[ad_1]

As Canada’s final frontier for mineral exploration, Nunavut can be probably the most promising. Overlaying an space roughly the dimensions of Western Europe, the area is extremely wealthy in mineral sources, together with iron ore, diamonds and oil and gasoline, plus a wealth of important minerals.

Along with this spectacular mineral stock, gold is arguably Nunavut’s best mineral useful resource. Together with two present producing gold mines, the territory hosts a number of gold deposits at numerous phases of exploration, building and growth.

One of the vital promising areas for gold exploration and discovery in Nunavut sits proximal to the Rankin Inlet. Primarily, this promise is as a result of it hosts Canada’s second largest greenstone belt — geologic formations recognized for having extremely wealthy deposits of gold. Vital exploration and discovery has already occurred on this space, yielding each precious knowledge and improved geological fashions that may be leveraged by newcomers to the world.

Nevertheless, it is necessary to notice that even with the rising exploration within the territory, a lot of Nunavut’s gold potential stays untapped, primed for discovery and eventual manufacturing — a undeniable fact that has not gone unnoticed by many junior mining firms.

Furthermore, though Nunavut is taken into account a frontier district, beforehand explored properties with precious knowledge and present infrastructure can be found for these firms searching for enticing acquisition targets.

Gold mining in Nunavut: Driver of financial development

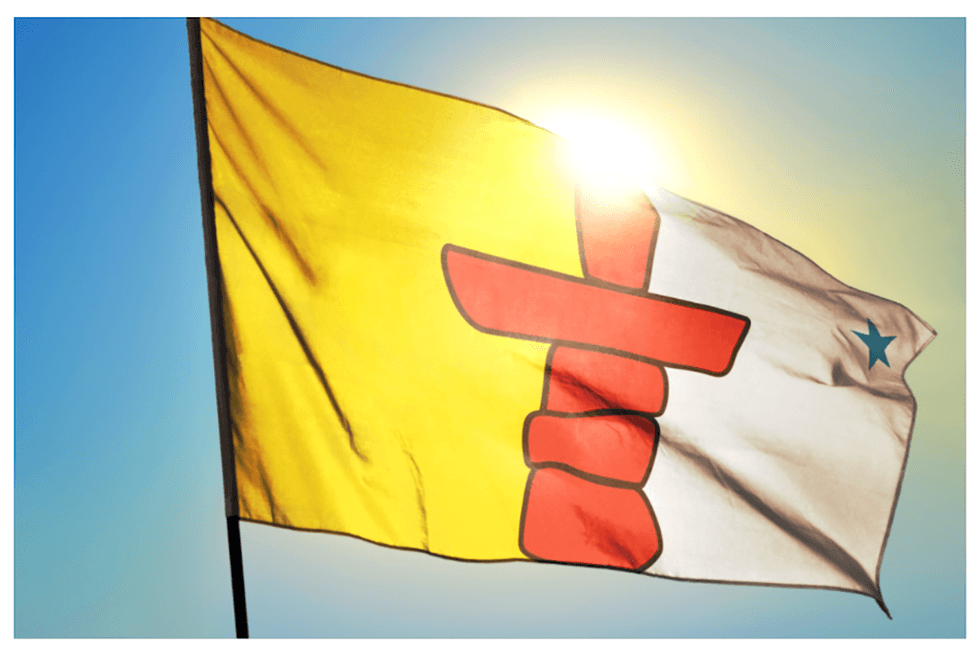

The potential for discovery in a secure mining jurisdiction is very interesting for junior useful resource firms. The territory has established a transparent authorized framework for mining claims beneath the Nunavut Land Claims Settlement (NLCA) signed in 1993 by representatives of Nunavut Tunngavik Included (representing the Inuit of Nunavut) and the governments of Canada and the Northwest Territories. The NLCA represents the most important Aboriginal land declare settlement in Canadian historical past.

Nunavut’s Indigenous governing businesses acknowledge the financial potential for mining in each native employment and enterprise procurement. Whereas the allowing regulatory course of in Nunavut could also be characterised as rigorous, it is also notably honest and clear. That is very true for gold tasks, which have a a lot smaller environmental footprint than the territory’s iron ore operations.

The gold-mining business is fueling a interval of financial prosperity and funding in Nunavut. In 2020, Nunavut’s GDP elevated by 23.65 %. It was one in every of solely two Canadian jurisdictions to expertise development. The territory adopted it up with a 6.7 % enhance in GDP in 2021 in comparison with nationwide GDP development of 4.8 %.

A lot of this financial growth might be attributed to mining and useful resource manufacturing, which collectively accounts for 34.4 % of the territory’s GDP — and which has itself skilled appreciable development, blowing previous projections within the course of. Nunavut’s mining sector grew by 10.9 % in 2021, and accounted for 50.5 % of the territory’s general development.

Treasured metals mining is a very necessary subsector. Gold and silver ore mining exercise elevated by 27 % in 2021, the third consecutive 12 months of development for this sector.

The Convention Board of Canada has projected a “shiny” outlook for Nunavut’s financial system going ahead, with emphasis on new and elevated manufacturing from the territory’s mining tasks.

Gold mining in Nunavut: Present mining operations

Nunavut is house to a few producing mines — two gold and one iron.

The Mary River iron ore. mine on Baffin Island is owned by Baffinland Iron Mines. The 2 gold mines, the Meadowbank complicated and the Meliadine gold mine, are owned and operated by Agnico Eagle Mines (TSX:AEM,NYSE:AEM). Agnico Eagle additionally holds the Hope Bay gold mine, which is at present on standby whereas the corporate switches focus to a big exploration challenge on the property meant to optimize the mine plan. Meadowbank, Nunavut’s first gold mine, commenced manufacturing in 2010 and breathed new life into the financial system.

Agnico Eagle’s success has paved the best way to proving gold mining in Nunavut might be each worthwhile for mining firms and advantageous for the territory and its communities. In 2021, the Meadowbank complicated produced a file 367,630 ounces of gold. The mine represents 25 % of Nunavut’s GDP, has greater than 400 Inuit staff and generated $469 million in native enterprise procurement in 2020.

An extra gold mine on the horizon for Nunavut is Sabina Gold & Silver’s (TSX:SBB,OTCQX:SGSVF) Goose mine, a big high-grade gold challenge within the Kitikmeot area. Sabina is on monitor to convey the Goose mine into manufacturing within the first quarter of 2025. As soon as in manufacturing, the mine is anticipated to provide roughly 250,000 ounces of gold over 15 years by way of open-pit and underground mining operations.

These mines are notable hallmarks of what is potential within the territory to return. Nunavut is now within the midst of an enormous gold rush, pushed concurrently by strong gold costs and advances in exploration expertise, which has made new discoveries potential.

Gold mining in Nunavut: Potential for brand new discoveries

Till pretty just lately, Nunavut had but to be examined by trendy gold exploration methods, leaving a lot of the territory comparatively untouched in comparison with extra mature mining jurisdictions akin to Ontario, Quebec and BC.

In Nunavut, the Inuit maintain the mineral claims to a lot of the extremely potential floor. Initially, the bottom staking course of for these lands was extremely troublesome, and would require firm representatives to be flown out to the positioning of a potential mine. Nevertheless, current technological developments within the mining sector have rendered this pointless — and Nunavut has taken full benefit of this.

After submitting an expression of curiosity to and receiving approval from the Nunavut Influence Evaluation Board, the governing physique created by the Nunavut Land Declare Settlement, Nunavut authorities, prospectors can then stake their claims just about.

New Break Sources (CSE:NBRK) is one in every of a number of mineral exploration and growth firms that has taken full benefit of this. Along with two tasks at present present process approvals — Sy gold and Agikuni Lake — New Break owns each the Sundog gold challenge and the Esker/Noomut gold challenge.

Sundog is located on 9,145 hectares of Inuit-Owned Land roughly 16 kilometers northeast of the Cullaton Lake airstrip. Characterised by high-grade floor gold exposures and two banded iron formations, it has been recognized as having the potential for Algoma-type mineralization, as current research of the Musselwhite, Meadowbank and Meliadine deposits present. It represents an underexplored space of the central Ennadai-Rankin Archean greenstone belt.

First staked in 2021, the Eskter/Noomut gold challenge is situated on the japanese shoreline of South Henik Lake. It encompasses three declare blocks, comprising 323 models of claims over roughly 6,227 hectares. With floor rights managed by the Kivalliq Inuit Affiliation, the mine is equally located on the Ennadai-Rankin greenstone belt.

“There are mineralized gold showings principally within the Kimberley area of Nunavut,” notes New Break Sources CEO Michael Farrant. “That is the southernmost area that is contained within the NSI Rankin greenstone belt, and the second largest greenstone belt in Canada.”

Along with New Break’s tasks, many different discoveries have been remodeled the previous a number of years. These embody Nord Gold at Pistol Bay, Fury Gold Mines’ (TSX:FURY,NYSEAMERICAN:FURY) Committee Bay and Solstice Gold’s (TSXV:SGC) Qaiqtuq gold challenge.

Takeaway

Nunavut is a area with huge mining potential that far outweighs the challenges of its harsh northern setting. The digital claims platform and clear allowing course of have significantly lowered the price of entry. With the success of present tasks within the territory, it’s changing into an much more interesting gold jurisdiction for junior useful resource firms and buyers alike.

This INNSpired article is sponsored by New Break Sources (CSE:NBRK). This INNSpired article gives info which was sourced by the Investing Information Community (INN) and accepted by New Break Sourcesas a way to assist buyers be taught extra concerning the firm. New Break Sources is a consumer of INN. The corporate’s marketing campaign charges pay for INN to create and replace this INNSpired article.

This INNSpired article was written in accordance with INN editorial requirements to coach buyers.

INN doesn’t present funding recommendation and the knowledge on this profile shouldn’t be thought-about a advice to purchase or promote any safety. INN doesn’t endorse or suggest the enterprise, merchandise, companies or securities of any firm profiled.

The data contained right here is for info functions solely and isn’t to be construed as a proposal or solicitation for the sale or buy of securities. Readers ought to conduct their very own analysis for all info publicly obtainable in regards to the firm. Prior to creating any funding choice, it is strongly recommended that readers seek the advice of immediately with New Break Sourcesand search recommendation from a professional funding advisor.

[ad_2]