting that these governments which can be simpler in upholding the rule of legislation and which have higher designed programmes of intervention of their market economies ship total larger ranges of revenue for the folks within the jurisdictions for which they’re accountable than these governments that chorus from energetic engagement of their societies and economies for no matter motive. The implication of Mosler and Mitchell’s reasoning, that governments mustn’t intervene of their economies is, due to this fact, inappropriate.

l. As a matter of truth, governments do spend earlier than they tax: the logic, implicit in Mosler and Mitchell’s claims that authorities’s tax first is, due to this fact, factually incorrect and opposite to what they themselves say of MMT.

Having handled this problem and having demonstrated that the idea of the claims that Mosler has made in his paper on tax seem like incorrect, the opposite points to which he refers inside it may be dismissed pretty shortly.

Mosler’s claims on inflation

On inflation, Mosler says:

INFLATION:

Solely MMT acknowledges the supply of the worth stage: the foreign money itself is a public monopoly and monopolists are essentially “value setters.”

Market forces decide relative costs. Their solely info with regard to absolutely the worth of the foreign money comes from the state by means of its insurance policies and institutional construction.

Subsequently:

The worth stage is essentially a perform of costs paid by the federal government’s brokers when it spends, or collateral demanded when it lends.

Mosler argues that that is the case as a result of:

In what’s known as a market financial system, the federal government want solely set just one value, as market forces repeatedly decide all different costs as expressions of relative worth, as additional influenced by institutional construction.

As with Mosler’s arguments on taxation, this argument seems to have implicit inside it Mosler’s obvious perception that an financial system would, with out authorities, intervention act optimally, utilizing assets to the perfect impact, at full employment, and with steady costs. For my part that argument is incorrect.

Markets are totally able to creating inflationary strain with none involvement of presidency, whether or not on account of value hypothesis, extreme revenue taking, the exploitation of monopoly energy, deliberate disruption of provide chains, or imbalances of energy throughout the market, e.g. between monopsonist[6] employers and staff denied union illustration. To disregard all these prospects and to counsel that the one reason for inflationary strain is the costs paid by the federal government when it spends pushes the boundaries of credibility past any cheap limits, for my part. It does additionally, as soon as once more, indicate that it’s Mosler’s perception that society could be higher off with out authorities. Only a few of those that seem to help MMT appear to share that view.

Mosler on the Job Assure

Lastly, Mosler turns to what MMT describes because the Job Assure. On this he says:

Residual unemployment is brought on by the federal government not hiring all of people who its tax liabilities have prompted to change into unemployed. That’s, it is a case of a monopolist- the government- limiting provide, which on this case refers to web authorities spending.

Present coverage is to make the most of unemployment as a counter-cyclical buffer inventory to advertise value stability. One other coverage possibility is for the federal government to make use of an employed buffer inventory, somewhat than an unemployed buffer inventory, to advertise value stability.

The Job Assure is a proposal for the US Authorities to make use of an employed buffer inventory coverage by funding a full time job for anybody prepared and capable of work at a hard and fast fee of pay. A $15 per hour wage has at present been proposed. This wage turns into the numeraire for the currency- the worth set by the monopolist that defines the worth of the foreign money whereas permitting different costs to specific relative worth as additional influenced by the institutional construction.

The Job Assure works to advertise value stability extra successfully than the present coverage of utilizing unemployment, by higher facilitating the transition from unemployment to personal sector employment, as non-public employers do not like to rent the unemployed.

It additionally supplies for a type of full employment, and on the identical time is a way to introduce minimal compensation and advantages “from the underside up,” as non-public sector employers compete for Job Assure staff.

There are good causes to assume {that a} authorities ought to proactively help employment by means of the provision of a job assure at a minimal wage. These good causes don’t embody these famous by Mosler as a result of, for causes, already famous, the underlying assumptions in his first two paragraphs seem for my part to be incorrect and, as a consequence it must be assumed that the opposite claims that comply with are unsupported.

Abstract

In his paper Mosler claimed to set out the basics of MMT. My argument is that he failed to take action.

These fundamentals are, for my part:

- {That a} authorities that has its personal central financial institution and foreign money, which foreign money is internationally acceptable, want neither tax nor borrow earlier than spending as a result of its total authorities expenditure may be funded by new cash creation by its central financial institution performing on its behalf, with the federal government then being indebted to its central financial institution for the sum expended.

- A authorities that borrows on this method from its personal central financial institution want by no means repay the debt it owes to its central financial institution as a result of that debt represents the cash provide of the jurisdiction for which it’s accountable and that cash provide should, due to this fact, be maintained if the extent of financial exercise in that jurisdiction is to be sustained.

- The first function of taxation within the funding cycle of such a authorities is to manage the inflation that could be brought on by the extreme creation of latest cash by that authorities when fulfilling its expenditure plans.

- The secondary function of tax within the authorities’s funding cycle is to supply the federal government created foreign money of a jurisdiction with worth in change. That occurs as a result of if the tax owing to a authorities can solely be settled utilizing the foreign money that authorities creates these transacting in that financial system who’re more likely to have tax liabilities arising in consequence will be unable to afford the change danger arising from buying and selling in some other foreign money.

- As soon as these roles of taxation have been fulfilled the extra function of taxation for a authorities is as a software for the supply of its financial, social, regulatory and inequality agendas. The design of taxes for this objective is, nonetheless, by no means meant to have a income elevating perform to allow authorities expenditure to happen, that expenditure having already been funded by the central financial institution of the jurisdiction on the federal government’s behalf.

- A authorities within the scenario described needn’t steadiness its expenditure and taxation revenue. In most conditions that steadiness would, in reality, be undesirable. If the federal government has a rising financial system and modest, however managed inflation inside that financial system, then the enlargement of its cash provide is important, and that enlargement of the cash provide is greatest delivered by the working of presidency deficits. Such deficits characterize a shortfall of tax receipts in comparison with authorities expenditure. This coverage ought to be most well-liked to growing the dimensions of personal sector borrowing throughout the financial system, which is the choice supply of latest cash creation.

- A authorities within the scenario described want by no means borrow from monetary markets. That’s as a result of the federal government can all the time borrow as an alternative from its personal central financial institution. It has no dependency on monetary markets as a consequence.

- A authorities within the scenario described might, nonetheless, want to provide a financial savings banking facility to these within the jurisdiction for which it’s accountable who want to save within the foreign money that the federal government in query has created. It does so in its capability as a borrower of final resort. This sediment taking doesn’t characterize authorities borrowing: it’s a banking association. Even when the funds deposited with the federal government are then used to clear the obvious overdraft superior by the central financial institution to the federal government the standing of those deposits as a third-party financial institution or financial savings facility just isn’t modified: the central financial institution can all the time assure the reimbursement of the deposits in query by the creation of latest cash, which is exactly why the federal government is ready to provide this borrower of final resort facility.

- A authorities on this place doesn’t want to make use of rates of interest to manage inflation. It may well as an alternative use the next mechanisms to manage:

- Various tax charges over a number of taxes to deal with the reason for the inflation being suffered. New taxes could also be required to help this course of.

- Various the dimensions of the deficit.

- Credit score controls to restrict industrial financial institution lending.

- A authorities on this place would search to run a low efficient rate of interest coverage inside its financial system to firstly minimise curiosity obligations to these to whom it supplies banking services; secondly to supply the absolute best setting for funding by reducing the price of capital; and thirdly to minimise the upward reallocation of assets throughout the society for which it’s accountable on account of curiosity paid, thereby decreasing inequality, which objectives together have the perfect probability of delivering total financial prosperity.

- A authorities on this place can have a coverage of full employment, understanding that till that time is reached, there might be under-used assets inside that financial system for which they’re accountable, which means that inflation won’t be stimulated in consequence as long as the assets put to make use of are these at present unemployed, whether or not they be folks, bodily property, or mental property. This coverage might embody the availability of a job assure for all these searching for work throughout the financial system who’re unable to safe it, however any such coverage should mirror the person circumstances of the job seeker and be in line with the general supply of social safety throughout the jurisdiction for which the federal government is accountable, and can’t as such be a crucial element throughout the financial coverage of the federal government in query.

In distinction, Mosler seems to counsel that:

- Economies could be higher off with out governments.

- Governments act with malign intent to impose their wills on society.

- They achieve this by taxing earlier than spending.

- Having imposed that taxation they then intentionally create unemployment by refusing to spend the revenues they increase, which he (together with Invoice Mitchell) suggests should equal the tax raised if unemployment is to be prevented.

On the identical time Mosler supplies no clarification as to what MMT actually is, the way it may work, what the broader function of tax is inside it (within the course of most particularly ignoring its function in controlling inflation, which phenomenon he incorrectly explains, for my part), while selling a job assure on the idea of what I feel to be false premises.

I’m, after all, conscious that there are others (most particularly, however not solely, Stephanie Kelton) who’ve made good these deficiencies and who’ve offered coherent and logical arguments for MMT, as I additionally assume I do. Consequently, I stress that in penning this be aware I’m not suggesting that MMT just isn’t credible. I consider that it’s. What I’m saying is that vital components of the arguments promoted by Warren Mosler and Invoice Mitchell seem to me to straight contradict lots of MMT’s generally understood basic tenets. Additionally they seem to advertise arguments hostile to the existence and benevolence of presidency that would seem straight opposite to the views that lots of MMT’s advocates would seem to help.

[1] Richard Murphy is the director of Tax Analysis LLP, Professor of Accounting Follow, Sheffield College Administration College, a chartered accountant and Fellow of the Academy of Social Sciences.

[2] Tax Analysis LLP, 33 Kingsley Stroll, Ely, Cambridgeshire, CB6 3BZ. Registered at this tackle. Registered quantity OC316294

[3] https://billmitchell.org/weblog/?p=33152

[4] https://billmitchell.org/weblog/?p=7261

[5] https://billmitchell.org/weblog/?p=50005

[6] A monopsonist is a single purchaser for a services or products of which there are a lot of sellers.

[ad_2]