[ad_1]

SNAP’s obtained a brand new recreation plan up its sleeve and, relying on how nicely it suits, it might make or break the inventory.

After flat or disappointing earnings experiences for many of 2022, primarily on account of weak social media advert revenues, SNAP inventory has suffered. The inventory’s value has been within the single-digits territory for the latter half of 2022. However there was some motion to the upside in SNAP’s value which may have been due to extra optimistic firm fundamentals, or it could possibly be driving the wave created by Meta Platforms (META).

SNAP has taken a leap by investing in augmented actuality (AR) expertise, which could possibly be an asset for corporations that publicize on the SNAP platform. Think about nearly attempting on a pair of denims before you purchase them. Or ensuring an L-shaped desk suits completely in your house workplace earlier than committing to a heavy merchandise buy. This funding could possibly be the information that reignites investor optimism within the inventory, which appears to be beginning to take maintain (see chart under). However will it stick this time?

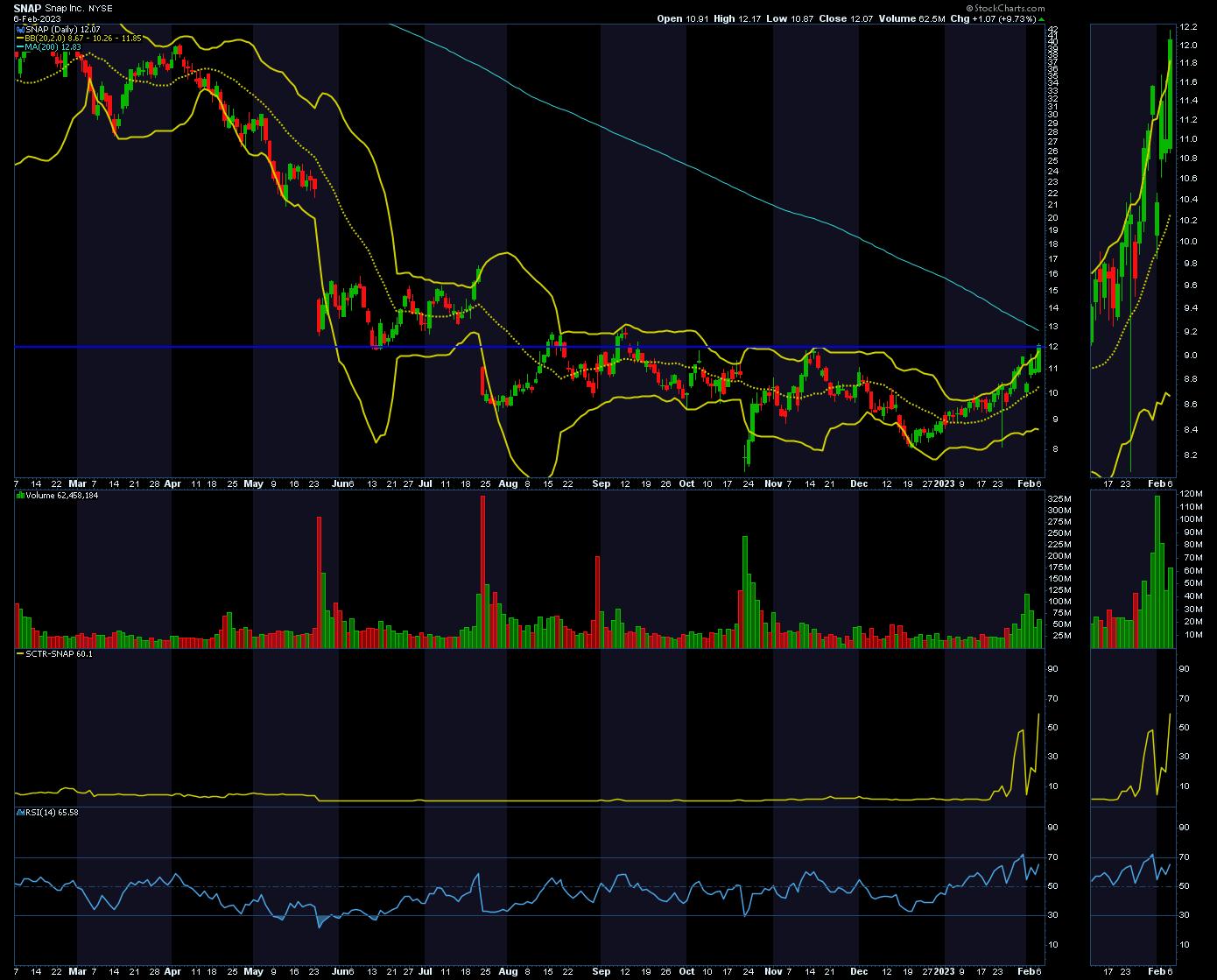

CHART 1: DAILY CHART OF SNAP. The worth has moved above the higher Bollinger Band (see thumbnail view on the precise facet of value chart), which is an indication of energy. The query is that if the energy can proceed. Click on on the chart to see a dwell model.Chart supply: StockCharts.com. For illustrative functions solely.

CHART 1: DAILY CHART OF SNAP. The worth has moved above the higher Bollinger Band (see thumbnail view on the precise facet of value chart), which is an indication of energy. The query is that if the energy can proceed. Click on on the chart to see a dwell model.Chart supply: StockCharts.com. For illustrative functions solely.

Snap, Crackle, and Pop

Within the above chart of SNAP, you see a couple of issues the inventory value has getting in its favor.

- Value has exceeded the higher Bollinger Band®, which generally is a optimistic signal. For many of 2023, value has moved alongside the higher band, however now that it has exceeded it, will value proceed strolling the band, or will it pull again, prefer it did the final time this occurred?

- SNAP’s StockCharts Technical Rank (SCTR) was up by 39.8 factors on February 6. That is a giant one-day leap, particularly after being near zero for virtually all of 2022; whether or not it may maintain on or transfer larger up its rank stays to be seen.

- The relative energy index (RSI) is climbing up in the direction of the 70 stage. This occurred extra lately on January 31, proper earlier than the corporate introduced earnings. However, after a disappointing earnings report, the worth gapped down. Will a follow-through in an upward value transfer happen this time and, if it does, will the RSI stay above 70 for some time? That is one thing to keep watch over.

- SNAP’s inventory value is barely above its earlier November 2022 excessive. If you happen to return so far as June 2022, this stage was a short-lived assist stage.

Or, It May Fizzle

The short-term nature of SNAP’s value swings is one thing to remember for those who’re contemplating shopping for the inventory. Since June 2022, each time the inventory tried to maneuver larger, it lacked the momentum to push the worth larger. Since then, the inventory has been shifting sideways.

One other level to remember is that the 200-day shifting common (MA) is sloping downward (blue line), which implies the general long-term development remains to be down. If the inventory value strikes above the $12 stage, the 200-day MA may act as a resistance stage.

In case you are contemplating shopping for SNAP, set an alert for when its value crosses above the 200-day MA. A transfer past that stage supported by elevated quantity, excessive SCTR, and an RSI that is above 70 may set the replenish for the beginning of an uptrend. The important thing could be for the 200-day MA to show and slope up. Then you should utilize your personal judgment and determine if the inventory suits your portfolio and for a way lengthy.

Jayanthi Gopalakrishnan

Director, Web site Content material

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra

Subscribe to Do not Ignore This Chart! to be notified every time a brand new publish is added to this weblog!

[ad_2]