[ad_1]

Friday marks the primary anniversary of Russia’s full-scale invasion of Ukraine, an occasion that shocked the world by bringing large-scale battle to European soil.

US president Joe Biden’s go to to Poland at the beginning of the week will function a present of power to Ukrainian and Nato allies within the face of Russia’s long-expected spring offensive.

The EU’s International Affairs Council assembly on Monday will give attention to the battle and it will likely be the keynote merchandise at Friday’s UN Safety Council assembly in New York. Ukrainian president Volodymyr Zelenskyy could journey to Manhattan to deal with the assembled delegates.

The Monetary Occasions has a particular journal concern marking the anniversary of the battle that includes essays by our Ukrainian correspondent Christopher Miller and educational Mary Elise Sarotte, alongside a highly effective image package deal by Ukrainian photographers.

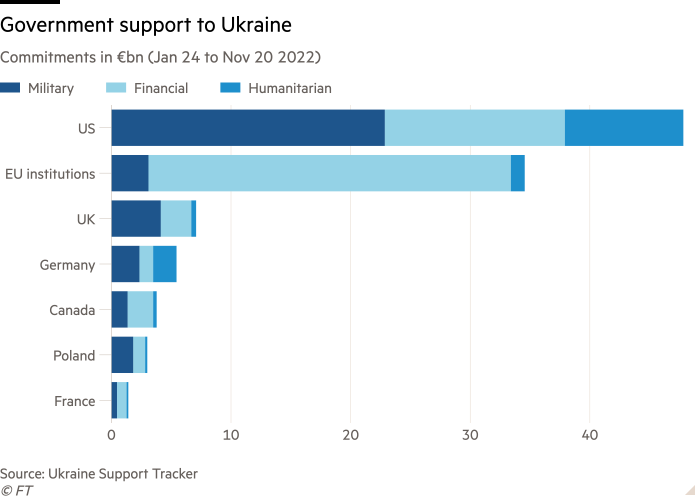

Henry Foy examines how western governments have offered greater than $110bn in assist to Kyiv since final February — $38bn within the type of weapons — and the way the fact of sustaining these numbers is simply simply starting to daybreak on the west.

The UK’s winter of commercial unrest rumbles on. Employees at greater than 150 larger training establishments will stroll out in a long-running dispute over pay and situations whereas regional ambulance employees in England and Northern Eire will maintain varied strikes this week.

FT Stay holds a free on-line occasion, the Way forward for Enterprise Training: Highlight on MBA, on Wednesday, the place the FT’s international training editor and enterprise training rankings supervisor, will share particulars about how the most effective enterprise faculties are rated. Click on right here to register.

Financial information

Gross home product is the primary US information level on Tuesday and minutes from the final Federal Reserve’s assembly land on Wednesday.

UK public-sector borrowing figures for January are out on Tuesday. Will increase in debt curiosity and spending on power assist schemes made final month’s launch the very best month-to-month complete since data started in January 1993.

Turkey’s central financial institution declares rates of interest on Thursday.

Corporations

UK banks will keep within the highlight. Final week NatWest introduced an nearly tripling of income pushed by larger rates of interest. These must also enhance income for HSBC and Lloyds Banking Group once they report on Tuesday and Wednesday respectively, however these income channels are wanting more and more exhausted.

A number of miners report this week, together with Newmont, the world’s largest gold miner, which launched an all-share $17bn bid for Australian rival Newcrest earlier this month. World demand for gold is surging as central banks and buyers shelter from persistent inflation and geopolitical upheaval.

Learn the complete week forward calendar right here.

[ad_2]