[ad_1]

Are shares in a bull market section for the time being?

Nicely, that definitely depends upon the place you are trying. For those who’re analyzing the Nasdaq 100 index, or semiconductors, or AAPL, or NFLX, or a handful of different mega-cap progress names, then that’s principally an plain fact at this level. For those who’re power shares, or the monetary sector, or the equal-weighted S&P 500, or to be fully sincere most US shares at this level, then that reply is slightly harder to justify.

So how a lot of an issue is it that this “slim management” concern we have mentioned regularly on The Ultimate Bar continues to plague the fairness markets as we close to the tip of Could 2023? That relies upon on what you personal throughout this narrowly-led bull market section!

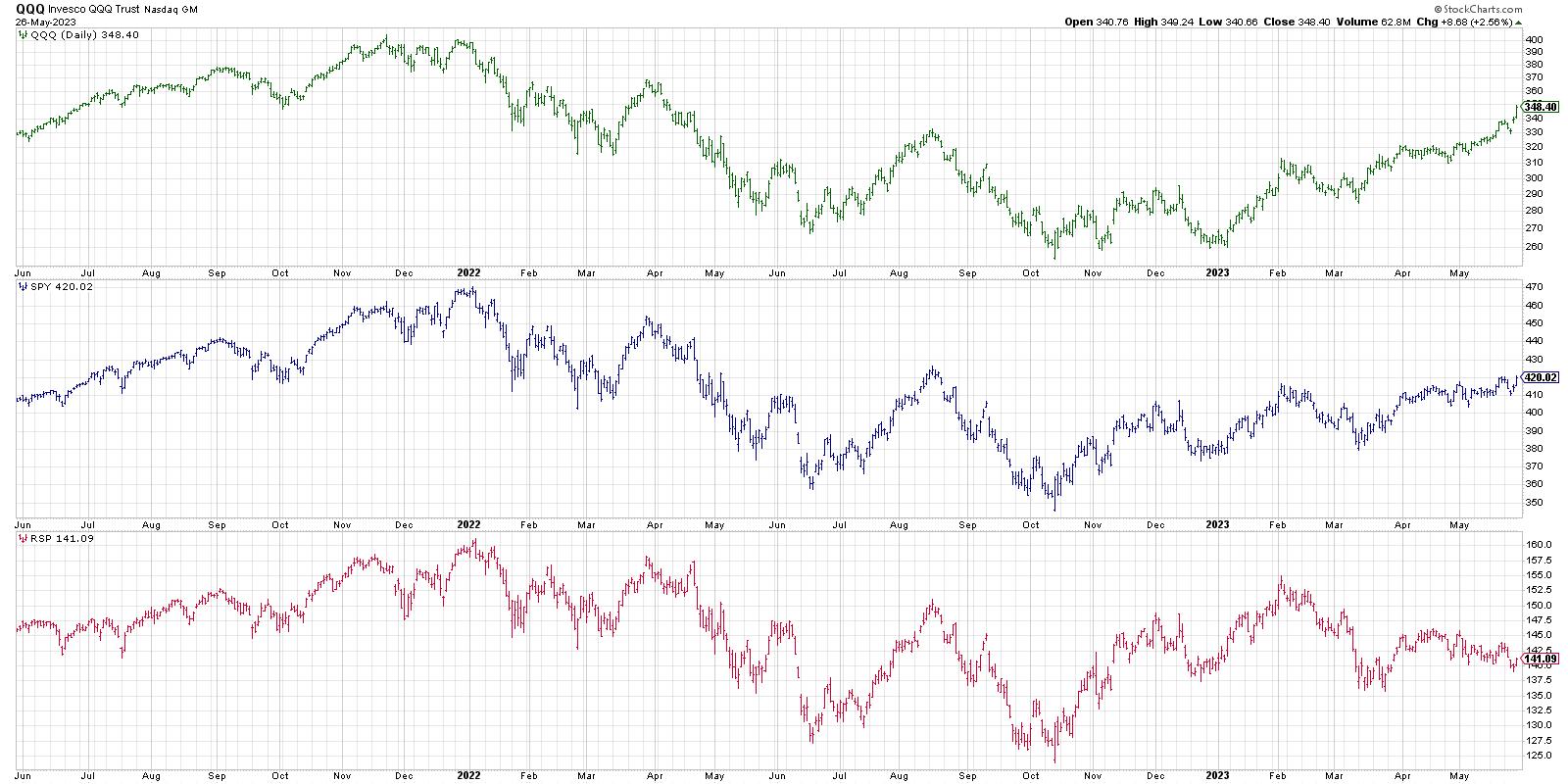

For those who’re within the Nasdaq 100 (high panel, black) names like MSFT and AAPL, you are seeing one other sturdy up week. You’ve got skilled a brand new excessive each month up to now in 2023, together with Could. The pattern is your good friend, and that pattern is clearly bullish!

For those who personal the S&P 500 index (center panel, blue), you are in all probability feeling cautiously assured at this level, with one other take a look at of the February highs working this final week. Though earlier makes an attempt to push above S&P 4200 have failed, the rally by the course of this week most certainly enables you to head into the vacation weekend with renewed optimism.

What about in the event you personal the “common” S&P 500 inventory, as represented by RSP, the equal-weighted S&P 500 ETF (backside panel, purple)? Now you are considering much less concerning the February highs and extra concerning the March lows, that are nonetheless very a lot in play.

And it isn’t simply the S&P 500 index having this “lack of participation” concern. Listed below are the cumulative advance-decline traces for the NYSE, massive caps, mid caps, and small caps.

Notice how, whereas the S&P 500 has been trending greater during the last six weeks, actually all 4 of these advance-decline traces are sloping decrease. If the A-D traces are the true illustration of the market pattern, an argument that we discover has nice worth nowadays, then this can be in truth a transparent bear market section! But the averages maintain pushing onward and ever upward.

So as to add gas to the bullish hearth, we’ve got the New Dow Idea chart very near signaling a “bull affirmation” sign. We would want to see an upside follow-through subsequent week to finish the sample, however the setup up to now appears constructive.

Charts like Netflix (NFLX) maintain pushing above key resistance ranges, indicating that further consumers are coming in and offering additional upside momentum. And with Shopper Staples shares pulling again from their very own resistance ranges, the offense-defense ratio seems to be rotating clearly to the offensive aspect.

My greatest concern for this market? Restricted upside from present ranges. There are certainly two ways in which this market resolves from right here.

The primary possibility is that breadth circumstances enhance, with beaten-down names which have but to be taking part within the upswing begin regaining their floor. There are extra 52-week highs available and charts just like the McClellan Oscillator get out of the “bearish” area by breaking again above the zero degree.

The second possibility is that the inflow of demand for progress shares pushes costs to unsustainable ranges, because the FOMO-led AI craze evaporates, the music stops, and the dearth of breadth assist lastly turns into the demise knell for the nice bull market of early 2023.

What’s the excellent news?

If the bullish possibility performs out, there will likely be loads of shopping for alternatives. Whereas it looks like you will have missed out on the most important bull run in inventory market historical past, issues could be getting began. Look ahead to breakouts, set value alert, run your scans, and you can find charts which are at actionable entry factors.

If the bearish possibility performs out, then the charts will inform you when the uptrend in progress shares has run its course. Watch indicators like RSI for bearish divergences, use one thing like MACD or PPO to substantiate a draw back rotation, and persist with uptrends till the chart tells you the uptrend is finished.

I requested our three panelists on The Pitch this week (thanks once more to Dave Landry, Mark Newton, and Joe Rabil!) how they handle to outlive difficult durations like this. I assumed Mark’s response was nearly as good as I’ve heard.

“Nicely, I attempt to encompass myself with charts moderately than information.”

Nicely stated, Mark.

Our newest YouTube video digs into the chart of Netflix, monitoring the newest breakout and utilizing RSI and Fibonacci Retracements to establish potential resistance ranges. Test it out!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method characterize the views or opinions of some other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders reduce behavioral biases by technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor determination making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing threat by market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra

Subscribe to The Conscious Investor to be notified each time a brand new publish is added to this weblog!

[ad_2]