[ad_1]

Achieve perception into the Fed’s rate of interest choice and discover how one can strategize your trades sooner or later.

CHARTWATCHERS KEY POINTS

- The Fed raises rates of interest by 25 foundation factors (0.25 share factors).

- Inventory markets closed larger after listening to Chairman Powell’s feedback.

- Monitoring sector efficiency often is the option to go in 2023.

Can the market transfer on and depart inflation within the rearview mirror? Not simply but. As anticipated, the Fed raised rates of interest by 25 foundation factors of their February 1 assembly. This was in keeping with the CME FedWatch Software expectations, which confirmed a 99% probability of a 25 foundation level price hike. The rate of interest hike enhance brings the goal vary to 4.50%–4.75%.

Should you take a look at the Dot-Plot on the identical web site (rate of interest projections), the median goal vary is 5.1%. Which means the Fed is prone to proceed elevating rates of interest a minimum of within the subsequent few conferences.

The Fed continues to be agency on its major goal to convey inflation all the way down to 2%. To achieve this goal, the Fed would wish to convey financial coverage to sufficiently restrictive ranges. Briefly, we’re not there but. The one distinction this time is that the main target seems to have shifted to the extent of price hikes versus the tempo of price hikes.

If you look out additional into 2024 and past on the Dot Plot, you will see that rates of interest are projected to return down. This means that, sooner or later, the Fed is prone to pivot. However, in the mean time, there is not any telling when the central financial institution will hit the brakes on the rising cycle. The market has priced in the potential for a 25 foundation level enhance in March, nevertheless it’s possible that we’ll see just a few extra price hikes as a result of inflation continues to be operating excessive.

Whereas the disinflationary course of has began, the Fed might want to see the results within the companies sector, ex-housing earlier than gaining confidence that inflation is coming down.

Earlier than the Fed’s Announcement

Forward of the Fed assembly, the financial system appears to be in respectable form. Latest financial studies have indicated the next:

- This autumn GDP rose larger than anticipated.

- Shopper Value Index (CPI), Producer Value Index (PPI), and Private Consumption Expenditure Value Index (PCE) supported the idea that inflation could also be easing.

- 10-year yields have eased.

Within the minutes previous to the FOMC announcement, the Dow Jones Industrial Common ($INDU) was already down 332 factors, the S&P 500 index ($SPX) was down 0.5%, and the tech-heavy Nasdaq Composite ($COMPQ) additionally fell 0.3%. After the announcement, the three indexes fell additional, however then began coming again. On the shut of the buying and selling day, $INDU was up 0.02%, $SPX was up 1.05%, and $COMPQ closed larger by 2%. General, buyers reacted positively to the Fed choice and Powell’s feedback (extra on this under).

One space the Fed is watching carefully is the job market. The JOLTS report was robust, indicating a rise in December job openings. The January jobs report will give additional perception into the tightness of the job market. The expectation is for a 190,000 enhance, with the unemployment price at 3.6%. The following spherical of inflationary studies will most likely play an enormous position in informing the Fed’s financial stance. Within the meantime, let’s check out what the charts are exhibiting.

The chart under seems to be at varied information factors that paint an image of the U.S. financial system (click on on chart to view the reside chart).

The next factors floor from this chart:

- Fairness costs as represented by the S&P 500 index ($SPX) are rising. The $SPX is buying and selling above its 200-day shifting common.

- The U.S. greenback ($USD) is weakening. A weakening greenback might assist exports.

- The CBOE Volatility Index ($VIX) is declining. After spending a while ranging between 20 and 35, the $VIX is now hanging out under the 20 ranges.

- Excessive-yield company bonds (utilizing HYG as a proxy) are trending larger. A few of these bonds are yielding larger than 7%. When high-yield bonds are on the rise, it means that enterprise borrowing circumstances are easing.

- Mortgage charges ($$MORTGAGE30YR) have been declining since November, though we’ve but to see house gross sales enhance.

Powell’s Phrases: How Did the Market React?

The Fed is strongly dedicated to bringing inflation all the way down to its 2% objective. Which means ongoing rate of interest will increase, attaining value stability, and a big discount of its steadiness sheet. Though financial progress has slowed down as a result of restrictive financial coverage, the labor market stays extraordinarily tight. The labor market is out of steadiness—wage progress is excessive and job positive factors are strong, however the labor pressure participation hasn’t modified a lot from a yr in the past.

Whereas acknowledging the risks of over-tightening, the Fed believes the chance of implementing too-loose a coverage that proves ineffective over time could also be larger than implementing a restrictive stance that yields subdued financial progress.

What Does This Imply for Your Portfolio?

“Do not wager in opposition to the Fed” is one of the best plan of action to take. Some economists imagine the U.S. financial system might expertise a “rolling recession” in 2023. It is a sort of recession that hits sectors at totally different occasions (therefore, “rolling”) versus hitting all sectors concurrently. Just a few economists imagine we’re already in a single. We have seen layoffs within the Tech sector, weaker earnings studies, and a slowdown within the housing market. But inflation is cooling, the financial system continues to be rising, and the job market continues to be robust.

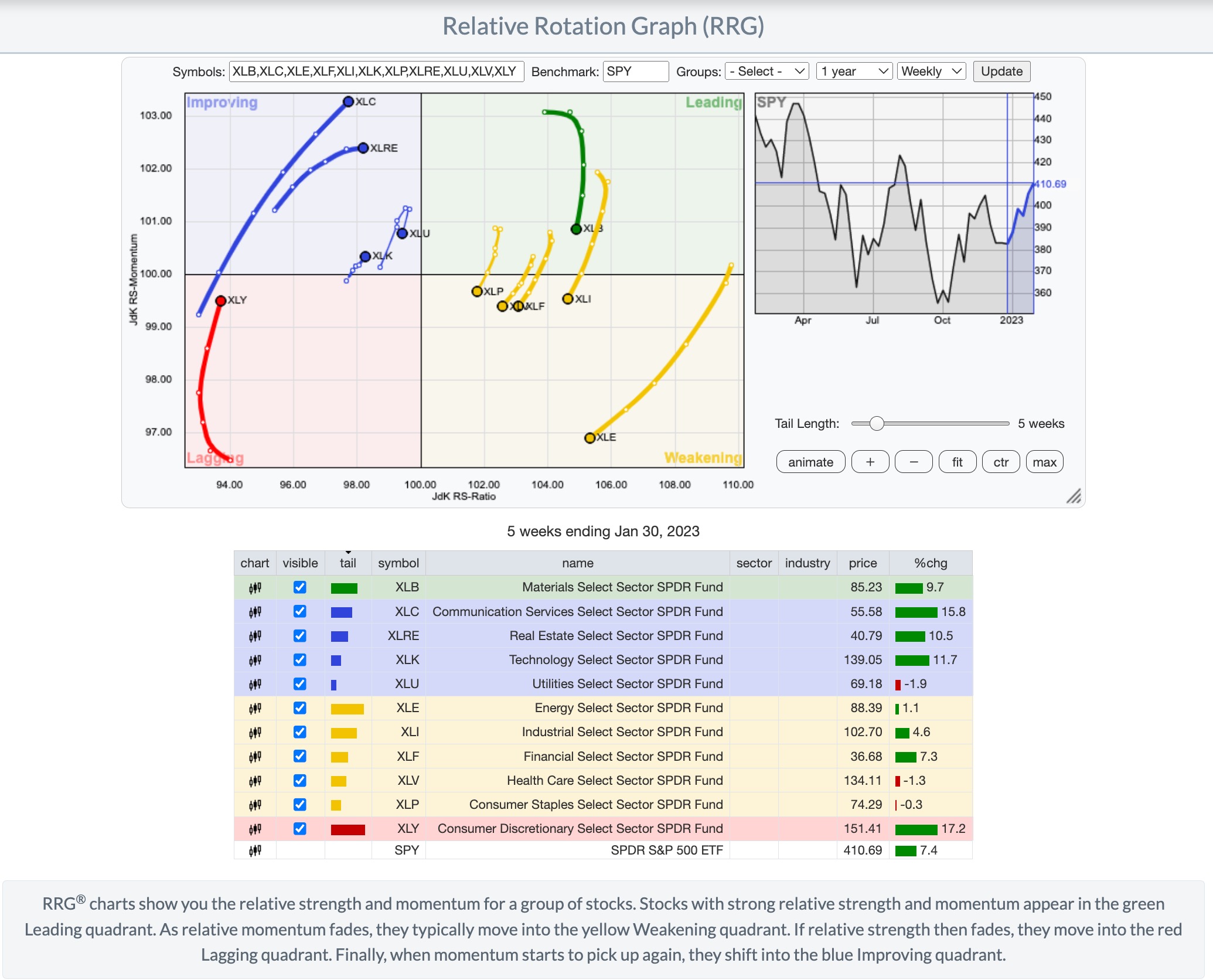

Housing and manufacturing could also be some industries to control. And do not rule out world markets, particularly rising markets. The markets are dynamic, and issues can change on a dime. Thankfully, the Relative Rotation Graphs (RRG) in your StockCharts platform present a visible overview of which sectors are main, bettering, lagging, or weakening by analyzing their relative power and momentum. You may take a look at the efficiency of various teams of shares utilizing totally different time frames. The chart under shows the RRG of the 11 S&P sectors.

Need to discover the RRG instrument? Try the video under.

Jayanthi Gopalakrishnan

Director, Web site Content material

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra

Subscribe to ChartWatchers to be notified each time a brand new publish is added to this weblog!

[ad_2]