[ad_1]

What a distinction a day makes. A lot for Tuesday’s aid rally in banks. The banking contagion continued with Credit score Suisse’s fallout, which introduced the banking fiasco to a worldwide stage. The domino impact was felt within the banking sector as soon as once more and continued into Thursday, with nationwide and regional banks getting hit arduous. One take a look at the chart of the KBW Financial institution Index ($BKX) provides you with a good suggestion of how arduous the banking sector was hit. As of Thursday morning, the big banks have misplaced about $165 billion in market cap. Ouch!

CHART 1: WHEN WILL BANK STOCKS REVERSE? Control the KBW Financial institution Index ($BKX) for any indicators of reversal.Chart supply: StockCharts.com. For illustrative functions solely.

$BKX has an extended solution to go earlier than coming near its 200-day shifting common, however what’s extra fascinating is that the index began falling just a few days earlier than the Silicon Valley Financial institution information broke. It is easy to say in hindsight, however should you had this index in one among your ChartLists, you might need observed that it fell under its 200-day shifting common on March 7, 2023. Silvergate was the primary to break down, however, as a result of they had been targeted on cryptocurrencies, perhaps buyers thought it unlikely to spill over to different banks. Regardless, that transfer under the 200-day MA ought to have alerted you that one thing could have been brewing within the banking sector.

What the Regional Financial institution Disaster Imply for the Economic system

Financial progress and banking efficiency are strongly correlated. In gentle of the selloff within the banks, together with the more moderen inflation knowledge indicating that inflation is cooling, will the Federal Reserve pause their rate of interest hikes of their assembly scheduled for subsequent week? The ECB raised rates of interest by 50 foundation factors even after the Credit score Suisse fiasco. On condition that inflation continues to be a priority, it is probably the Fed will elevate 25 bps.

Extra importantly, what does the banking disaster imply for the general economic system? The implications are nonetheless unsure. That is as a result of we’re in an inflationary surroundings, and the Fed has said that its goal is to deliver inflation right down to 2%. So, on the one hand, the Fed is preventing inflation with out considerably slowing the economic system, whereas, alternatively, it is attempting to deliver some stability to the monetary markets.

It is price maintaining a tally of ratios equivalent to worth vs. progress, small caps vs. giant caps, shares vs. commodities, and so forth.

So long as the Fed is wrestling with financial coverage selections, do not be stunned to see extra volatility within the inventory markets. Rising rates of interest, an inverted yield curve, and a slowing economic system could have performed a job in exposing some banks to further threat. What does elevated volatility imply to your portfolio? Must you be taking a look at progress or worth shares? Know-how? Gold?

A unstable surroundings sends individuals to completely different asset courses. Gold costs have moved increased because the banking fallout, the Know-how sector is one other enticing alternative, and buyers are additionally turning to put money into Bitcoin. Keep in mind, a unstable market means chasing completely different asset courses to make short-term returns. If that is not your factor, chances are you’ll be higher off ready for investor sentiment to settle earlier than deciding the place to take a position. It is price maintaining a tally of ratios equivalent to worth vs. progress, small caps vs. giant caps, shares vs. commodities, and so forth.

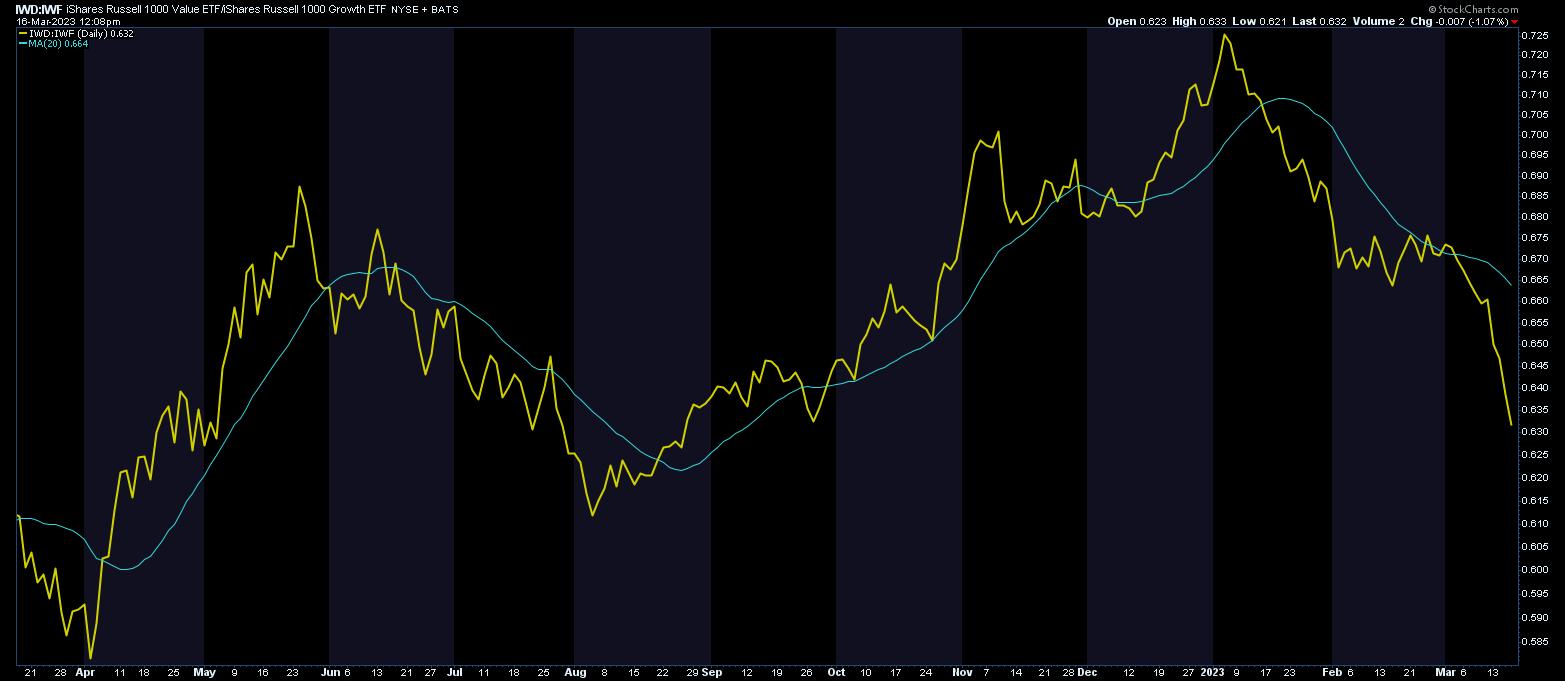

The chart under is of worth vs. progress shares. Discover that worth shares have had a steep decline with respect to progress shares. Hold a watch out for a reversal with follow-through on this ratio.

CHART 2: VALUE STOCKS PLUMMET WITH RESPECT TO GROWTH STOCKS. Does it imply you need to put money into progress shares or one thing else? Throughout unsure instances, buyers transfer from one asset class to a different, hoping to make short-term returns.Chart supply: StockCharts.com. For illustrative functions solely.

A few of the giant nationwide banks are thought of worth shares, and people might see some aid if the downfall is extra targeted on regional banks. Moreover banks, homebuilders, communications networks, and semiconductor shares make up many worth shares.

The regional financial institution disaster will probably spill over into homebuilders and actual property funding trusts (REITs). Keep in mind, homebuilders and industrial builders rely on regional banks for loans. If the regional banks tighten lending, it might harm these industries. However, decrease mortgage charges might assist the housing market, however it stays to be seen if the demand will probably be sufficient to help homebuilders.

Following Market Breadth

A much bigger concern is when banks will begin turning round. It is one thing to look at, since you might decide up some financial institution shares at discount costs. Two charts so as to add to your ChartLists could be the SPDR S&P Financial institution ETF (KBE) and the SPDR S&P Regional Banking ETF (KRE). Let’s concentrate on KBE, since that encompasses the bigger banks, which might see aid faster than the regional banks.

The chart under analyzes the market breadth of KBE. Market breadth indicators are nice at exhibiting when investor sentiment could have modified. StockCharts has a group of market breadth indicators that can be utilized for numerous sectors or the general market. The bullish p.c index of the financials and the advance-decline line are simply two out of an extended listing.

CHART 3: GETTING A SNAPSHOT OF MARKET INTERNALS. Market breadth indicators assist establish adjustments in investor sentiment. Right here, two market breadth indicators are utilized to the chart of the SPDR S&P Financial institution Index (KBE).Chart supply: StockCharts.com. For illustrative functions solely.

The S&P Monetary Sector Bullish P.c Index ($BPFINA) has fallen in line with the SPDR S&P Financial institution ETF (ticker: KBE) and is properly under 30%. This means widespread weak spot within the Monetary sector. It’s going to have to show, transfer above 30%, and observe by to point out a change in investor sentiment. Keep in mind, the bullish p.c index is an indicator primarily based on level and determine charts. That implies that any rally makes an attempt should type increased highs earlier than the bullish p.c index reverses.

One other indicator added to the above chart is the advance-decline line. Because the large banks and among the regional banks are usually large-cap shares, you would apply the SPX Advance-Decline line to investigate the banking sector. This line additionally trending decrease, suggesting that there continues to be broad participation available in the market decline. Extra fascinating is that, since early February, this line has been trending decrease. Check out completely different market breadth indicators with completely different sectors to establish which sectors are reversing and which of them are trending. In a unstable market, it is best to keep watch over all market sectors.

The Backside Line

It is solely pure for buyers to be reminded of the 2008 disaster and suppose that the regional financial institution fallout might elevate the potential of a recession. However that is determined by the depth of the monetary stress, which can unravel over time. So, let’s hope this banking disaster is extra managed and the damages are short-lived. Within the meantime, be ready for extra volatility.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra

Subscribe to ChartWatchers to be notified every time a brand new put up is added to this weblog!

[ad_2]