[ad_1]

The insurance coverage enhances Social Safety’s position of offsetting Black/White inequality.

My colleagues have simply accomplished a actually attention-grabbing examine pertaining to the progressivity of Social Safety. The same old story focuses on cash’s value, highlighting the offsetting impact of two elements. On the one hand, Social Safety helps Black people and people with much less schooling – and due to this fact low earnings – by its progressive profit construction. Alternatively, the worth of lifetime advantages inherently will increase for people who are likely to reside longer – White folks and people with extra schooling.

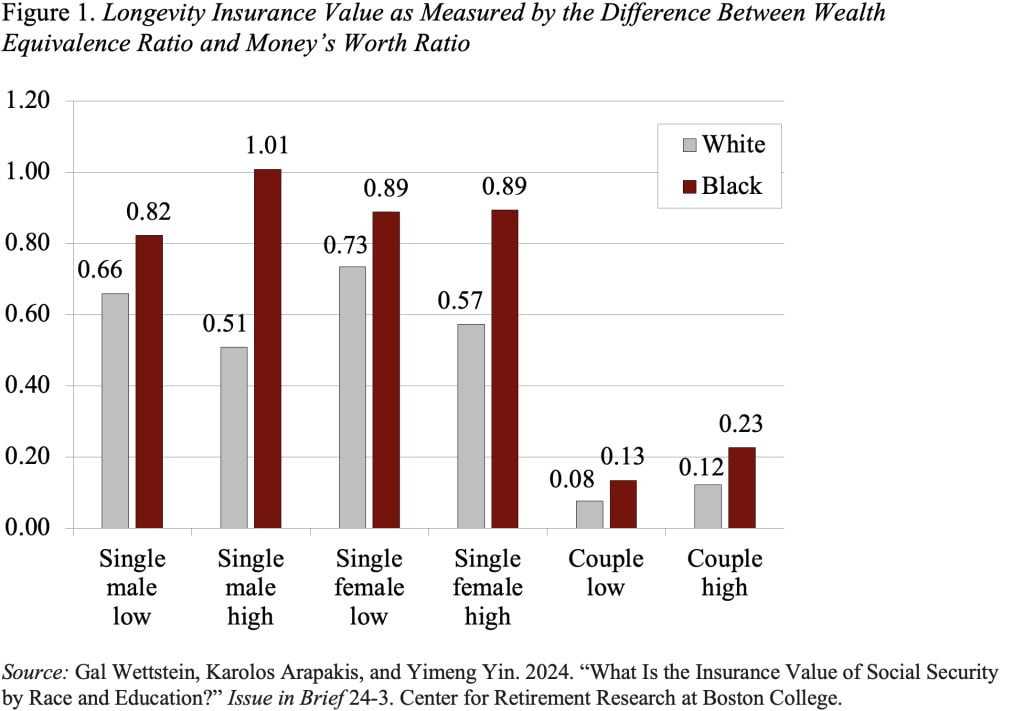

No matter how these elements stability out, although, the cash’s value method neglects the longevity insurance coverage offered by this system. As a result of Social Safety offers a life annuity, it presents households safety in opposition to outliving their sources. The worth of this safety will increase with the unpredictability of their lifespan. It seems that this longevity insurance coverage is especially essential for Black households and people with much less schooling, as a result of, whereas these teams have decrease common lifespans than others, they face higher uncertainty round their averages.

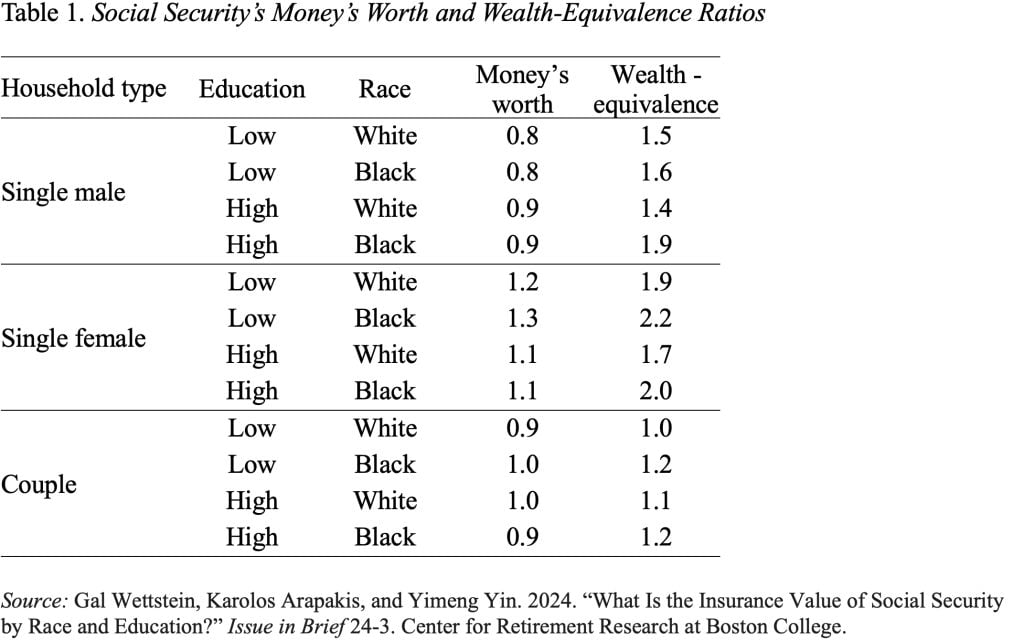

The evaluation considers stylized households, differentiated by race (Black or White), schooling (low or excessive), and family composition (single man, single lady, or married couple). This course of leads to 12 stylized households that differ when it comes to their mortality chances, lifetime earnings, pension revenue, Social Safety advantages, and wealth at age 65.

Step one is to calculate the cash’s value of Social Safety – the anticipated current worth of every family’s advantages relative to the lifetime contributions. The following step is to measure the worth of Social Safety together with longevity insurance coverage. This evaluation requires an advanced mannequin to calculate how rather more wealth households would must be as effectively off in a world with no Social Safety program as they’re with this system. This measure can also be associated to lifetime contributions. Evaluating these two measures exhibits how neglecting longevity insurance coverage underestimates the worth of Social Safety to numerous forms of households.

The outcomes point out that the wealth equivalence of Social Safety retirement advantages is a minimum of as nice because the lifetime payroll taxes for nearly all family sorts (see Desk 1). This discovering implies households typically favor a world by which Social Safety exists to 1 by which it doesn’t.

The distinction between the wealth-equivalence ratio and the cash’s value ratio serves as an approximate measure of the longevity insurance coverage worth of Social Safety. The outcomes present that Black households constantly derive extra insurance coverage worth from Social Safety than Whites, reflecting the truth that Black households face higher longevity threat (see Determine 1). Additionally, as anticipated, single households worth the longevity insurance coverage greater than {couples}, who can self-insure by transferring wealth after dying.

The message right here is essential. Cash’s value alone doesn’t absolutely mirror the worth of Social Safety. Individuals additionally worth the insurance coverage safety in opposition to operating out of cash. And the worth of that longevity insurance coverage is especially invaluable to Black households. In brief, Social Safety is an much more essential equalizer than recommended by different research.

[ad_2]