[ad_1]

Pivot factors are probably the most broadly used technical instruments amongst Foreign exchange merchants, and their distinctive construction gives a particular window into potential value actions.

Pivot factors are in style as a result of the calculations that construct them are one of many best to know within the universe of indicators. Their simplicity means merchants can intuitively perceive pivot factors and the way they need to use them on charts.

Learn on to seek out what pivot factors are, how they’re calculated, and the way merchants can use them to find out assist, resistance, or breakout ranges successfully for extra worthwhile buying and selling.

Be aware: there are various kinds of pivot factors together with customary pivot factors, Woodie’s pivot factors, camarilla pivot factors, Fibonacci pivot factors, and Demark pivot factors. This text will concentrate on the preferred model, customary pivot factors.

What Info Do Pivot Factors Give?

Pivot factors give two principal items of knowledge:

- A bullish or bearish sentiment of the worth.

- Future assist or resistance ranges.

To discover learn how to discover assist and resistance with pivot factors, let’s first have a look at learn how to calculate them.

How Are Pivot Factors Calculated?

Merchants don’t usually calculate pivot factors by hand—as an alternative, they’ll normally show it on the chart as an indicator, with the indicator making and displaying the calculation outcomes robotically on the worth chart. Nevertheless, it may be helpful to know the calculation, so that you get a greater concept of what pivot factors signify once you see them displayed on a value chart.

Step one is to calculate the principle, central pivot level. After that, we are able to calculate the opposite pivot factors as they’re derived from the central pivot level.

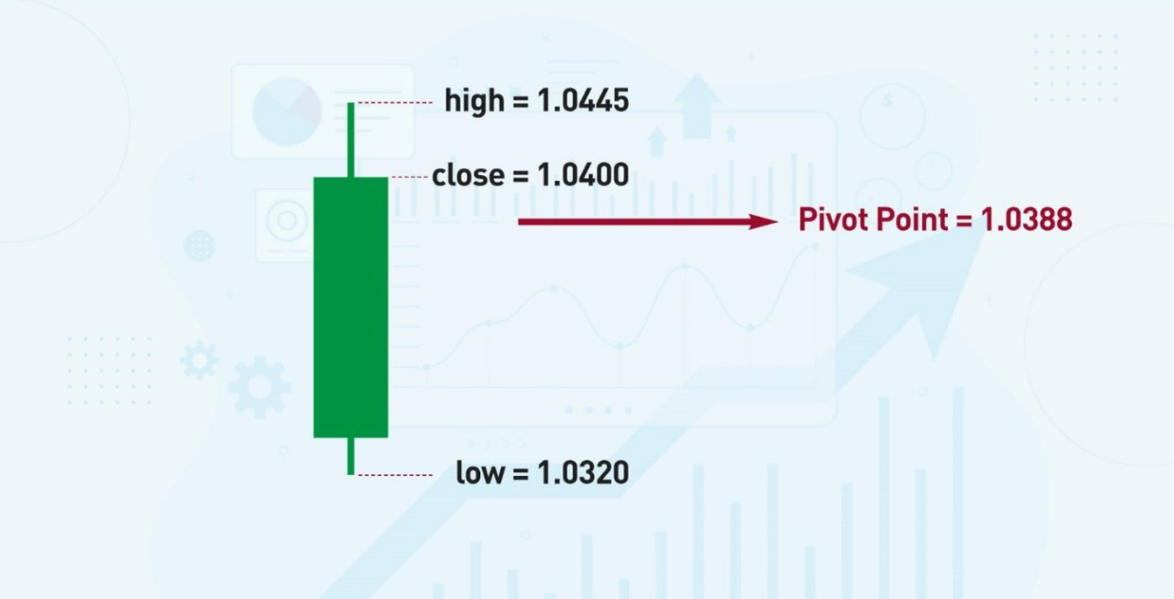

The central pivot level is the typical of the earlier candle’s excessive, low, and shut. Mathematically, that is represented by the next components:

Pivot Level = (Excessive + Low + Shut) / 3.

The latest candle dictates Pivot Factors.

Pivot factors are at all times calculated utilizing solely the newest candle. In distinction, most different indicators, e.g., shifting averages, RSI, and so forth., contemplate a number of earlier candles to derive their ranges. For instance, a 10-period shifting common calculates the typical closing value of the final ten candles.

Keep in mind, I can not use the present candle when calculating pivot factors. I have to use the earlier candle or await the present candle to shut.

Buying and selling the Pivot Level

Merchants that use pivot level methods contemplate the market bullish or bearish relying on which aspect the worth is of the pivot level:

Bullish when the worth is above the Pivot Level

Bearish when the worth is above the Pivot Level

That is probably the most primary means to make use of a pivot level. Nevertheless, this isn’t a sign to blindly bounce right into a commerce simply because the worth is above or beneath the pivot level. I would wish different components to substantiate a commerce.

Now, let’s have a look at the secondary pivot factors derived from the principle central pivot level.

Discovering Assist and Resistance with Pivot Factors

From the principle central pivot level, we are able to calculate secondary pivot factors, which can be utilized as assist and resistance ranges, on both sides of it. A typical setting is 3 resistance ranges above the pivot Level (often known as R1, R2, and R3) and three assist ranges beneath it (often known as S1, S2, and S3).

I’ll write out the calculation for each within the order through which they seem on the chart from the very best degree (R3) to the bottom degree (S3), with PP representing the worth of the principle central pivot level.

R3 = Excessive + 2*(PP – Low)

R2 = PP + Excessive – Low

R1 = 2*PP – Low

Pivot Level = (Excessive + Low + Shut) / 3

S1 = 2*PP – Excessive

S2 = PP – (Excessive – Low)

S3 = Low – 2*(Excessive-PP)

My platform, TradingView, can show as much as 5 assist and resistance ranges (i.e., R1 to R5 and S1 to S5), however after I use pivot factors, I’ll change the settings to show solely the primary three ranges.

Pivot level buying and selling technique concept: transfer down a timeframe from the degrees.

Every candle will produce its personal pivot level ranges. This implies the degrees will change with every candle. So, one method to commerce pivot factors is to maneuver down a timeframe. For instance, plot pivot factors on the next timeframe after which use them on a decrease timeframe to commerce.

Buying and selling Pivot Level Ranges as Assist and Resistance

Let’s say I’m usually bullish on the EUR/USD foreign money pair, and I wish to use pivot factors to assist plan my trades. These are the steps I can take:

- I wait till the worth is above the principle central pivot level.

- I received’t enter a commerce if the worth is barely beneath R1 or R2. I’ll both await the worth to interrupt above certainly one of these resistance ranges and ideally use that degree as a assist.

- If the worth is above R3, I could go on the commerce—there’s a good probability the worth is over-extended, and many of the upwards motion is completed, with a bearish retracement fairly prone to occur subsequent.

Assist and Resistance Function Reversal

As a result of pivot level buying and selling is normally a kind of assist and resistance technique, it’s price understanding the idea of assist and resistance function reversal. That is when the worth breaks a resistance degree, and it subsequently turns into assist or the opposite means round, the worth breaks assist, which then turns into resistance on the best way down.

Let’s say I’m bullish, and the worth breaks R1. I can await R1 to show into assist to substantiate the extent earlier than getting into an extended commerce.

Statistical Possibilities

Having a hard and fast calculation for future assist and resistance ranges means merchants can measure traditionally how typically the worth reached these ranges previously, after which probably use these statistics to evaluate future chances. For instance, with the EUR/USD foreign money pair over the previous 12 months, let’s say R1 & S1 have been reached by the worth on 42% of days. I don’t know if that’s true—I’m utilizing this quantity for example. If I’ve an extended bias, I could select to place the take-profit barely beneath R1 as a result of I do know that greater than half the time, the worth doesn’t attain there on the identical day.

Market Context Issues

There’s a motive why I’m not giving a hard and fast algorithm to commerce pivot factors on this article. Any indicator ought to solely be used as a part of the general market context. I wish to know the larger image pattern, chart patterns or assist and resistance ranges. Pivot factors can then assist me capitalize on that. For instance, if I see a giant assist degree on the upper timeframe that I believe will maintain, I could go lengthy at S1 and even S2 if they’re confluent with that degree, regardless that that’s beneath the principle central pivot level as a result of I see S1 and S2 as sturdy retraces throughout the larger image. A technique to make use of pivot factors is to put the indicator on the chart and see if any pivot factors are confluent with value ranges which you already see as important for an additional motive – and in that case, to deal with these ranges as extra prone to maintain as assist or resistance as a result of confluence.

Discover Pivot Factors on MetaTrader MT4 & MT5

On the time of writing, I observed that the variations of MetaTrader I’ve downloaded from just a few brokers wouldn’t have pivot factors robotically as a part of their indicator suites. That could be due to the precise variations I’ve downloaded, however you could have discovered the identical difficulty. The wonderful thing about MetaTrader is that there’s an enormous group that write indicators to add-on. I searched on-line for “pivot factors for MetaTrader” and located choices for putting in pivot factors indicators.

Backside Line

Pivot factors are a novel indicator utilizing solely the earlier candle’s excessive, low, and shut for the calculation.

A pivot level can present a bullish bias if the worth is above the pivot level and a bearish bias if the worth is beneath the pivot level.

Moreover, pivot factors can act as future assist and resistance ranges which point out the place the worth might pause or reverse. Merchants may use the degrees to put cease losses or revenue targets.

Discovering assist and resistance with pivot factors needs to be accomplished in step with the broader market context, for instance, buying and selling in step with the upper timeframe pattern, or listening to solely the pivot factors that are displaying confluence.

Automate your buying and selling with our Robots and Utilities

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865

EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

Utility ⚒

EasyTradePad MT4 – https://www.mql5.com/en/market/product/72256

EasyTradePad MT5 – https://www.mql5.com/en/market/product/72454

Danger supervisor MT4 – https://www.mql5.com/en/market/product/72214

Danger supervisor MT5 – https://www.mql5.com/en/market/product/72414

Indicators 📈

3 in 1 Indicator iPump MT4 – https://www.mql5.com/en/market/product/72257

3 in 1 Indicator iPump MT5 – https://www.mql5.com/en/market/product/72442

Energy Reserve MT4- https://www.mql5.com/en/market/product/72392

Energy Reserve MT5 – https://www.mql5.com/en/market/product/72410

[ad_2]