[ad_1]

It is no shock that the Know-how sector was essentially the most talked-about sector of the previous a number of weeks. AI FOMO was all over the place on Wall Avenue as Nvidia (NVDA) and different AI shares pulled forward of their non-AI counterparts. Ultimately, Tech shares, normally, saved the Nasdaq properly forward of the broader S&P 500 index ($SPX) and the large-cap Dow Jones Industrial Common ($INDU). The robust Tech momentum had traders questioning whether or not the transfer had actual substance behind it or if it was pushed by AI exuberance.

A Technical Take a look at the Tech Sector

Under, the every day chart of the Know-how Choose Sector SPDR Fund (XLK) reveals an uptrend in play. Is it ripe for a pullback?

CHART 1: DAILY CHART OF SELECT SECTOR SPDR TECHNOLOGY ETF XLK. The ETF has been in a robust bull rally fueled principally by AI shares. However is the rally sustainable? It helps to take a look at technical indicators, such because the Ichimoku cloud, stochastic oscillator, Chaikin Cash Move, and market breadth.Chart supply: StockCharts.com (click on chart for reside model). For instructional functions solely.

XLK is on the $166 worth stage, having pulled again barely from its 12-month excessive of $168. Nonetheless, it is properly above its 50-day and 200-day easy shifting common studying, whereas XLK seems to be on the verge of a parabolic curve.

Let’s take a look at the Ichimoku cloud to see what sort of forward-looking development state of affairs and assist and resistance it would mission. The Ichimoku cloud bullishly plots resistance 26 days forward between $154 and $158. This may very well be a sign that XLK could also be over-extended. In different phrases, it has loads of room to fall.

The Stochastic Oscillator displayed within the high panel above the worth chart means that XLK is in overbought territory, which helps the potential for XLK falling to the $154–$158 stage within the subsequent few weeks.

It helps to see if the worth momentum is pushed by robust shopping for stress. The Chaikin Cash Move (CMF) indicator helps determine whether or not shopping for stress is strengthening or weakening. The CMF is displaying divergence, which means that though worth is rising, shopping for stress is dwindling.

The XLK Excessive-Low % ($XLKHLP) indicator helps to see whether or not shares inside the sector have reached new highs or lows and the frequency and recency of those new highs and lows. It is a lagging breadth indicator, but it could possibly assist a thesis that may discover the sector in a bullish, bearish, strengthening, or weakening situation.

The $XLKHLP is displayed within the lowest panel beneath the worth chart. It has been shifting up and down by a variety for the reason that begin of the AI growth, however, total, it gave some bullish indication that shares within the sector (in all probability AI-related names) have been reaching new highs. However the indicator has fallen since reaching a excessive of $168, which additional confirms the worth motion in XLK.

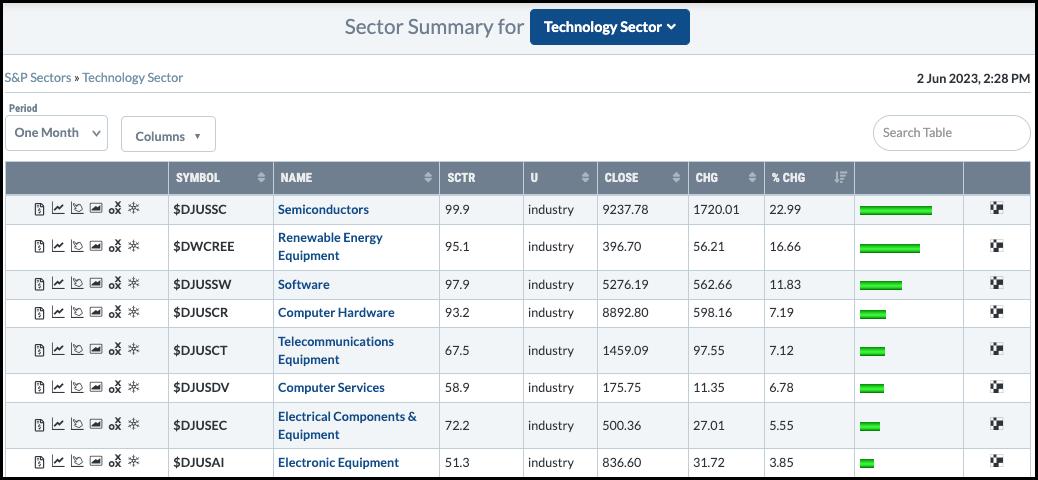

On an industry-group stage and on a month-to-month scale, Semiconductors seem to steer the pack (once more, most definitely AI-driven), as you may see beneath.

CHART 2: MONTHLY SECTOR SUMMARY. Semiconductors within the lead.Chart supply: StockCharts.com. For instructional functions solely.

However in case you take a look at the {industry} teams over a quarterly timespan, you will see that “chips,” lagging in third place, solely got here to dominate inside the final week, possible spurred on by NVDA’s current earnings and the following AI FOMO frenzy.

CHART 3: STOCKCHARTS PERFCHART OF TECH SECTOR COMPONENTS.Chart supply: StockCharts.com. For instructional functions solely.

If you happen to take a look at the inventory that served as a catalyst to all this—NVDA, the chip inventory that additionally occurred to succeed in the elite $1 trillion market cap stage final week—you see an identical studying to that of the general sector.

CHART 4: DAILY CHART OF NVIDIA STOCK.Chart supply: StockCharts.com (click on on chart for reside model). For instructional functions solely.

Whereas the overbought Stochastic readings and CMF divergences are obvious, notice that NVDA seems to be exhibiting an exhaustion hole sample on excessive quantity. This might usually trace of a pullback. However the Ichimoku cloud stage and the Quantity by Worth bar ranges appear to converge between the $290 and $300 vary, which ought to function ample assist (primarily based on the amount of buying and selling and illustration of shopping for stress, along with the cloud itself). A break beneath that might see assist at $260, barely beneath the March and April lows.

The Backside Line

The Tech sector has seen spectacular performances this week, with AI firms, notably Nvidia, main the cost. Nevertheless, indicators counsel a attainable overextension within the sector, and whereas AI-related names have reached new highs, there is a looming chance of a pullback.

It is essential for traders to stay vigilant, because the obvious “AI FOMO” may very well be adopted by a interval of market correction, particularly in overvalued shares. Regardless of this, a robust assist stage exists, lowering the potential for excessive losses. The scenario underscores the necessity for balanced funding methods that think about each the potential rewards and inherent dangers of investing in high-growth sectors like AI.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Karl Montevirgen is an expert freelance author who focuses on finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in crucial research/writing and music composition from the California Institute of the Arts.

Be taught Extra

Subscribe to ChartWatchers to be notified each time a brand new submit is added to this weblog!

[ad_2]