[ad_1]

Presents Lengthy-Time period Monetary Development Targets, Together with Extra Than $1 Billion in Cloud Annual Recurring Income (ARR) and Roughly $550 Million in Free Money Movement in Fiscal 2025

Reaffirms Fiscal 2021 Monetary Outlook

Teradata (NYSE: TDC) highlighted the Firm’s profitable cloud-first transformation and ongoing strategic initiatives to ship sustainable progress and worth creation at its Investor Day held just about at the moment.

“Over the course of the final yr, we’ve launched into a journey to cloud-first and at the moment, we’re a brand new, reimagined Teradata – a worthwhile progress firm with the proper technique, expertise and crew to win in a big and rising market,” stated Steve McMillan, Teradata President and CEO. “Now we have lengthy been trusted by our prospects however what units Teradata aside is our distinctive skill to supply a real hybrid, multi-cloud resolution, delivering the perfect worth efficiency at scale within the business.”

McMillan continued, “This yr we constantly targeted on delivering on our commitments, together with constructing our recurring income streams into sustainable and worthwhile income and free money move. All of which positions us to realize over $1 billion in Cloud ARR(1) and roughly $550 million in free money move(2) in fiscal 2025 and ship vital long-term worth to our shareholders.”

A Reimagined Teradata

On the Investor Day occasion, Teradata’s new management crew outlined its three foundational cornerstones for long-term progress and worth creation:

- Effectively-positioned to win in a big and quickly rising market within the cloud supported by patented expertise and differentiated hybrid, multi-cloud capabilities;

- Robust place within the enterprise market, with expanded concentrate on the worldwide 10,000 corporations throughout seven key verticals; and

- Business-leading administration crew and greater than 7,000 world workforce with wealthy data and deep experience.

Continued Robust Monetary Efficiency By Fiscal 2025 and Past

Teradata at the moment offered monetary targets by fiscal 2025, together with:

- Greater than $1 billion in Cloud ARR, representing over 50% in whole ARR in fiscal 2025(1);

- Roughly $550 million free money move in fiscal 2025(2);

- Low 20% non-GAAP working margin in fiscal 2025(3); and

- Implementing a returns-based capital return program of at the very least 50% of free money move yearly by fiscal 2025(2).

For fiscal 2022, the corporate preliminarily estimates:

- At the least 70% progress in Cloud ARR year-over-year(1);

- Non-GAAP diluted internet earnings per share within the vary of $1.60 to $1.70(3); and

- Free money move of roughly $400 million(2).

Non-GAAP diluted internet earnings per share in fiscal 2022 is predicted to be impacted primarily by upfront recurring income acknowledged in fiscal 2021.

Reaffirmation of 2021 Monetary Outlook

Teradata additionally at the moment reaffirmed its outlook for fiscal 2021, which was beforehand offered in its second-quarter 2021 monetary outcomes press launch issued on August 5, 2021:

- Public cloud ARR is predicted to extend by at the very least 100% year-over-year(1);

- Whole ARR is predicted to develop at a mid-to-high-single-digit share year-over-year(1);

- Recurring income is predicted to develop at a high-single-digit to low-double-digit share year-over-year;

- Whole income is predicted to develop at a low-single-digit to mid-single-digit share year-over-year;

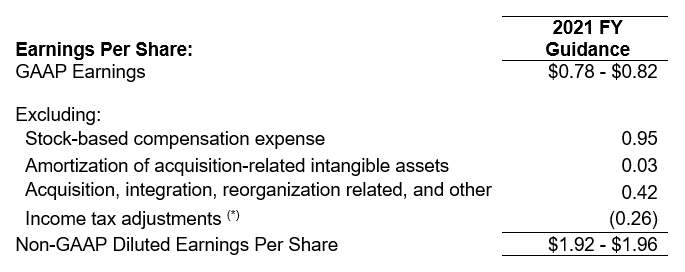

- GAAP earnings per diluted share is predicted to be within the vary of $0.78 to $0.82;

- Non-GAAP earnings per diluted share, excluding stock-based compensation expense, reorganization-related bills, and different particular objects, is predicted to be within the vary of $1.92 to $1.96(3);

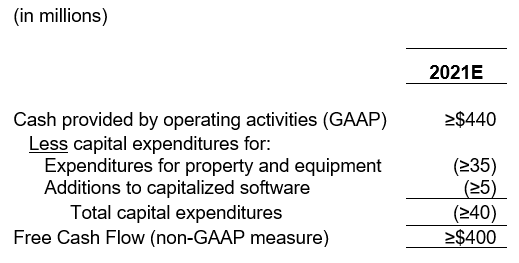

- Money move from operations is predicted to be at the very least $440 million; and

- Free money move is predicted to be at the very least $400 million(2).

Webcast Replay and Supplemental Materials

To entry the replay of at the moment’s digital Investor Day occasion and presentation supplies, go to the investor relations web page of Teradata’s web site at https://investor.teradata.com.

1. Annual recurring income (ARR) is outlined because the annual worth at a cut-off date of all recurring contracts, together with subscription, cloud, software program improve rights, and upkeep. ARR doesn’t embody managed companies and third-party software program.

Cloud ARR represents public cloud ARR, which is outlined because the annual worth at a cut-off date of all contracts associated to public cloud implementations of Teradata Vantage and doesn’t embody ARR associated to non-public or managed cloud implementations.

2. Free money move is a non-GAAP measure. As described under, the Firm believes that free money move is a helpful non-GAAP measure for traders. Teradata defines free money move as money offered by / utilized in working actions, much less capital expenditures for property and tools, and additions to capitalized software program. Free money move doesn’t have a uniform definition below GAAP and, subsequently, Teradata’s definition might differ from different corporations’ definitions of this measure. Teradata’s administration makes use of free money move to evaluate the monetary efficiency of the Firm and believes it’s helpful for traders as a result of it relates the working money move of the Firm to the capital that’s spent to proceed and enhance enterprise operations. Particularly, free money move signifies the amount of money generated after capital expenditures for, amongst different issues, funding within the Firm’s present companies, strategic acquisitions, strengthening the Firm’s stability sheet, repurchase of the Firm’s inventory and reimbursement of the Firm’s debt obligations, if any. Free money move doesn’t signify the residual money move obtainable for discretionary expenditures since there could also be different nondiscretionary expenditures that aren’t deducted from the measure. This non-GAAP measure just isn’t meant to be thought-about in isolation to, as an alternative to, or superior to, outcomes decided in accordance with GAAP, and needs to be learn solely along with our condensed consolidated monetary statements ready in accordance with GAAP.

The next desk reconciles Teradata’s projected money offered by working actions below GAAP to projected free money move for fiscal 2021.

For estimates of free money move for fiscal 2022 and monetary 2025, Teradata just isn’t offering a reconciliation to essentially the most comparable GAAP measure (money offered by working actions estimate) as non-GAAP changes relate to occasions that haven’t but occurred and can be unreasonably burdensome to forecast.

3. Teradata experiences its leads to accordance with GAAP. Nevertheless, as described under, the Firm believes that sure non-GAAP measures equivalent to non-GAAP earnings per diluted share, or EPS, and non-GAAP working margin, which exclude sure objects (in addition to free money move) are helpful for traders. Our non-GAAP measures are usually not meant to be thought-about in isolation to, as substitutes for, or superior to, outcomes decided in accordance with GAAP, and needs to be learn solely along with our condensed consolidated monetary statements ready in accordance with GAAP. Every of our non-GAAP measures would not have a uniform definition below GAAP and subsequently, Teradata’s definition might differ from different corporations’ definitions of those measures.

The next tables reconcile Teradata’s projected EPS below GAAP to the Firm’s projected non-GAAP EPS for fiscal 2021, which exclude sure specified objects. Our administration internally makes use of supplemental non-GAAP monetary measures, equivalent to gross revenue, working revenue, working margin, internet revenue, and EPS, excluding sure objects, to know, handle and consider our enterprise and help working choices frequently. The Firm believes such non-GAAP monetary measures (1) present helpful data to traders concerning the underlying enterprise developments and efficiency of the Firm’s ongoing operations, (2) are helpful for period-over-period comparisons of such operations and outcomes, which may be extra simply in comparison with peer corporations and permit traders a view of the Firm’s working outcomes excluding stock-based compensation expense and particular objects, (3) present helpful data to administration and traders concerning current and future enterprise developments, and (4) present consistency and comparability with previous experiences and projections of future outcomes.

* Represents the revenue tax impact of the pre-tax changes to reconcile GAAP to Non-GAAP revenue based mostly on the relevant jurisdictional statutory tax fee of the underlying merchandise. Together with the revenue tax impact assists traders in understanding the tax provision related to these changes and the efficient tax fee associated to the underlying enterprise and efficiency of the Firm’s ongoing operations.

For non-GAAP Diluted Earnings Per Share preliminary estimate for fiscal 2022, Teradata just isn’t offering a reconciliation to essentially the most comparable GAAP measure (GAAP Diluted Earnings Per Share preliminary estimate for fiscal 2022) as non-GAAP changes relate to occasions that haven’t but occurred and can be unreasonably burdensome to forecast. As well as, for the non-GAAP working margin goal for fiscal 2025, Teradata just isn’t offering a reconciliation to essentially the most comparable GAAP measure (GAAP working margin goal for fiscal 2025) as non-GAAP changes relate to occasions that haven’t but occurred and can be unreasonably burdensome to forecast.

Observe to Traders

This launch comprises forward-looking statements throughout the that means of Part 21E of the Securities and Trade Act of 1934. Ahead-looking statements usually relate to opinions, beliefs, and projections of anticipated future monetary and working efficiency, enterprise developments, and market situations, amongst different issues. These forward-looking statements are based mostly upon present expectations and assumptions and contain dangers and uncertainties that would trigger precise outcomes to vary materially, together with the elements mentioned on this launch and people regarding: the worldwide financial atmosphere and enterprise situations typically or on the power of our suppliers to fulfill their commitments to us, or the timing of purchases by our present and potential prospects; the quickly altering and intensely aggressive nature of the knowledge expertise business and the info analytics enterprise; fluctuations in our working outcomes; our skill to comprehend the anticipated advantages of our enterprise transformation program or different restructuring and price saving initiatives; dangers inherent in working in international nations, together with international forex fluctuations; dangers related to the continued and unsure impression of the COVID-19 pandemic on our enterprise, monetary situation and working outcomes, together with the impression of the COVID-19 pandemic on our prospects and suppliers; dangers related to knowledge privateness, cyberattacks and sustaining safe and efficient inner data expertise and management techniques; the well timed and profitable improvement, manufacturing or acquisition, availability and/or market acceptance of latest and present merchandise, product options and companies; tax charges; turnover of workforce and the power to draw and retain expert workers; defending our mental property; the supply and profitable exploitation of latest alliance and acquisition alternatives; subscription preparations could also be cancelled or fail to be renewed; the impression on our enterprise and monetary reporting from adjustments in accounting guidelines; and different elements described infrequently in Teradata’s filings with the U.S. Securities and Trade Fee, together with its annual report on Kind 10-Ok for the yr ended December 31, 2020 and subsequent quarterly experiences on Types 10-Q, in addition to the Firm’s annual report back to stockholders. The forward-looking statements included on this launch are made as of September 9, 2021, and Teradata doesn’t undertake any obligation to publicly replace or revise any forward-looking statements, whether or not on account of new data, future occasions or in any other case, besides as required by regulation.

At Teradata, we imagine that folks thrive when empowered with higher data. We provide essentially the most full cloud analytics and knowledge platform, together with for AI. By delivering harmonized knowledge and trusted AI/ML, we allow extra assured decision-making, unlock sooner innovation, and drive the impactful enterprise outcomes organizations want most. See how at Teradata.com.

[ad_2]