[ad_1]

Final week, we went via the Revenue and Loss Assertion. This week we’re going to deal with the steadiness sheet. The steadiness sheet and the revenue and loss assertion go hand and hand and must be evaluated collectively.

What’s a Stability Sheet?

If you happen to bear in mind, the revenue and loss assertion reveals the inflows (income) and the outflows (bills) of an organization over a set time period, by month, by quarter, by yr. A steadiness sheet on the opposite palms reveals the well being of a enterprise and it’s a set time period. In different phrases a steadiness sheet reveals you a firms monetary state of affairs at that specific second in time.

A steadiness sheet consists of two major objects, belongings and liabilities. Property are issues which have worth, like money, stock, property, gear, cash owed to the corporate and many others. Liabilities are monetary obligations of the corporate like loans/debt, or payments which are due.

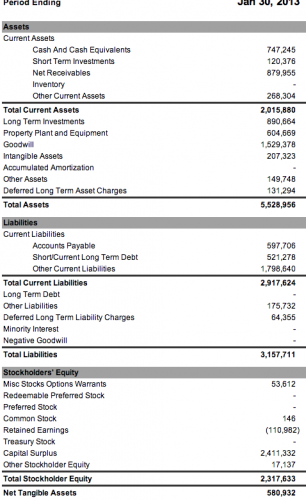

Just like the revenue and loss assertion, let’s take a look at an instance of a steadiness sheet. Under is Salesforce’s balances sheet of January thirtieth 2013:

Learn a Stability Sheet – Property

Present Property

The very first thing you’ll see on a steadiness sheet is the belongings and a very powerful asset is money. No matter how a lot income an organization makes, no matter how in style their product, no matter how briskly they’re rising if you happen to run out of money, you’re screwed. Once you take a look at a steadiness sheet, the very first thing you wish to take a look at is money. Have they got sufficient to function the enterprise?

The second line below belongings is brief time period investments. Brief time period investments are investments that may be liquidated in lower than a yr. They are often shares, bonds, and many others. The important thing level right here is that it’s simple to show these investments into money if mandatory. It seems Salesforce doesn’t make investments lots in short-term devices, about 20% of money. This may very well be as a result of they don’t place confidence in the present markets or another motive.

Subsequent on line is internet receivables. Web receivables is the amount of cash owed to the corporate for it’s services and products by it’s prospects. The factor to consider when this quantity is how large it’s in relationship to income (suppose P&L Assertion right here). If internet receivables will get too excessive there’s a downside. For instance if the online receivables exceeds 3 months income, there’s a assortment downside. One other time period for this assortment downside known as DSO (Days Gross sales Excellent). Corporations DON’T need DSO to be too excessive.

After internet receivables is stock. Stock speaks for itself. The stock line merchandise is the worth of all of the stock the corporate is carrying on the time the steadiness sheet is completed. Being a software program firm, Salesforce doesn’t carry stock. If what you promote impacts your prospects stock, it’s necessary to grasp this quantity and it’s relationship to complete belongings in addition to stock flip or stock velocity. We’ll discuss these two phrases in a later submit.

Lengthy-Time period Property

The subsequent set of belongings are long-term belongings. Lengthy-term belongings are belongings which are troublesome to liquidate or flip into money. The overall rule of thumb is that they take greater than a yr to show into money. Salesforce has nearly 900 million {dollars} tied in long-term investments. I’m undecided what they’re, however they are often issues like funding in different firms or start-ups. It may be troublesome to find out what represents a firms long-term investments however is likely to be discovered within the 10K. Property and Gear is most frequently a very powerful long-term asset. It represents the belongings essential to run the enterprise. It’s the price of the capital gear.

Salesforce has simply over 600 million in property and gear. I believe an enormous portion of that’s their servers. In the event that they don’t rack their very own servers and home their very own infrastructure, I don’t know what sort of asset, in step with Salesforce’s enterprise, may signify such a big quantity. It’s necessary to grasp this line merchandise if the product you promote falls into the capital gear class.

Subsequent is goodwill. I really like this one. Each time I hear it, it makes me consider the charity and secondhand retailer Goodwill. The easiest way to explain goodwill is to consider it as overpaying. If an organization pays greater than “e book worth” when shopping for an organization, the distinction must be accounted for. That is known as goodwill. Salesforce goodwill quantity is 1.5 billion {dollars}. That is excessive in relationship to it’s complete belongings, nearly 20%.

Salesforce has purchased plenty of firms over the previous few years. I’m positive this quantity is partly the results of their latest shopping for spree which has included Buddy Media for 659 million, Goinstant for 70 million, Thinkfuse and ChoicePass. If time beyond regulation an organization feels the goodwill of an acquisition has declined, they’ll write it down and that happens as one-time expense hit on the P&L.

Studying a Stability Sheet – Liabilities

Now that we’ve totaled up all the good things, the stuff “owned,” is owed to the corporate or has worth, we now have to look every part we owe. These are known as liabilities. After money, liabilities or debt is a very powerful a part of the steadiness sheet. Debt can bury a enterprise. Not simply the quantity of debt but in addition the phrases of the debt, which aren’t represented within the steadiness sheet. Debt eats at money and that leaves much less for operations.

Present Liabilities

The primary line in that is Present Liabilities. Like present belongings, present liabilities are issues due instantly. The fist sort of present liabilities are accounts payable. In Salesforce’s steadiness sheet it seems they’re together with accrued bills with accounts payable. Accrued bills are the anticipation of issues like worker advantages arising, curiosity on loans, providers but to be invoiced and many others. Whereas accounts payable are for providers the place bills are due, and which were invoiced by distributors.

The final legal responsibility I’m going to handle right here is different present liabilities. Salesforce.com has nearly 1.8 billion in different present liabilities. I’ve to admit, I’m undecided what that’s and why it’s so large. Different present liabilities can embrace tax liabilities (gross sales and payroll), present maturity of debt, in different phrases, some or all of a long-term debt due throughout the yr or it additionally may be unearned income. Unearned income is when money is acquired earlier than the service is delivered. Being a subscription enterprise a few of this legal responsibility may very well be unearned income.

Lengthy-Time period Debt

After present liabilities is long-term debt. Lengthy-term debt may very well be for a cash borrowed for a plant, actual property and many others. In Salesforce’s case they haven’t any long-term debt.

As soon as all these numbers have been compiled, we easy must subtract complete liabilities from complete belongings and also you’ll understand how properly the corporate is working. Bear in mind nevertheless, money is king. If the belongings far outweigh the liabilities but their is little money readily available, the corporate is a brief highway away from bother. Salesforce.com has $5.5 billion in belongings and $3.2 in liabilities. They’re doing properly. I wouldn’t say they’re crushing it, however a 2.3 billion greenback separation isn’t one thing to lose sleep over. Bear in mind the nearer these two numbers are the extra precarious the businesses state of affairs is.

Salesforce has 700m in money readily available. Nevertheless, their annual bills (see P&L) complete 2.4B. This implies Salesforce has lower than one years working capital readily available. Salesforce is a subscription primarily based firm, so their income is extra protected than most firms, however evaluating money readily available to working bills is all the time a very good factor.

Stockholder Fairness

The final a part of the steadiness sheet is the Stockholder Fairness. Stockholder Fairness is made up of primarily two issues, the quantity personal fairness and public buyers have within the firm and the retained earnings. On this case Salesforce’s complete Stockholder Fairness is 3.1B. In essence this quantity represents “e book worth” Saleforce.com’s “e book worth” is 3.1B {dollars}, which is simply 8% of it’s market cap. We’ll deal with market capitalization in one other submit.

There you’ve it. A steadiness sheet highlights the capital in a enterprise at a time limit. The extra capital the higher the enterprise. Fairly easy actually. To get a very good really feel of a enterprise learn the P&L and the steadiness sheet on the similar time. It gives you a a lot better image of what’s truly occurring.

WITCE (What’s The Prospects Expertise) Stability Sheet Questions:

- How does your services or products have an effect on the steadiness sheet??

- Does shopping for your product require debt, if that’s the case can the corporate you might be promoting to afford the debt?

- Does your services or products enhance the steadiness sheet?

- Is your services or products too small to make a dent within the steadiness sheet?

- How does your prospects present monetary state of affairs have an effect on their potential to buy what you might be promoting?

- What do the steadiness sheets of firms in your trade sometimes seem like? Are their widespread threads? Are there anomalies related to that trade solely? If that’s the case, how do the have an effect on what you promote?

- Are the businesses you’re chasing wholesome firms or struggling ones?

- Does the steadiness sheet of your goal firms have an effect on what you promote and the way you promote it? No? Why not? Sure? How?

- How can the steadiness sheet have an effect on your deal technique?

How does your product of service have an effect on the steadiness sheet expertise of your prospects and prospects?

The steadiness sheet is a cool instrument to gauge the well being and stability of an organization. When it’s accessible, take the time to test them out, ya by no means know what you may be taught.

[ad_2]