[ad_1]

Some merchants earn cash by constantly making small earnings with a comparatively excessive likelihood. Some merchants take a distinct strategy. They like excessive yielding trades that might flip their fortunes round. Each approaches work very properly. In reality, many beneficial merchants would say they’ve win charges beneath 50%, but they’re nonetheless worthwhile. That’s due to the excessive yielding profitable trades that they’ve.

Though it might appear counter-intuitive, day buying and selling could in all probability be an excellent alternative to search out excessive yielding trades. It is because buying and selling on the decrease timeframes permit merchants to danger lesser than they might in the event that they had been buying and selling on the upper timeframes. Tighter cease losses permit for smaller dangers. On the similar time, day buying and selling may additionally permit merchants to enter a recent development proper firstly and exit on the finish. This permits for larger yields which merchants may miss in the event that they weren’t paying shut consideration to the decrease timeframes.

Breakouts are additionally prime situations to search out these excessive yielding trades. It is because breakouts may typically be a catalyst for a robust development. Buying and selling throughout breakouts give merchants the chance to seize large traits that ought to end in large earnings.

Breakout Zones

Breakout Zones is an easy technical indicator which helps merchants establish attainable breakout zones in a day buying and selling state of affairs.

Breakout Zones identifies assist and resistance zones primarily based on the value vary created in the course of the early hours of a buying and selling day. This indicator marks the highs and lows of value motion inside the first few hours of a buying and selling day. It then adjusts by a couple of pips to establish the extent which value ought to breakthrough strongly from to substantiate a attainable breakout. The assist and resistance strains shaped are then prolonged as much as only a few hours earlier than the following buying and selling day.

Merchants can use this indicator both for breakout day buying and selling methods or vary buying and selling methods. If value breaks out with sturdy momentum outdoors of the vary, value could begin a brand new development which merchants can commerce. Then again, if value tends to bounce off from the assist or resistance strains, it will also be hypothesized that value could both reverse or grow to be vary sure. Merchants can then commerce the bounce accordingly.

SwingMan UltraSuper TRIX

SwingMan UltraSuper TRIX is a customized technical indicator which is a modified oscillator.

This indicator plots histogram bars which oscillate freely across the midline zero. Optimistic bars point out a bullish development bias, whereas destructive bars point out a bearish development bias.

The traits of this oscillator is that it plots clean strains. This permits it to create clear commerce indicators with much less false reversal indicators.

This indicator plots histogram bars that change colour to point the strengthening and weakening of a development bias. Inexperienced bars point out a strengthening bullish development, whereas yellow inexperienced bars point out a weakening bullish development. Maroon bars point out a strengthening bearish development, whereas tomato bars point out a weakening bearish development.

This indicator additionally plots arrows to point or verify reversals. That is primarily based on the crossing over of the histogram bars from optimistic to destructive or vice versa.

Buying and selling Technique

SwingMan Breakout Foreign exchange Day Buying and selling Technique trades on breakouts coming from the swing highs and swing lows of value motion shaped in the course of the early hours of a buying and selling day.

The Breakout Zones indicator is used to mechanically plot the wanted breakout ranges. Value motion is then noticed as value nears these ranges.

Breakout commerce setups are confirmed primarily based on value motion breaking out of the mentioned vary, whereas being confirmed by the SwingMan UltraSuper TRIX development reversal.

On the SwingMan UltraSuper TRIX, development reversal indicators are merely primarily based on the arrows plotted and the shifting of the histogram bars from optimistic to destructive or vice versa.

Indicators:

- Breakout-zones

- SwingMan-UltraSuperTRIX_PV_4col

Most well-liked Time Frames: 5-minute chart solely

Forex Pairs: FX majors, minors and crosses with excessive volatility

Buying and selling Periods: Tokyo, London and New York classes

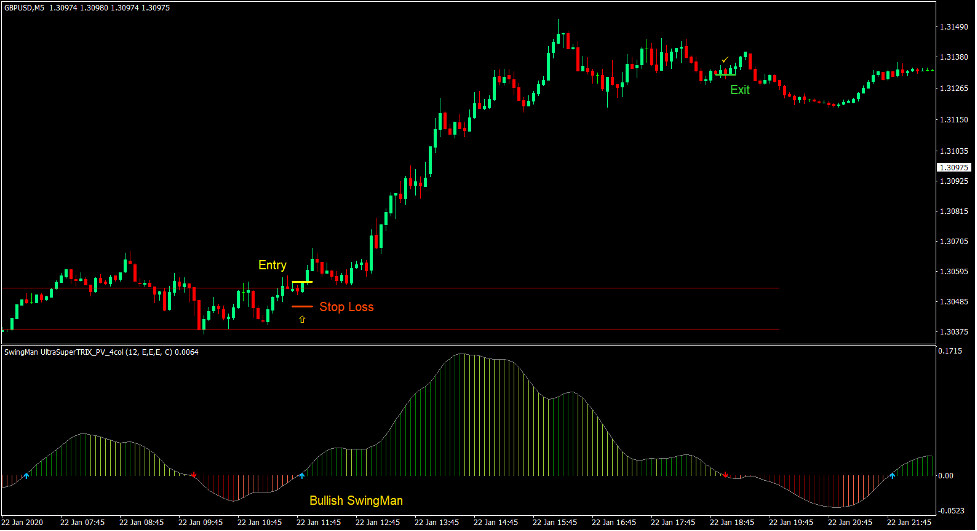

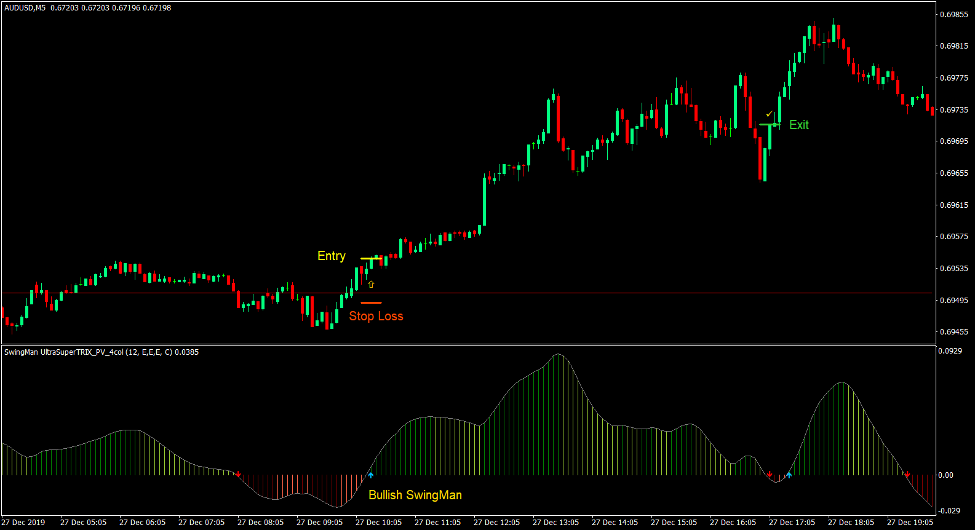

Purchase Commerce Setup

Entry

- Value motion ought to break above the every day resistance stage plotted by the Breakout Zones indicator.

- The SwingMan UltraSuper TRIX indicator ought to plot an arrow pointing up together with the histogram bars crossing above zero.

- Enter a purchase order on the confluence of the situations above.

Cease Loss

- Set the cease loss on a assist beneath the entry candle.

Exit

- Shut the commerce as quickly because the SwingMan UltraSuper TRIX indicator plots an arrow pointing down.

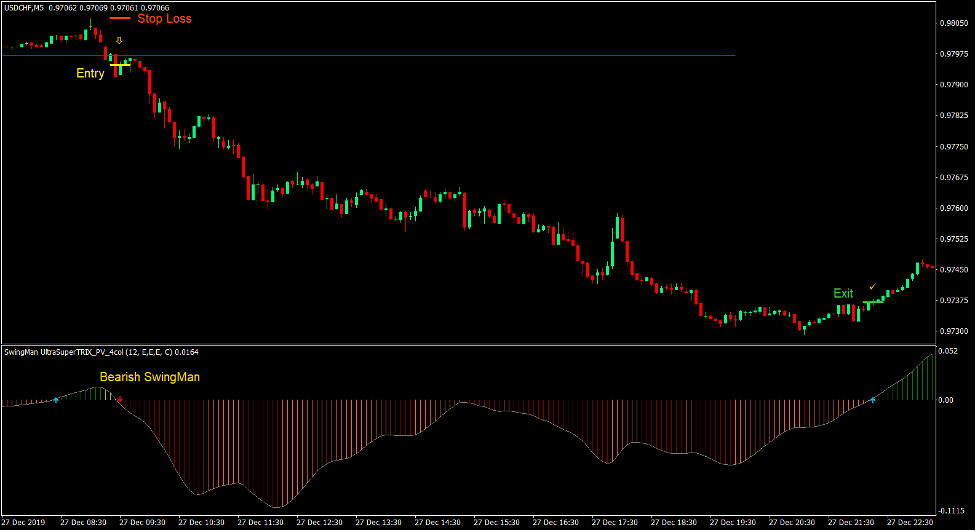

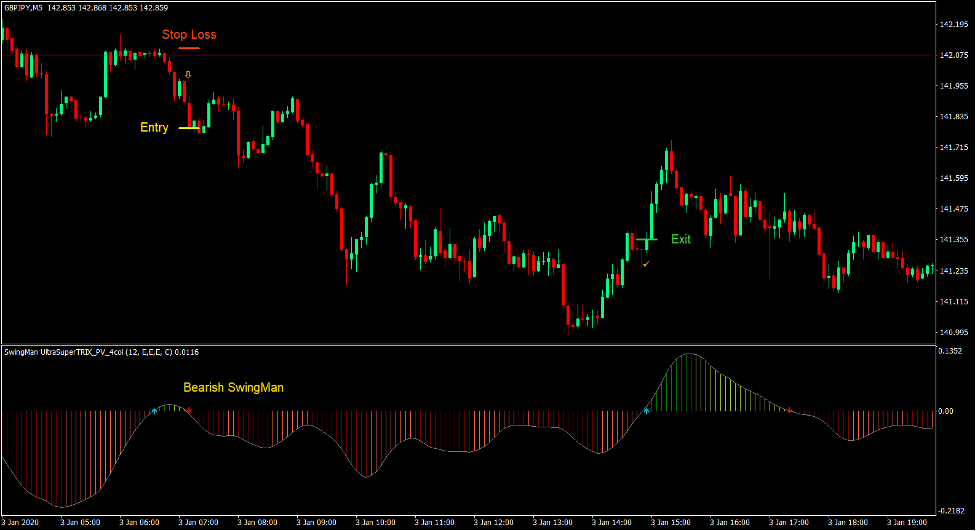

Promote Commerce Setup

Entry

- Value motion ought to break beneath the every day assist stage plotted by the Breakout Zones indicator.

- The SwingMan UltraSuper TRIX indicator ought to plot an arrow pointing down together with the histogram bars crossing beneath zero.

- Enter a seell order on the confluence of the situations above.

Cease Loss

- Set the cease loss on a resistance above the entry candle.

Exit

- Shut the commerce as quickly because the SwingMan UltraSuper TRIX indicator plots an arrow pointing up.

Conclusion

This easy buying and selling technique is one which may work properly if you’re keen and affected person sufficient to attend for the best commerce. It is because as an alternative of going for the regular and correct strategy, this technique goals to swing for the fences. If completed proper, merchants my catch the best commerce that might propel their accounts to a different stage.

This technique is finest used if set at excessive volatility begin of day classes. This might normally be the London session. Sensible merchants would additionally make use of value motion confirmations as a further confluence to the given indicators.

Foreign exchange Buying and selling Methods Set up Directions

SwingMan Breakout Foreign exchange Day Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past knowledge and buying and selling indicators.

SwingMan Breakout Foreign exchange Day Buying and selling Technique gives a chance to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional value motion and alter this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

The right way to set up SwingMan Breakout Foreign exchange Day Buying and selling Technique?

- Obtain SwingMan Breakout Foreign exchange Day Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick SwingMan Breakout Foreign exchange Day Buying and selling Technique

- You will notice SwingMan Breakout Foreign exchange Day Buying and selling Technique is out there in your Chart

*Observe: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]