[ad_1]

From oil markets to treasury stacking, backdoor QE, investor fantasy and hedge fund prepping, it’s changing into increasingly more clear that the massive boys are bracing for catastrophe as gold stretches its legs for a speedy run north.

Just lately, I dove into the cracks within the petrodollar as yet one more symptom of a world turning its again on USTs and USDs.

Gold, in fact, has a task in these headlines if one appears deep sufficient.

So, let’s look deeper.

Diving Deeper into the Oil Story

The headlines of late, for instance, are all about “shock” OPEC manufacturing cuts.

Why is that this occurring and what does it say about gold down the street?

First, let’s face the politics.

As famous many instances, it appears US coverage, on the whole lot from short-sighted (suicidal?) sanctions to the “inexperienced initiative” makes nearly zero sense in the true world, which is miles aside from the “keep-me-elected” fantasy-world of DC.

In spite of everything, power, issues, which suggests oil issues.

However the present regime in DC has been shedding mates in Saudi Arabia and slicing its prior and as soon as admirable shale manufacturing outputs (assume 2016-2020) within the US regardless of a world that also runs on black gold combating in opposition to inexperienced politics.

The DC assault on shale could make the Greta Thunbergs completely satisfied, however let’s be blunt: It defies financial widespread sense.

Saudi, by slicing manufacturing, is now displaying a nonetheless very a lot oil-dependent world it’s not afraid of shedding market share to the USA within the face of rising oil for the easy motive that the USA simply aint obtained sufficient oil to fill the hole or flex its power muscle mass.

Within the meantime, Chinese language demand for crude is peaking whereas Russian oil flows to the east (together with to Japan) are hitting new highs at costs above the US-led value cap of $60/barrel.

If DC has any blunt realists (wrongly castigated as tree-killers) left, it must re-think its anti-oil insurance policies and get again towards that current period when US shale was answerable for 90% of whole international oil provide progress.

If not, oil costs can and can spike, making Powell’s struggle on inflation much more of an open charade.

Talking of inflation…

Ghana Oil-for-Gold Beats Inflation

Relating to oil and the decades-long bully-effect of a usurious USD (See: Confessions of an Financial Hitman), we’ve argued numerous instances {that a} robust USD and an imposed petrodollar was gutting creating economies all over the world.

We additionally warned that creating economies (spurned by international mistrust of the Dollar in a post-Putin-sanction period of a weaponized reserve foreign money) would reply by turning their backs on US insurance policies and its greenback.

Within the outdated days, the US might export its inflation overseas. However these days, as we warned as early as March 2022, could be slowly however steadily coming to a hegemonic finish.

Once more, this doesn’t imply (nod to the Brent Johnson) the top of the USD as a reserve foreign money, simply the gradual finish of the USD as a trusted, used or efficient foreign money.

Towards that gradual however regular finish, it’s maybe value noting that Ghana’s inflation charge has fallen from 156% to simply over 60% because it started buying and selling oil for gold quite than weaponized USDs.

Hmmm.

Gold Works Higher than Inflated Dollars

The obvious conclusion we will draw from such a predictable correlation is that gold appears to be working higher than fiat {dollars} to battle/handle inflation, a reality we’ve been arguing for properly…a long time.

From India to China, Ghana, Malaysia, China and 37 different international locations engaged in non-USD bilateral commerce agreements, the inflation-infected USD is shedding its place in additional than simply the essential oil commerce.

Nations trapped in USD-denominated debt-traps (due to a rate-hiked and therefore stronger and dearer USD) at the moment are discovering methods to tie their exports (i.e., oil) to a extra secure financial asset (i.e., GOLD).

This, in fact, makes me that rather more assured that because the world strikes nearer to its international (and USD-driven) “Uh-Oh” second, that the already-telegraphed Bretton Woods 2.0 must contain a brand new international order tied to one thing golden quite than simply one thing fiat.

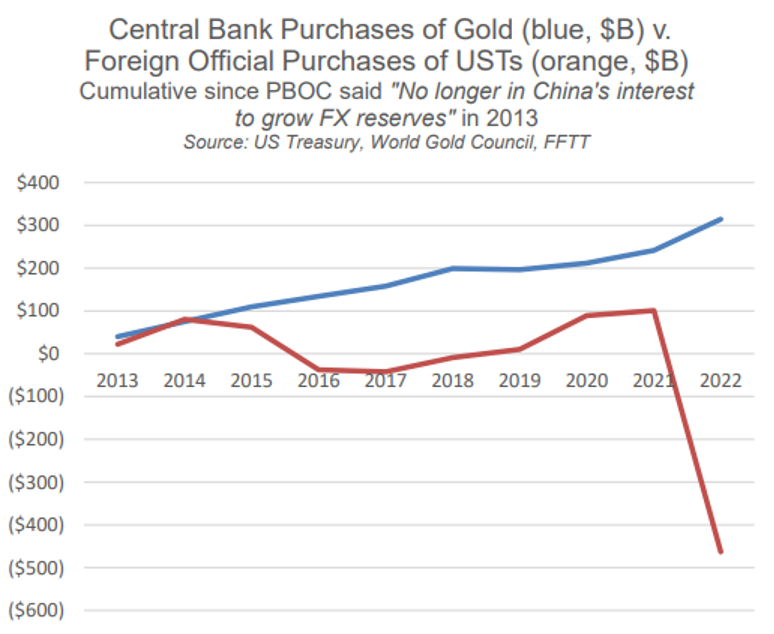

This, once more, explains why so most of the world’s central banks are loading up on gold quite than Uncle Sam’s IOUs.

Gosh. Simply see for your self:

Ouch.

Uh-oh?

US Buyers: Nonetheless Excessive on Previous Fantasy Quite than Present Actuality

Sadly, nonetheless, the US basically, and US traders specifically, stay trapped in a spiral of cognitive dissonance and nonetheless imagine at the moment and tomorrow’s America is the America of magical leaders, deficits with out tears and the balanced-budget honesty of the Eisenhower period.

That’s why the overwhelming majority (and their consensus-think, safety-in-numbers advisors) are nonetheless huddling in correlated 60/40 inventory bond allocations quite than bodily gold in accordance with a current BofA survey of wealth “advisors.”

This at all times jogs my memory of a phrase circling round Tokyo simply earlier than the grotesquely inflated Nikkei bubble misplaced higher than 80% of its scorching air within the crash of 1989, particularly: “How can we get harm if we’re all crossing the street on the similar time?”

Nicely, a big swath of US traders (and their “advisors”) is about to learn how.

Doubling Down on Return Free Threat

This will likely clarify why US households (a statistical time period of artwork which incorporates hedge funds) have upped their allocations to USTs by 165% ($1.6T) since This fall of 2022 on the similar time that the remainder of the world (see above) has been dumping them.

However in all equity, this does make some sense, as greater charges within the US give traders in USTs (particularly in short-duration/cash market securities) a higher return than their checking or financial savings accounts.

Sadly, the place the plenty go can also be the place bubbles go; however as I prefer to remind: All bubbles pop.

In fact, when adjusted for inflation, these poor US traders are nonetheless getting a detrimental return on USTs.

Foreigners, in fact, have stopped falling for this, however when People themselves get suckered en masse into this similar bond-trap, they’re mainly simply paying an invisible tax whereas chipping away at GDP progress and unknowingly serving to Uncle Sam finance his debt totally free (particularly: at a loss to themselves).

Loopy?

Yep.

Destructive Returning IOUs—The Lesser of Evils

However why are hedge funds (i.e., the “good cash”) falling for this? Why are they loading up on USTs?

As a result of they see bother forward, and even a detrimental returning UST is safer (much less evil) than a tanking S&P–and that’s precisely what the professionals are bracing for/anticipating.

Ready for a Market Backside

Briefly: The large-boys are safe-havening at the moment in negative-USTs in order that they’ll have dry powder at hand to purchase a pending and large market backside tomorrow.

As soon as they will purchase a backside, they too will dump Uncle Sam’s IOUs because the QE (together with inflation) kicks again to new highs thereafter.

And talking of QE…

Backdoor QE: Coordinated and Artificial Liquidity by One other Title

I’ve at all times endeavored to simplify the advanced with big-picture widespread sense.

Towards this finish, let’s hold it easy.

And the easy fact is that this: With US debt at unprecedented and unsustainable ranges, it’s a matter of nationwide survival to stop bond yields—and therefore bond-driven quite than Fed- “set” rates of interest–from spiking.

Such a pure, and bond-driven spike, in any case, would make Uncle Sam’s embarrassing debt too costly to operate.

Survival vs. Debate

Thus, and to repeat: Maintaining bond yields managed just isn’t a matter of pundit debate however nationwide survival.

Since bond yields spike when bond costs fall, it’s thus a matter of sovereign survival to maintain nationwide bond costs at moderately excessive ranges.

This, nonetheless, is naturally unimaginable when bond demand (and therefore value) is naturally sinking.

This pure actuality opens the door to the un-natural “resolution” whereby central banks un-naturally print trillions (“artificial demand”) to purchase their very own bonds/debt.

In fact, this sport is in any other case generally known as QE, or “Quantitative Easing”–that ironic euphemism for un-natural, anti-capitalist, anti-free market and anti-free-price-discovery Wall Avenue socialism whose inflationary penalties trigger Principal Avenue feudalism.

Briefly: QE has backstopped a contemporary system of central-bank-created lords and serfs.

Which one are you?

See why Thomas Jefferson and Andrew Jackson feared a Federal Reserve, which is neither “federal,” nor a solvent “reserve.”

The ironies, they do abound…

How Can there be QE if the Headlines Say QT?

However the official narrative and headlines are nonetheless telling us solely tales of QT (Quantitative Tightening) quite than QE, so what’s the issue?

Nicely, as with nearly the whole lot from CPI knowledge and transitory inflation memes to recession re-defining, the official narrative just isn’t at all times the truthful narrative…

In actual fact, back-door or “hidden QE” is throughout us, from the Fed bailing out/funding repo markets and lifeless regional banks to central banks making secret offers behind the scenes.

Though it’s not formally QE when the central financial institution of 1 nation is shopping for the IOUs (bonds) of one other nation, it’s greater than doubtless that main central banks are appearing in a coordinated solution to “QE one another’s debt,” a system which former Fed official, Kathleen Tyson, describes as a “Daisy Chain.”

And if we have a look at the IMF’s personal knowledge, we will join the dots of this Daisy Chain with relative (quite than tin-foil-hatted) readability.

Since This fall of 2022, for instance, general FX reserves at the moment are up by over $340B, the equal of over $100B monthly of central financial institution QE by one other title.

Towards that finish, the maths is straightforward, with: 1) GBP reserves up 10% (no shock given the gilt implosion of Oct. 2022), JPY reserves up practically 8%, EUR reserves up 7% and USD reserves solely up solely 0.5%.

Not solely does this appear like backdoor QE masquerading as “constructing extra reserves,” it appears to me, at the least, like a coordinated try by DXY central banks to collectively weaken the 2022 USD which Powell’s charge hikes had made painfully too excessive for the remainder of the world, a reality/pivot of which we warned all through 2022.

Because the above G7 insurance policies kicked in, the USD has fallen 11% into 2023 as the opposite DXY currencies (JPY, EUR and GBP) gave themselves a bit of backdoor/QE enhance.

It appears, in brief, that the necessity for synthetic liquidity in a world thirsty for USDs discovered a intelligent solution to weaken the relative energy (and value) of that USD (and confront/tame skyrocketing volatility in USTs) with out overtly requiring Powell to mouse-click {dollars} from his personal laptop computer.

Why Markets Rise right into a Recession

This unofficial however doubtless coordinated play to constructively weaken the USD among the many massive boys helps clarify why the S&P has been rising into 2023 regardless of open indicators that the nation is itself marching towards a recession.

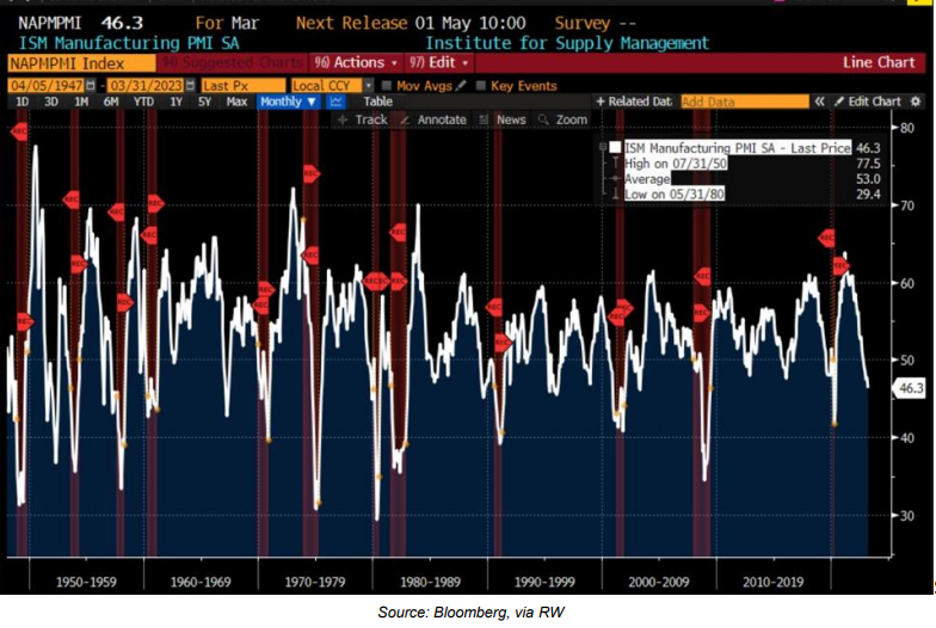

US Manufacturing knowledge (ISM) is now at ranges per a recession…

Once more: The ironies (and un-natural manipulations) abound.

In the meantime, the Atlanta Fed’s GDPNow is down 1.5% from March’s 3.2% determine.

However hey, who wants progress, productiveness, tax receipts or perhaps a modicum of nationwide financial well being to maintain a liquidity-supported inventory market from defying actuality—at the least for now…

Ready to Pay the Debt Piper…

Finally, in fact, debt will get the final, merciless snicker, and with the US heading towards a deficit that’s higher than 50% of GLOBAL GDP (!), I personally imagine the Fed might want to return to its personal cash printer in a giant means as soon as this market charade ends in an historic “uh-oh” second.

This seemingly inevitable return to mouse-click trillions (inflationary) will doubtless come after a deflationary implosion in fairness property at present supported by the foregoing tips and fantasy quite than earnings and progress.

Within the interim, and like these hedge fund jocks mentioned above, we will solely watch for issues to get S&P ugly as gold, typically sympathetic within the first hours of a market crash, rips towards all-time highs thereafter.

[ad_2]