[ad_1]

Sure, mounted revenue was hit by rising rates of interest, nevertheless it’s a small share of plan portfolios.

My colleagues JP Aubry and Yimeng Yin simply launched an replace on state and native pension plans. Their evaluation in contrast 2023 to 2019 – the yr earlier than all of the craziness started. Consider the bizarre occasions which have occurred in the previous few years: 1) the onset of COVID; 2) the next COVID stimulus; 3) declining rates of interest; 4) rising inflation; after which 5) rising rates of interest.

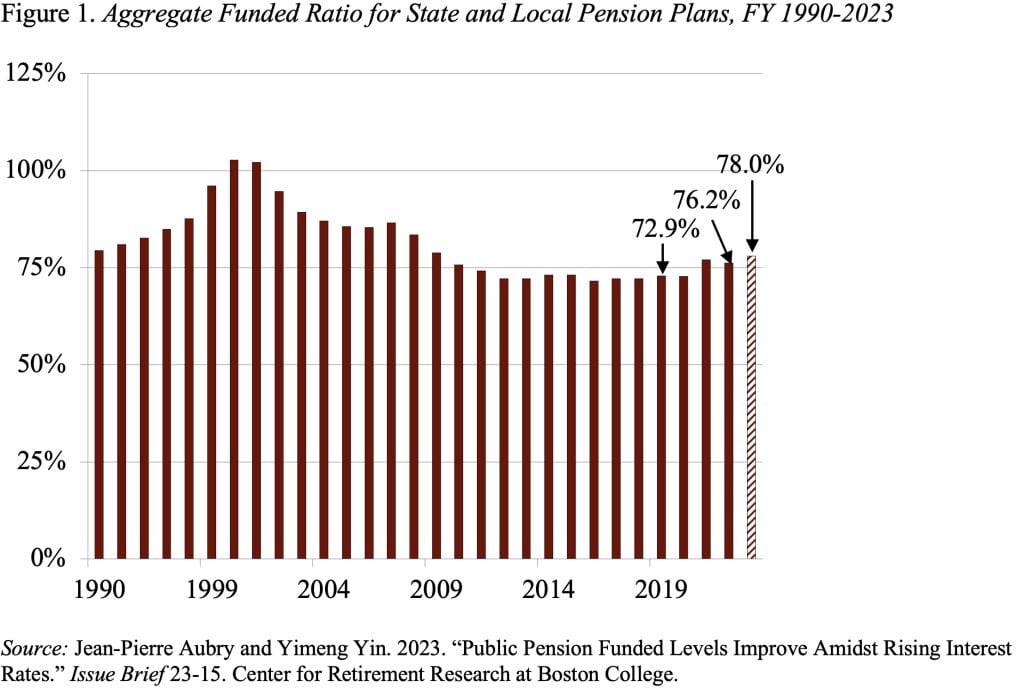

Regardless of the volatility of asset values over this era, the 2023 funded standing of state and native pension plans is about 78 p.c, which is 5 proportion factors greater than in 2019 (see Determine 1). In fact, the numbers for 2023 are estimates based mostly on plan-by-plan projections, however these projections have a superb observe file.

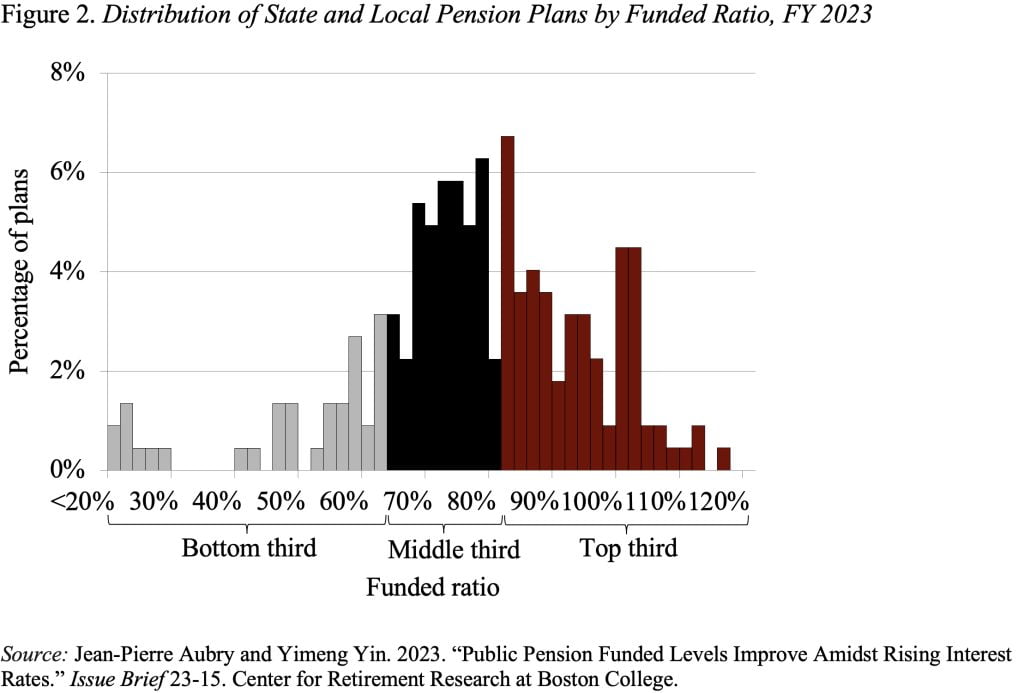

Whereas the combination funded ratio gives a helpful measure of the general public pension panorama at massive, it can also obscure variations in funding on the plan stage. Determine 2 separates the plans into thirds based mostly on their present actuarial funded standing. The typical 2023 funded ratio for every group was 57.6 p.c for the underside third, 79.5 p.c for the center third, and 91.1 p.c for the highest third.

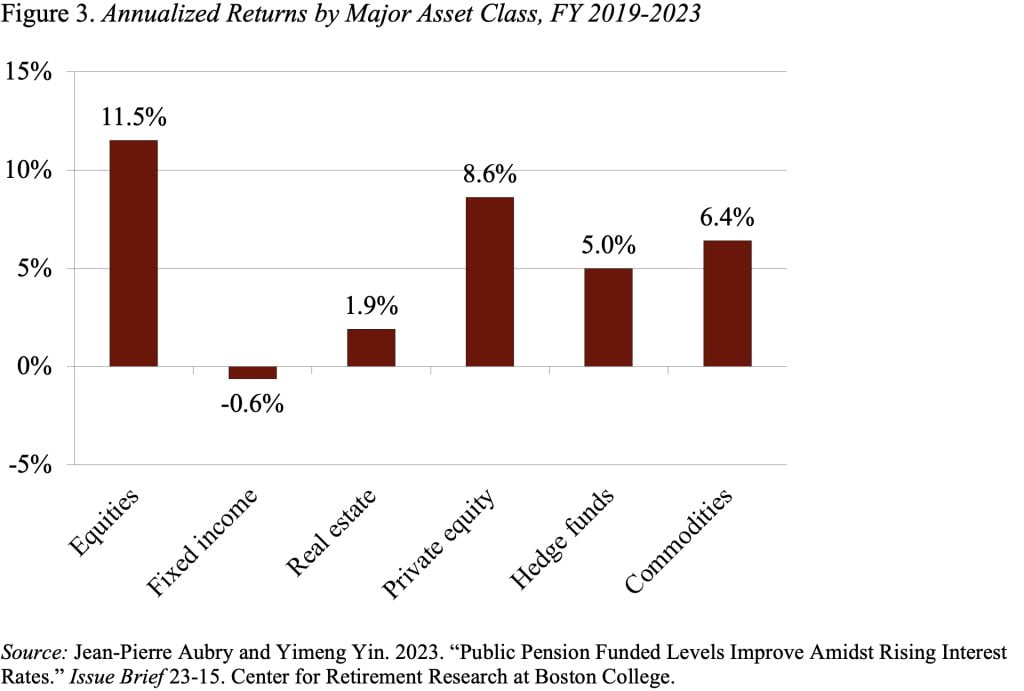

The main purpose for the development in plans’ funded standing is that, regardless of the turbulence within the financial system, complete annualized returns, which embrace curiosity and dividends, have risen noticeably for nearly all main asset class indices over the 2019-2023 interval (see Determine 3). The exception over this quick and unstable interval is fixed-income property, which have declined in worth.

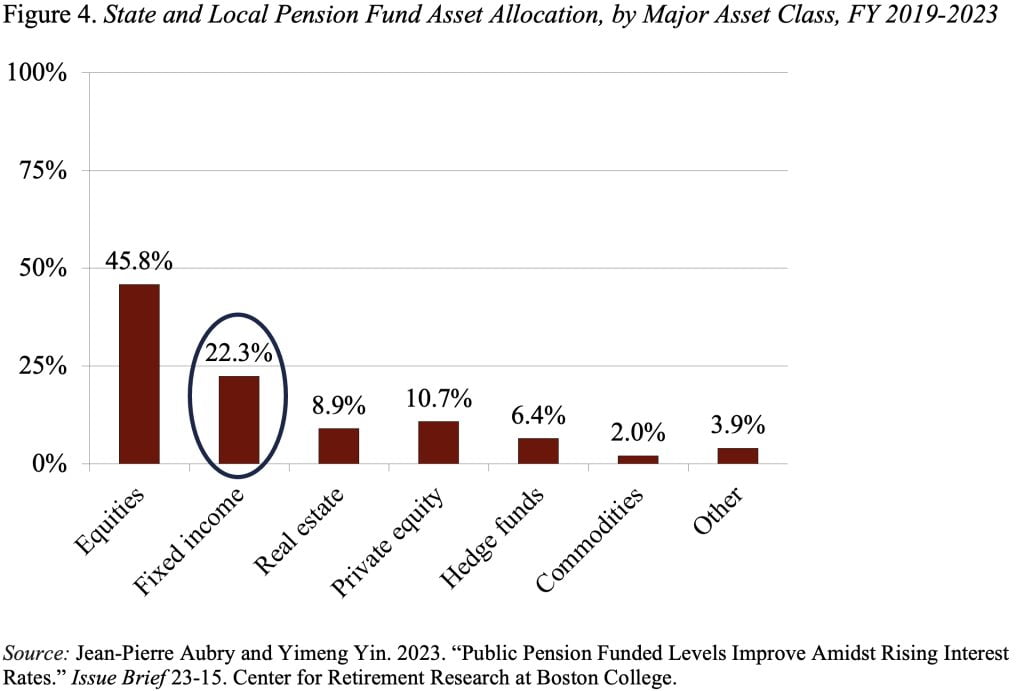

The impact of mounted revenue’s decline on general portfolio efficiency has been modest as a result of, since 2019, mounted revenue has averaged solely about 20 p.c of pension fund property (see Determine 4).

So, issues are trying just a little higher for state and native pensions. Sure, the funded ratios are biased upward as a result of plans use the assumed return on their portfolios – roughly 7 p.c – to low cost promised advantages. That stated, traits are essential, and the development is nice.

Furthermore, annual state and native profit funds as a share of the financial system are approaching their peak for 2 causes. First, most pension plans don’t totally index retiree advantages for inflation, which lowers the true worth of advantages over time. Second, the profit reductions for brand new hires – launched within the wake of the Nice Recession – have began to have an effect.

With liabilities in verify and strong asset efficiency, perhaps we are able to all chill out a bit about the way forward for the state and native pension system.

[ad_2]