[ad_1]

Pattern-momentum methods buying and selling ETFs had been interesting as a result of they generated decrease drawdowns and respectable returns. Pattern-momentum methods buying and selling shares, in distinction, had been usually topic to increased drawdowns, although returns had been increased. Whereas I can’t converse for all ETF methods, my expertise reveals that ETF methods have misplaced their low-drawdown edge. This makes inventory methods extra interesting as a result of they now have comparable drawdown profiles.

Pattern-momentum methods buying and selling ETFs had been interesting as a result of they generated decrease drawdowns and respectable returns. Pattern-momentum methods buying and selling shares, in distinction, had been usually topic to increased drawdowns, although returns had been increased. Whereas I can’t converse for all ETF methods, my expertise reveals that ETF methods have misplaced their low-drawdown edge. This makes inventory methods extra interesting as a result of they now have comparable drawdown profiles.

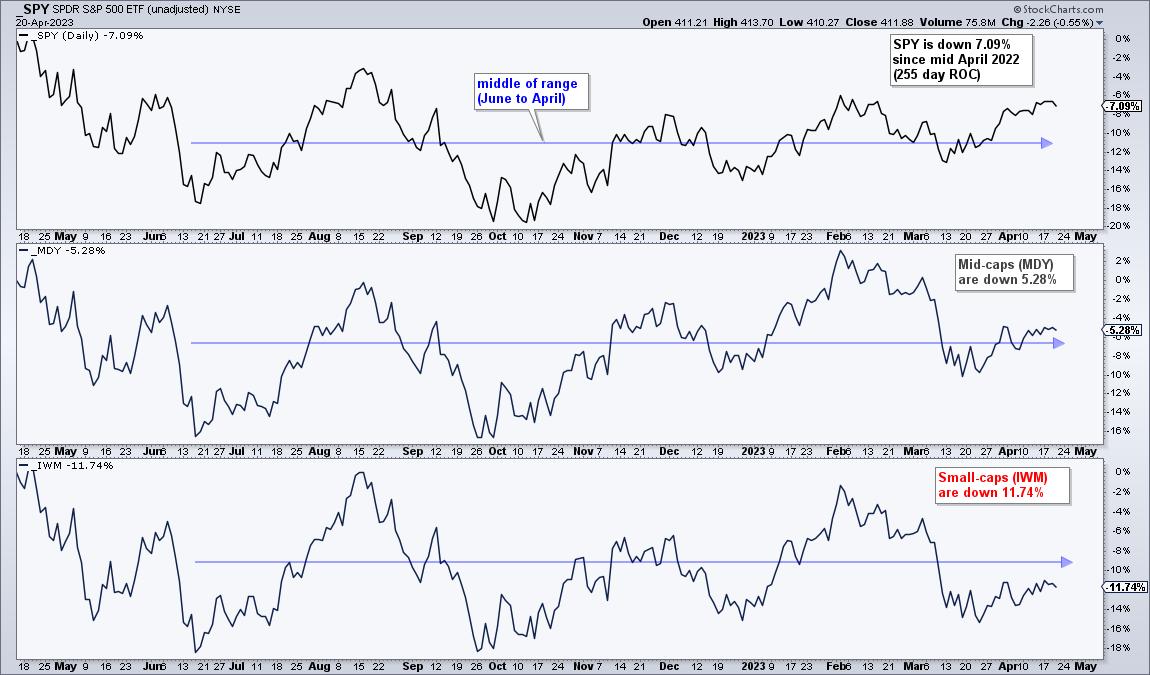

Earlier than ETF efficiency, let us take a look at 1-year (255-day ROC) returns for the S&P 500 SPDR (large-caps), the S&P MidCap 400 SPDR and the Russell 2000 ETF. SPY is down 7.09%, MDY is down 5.28% and IWM is down 11.74%. There’s a clear downward bias over the previous yr. The blue traces mark the center of the 10-month vary for every ETF (mid-June to mid-April). All three are largely vary certain. SPY is within the higher half of its vary, MDY is simply above the mid level and IWM is within the decrease half. It’s a very combined market, at finest.

Inventory-based ETFs replicate the divided market as a result of few did not generate outsized returns. Pattern-momentum methods depend upon outsized returns to generate optimistic expectancy. Inventory-based ETFs are at an obstacle when the market is split as a result of they maintain a basket of shares. ETFs can’t keep away from the losers in a divided market and this weighs on efficiency.

The final 12 months have been tough, very tough. The desk under reveals efficiency based mostly on the 255-day Charge-of-Change. Of the 170 stock-based ETFs in our Grasp Record, only one gained greater than 20% (ITB) and just one gained between 10 and 20 % (XHB). The lack to generate outsized returns is the Achilles Heel for ETFs. Solely 9% of the ETFs had been up, 91% had been down and the typical acquire/loss was a lack of 13.74%. That’s ugly.

The second line reveals comparable numbers for shares within the S&P 500. The common return remains to be detrimental, however a lot much less detrimental (-6.12% vs -13.74%). 35% of S&P 500 shares are up over the past 255 days and 65% are down. There may be nonetheless a detrimental bias right here, however the massive distinction turns into clear after we take a look at the outsized good points. 10.74% of shares are up greater than 20 % and 9.54% are up between 10 and 20 % (inexperienced shading).

Regardless of a tough 12 months, the S&P 500 was in a position to produce extra outsized good points than the 170 stock-based ETFs in my universe. Our trend-momentum methods based mostly on ETFs skilled their largest drawdowns lately. Comparable trend-momentum methods buying and selling S&P 500 shares carried out higher as a result of they had been in a position to weed out the losers and catch some outsized good points.

TrendInvestorPro will introduce a trend-momentum technique for buying and selling shares within the S&P 500 subsequent week. Additionally notice that there’s an expanded model of this text accessible to subscribers. This text reveals revenue distributions for a typical trend-momentum technique, drawdowns for inventory/ETF methods and additional explains the Achilles Heel for ETFs. Click on right here for fast entry.

The Pattern Composite, ATR Trailing Cease and 9 different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to take your evaluation course of to the following stage.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering indicators inside the development, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.

Subscribe to Artwork’s Charts to be notified at any time when a brand new put up is added to this weblog!

[ad_2]