[ad_1]

(Bloomberg) — The Eskom danger premium is in full power for South Africa’s rand.

The foreign money of Africa’s most industrialized economic system is headed for a fourth weekly loss versus the greenback, the longest streak since an emerging-market-wide selloff in October. This time, the under-performance is restricted to South Africa. The rand is already down 4.1% this 12 months, whereas most of its friends are firmer, with Chile’s racking positive factors of over 6%.

“For the reason that begin of the 12 months, the rand has been one of many worst performers in EM,” mentioned Daria Parkhomenko, an FX strategist at RBC Capital Markets in a notice to shoppers. “We expect {that a} key driver of this has been the rand carrying a danger premium for the worsening energy scenario.”

Parkhomenko mentioned market confidence was low as President Cyril Ramaphosa’s response to the continued disaster has been gradual, whereas some pledges to deal with the scenario haven’t been met sufficiently. Turning the tide with buyers would increase the foreign money, she mentioned.

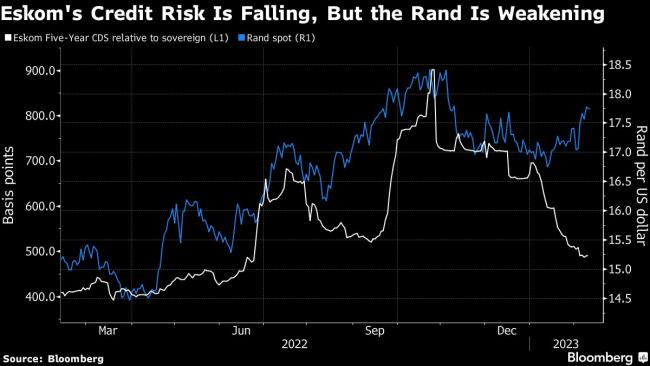

“By our estimates, the pair would have house to dump by virtually 5%, with all else equal,” she mentioned. “That may equate to ~16.90/95 from present spot ranges of ~17.80.”

Credit score default swaps for Eskom Holdings SOC Ltd. are buying and selling on the least expensive in about eight months. That’s in anticipation of South Africa taking on as a lot as two-thirds of Eskom’s debt later this 12 months, a deal that could be introduced within the annual price range on Feb. 22.

The state electrical energy firm has imposed energy cuts for 13 consecutive months, primarily based on Bloomberg calculations. Ramaphosa declared a state of catastrophe to allow the federal government to speed up its response to an ongoing vitality disaster, and mentioned he’ll appoint a minister in his workplace who will give attention to boosting the ability provide.

“This is usually a optimistic step,” mentioned Parkhomenko. “However now the query is who will or not it’s? Then, what is going to occur with the Division of Minerals Sources and Power, and can Ramaphosa take away Gwede Mantashe from overseeing this division?”

“If the disaster worsens – a situation that can not be dominated out – the market must carry an excellent bigger danger premium,” she mentioned. “A extra extreme deterioration would doubtless see check the triple prime at ~18.50, with all else equal.”

[ad_2]