[ad_1]

What compels me to jot down a daring headline claiming one sector is clearly poised to interrupt out to the upside?

As a development follower, I’ve three targets day-after-day: establish tendencies, observe these tendencies, and anticipate when these tendencies could reverse. Easy, proper?

Vitality has been the worst-performing sector in 2023, so the development has been confirmed damaging. Particularly on a relative foundation, power has been a reasonably powerful place to be.

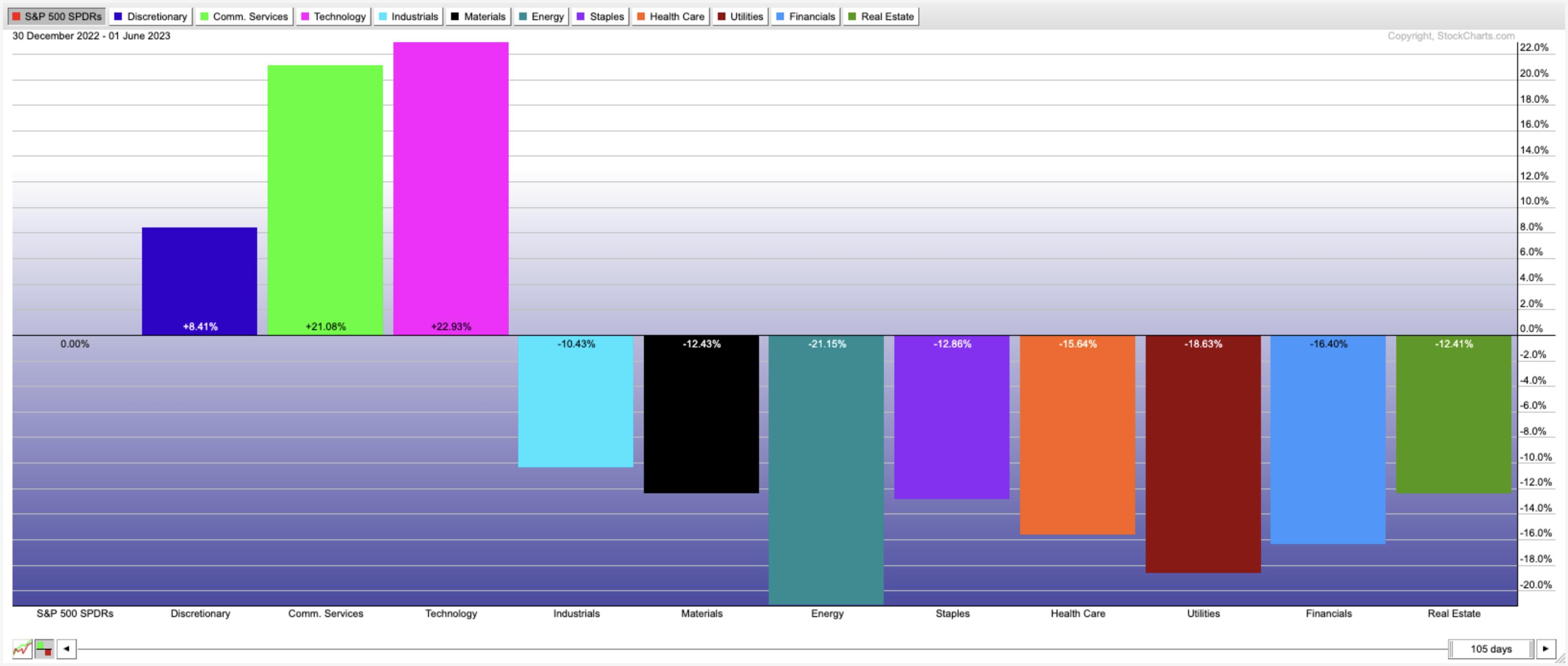

Right here, we see how three progress sectors–Client Discretionary, Communication Providers, and Know-how–have completely dominated the US fairness markets in 2023. The whole lot else has underperformed, with Vitality coming in with a -21% relative return within the first 5 months of this yr.

So what tells us this confirmed downtrend could also be at an finish?

Weekly Chart Exhibits Key Help

Let’s begin with the weekly chart of the Oil Providers ETF (OIH). Though the development for these power shares in 2023 has been down, as evidenced by the each day chart beneath, the weekly chart really exhibits a reasonably constant stepwise uptrend over the past two years.

Word the similarities between the latest of assist at $250 with earlier pullbacks in mid-2022 and late 2021. In all three circumstances, the value has pulled again and fashioned a double backside. The weekly RSI has come all the way down to round 40, however not a lot decrease. That is traditional conduct for a market in a main uptrend experiencing short-term pullbacks.

And whereas this time definitely may very well be totally different, I am inclined to imagine {that a} worth development with sure traits will proceed in its present type till confirmed in any other case.

Each day Chart Options Bullish Divergence

Now that we have established the long-term uptrend and the way the latest pullback matches into that bigger development, let’s examine the each day chart to see what the short-term image has concerned.

Now we see the a number of exams of resistance round $330 within the first quarter, adopted by a major drop in March. You might discover the dashed pink line which represents a 61.8% retracement of the September 2022 to January 2023 rally.

In order that first huge pullback of 2023 got here proper all the way down to a Fibonacci assist degree. In Could, we noticed the OIH make frequent retests of assist round $250, demonstrating that keen consumers have been keen to step in and purchase OIH at that worth level.

In case you examine the RSI within the panel beneath the value, you will see a transparent bullish momentum divergence. That is the place the value is making decrease lows whereas the indicator is making greater lows. This tends to counsel a lessening of bearish momentum, and lack of draw back strain on worth.

Now We Want Comply with-By means of

So it is all bullish from right here, proper? Maybe. However as they are saying, “the proof is within the worth.”

Vitality shares ended this week able of short-term power, handily outperforming progress sectors like Know-how and Communication Providers on Friday. Lengthy-term beneficial properties all the time begin as short-term beneficial properties, so now we have to verify when a brand new uptrend is in place.

First, I am watching the 50-day shifting common. The OIH pushed above this key development barometer this week, and I would wish to see if there’s additional upside momentum subsequent week as properly.

Second, I would be in search of the RSI to push above 60. In bearish phases, the RSI tends to achieve as much as round 60 on upswings. In bullish durations, the RSI tends to turn out to be overbought. Can the RSI present that extra keen consumers are coming into the fray?

Lastly, it is all about relative power. For power shares to be a compelling choice for fairness traders, the sector wants to begin outperforming the benchmarks. Search for the relative power to (lastly!) flip greater.

We have spoken usually of the dominance of a comparatively small variety of mega-cap progress shares. How will we all know when there’s new management rising for shares? Simply watch the value!

Fascinated about consuming this content material in a handy video format? Simply head over to my YouTube channel!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any manner symbolize the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders reduce behavioral biases via technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor resolution making in his weblog, The Aware Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing threat via market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra

Subscribe to The Aware Investor to be notified each time a brand new publish is added to this weblog!

[ad_2]