[ad_1]

The temporary’s key findings are:

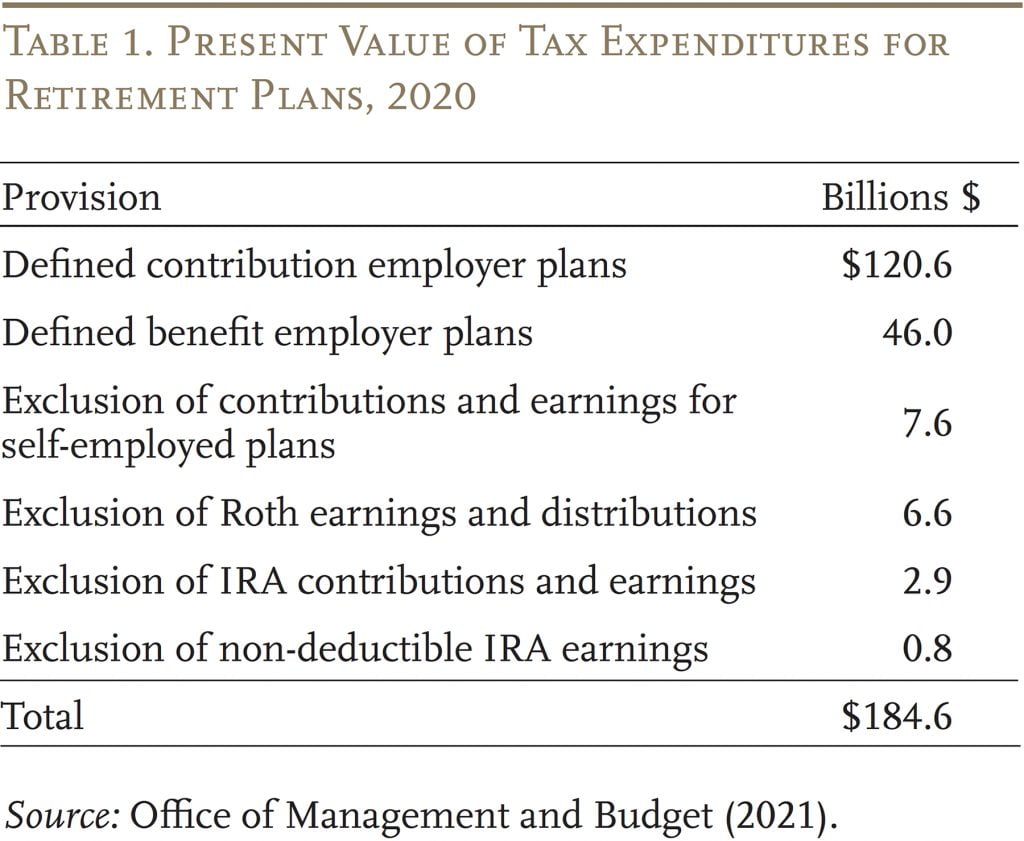

- Tax preferences for saving in retirement plans are costly – about $185 billion in 2020, in response to Treasury estimates.

- Strikingly, additionally they appear a nasty deal for taxpayers, primarily benefiting excessive earners whereas failing to considerably increase nationwide saving.

- Thus, the case is robust for eliminating or lowering these preferences.

- The ensuing enhance in tax revenues could possibly be reallocated to fixing Social Safety’s funds.

Introduction

The U.S. Treasury estimates that the tax choice for employer-sponsored retirement plans and IRAs diminished federal earnings taxes by about $185-$189 billion in 2020, equal to about 0.9 % of gross home product. Nonetheless, the very best proof means that the federal tax preferences do little to extend retirement saving.

Whereas this dismal evaluation might sound like dangerous information, it really affords policymakers a chance to strengthen the nation’s retirement earnings system. Revenues saved from repealing the retirement saving tax preferences could possibly be reallocated to deal with nearly all of Social Safety’s long-term funding hole.

This temporary, which relies on a latest paper, reassesses the favorable tax therapy of retirement plans and explores a chance to make use of taxpayer assets extra productively. The primary part addresses the income loss, contemplating the influence not solely on the non-public earnings tax but in addition the payroll tax, concluding that the revenues forgone are important. The second part examines who receives these tax expenditures, concluding that the majority goes to excessive earners. The third part explores what taxpayers get for his or her cash, discovering that the favorable tax therapy has didn’t considerably enhance nationwide saving. The fourth part explores methods to recoup all or among the tax subsidies. The fifth part explores how the financial savings from eliminating or lowering the tax subsidies could possibly be utilized to Social Safety.

The ultimate part concludes that it makes little sense to throw increasingly taxpayer cash at employer plans and IRAs. The truth is, the case is robust for eliminating the present tax expenditures on retirement plans, and utilizing the rise in tax revenues to deal with Social Safety’s long-term financing shortfall.

Present Tax Therapy of Retirement Plans

The tax expenditures, below the non-public earnings tax, come up as a result of staff can defer taxes on compensation that they obtain within the type of retirement financial savings. In conventional outlined contribution (DC) plans, staff will not be taxed both on their very own or their employer’s contributions within the present 12 months or on the funding earnings on their balances. As a substitute, members are allowed to defer taxes till advantages are obtained in retirement, at which era each contributions and funding earnings are taxed as unusual earnings. Equally, members in conventional outlined profit (DB) pensions will not be taxed on the annual enhance within the worth of their accrued advantages however reasonably defer paying taxes till they obtain advantages in retirement. Relative to saving by way of an unusual funding account, the tax therapy for employer-sponsored retirement plans considerably reduces the lifetime taxes of collaborating staff.

This favorable therapy of retirement saving leads to decrease tax revenues. Traditionally, the federal authorities estimated the misplaced income on a money foundation. In 2020, this method produced a income lack of $189 billion. Whereas the cash-flow method is significant for everlasting deductions and exclusions, it doesn’t accurately account for tax concessions when tax funds are deferred.

A greater method to measuring the price of the favorable tax provisions is the distinction within the internet current worth of the revenues from contributions in a given 12 months below two tax guidelines – the foundations for saving exterior a retirement plan and the present favorable guidelines for saving in a retirement plan. The Treasury’s 2020 estimate for this current worth idea was $185 billion (see Desk 1).

Income losses additionally prolong to the payroll tax for Social Safety and Medicare. Within the case of DC retirement plans, worker contributions are taxed as earnings, however employer contributions will not be. Thus, calculating the income loss entails making use of solely the employer portion of the payroll tax – 7.65 % – to employer contributions. With respect to DB plans, the annual enhance within the worth of accrued DB advantages is excluded from the payroll tax base for each employers and staff, so the income loss estimate applies the complete 15.3-percent payroll tax right here. For 2020, our complete estimate of the payroll tax income loss is $68 billion.

Briefly, the tax preferences for retirement plans price the Federal Treasury and Social Safety/Medicare a major amount of cash. Who will get these preferences, and what can we obtain in trade?

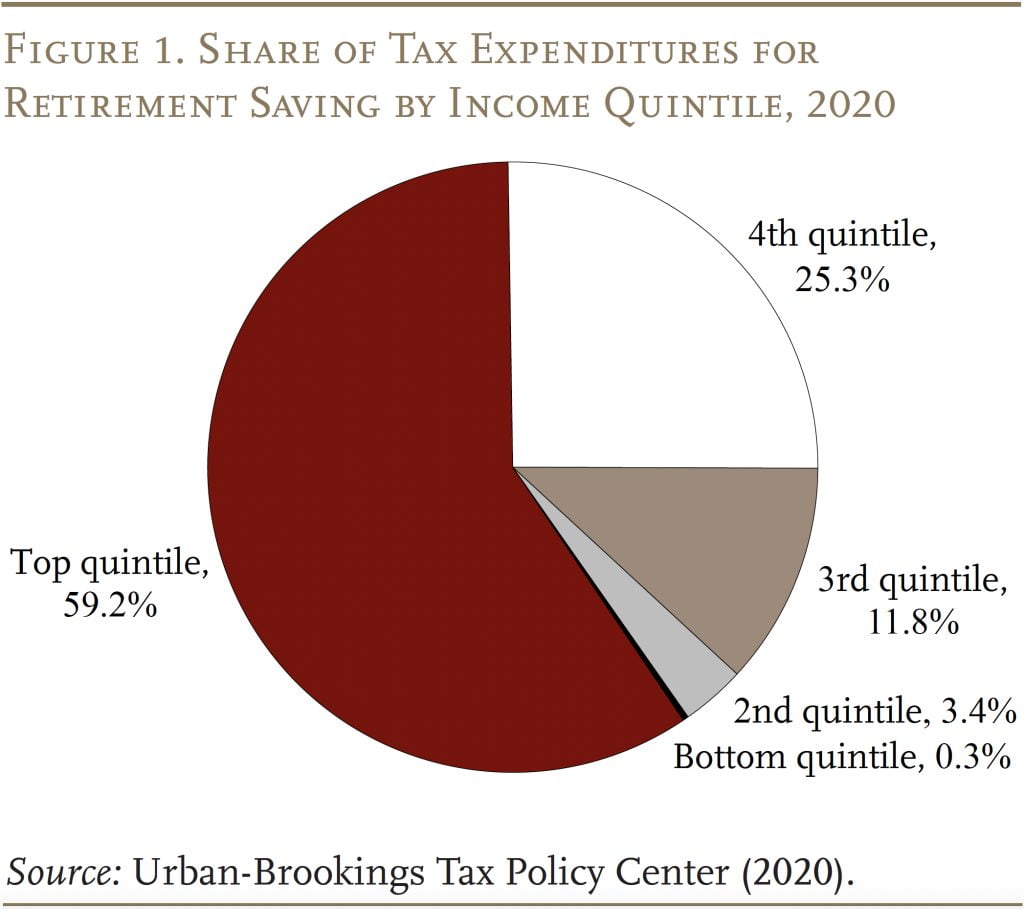

Who Will get the Tax Expenditures?

Tax expenditures for retirement saving are more likely to profit excessive earners than their low-earning counterparts, for quite a lot of causes. Higher-income taxpayers usually tend to have entry to employer-sponsored retirement plans, usually tend to take part of their employer’s plan, and contribute extra after they do take part. Certainly, simulations from the City-Brookings Tax Coverage Heart counsel that 59 % of the present tax expenditures for retirement saving flows to the highest quintile of the earnings distribution (see Determine 1).

Over time, Congress has made two forms of modifications that consequence within the prime quintile receiving an rising proportion of tax expenditures. First, it launched after which expanded so-called catch-up contributions for these ages 50 and over. Most not too long ago, the SECURE 2.0 Act additional elevated the catch-up limits for these 60-63. Larger limits profit solely these constrained by the prevailing cutoffs: solely 16 % of members in Vanguard plans took benefit of the catch-up characteristic and these have been overwhelmingly excessive earners.

One other set of modifications that principally advantages high-income households is the rise within the age for taking required minimal distributions from DC plans. Previous to January 2020, minimal distributions have been required to start at age 70½. The 2019 SECURE Act raised the age to 72, and the 2022 SECURE 2.0 Act additional elevated it to 73 in 2023 and 75 in 2033. Growing the age requirement to 75 permits members to benefit from 4½ extra years of tax-free development. Typically, solely the wealthiest will have the ability to profit from this provision.

What Do the Tax Expenditures Purchase Us?

Provided that the tax expenditures go overwhelmingly to upper-income households, who face nearly no threat of poverty in outdated age, it’s price asking whether or not these expenditures accomplish some broader social aim equivalent to rising nationwide saving or increasing the share of staff coated by a retirement plan.

Do the Tax Expenditures Enhance Saving?

The tax subsidy for retirement saving could also be justified if it promotes nationwide capital formation. The rise in nationwide capital formation is the sum of presidency saving – revenues much less expenditures – and saving by people. Because the lack of revenues produced by the tax expenditure reduces authorities saving, the query is whether or not individuals coated by retirment plans enhance their saving by sufficient to make up for this loss. The load of the proof signifies that they don’t.

It’d initially appear that tax preferences do certainly enhance nationwide saving. In spite of everything, the tax preferences make retirement saving extra engaging to the savers and big quantities have been accrued in retirement plans. However the economists’ lifecycle mannequin suggests that individuals might merely shift financial savings from unusual taxable funding accounts to tax-favored retirement accounts with the intention to reap the advantages of the tax choice. If we assume that 65 to 70 cents of every greenback of retirement plan financial savings in any other case would have been saved in taxable funding accounts, about $644 billion of the $954 billion in annual retirement plan contributions would have occurred regardless, leaving a internet increment to financial savings of $310 billion. With the Treasury’s income loss estimate of $185 billion, plainly the majority of the rise in personal saving might have been offset by the discount in authorities saving.

Equally, latest research of computerized saving insurance policies equivalent to 401(ok) defaults have discovered they’re fairly efficient at rising participation in retirement plans, nevertheless it stays unclear whether or not they elevate complete family saving. For example, a 2022 examine discovered that computerized enrollment of Division of Protection staff within the federal authorities’s Thrift Financial savings Plan considerably elevated plan balances, however had little or no impact on members’ internet price. In such circumstances, nationwide saving would lower because of the budgetary price of the tax choice.

Likewise, if a family focused a selected determine for his or her retirement saving, equivalent to a greenback quantity at retirement or the power to switch some share of their pre-retirement earnings, a tax choice for retirement saving successfully will increase the after-tax return, which may trigger the family to save lots of much less.

Briefly, concept doesn’t present a robust foundation to imagine that the federal tax preferences should enhance internet complete saving. Thus, the query have to be resolved empirically. Within the mid-Nineties, two distinguished research got here to conflicting conclusions concerning the efficacy of the retirement saving tax choice. Since that point, nevertheless, further research utilizing new information and strategies have largely concluded that the web results of the tax choice are small. However analysis specializing in america has been impeded by the shortage of high-quality information on saving and wealth.

Because of this, economists turned to Danish tax information, which monitor the earnings, saving, and wealth of over 4 million individuals. To check the impact of tax subsidies, they used responses to a 1999 discount within the subsidy for retirement contributions for these within the prime tax bracket. The outcomes present that, for some, pension contributions declined. However the decline was practically totally offset by a rise in different forms of saving. The tax subsidy, in different phrases, had primarily induced people to shift their saving from taxable to tax-advantaged retirement accounts, to not enhance total family saving. The response was additionally extremely concentrated, with most people doing nothing and solely about 15 % shifting their saving. The authors concluded that tax incentives had just about no influence on retirement saving.

The outcomes of this examine have been nicely obtained and broadly accepted. The load of the proof signifies that tax incentives don’t enhance complete saving in a significant manner.

Do the Tax Expenditures Enhance Protection?

It’s doable that, even when the tax incentive doesn’t induce high-income households to extend their complete retirement saving, the inducement does encourage corporations to supply retirement plans. Within the course of, office retirement plans can be supplied to lower-paid staff, who presently lack a handy solution to save for retirement. Nonetheless, little analysis has produced any proof of a relationship between tax expenditures and retirement plan protection.

For example, if the retirement saving tax expenditure accruing to high-earners elevated the supply of office retirement plans to low- and middle-earners, one may anticipate retirement plan protection to be greater in states that levy excessive state earnings taxes on excessive earners, because the federal tax expenditure serves to scale back state earnings tax liabilities as nicely. Nonetheless, after controlling for a wide range of demographic and labor drive traits, no statistically important relationship exists between the utmost earnings tax fee levied by a state and the proportion of staff supplied a retirement plan at work.

Furthermore, the proportion of staff collaborating in a retirement plan has not elevated over time (see Determine 2). However, neither have tax expenditures as a share of GDP. Thus, it’s doable that protection is greater than it will have been within the absence of the tax expenditures, however, once more, no proof helps such a rivalry.

Even when the retirement tax expenditure did enhance retirement plan protection, far cheaper means exist to attain this aim, equivalent to a authorities mandate to enroll staff in a retirement plan. For example, in 2008 the UK established a system that requires all personal sector employers to auto-enroll their staff in a retirement plan. The employer can select between adopting its personal plan or utilizing the Nationwide Employment Financial savings Belief (NEST), an outlined contribution plan run by a public company.

The USA, nevertheless, with a strictly voluntary private-sector retirement system, has no room for mandates. With no mandate or a subsidy by way of tax expenditures, although, would employers nonetheless provide plans? You will need to do not forget that retirement plans existed earlier than the earnings tax, so tax advantages are clearly not the one purpose employers sponsor retirement plans. Employers considered DB pensions as a helpful software for managing their workforce. These plans offered advantages based mostly on last pay and years on the job. Because of this, the worth of pension advantages elevated quickly as job tenure lengthened, which motivated staff to stick with the agency. DB plans additionally inspired staff to retire when their productiveness started to say no.

Whereas the contribution of DC plans to personnel administration might seem much less compelling – they haven’t any penalty for altering jobs and no retirement incentives – economists contend that DC plans assist employers appeal to and retain high-quality staff who’ve low low cost charges and worth saving. Employer-sponsored plans additionally are inclined to have price and comfort benefits over do-it-yourself IRA plans, making such plans a lovely profit for workers. Furthermore, employers have an actual curiosity in ensuring their staff have the assets to retire as soon as their productiveness falls off.

Whereas employers have financial incentives to supply plans, it might be time to ask whether or not employer-centered preparations take advantage of sense. The truth is, the ERISA Business Committee, a corporation representing the worker profit plans of America’s largest employers, issued a report in 2007 suggesting “a brand new advantages platform for all times safety.” The brand new profit choices can be administered by competing third-party Advantages Directors, with employers and people offering the funding. The construction would additionally allow people with out an employer relationship to contribute to a retirement plan. Combining the brand new advantages platform with computerized enrollment may produce a significantly better retirement system.

In any case, the present method of providing tax expenditures is dear and doesn’t seem to work.

Decreasing Tax Expenditures for Retirement Plans

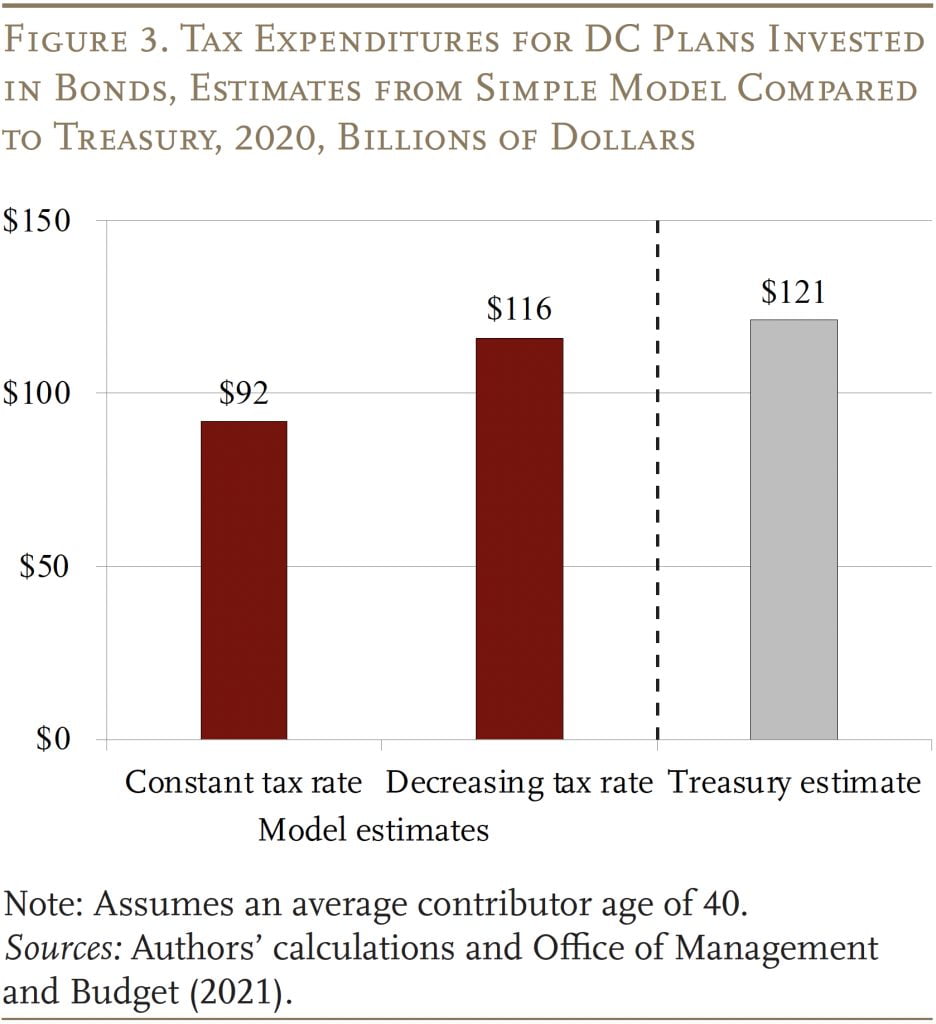

The next dialogue focuses on conventional DC plans, which account for about two-thirds of the retirement-related income loss. Fully eliminating the tax expenditure for DC plans is easy – merely embody each worker and employer contributions within the worker’s earnings and tax the returns on contributions just like the returns on different saving. The Inside Income Service already has the data on worker and employer contributions, and will require firms to report earnings on equities and bonds and realized capital positive factors from these new contributions on an annual foundation. In keeping with Treasury estimates, revenues would enhance by $121 billion.

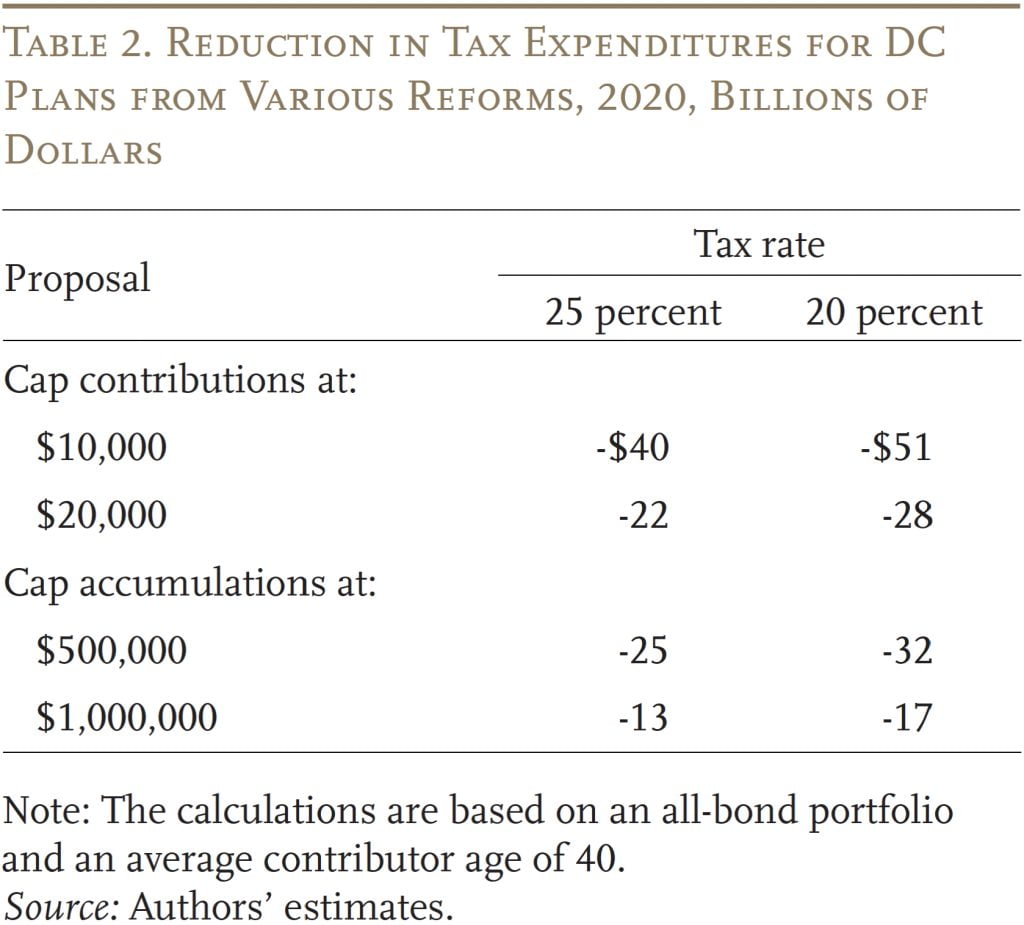

A substitute for eliminating the subsidy completely is to restrict the amount of cash that goes right into a plan, and thereby the share of the subsidy going to excessive earners. One possibility is to limit mixed employee-employer contributions to, say, $10,000 or $20,000 per 12 months. Another choice would restrict complete accumulations in tax-favored retirement plans to, say, $500,000 or $1 million.

To estimate the potential income positive factors from such an method requires utilizing a easy mannequin to ascertain a benchmark after which estimating the influence of making use of completely different caps. The mannequin requires just a few items of data: the quantity contributed to DC plans, the speed of return earned on investments, the speed used to low cost future values to the current, the size of time the cash is held within the plan, and the typical marginal tax fee earlier than and after retirement. The calculation then entails evaluating Treasury receipts if the saving occurred exterior a retirement plan to receipts when the cash is accrued inside a plan.

The mannequin assumes – just like the Treasury – that each one cash in DC plans is invested in bonds and that bonds yield an actual return of two.5 %. Additional, the calculation assumes that the speed of return equals the low cost fee. Contributions to private-sector DC plans ($526 billion) and the Federal Thrift Financial savings Plan ($36 billion) in 2020 totaled $562 billion. If contributors are age 40, the whole account is liquidated and the remaining untaxed portion is taxed in full at age 80, and the typical marginal tax fee is 25 %, then the tax expenditure for 2020 can be $92 billion. Nonetheless, substantial proof suggests that individuals face decrease tax charges in retirement than when working. Assume then that the tax fee drops to twenty % between ages 70 and 80, so the income loss will increase to $116 billion – very near the Treasury estimate for 2020 (see Determine 3).

The subsequent step is to estimate the influence of reducing the contribution limits. The 2019 Survey of Client Funds offers information on the share of contributions and accumulations above the proposed caps, and Desk 2 exhibits the quantity that the tax expenditure can be diminished below every possibility. The primary column assumes that the tax fee stays at 25 % and the second column assumes that the speed drops to twenty % as contributions from excessive earnings decline in significance.

Quite a few different choices exist for reducing again on the present stage of tax expenditures in DC plans, equivalent to retaining the deduction (or changing it with a credit score) however then taxing the earnings on plan property yearly (the so-called inside buildup) and/or shifting the age for taking the RMD again from the scheduled 75 to 70½. No matter method is taken, comparable modifications can be required for Roth DCs and for DB plans to keep away from a wholesale shift in plan sort to retain the tax benefits.

Making use of the Tax Financial savings to Social Safety

The 2023 Social Safety Trustees Report initiatives that, over the following 75 years, Social Safety faces an actuarial deficit of 1.3 % of gross home product. Over the identical interval, the Congressional Funds Workplace estimates a bigger shortfall of 1.7 % of GDP. Each teams mission that Social Safety’s mixed belief funds will probably be exhausted within the early to mid-2030s, an occasion that with out elevated revenues will set off reductions to retirement, incapacity and survivor advantages. As mentioned, the U.S. Treasury’s 2020 estimated internet current worth of the retirement tax expenditure was about 0.9 % of GDP, and the CBO’s estimate for 2019 was related. As well as, together with the results of foregone payroll tax revenues would convey the full as much as 1.3 % of GDP, in response to the CBO. Rollbacks of the ineffective retirement saving tax choice may fill a considerable portion of Social Safety’s long-term funding hole.

Within the shorter time period, the income positive factors from lowering or eliminating the retirement tax choice would exceed the web current worth figures estimated by Treasury and the CBO, as a result of even when the tax choice have been instantly eradicated at the moment, the federal authorities would proceed to gather earnings taxes on retirement plan advantages that have been topic to the tax choice on the time the contributions have been made.

Reallocating the proceeds from eliminating or lowering the retirement tax expenditure to Social Safety may assist Democrats and Republicans bridge the decades-long divide over whether or not to take care of Social Safety’s solvency by elevating taxes or lowering advantages. Redirecting the tax expenditure to Social Safety would reallocate current funds that don’t considerably enhance retirement earnings safety to a program that indisputably does. The front-loaded nature of financial savings from lowering the tax expenditure additionally may present time for different modifications to Social Safety to be phased in. Lastly, linking reductions to the tax expenditure to sustaining Social Safety’s solvency may overcome the legislative inertia that has for years delayed motion on Social Safety reform.

Conclusion

Tax expenditures for employer-sponsored retirement plans are costly – costing about $185 billion in 2020. And, strikingly, they seem like a really dangerous deal for taxpayers. The present tax preferences primarily profit excessive earners, and the tax expenditure has failed at its broader coverage targets of accelerating nationwide saving or increasing plan protection. Due to this fact, the case is robust for curbing these tax breaks.

To scale back retirement tax expenditures, the federal government may restrict contributions or accumulations in tax-favored plans or tax the earnings on these plans annually. Whereas lowering these tax incentives may, maybe, considerably cut back curiosity amongst employers in providing work-based financial savings plans, various preparations could possibly be made to make sure that all staff have an organized solution to save for retirement.

Finally, lowering tax expenditures for retirement plans could possibly be an efficient manner to assist deal with different urgent calls for on the federal finances, equivalent to Social Safety’s financing shortfall.

References

Attanasio, Orazio P., James Banks, and Matthew Wakefield. 2004. “Effectiveness of Tax Incentives to Increase (Retirement) Saving: Theoretical Motivation and Empirical Proof.” IFS Working Papers No. WP04/33. London, England: Institute for Fiscal Research.

Attanasio, Orazio P. and Thomas DeLeire. 2002. “The Impact of Particular person Retirement Accounts on Family Consumption and Nationwide Saving.” The Financial Journal 112(481): 504-538.

Auerbach, Alan, William G. Gale, and Peter R. Orszag. 2003. “Reassessing the Fiscal Hole: The Position of Tax-Deferred Saving.” Tax Notes 100(July 28): 567-584.

Benjamin, Daniel J. 2003. “Does 401(ok) Eligibility Enhance Saving?: Proof from Propensity Rating Subclassification.” Journal of Public Economics 87(5-6): 1259-1290.

Beshears, John, James J. Choi, David Laibson, Brigitte C. Madrian, and William L Skimmyhorn. 2022. “Borrowing to Save? The Affect of Computerized Enrollment on Debt.” The Journal of Finance 77(1): 403-447.

Biggs, Andrew G., Alicia H. Munnell, and Michael Wicklein. 2024. “The Case for Utilizing Subsidies for Retirement Plans to Repair Social Safety.” Working Paper 2024-1. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Boskin, Michael J. 2003. “Deferred Taxes within the Public Funds.” Working Paper. Stanford, CA: Hoover Establishment.

Brady, Peter. 2016. “How America Helps Retirement: Difficult the Typical Knowledge on Who Advantages.” Washington, DC: Funding Firm Institute.

Card, David and Michael Ransom. 2011. “Pension Plan Traits and Framing Results in Worker Financial savings Conduct.” The Evaluate of Economics and Statistics 93(1): 228-243.

Chetty, Raj, John N. Friedman, Søren Leth-Petersen, Torben Heien Nielsen, Tore Olsen. 2014. “Energetic vs. Passive Selections and Crowd-Out in Retirement Financial savings Accounts: Proof from Denmark.” Quarterly Journal of Economics 129(3): 1141-1219.

CliftonLarsonAllen LLP. 2022. “Thrift Financial savings Fund: Monetary Statements, 2021 and 2020.” Minneapolis, MN.

Congressional Funds Workplace. 2023. CBO’s 2023 Lengthy-Time period Projections for Social Safety. Washington, DC.

Congressional Funds Workplace. 2019. The Distribution of Main Tax Expenditures in 2019. Washington, DC.

Damodaran, Aswath. 2022. Historic Returns on Shares, Bonds, and Payments – United States. New York, NY: New York College, Stern Faculty of Enterprise.

Doran, Michael. 2022. “The Nice American Retirement Fraud.” Elder Legislation Journal 30(1): 265-347.

Engen, Eric M., William G. Gale, and John Karl Scholz. 1996. “The Illusory Results of Saving Incentives on Saving.” Journal of Financial Views 10(4): 113-138.

Halperin, Daniel I. and Alicia H. Munnell. 2005. “Guaranteeing Retirement Earnings for All Staff.” In The Evolving Pension System: Developments, Results, and Proposals for Reform, edited by William G. Gale, John B. Shoven, and Mark J. Warshawsky, 155-190. Washington, DC: Brooking Establishment Press.

Inside Income Service. 2023. “IRA Contribution Info for Tax Yr 2020.” Washington, DC: U.S. Division of the Treasury.

Ippolito, Richard A. 1997. Pension Plans and Worker Efficiency. Chicago, IL: College of Chicago Press.

Munnell, Alicia H. 1976. “Personal Pensions and Saving: New Proof.” Journal of Political Economic system 84(5): 1013-1032.

Munnell, Alicia H., Laura Quinby, and Anthony Webb. 2012. “What’s the Tax Benefit of 401(ok)s?” Subject in Transient 12-4. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Workplace of Administration and Funds. 2021. Analytical Views, Funds of the U.S. Authorities, Fiscal Yr 2022. Washington, DC.

Pence, Karen M. 2002. 401(ok)s and Family Saving: New Proof from the Survey of Client Funds. Washington, DC: U.S. Board of Governors of the Federal Reserve System.

Poterba, James M., Steven F. Venti, and David A. Smart. 1996. “How Retirement Saving Packages Enhance Saving.” Journal of Financial Views 10(4): 91-112.

Siliciano, Robert and Gal Wettstein. 2021. “Can the Drawdown Patterns of Earlier Cohorts Assist Predict Boomers’ Conduct?” Working Paper 2021-11. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

City-Brookings Tax Coverage Heart. 2020. “City-Brookings Tax Coverage Microsimulation Mannequin.” Washington, DC.

U.S. Census Bureau. 2020. “2020 State & Native Authorities Finance Historic Datasets and Tables.” Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Survey of Client Funds, 1989-2022. Washington, DC.

U.S. Social Safety Administration. 2023. The Annual Report of the Board of Trustees of the Federal Outdated-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.

VanDerhei, Jack. 2011. “Tax Reform Choices: Selling Retirement Safety.” Subject Transient No. 364. Washington, DC: Worker Profit Analysis Institute.

[ad_2]