[ad_1]

The NYSE FANG+ index $NYFANG holds ten of the biggest shares within the US.

- Alphabet – GOOGL

- Snowflake – SNOW

- META Platforms – META

- NVIDIA Corp – NVDA

- Amazon – AMZN

- Microsoft – MSFT

- Superior Micro Gadgets – AMD

- Apple – AAPL

- Netflix – NFLX

- Tesla – TSLA

The index is equally weighted, so round 10% for every inventory.

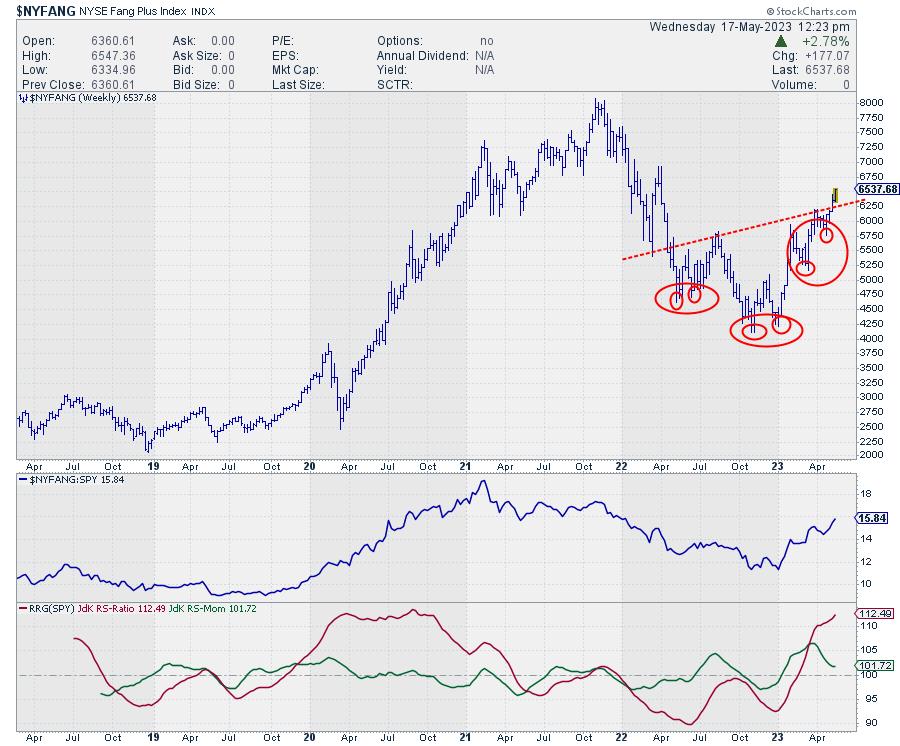

The value chart of the NYFANG+ index is characterised by a big advanced H&S reversal sample which was executed final week as the worth broke above the up-sloping neckline.

Primarily based on this formation, a value goal for the index might be calculated at round 8000, which matches with the all-time excessive for the index set on the finish of 2021.

From a relative perspective, the NYFANG index leaves the S&P 500 far behind and is steaming forward to additional outperformance.

The members come from three totally different sectors. Know-how, Shopper Discretionary, and Communication Providers. And all shares are within the S&P 500 index apart from SNOW.

Measured in opposition to $SPX

The primary RRG for this universe makes use of $SPX because the benchmark. It clearly exhibits the power of this group of shares as an entire. All of them are on the right-hand (sturdy) aspect of the graph.

The strongest trajectories are discovered for GOOGL, AMZN, SNOW, and NFLX. The primary three are both inside enhancing or main and at a robust RRG-Heading. NFLX is contained in the weakening quadrant however has simply turned again up and is now rotating towards main once more at a robust heading.

META, NVDA, and AMD are all dropping relative momentum however are nonetheless at excessive Jdk RS-Ratio readings, which means that they’re merely going by way of a short lived setback reasonably than a turnaround of the relative uptrend.

The one weak(er) inventory on this group is TSLA, which is shifting straight down on the JdK RS-Momentum scale and kind of precisely on the 100-level on the RS-Ratio axis.

NYFANG as a Closed Universe

Plotting the identical group in opposition to $NYFANG because the benchmark creates a so-called closed universe. Which means all shares plotted on the graph are included within the benchmark. This provides a greater perception into the (actual) relative power of the person shares in opposition to their friends within the universe.

The identical names pop up as sturdy. No shock there, however we’re getting a greater deal with on their relative place vis-a-vis one another.

AMD, META, and NVDA are nonetheless sturdy and on the right-hand aspect of the graph however clearly hoping by way of a setback.

TSLA is now clearly the weakest member of this group as it’s rotating into the lagging quadrant from enhancing at a protracted (sturdy momentum) tail.

AAPL appears to be halting its progress, however the different tails contained in the enhancing quadrant proceed to look promising.

Zooming in on Each day Time Body

To additional fine-tune the evaluation, I would like to have a look at the day by day RRG to see whether or not the rotations on the weekly are getting any affirmation or follow-through on the shorter timeframe.

On this day by day RRG, AMZN, GOOGL, and SNOW verify the power seen for these shares on the weekly RRG. This makes them potential shopping for candidates.

GOOGL

That is most likely the least attention-grabbing inventory from a threat/reward standpoint. After breaking above its horizontal resistance at 109, GOOGL rallied sharply and is now nearing its subsequent overhead barrier between 122.5-125. Due to this fact, restricted upside potential to the subsequent resistance stage, whereas there may be extra threat towards the assist stage.

The rotation on the RRG is powerful, however overhead value resistance is looming. Solely when GOOGL takes out 125, new upside potential turns into out there whereas on the similar time limiting threat as 125 will then begin to act as assist.

AMZN

The rotation of the tail for AMZN on the day by day RRG shouldn’t be very properly seen. If you open up this RRG in your personal account and spotlight AMZN, you will note that it has simply turned again up after a rotation by way of weakening, and is now heading up towards the main quadrant once more.

Mixed with the sturdy trajectory on the weekly RRG and the upward break on the worth chart, AMZN exhibits an attention-grabbing setup with upward potential to the final main peak, round 145.

I wrote about AMZN in this text just lately. The evaluation offered right here nonetheless stands.

SNOW

SNOW ended up in a big triangle consolidation after dropping from 400 again to 120 in lower than six months’ time. It appears just like the market has absorbed all this provide, and final week SNOW broke above its most up-to-date excessive and out of that giant triangle formation. That is undoubtedly an excellent signal.

On the weekly RRG, SNOW is contained in the enhancing quadrant however on the lowest RS-Ratio studying. On the day by day RRG, SNOW pushes deeper into main and is on the highest RS-Ratio studying. This mixture of rotations, along with the upward break in value, implies that the outlook is powerful. When the tail on the day by day RRG rolls over, that can most probably sign the beginning of the primary correction after the break, which can very doubtless supply good new entry alternatives.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to every message, however I’ll definitely learn them and, the place fairly doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra

Subscribe to RRG Charts to be notified at any time when a brand new put up is added to this weblog!

[ad_2]