[ad_1]

Momentum breakout methods are good beginning factors for brand spanking new merchants. It’s because robust momentum usually causes worth motion to proceed additional in its path because it carries quantity together with it. This gives merchants a wonderful short-term alternative which can present big income even in only a few interval bars. The problem is in how we may spot such momentum-based buying and selling alternative.

The technique proven beneath is an instance of a momentum-based technique which makes use of technical indicators to substantiate momentum.

Smoothed Repulse 2 Indicator

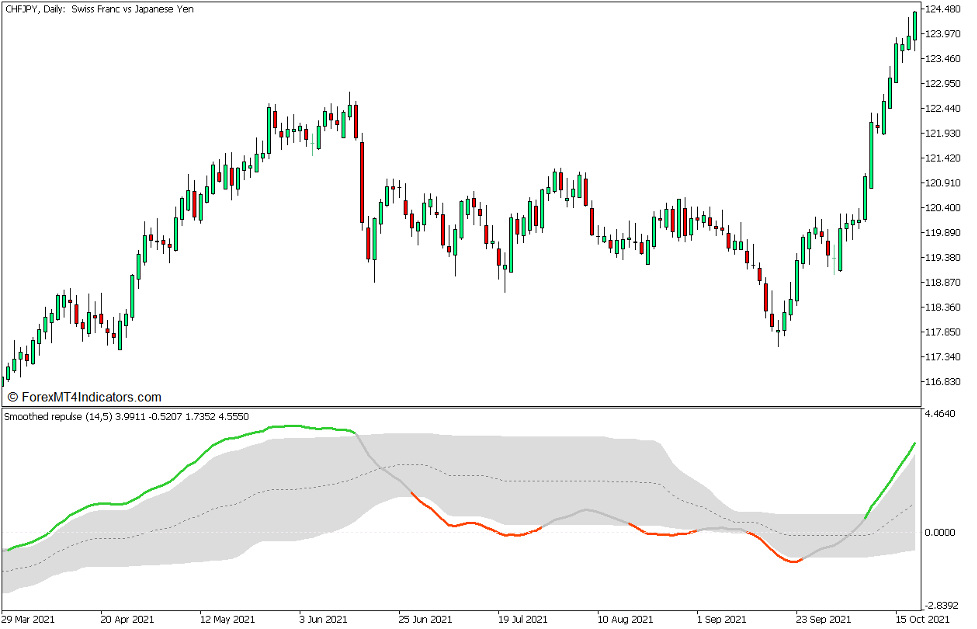

The Smoothed Repulse Indicator is a momentum-based pattern following technical indicator which was developed to supply merchants invaluable perception into how the markets are transferring, which can give merchants the extra confidence relating to how they’re studying the markets directional bias.

This indicator is an oscillator sort of technical indicator which plots two traces that oscillate round a midline, which is zero, and plots a band or channel-like construction round one of many traces. This indicator is predicated on transferring averages. It makes use of its underlying transferring common values as a foundation for plotting its two traces. The slower transferring line, which is the dashed line, acts as a sign line and because the median of the outer bands. The outer line acts as its fundamental line which gives merchants the indications as regards to the pattern and momentum path.

There are a number of methods to interpret this indicator. One technique is to determine the principle pattern bias primarily based on whether or not the traces are above or beneath zero. The second is to make use of the crossovers between the strong line and the dashed line as a foundation for figuring out short-term pattern reversals and path. The third technique is to make use of the slope of the strong line as a foundation for figuring out the short-term momentum path or trajectory. Lastly, merchants may use the breach of the strong line above the higher fringe of the band as a bullish momentum affirmation, or the drop of the strong line beneath the decrease fringe of the band as a bearish momentum affirmation.

The strong line additionally has a function whereby it modifications coloration at any time when the strong line breaches the vary of the band-like construction, which makes it simpler to substantiate momentum breakouts. Nonetheless, this function may also be modified whereby the road modifications coloration at any time when the strong line crosses over the dashed line or at any time when the slope of the strong line modifications.

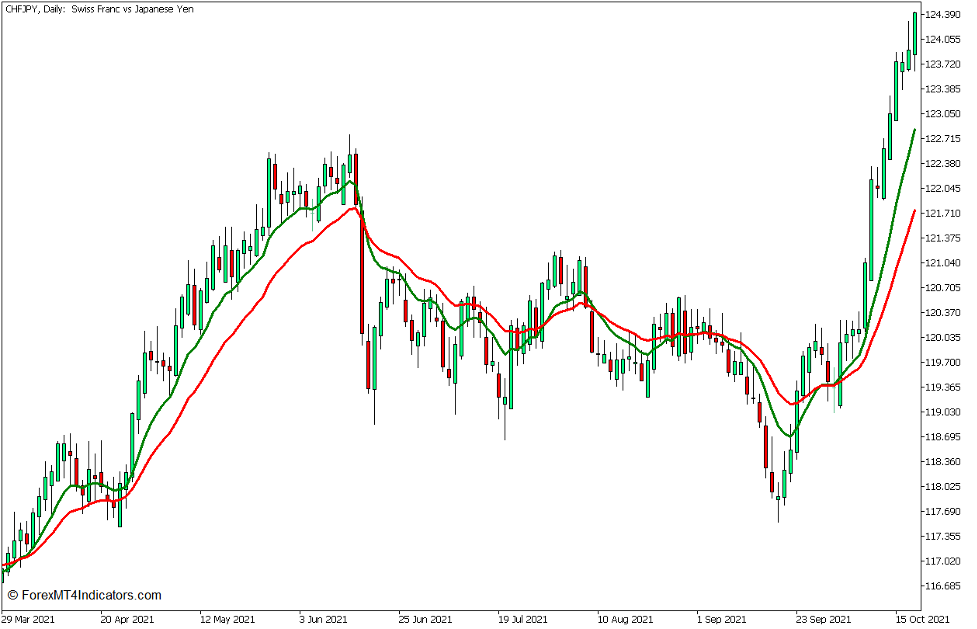

10 EMA and 20 EMA Pattern Path

Transferring averages are glorious instruments for figuring out pattern path successfully. One of many strategies utilized by merchants to determine pattern path utilizing transferring common traces is by a pair of transferring common traces and observing how the 2 traces work together with one another. Merchants could determine a bullish pattern path if a sooner transferring common line is above a slower transferring common line. Inversely, a bearish pattern path can be indicated if the sooner transferring common line is beneath the slower transferring common line.

The Exponential Transferring Common (EMA) is a wonderful software for figuring out pattern path. It’s because EMA traces had been developed to position extra weight on latest worth actions. This causes the transferring common line to be extra responsive to cost motion. Nonetheless, it additionally retains its smoothness which makes it much less prone to market noise corresponding to worth spikes.

The ten-bar EMA and 20-bar EMA is an effective transferring common pair for figuring out short-term pattern instructions. It’s attentive to have a tendency reversals but gives a transparent indication of the path of the pattern.

Buying and selling Technique Idea

Smoothed Repulse Momentum Breakout Foreign exchange Buying and selling Technique for MT5 is a momentum-based technique which makes use of the ten EMA, 20 EMA, and the Smoothed Repulse 2 oscillator to determine and make sure momentum-based commerce setups.

The ten EMA and 20 EMA traces are primarily used to determine and make sure the pattern path. That is primarily based on the situation of the ten EMA line in relation to the 20 EMA line.

As quickly because the pattern path is confirmed, we may then observe and look ahead to momentum breakouts and its affirmation.

Breakouts needs to be noticed on worth motion. That is primarily based on worth breaching a swing excessive resistance or swing low assist with momentum.

The Smoothed Repulse 2 oscillator is used to substantiate the momentum breakout primarily based on the altering of the colour of the strong line as breaches the vary of the bands.

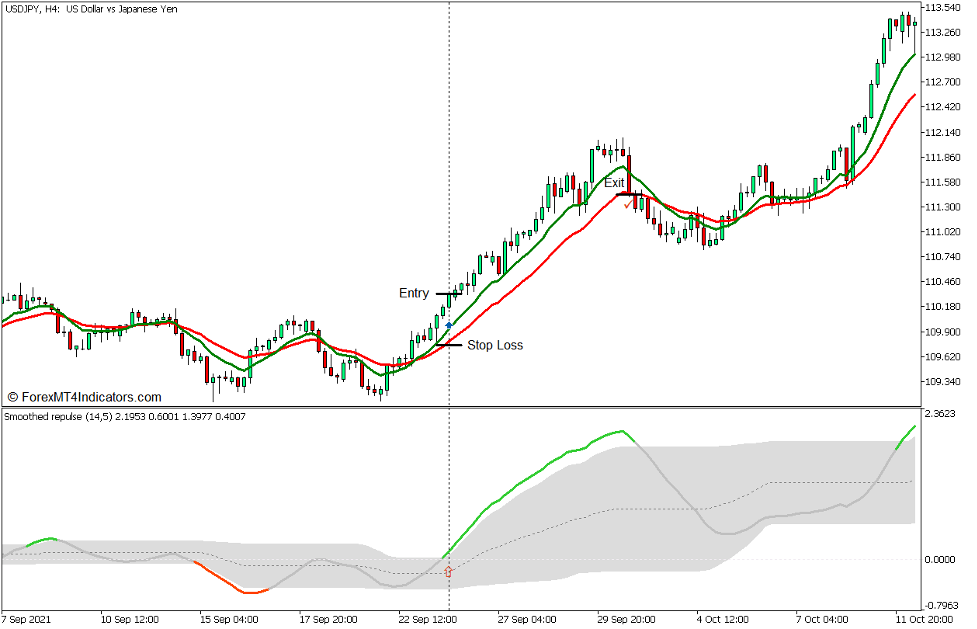

Purchase Commerce Setup

Entry

- The ten EMA line (inexperienced) needs to be above the 20 EMA line (pink) indicating a bullish pattern.

- Value ought to break above a visual swing excessive.

- Open a purchase order as quickly because the Smoothed Repulse 2 strong line modifications to lime inexperienced because it breaches above the higher band edge confirming the bullish momentum.

Cease Loss

- Set the cease loss on a fractal beneath the entry candle.

Exit

- Shut the commerce as quickly as worth closes beneath the 20 EMA line.

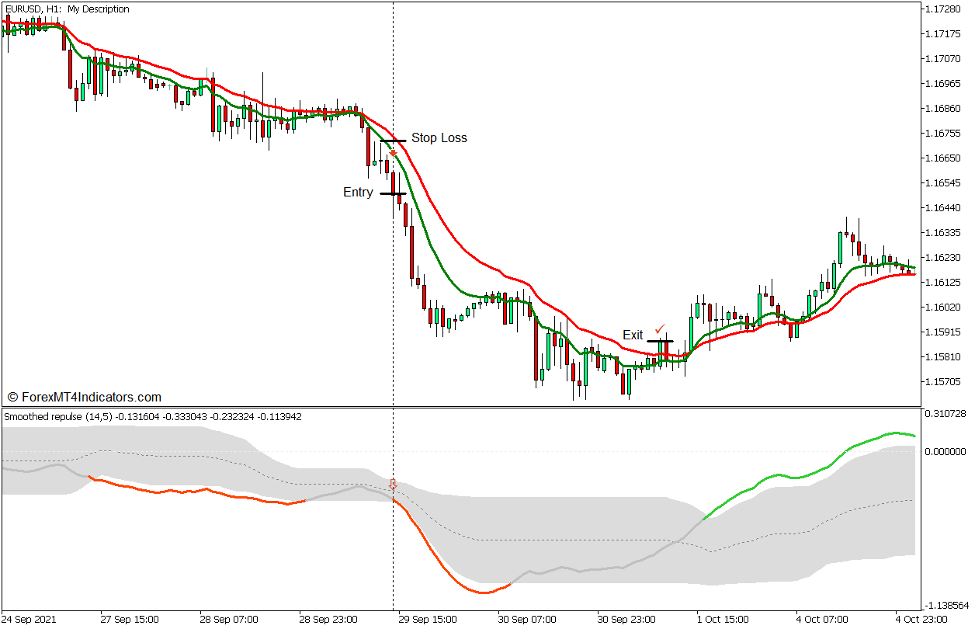

Promote Commerce Setup

Entry

- The ten EMA line (inexperienced) needs to be beneath the 20 EMA line (pink) indicating a bearish pattern.

- Value ought to drop beneath a visual swing low.

- Open a promote order as quickly because the Smoothed Repulse 2 strong line modifications to orange pink because it drops beneath the decrease band edge confirming the bearish momentum.

Cease Loss

- Set the cease loss on a fractal above the entry candle.

Exit

- Shut the commerce as quickly as worth closes above the 20 EMA line.

Conclusion

Momentum breakout methods will be glorious buying and selling alternatives. Nonetheless, recognizing momentum is commonly very tough for brand spanking new merchants. At occasions merchants would misjudge worth candles as momentum, making them open trades on the prime or backside of a minor market fluctuation. Different occasions it solely turns into apparent when the market has already had an excessive amount of of a run. Newbies would usually chase such momentum breakouts which could already be about to reverse. Merchants who don’t have a concrete and goal technique for figuring out and confirming momentum usually lose cash as they chase worth. This technique merely gives a affirmation of two components that are vital to momentum breakouts, that are the short-term pattern and an goal momentum sign. This technique shouldn’t be good. Merchants ought to nonetheless be taught to watch worth motion and the way momentum breakouts develop to be proficient in buying and selling momentum breakouts.

Foreign exchange Buying and selling Methods Set up Directions

Smoothed Repulse Momentum Breakout Foreign exchange Buying and selling Technique for MT5 is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the amassed historical past knowledge and buying and selling alerts.

Smoothed Repulse Momentum Breakout Foreign exchange Buying and selling Technique for MT5 gives a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional worth motion and alter this technique accordingly.

Really helpful Foreign exchange MetaTrader 5 Buying and selling Platforms

#1 – XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

#2 – Pocket Possibility

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 Total Ranking!

- Robotically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

Easy methods to set up Smoothed Repulse Momentum Breakout Foreign exchange Buying and selling Technique for MT5?

- Obtain Smoothed Repulse Momentum Breakout Foreign exchange Buying and selling Technique for MT5.zip

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Smoothed Repulse Momentum Breakout Foreign exchange Buying and selling Technique for MT5

- You will note Smoothed Repulse Momentum Breakout Foreign exchange Buying and selling Technique for MT5 is on the market in your Chart

*Be aware: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]