[ad_1]

Product hyperlink:

https://www.mql5.com/en/market/product/97538

Introduction

Welcome to the Superior CCI buying and selling bot and power, your all-in-one answer for learning and buying and selling your most well-liked property.

With this versatile instrument, you’ve full management over your technique. By adjusting the varied parameters, you possibly can create a novel technique primarily based on the CCI indicator, together with an MA filter, dynamic lot measurement, Kelly Criterion calculator, dynamic and trailing SL and TP ranges, account safety particularly designed for these taking the FTMO or different prop agency buying and selling challenges, analytics, stats, and primary image data.

Whether or not you are a scalper, breakout dealer, imply reversion dealer, pattern follower, or another kind of dealer, the Superior CCI buying and selling bot has obtained you lined. The ball is in your courtroom, so take your buying and selling to the following stage with the Superior CCI buying and selling bot and power.

At xignal-coding, we prioritize secure and accountable buying and selling. That is why we by no means use any martingale or high-risk programs that might put your account in peril. You’ll be able to belief that our robotic is designed that can assist you obtain success in a sustainable and accountable method.

Tabs

Inputs

Indicator Settings:

- CCI Interval -> The Interval of the CCI Indicator

- CCI Utilized Worth -> The Utilized Worth of the CCI Indicator

- ATR Interval -> The Interval of the ATR Indicator (if used for the SL and TP Ranges)

Entry Settings:

- Degree to ship a Purchase Order -> The CCI Degree the place we’re gonna ship a BUY order when crossed

- Cross kind for Purchase Order -> The crossing kind of the above stage. Above or Under (proper after the bar is closed)

- Degree to ship a Promote Order -> The CCI Degree the place we’re gonna ship a SELL order when crossed

- Cross kind for Promote Order -> The crossing kind of the above stage. Above or Under (proper after the bar is closed)

Place Settings:

- Lot Mode -> You’ll be able to choose between Fastened Lot, Dynamic Lot per 1,000 or Threat in % (relying on the StopLoss)

- Lot Measurement -> The Lot measurement of your positions. It is going to be used when you have chosen a Fastened Lot measurement, or it is going to be used to calculate the Lot measurement for the Dynamic Lot possibility (If the Dynamic Lot is chosen, and also you determine to commerce 0.01 per 1,000, then the robotic it should alter the lot measurement in your account steadiness. 0.02 if AB = 2000, 0.1 if AB is 10,000 and so on)

- Lot Threat in % -> The Threat you’d prefer to take if you choose the third Lot Mode possibility. The Lot can be calculated utilizing your StopLoss distnace, and in case of a loss, you’ll lose roughly this proportion of your Account Stability. (As a result of rounding of the calculations, the ultimate consequence could fluctuate somewhat, relying on the lot step)

- SL Technique -> Three other ways to calculate the Stoploss. Utilizing Factors, utilizing ATR or the latest Low (for Purchase) or Excessive (for Promote)

- TP Technique -> Choose between Factors or ATR distance

- GAP in Factors -> You’ll be able to add an additional distance to the latest Excessive or Low if that is the SL Technique you’ve chosen

- StopLoss distance in Factors -> The gap in Factors for the StopLoss

- TakeProfit distance in Factors -> The gap in Factors for the TakeProfit

- StopLoss distance in ATR -> The ATR multiplier for the StopLoss distance

- TakeProfit distance in ATR -> The ATR multiplier for the TakeProfit distance

Trailing Stoploss (All the time calculated in Factors):

- Use Trailing StopLoss -> Choose whether or not you wish to activate the Trailing SL or not

- Trailing Cease Set off -> After what number of factors in revenue you wish to activate the TSL

- Trailing Cease Distance -> The gap in factors you wish to place the SL from the market value after the TSL is triggered

- Trailing Step -> The step of the TSL

Common Settings:

- Shut Open Positions at Reverse Sign -> Select wheather you wish to shut your open positions when an reverse sign arrives (for instance shut all Purchase postitions earlier than sending a Promote and vice versa)

- Magic Quantity -> A novel identifier of the robotic. Keep in mind to alter it if you wish to have new stats or for those who add the robotic in a couple of charts

- Place Remark -> You’ll be able to have a customized remark in your positions

- Time Zone for Every day Stability -> It’s used for the Handle tabe and the Every day drawdown. Some prop buying and selling challenges like FTMO are utilizing the GMT time to calculate your steadiness of the day. You’ll be able to choose between the GMT and the dealer’s time.

- Most Purchase Positions -> What number of Purchase positions are allowed on the identical time

- Most Promote Positions -> What number of Promote positions are allowed on the identical time

Buying and selling Window:

- Beginning Hour -> The hour you want to begin buying and selling (Dealer’s time)

- Ending Hour -> The hour you’d prefer to cease buying and selling (Dealer’s time) – Each values are set as integers so as to be used within the Optimization Technique of the Technique tester)

- Shut all Open Positions at Ending Time -> Choose wheather you want to shut all of your open positions on the ending time or not

- Most unfold to open a place -> Open Positions provided that the unfold is beneath the chosen worth. 0 means disabled) If the unfold is larger, we’ll await the following sign.

MA Filter:

- Use MA Filter -> Select wheather you want to make use of the MA Filter or not

- MA Interval -> The interval of the Shifting Common

- MA Technique -> The tactic of the Shifting Common

- Purchase provided that Worth is Above/Under MA -> Choose between Above or Under. The robotic is gonna ship Purchase orders provided that the worth is Above or Under the Market Worth.

- Promote provided that Worth is Above/Under MA -> Choose between Above or Under. The robotic is gonna ship Promote orders provided that the worth is Above or Under the Market Worth.

- Shut Positions if Worth crosses MA -> You should utilize the MA as a dynamic exit stage. So when you have chosen to put orders solely when the worth is above the MA, the MA is gonna be used as a dynamic SL if this performance is enabled. However, for those who ship Purchase orders if the worth is beneath the MA, the MA is gonna be used as a dynamic TP.

Methods

Buying and selling Overbought and Oversold CCI Ranges

In all probability some of the widespread methods to make use of the CCI is to attend till a particular stage is crossed. On this instance we’re gonna see how this system behaved on the EURUSD H1 for the final 12 months, after we place a Promote order proper after the indicator crosses above the 110 stage and a Purchase order when it crosses beneath the -110.

Testing on “Each tick primarily based on actual ticks” as at all times.

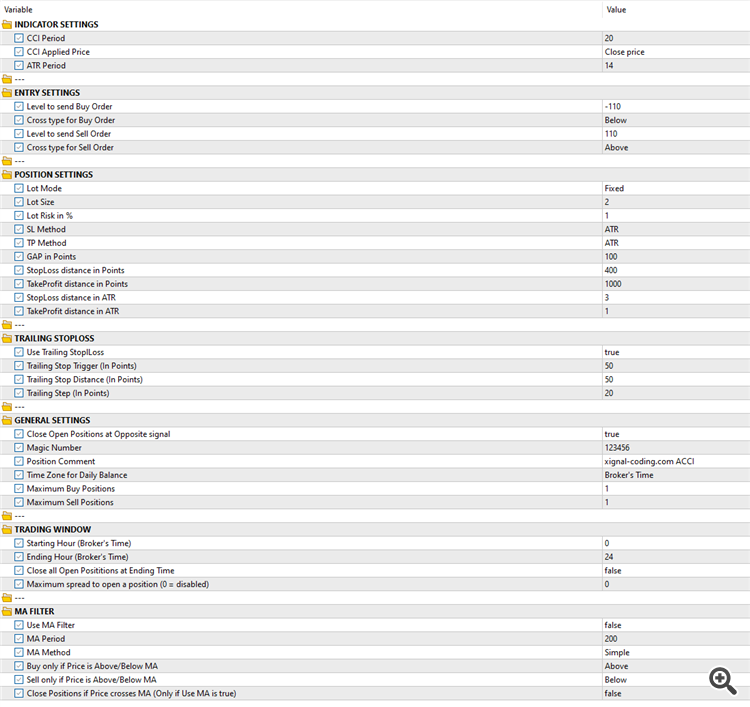

Let’s put together the robotic’s inputs for this:

We’re gonna use a interval of 20 for our CCI Indicator. That’s gonna make it extra delicate.

The ATR interval is gonna be the default, 14.

Now as we wish to backtest the technique, we’re gonna use the Fastened lot measurement mode. Later we are able to experiment by utilizing the Share of threat or the Dynamic Lot per 1,000. And as we wish to dream huge, we’re gonna use a excessive quantity measurement, so we’re gonna set it to 2. However is at all times really useful to make use of low lot measurement in the beginning.

For the opposite parameters, the Stoploss and the Takeprofit ranges are gonna be calculated utilizing the ATR Indicator. 3*ATR for the SL and 1*ATR for the TP. As we’re buying and selling oversold and overbought ranges, it is vitally logical to depart some house to the market earlier than reversing. And because of this the ratio on this case is 1:3.

Let’s additionally activate the Trailing StopLoss. We’re gonna activate it after 50 factors in revenue, we’re gonna place the SL stage on the entry value (aka break even) and we’re gonna use a step of 20 factors. That implies that we’re gonna change our stoploss each time we obtained 20 extra factors of revenue.

Lastly we’re gonna shut the open positions each time we get an reverse sign.

All the opposite parameters usually are not gonna be used on this instance. It is vitally straightforward for anybody to get misplaced with all these totally different combos of inputs, so we might prefer to hold issues as a lot easy as we are able to.

Let’s have a look at now what we obtained:

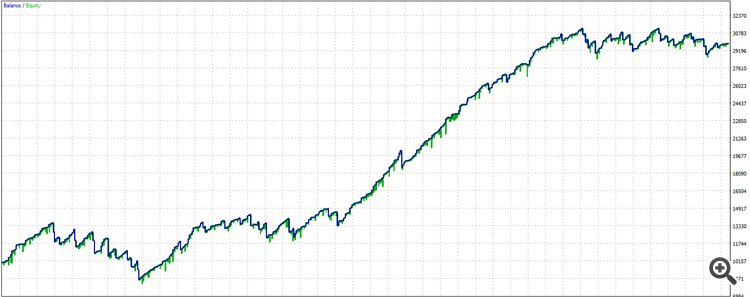

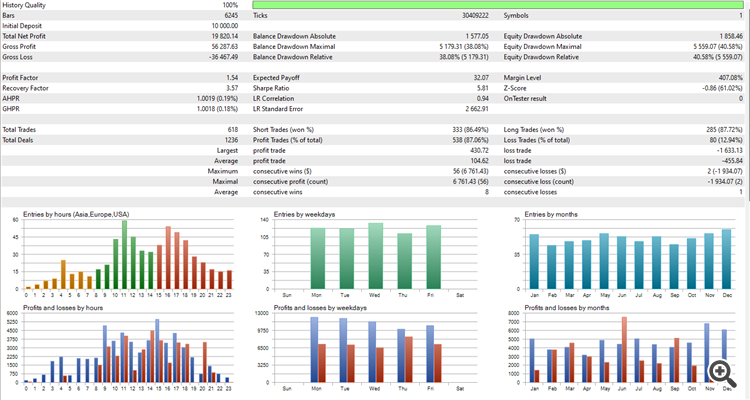

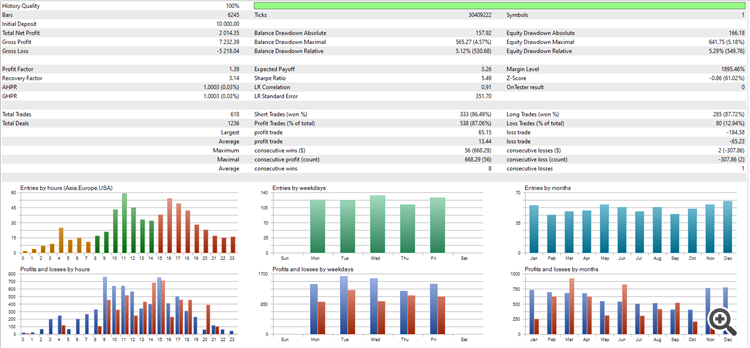

The consequence appears actually good. Having the ups and downs, as each wholesome technique will need to have. It began with a ten,000 EUR account steadiness and it ended up with nearly 30,000EUR. It is at 29,820.14EUR inside a 12 months. it’s nearly 300% revenue.

However wait a minute. is not it dangerous? What’s the drawdown? How can we be extra secure?

As talked about above on this instance we used a excessive lot measurement. Let’s check out the backtest:

What we are able to do about that?

How can we threat much less?

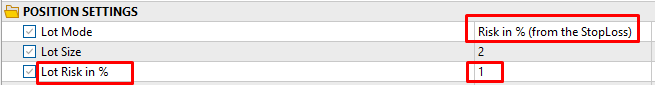

Right here we are able to use two totally different functionalities from the robotic. The primary one is the Account safety from the Handle tab of the dashboard. It isn’t accessible on the backtesing mode, so we’re gonna concentrate on the second and possibly an important. The Threat in proportion.

We are able to choose this technique so as to know precisely how a lot of our account steadiness we threat in every commerce. You’ll be able to set this worth as you want, relying on the chance you’d prefer to take.

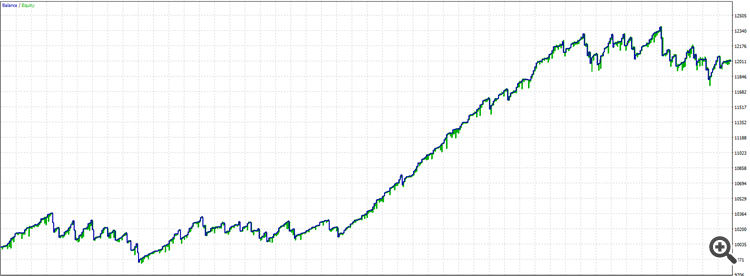

Let’s discover a really secure state of affairs, the place we threat just one% of our account steadiness:

On this case, the Lot Measurement area just isn’t used, and the Lot Threat in % takes its place.

As you possibly can see now, the drawdown dropped dramatically, however so did the revenue.

Conclusion

So it’s as much as you to search out the most effective mixture of threat and technique it doesn’t matter what your buying and selling model is!

I hope you discover this instrument helpful and aid you succeed within the markets!

[ad_2]