[ad_1]

II. Basic Information

- Structural basis:

- Estimating course primarily based on construction

- Regardless of how assorted the shape, construction breaks all of it

- The function of construction in buying and selling

- Provide and demand basis:

- Provide and demand buying and selling technique primarily based on construction

Provide and demand buying and selling technique primarily based on construction

Directional expectations from structural breakthroughs

Worth developments are pushed by the push of funds and profit-taking conduct, with pushing conduct forming the principle uptrend and profit-taking conduct forming changes. A collection of steady pushes and earnings, looking back, are developments.

Going with the pattern means breaking by the excessive/low level construction of costs and forming increased highs/decrease lows; reversal means breaking by the excessive/low level construction of costs and forming decrease highs/increased lows.

For instance, in an uptrend, the excessive factors are usually constantly damaged, and the low factors additionally constantly rise; when the pattern reverses downwards, the low factors shall be constantly damaged, and the excessive factors can even constantly decline.

Structural breakthroughs on a bigger timeframe will convey directional expectations. This course doesn’t have certainty, solely a barely increased likelihood benefit. Expert merchants can mix a number of strategies to boost likelihood, however it may well by no means attain 100%.

The importance of provide and demand relationships

Provide and demand relationships are the primary of Wyckoff’s three legal guidelines and are intently associated to fund conduct. From a macro perspective, provide and demand relationships decide the course of market value adjustments; from a micro perspective, provide and demand relationships additionally decide the entry and exit positions of merchants.

When provide and demand are balanced, the market is in a consolidation part; when provide and demand are imbalanced, the market strikes in a directional method.

- If provide is larger than demand, the market value will fall.

- If demand is larger than provide, the market value will rise.

Following the pattern or following large cash?

What makes the value candlestick transfer up and down? Is it the collective efforts of numerous particular person merchants?

The bigger the market quantity, the extra capital is required to maneuver costs. For instance, within the foreign exchange market, solely massive monetary establishments similar to banks, funding banks, and funds can considerably change costs, they usually play a decisive function available in the market pattern.

In contrast to particular person merchants, monetary establishments commerce with enormous quantities of capital and infrequently face the issue of inadequate liquidity[1]. Even when massive orders are break up into smaller ones, they may nonetheless trigger vital adjustments available in the market value.

For instance, if an establishment desires to finish one purchase order, there should be an equal quantity of promote orders available in the market. If there will not be sufficient promote orders on the present value, demand will far exceed provide, and the value will rise to match the promote orders till they’re fully stuffed. That is mirrored within the chart as a sudden look of a giant bullish candlestick (or a collection of bullish candlesticks).

It’s inconceivable for the remaining orders break up by establishments to proceed to be accomplished by pending orders. As well as, primarily based on value concerns, if the present value is much from the buildup zone, establishments will manipulate costs to return to the neighborhood of the buildup zone by closing worthwhile positions. If the buildup zone of the establishment might be recognized upfront, this is a superb buying and selling alternative.

The availability and demand buying and selling technique is a technique of figuring out the intentions of main funds, and following the footsteps of massive cash could also be extra dependable than following the pattern.

How one can Establish Establishment Accumulation Zones

After large cash enters the market, there shall be a transparent attribute, which seems as a big bullish or bearish candlestick on the chart, or a collection of bullish or bearish candlesticks. If considered by order move software program or quantity distribution charts, you will see that that inside the vary of those candlesticks, there are virtually solely purchase orders or promote orders.

These strongly imbalanced candlesticks are considerably much like hole openings. As a result of they’re brought on by inadequate liquidity, these massive candlesticks will also be known as liquidity gaps.

Aside from market fluctuations brought on by information, any massive candlestick has the potential to be a hint left by institutional accumulation. As a result of establishments will not be a union and nonetheless eat smaller fish, establishments within the Asian, European, and American periods additionally assault one another, particularly throughout the European and American periods, which regularly result in reversals. Solely underneath the situation of unified fundamentals, can clean pattern actions happen concurrently within the Asian, European, and American periods.

One of many strategies to find out whether or not it’s institutional accumulation is to verify the conduct of institutional accumulation if the value returns to the neighborhood of the start line of the massive candlestick shortly after.

Nevertheless, you will need to word that not all massive candlesticks in any place can be utilized. A limiting situation should be added, which is to interrupt by the excessive/low factors of the construction or vary. When a big candlestick which may be an institutional accumulation zone seems, it’s essential to see if the value can break by the earlier construction or vary subsequent. If it can not break by, it signifies that the trouble has no consequence, and there’s probably a divergence of quantity and value.

If a big candlestick seems and breaks by the earlier construction’s excessive/low level, then we are able to anticipate this institutional accumulation zone to be efficient and place a restrict order right here.

Structural Kinds of Institutional Accumulation Zones

The title “institutional accumulation zone” is a bit lengthy, and in the event you already perceive its which means, you may as well name it a supply-demand zone or choice zone. The time period “choice zone” is predicated on the breakout pullback system and “supply-demand zone” appears extra acceptable on this article. Provide-demand zones might be divided into two classes primarily based on their construction: reversal and continuation[2].

Reversal buildings:

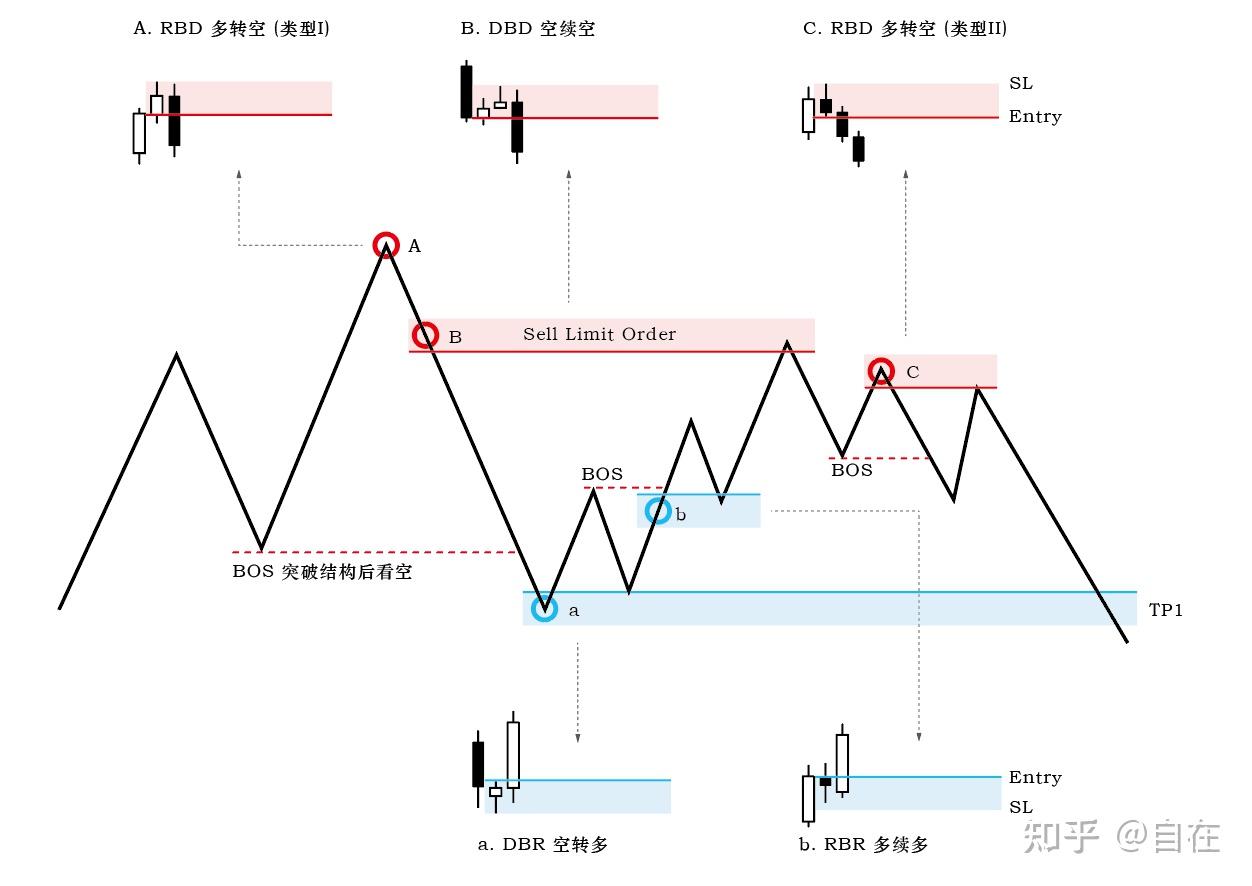

- RBD – Rally-Base-Drop (from uptrend to downtrend)

- DBR – Drop-Base-Rally (from downtrend to uptrend)

Continuation buildings:

- DBD – Drop-Base-Drop (downtrend continuation)

- RBR – Rally-Base-Rally (uptrend continuation)

Construction-based Provide-Demand Buying and selling Mannequin

• The pink block within the determine is the cease loss vary for the brief restrict order, and the pink line is the entry level for the brief place; the blue block is the cease loss vary for the lengthy restrict order, and the blue line is the entry level for the lengthy place.

• Level a is the primary goal of the restrict brief order at level B, the place some earnings shall be locked by decreasing the place, and level C is the second entry level for the brief place.

• Level b is the entry level for the contrarian lengthy place, which shall be totally closed at level B (additionally the realm for brief promoting, however not a market order, however a pre-set restrict brief order).

Two Momentum Sorts in Provide-Demand Zones

Within the supply-demand buying and selling mannequin, each factors A and C are reversal buildings, however the momentum of institutional accumulation is completely different.

- Engulfing Sample: Widespread supply-demand zones belong to engulfing candlestick combos, and the stronger the momentum, the longer the physique of the engulfing candlestick.

- Multi-Candlestick Reversal Sample: This sort of supply-demand zone has barely weaker momentum than the primary kind. Usually, the primary reversal candlestick is a piercing sample, and two or extra consecutive candlesticks are wanted to interrupt by the low level of the bottom candlestick (RBD) or the excessive level of the bottom candlestick (DBR).

Microscopic View of Provide-Demand Zones

Trying on the 4 buildings of the supply-demand zone, you will see that small candlesticks in between. If we swap to a smaller timeframe, what do these small candlesticks appear like? Do they develop into a consolidation vary? So, the massive candlesticks fashioned by institutional accumulation, are they a powerful breakout from the consolidation vary?

As talked about earlier, consolidation represents supply-demand steadiness, and breakout represents supply-demand imbalance. We should contemplate the supply-demand zone as an entry and exit foundation, anticipating a fast reversal when the value returns right here. Nevertheless, the imbalance of huge candlesticks is usually stuffed by counter orders, making it troublesome to reverse.

Due to this fact, the supply-demand zone ought to embody a consolidation vary of a balanced state. It’s not solely the start line of institutional accumulation, but in addition offers liquidity for numerous unfilled orders (worth traders are likely to promote within the premium zone and purchase within the low cost zone).

Candlesticks might be primarily divided into two varieties: vary candlesticks and momentum candlesticks:

- Vary candlesticks: They are often divided into two varieties in response to the proportion of the physique and the place of the closing value, particularly these with higher and decrease shadows exceeding 50% and people closing inside the vary of the earlier candlestick. Even when the candlestick is principally composed of a physique, it nonetheless belongs to the vary candlestick kind within the latter case.

- Momentum candlesticks: They primarily check with candlesticks with a physique portion exceeding 50%. Strictly talking, they need to have only a few shadows as a result of the physique of the momentum candlestick represents robust supply-demand imbalance, whereas the shadow signifies the existence of reverse supply-demand forces, which is a extra balanced state.

Oh, I virtually forgot to say that it’s not essential to calculate the ratio of the physique to the shadow primarily based on the OHLC values of the candlestick. Simply have a look at which one is larger at a look, and if you cannot inform, deal with it as a spread candlestick. Buying and selling isn’t an actual science, so in the event you’re not utilizing an EA, do not pursue accuracy an excessive amount of and do not waste your power on these items.

How one can decide the stop-loss vary

Often, we use the Base space that represents provide and demand steadiness among the many 4 provide and demand buildings because the stop-loss vary (the unfold needs to be added in precise buying and selling). There are roughly 3 ways to find out the stop-loss vary primarily based on entry likelihood and risk-reward ratio:

- Excessive likelihood: Use the excessive and low factors of the Base space’s interval candlestick because the entry and stop-loss factors. For instance, in a powerful upward momentum market, when the value pulls again, it is going to instantly reverse when it touches the excessive level of the interval candlestick. The drawback of utilizing the excessive and low factors of the interval candlestick is that typically the shadow vary is simply too massive, leading to a poor risk-reward ratio.

- Steadiness: Use the opening value of the interval candlestick close to the entry level and the excessive/low level of the shadow at a distance because the stop-loss level. It combines likelihood and risk-reward ratio and is appropriate for normal use.

- Excessive risk-reward ratio: Use the 50% level of the interval candlestick or the closing value because the entry level and the excessive/low level of the shadow at a distance because the stop-loss level. This entry technique has a comparatively good risk-reward ratio however can considerably scale back entry likelihood, and it’s normally used when the shadow vary is lengthy.

Observe: Select one of many three strategies, and don’t change it in response to subjective preferences, as this can solely lose consistency and never be well worth the effort.

For the Base space with a number of interval candlesticks, these candlesticks might be thought of as a consolidation zone.

- For the RBD (rally-base-drop) and DBD (drop-base-drop) buildings: Use the opening value of the bottom interval candlestick because the entry level and the excessive level of the shadow of the very best interval candlestick because the stop-loss level.

- For the DBR (drop-base-rally) and RBR (rally-base-rally) buildings: Use the opening value of the very best interval candlestick because the entry level and the low level of the shadow of the bottom interval candlestick because the stop-loss level.

Lastly, for the a number of candlestick reversal construction, select one of many three stop-loss strategies primarily based on the piercing candlestick.

How one can Choose the High quality of Provide and Demand Zones

Good provide and demand zones have two primary traits, that are clear and recent. Clear signifies that the imbalance is robust, whereas recent signifies that the liquidity hole left behind after the value imbalance has not been stuffed, and the value is prone to come again to check this zone.

The realm that has been examined is now not recent, or has develop into a comparatively secure space, and is now not in an imbalanced state. This technique of balancing after an imbalance is the provision and demand response.

Coach Sam Seiden additionally talked about that the standard of provide and demand zones might be judged primarily based on the stagnation time and the risk-reward ratio. Nevertheless, this isn’t a needed situation, particularly the concept of stagnation time, which might be ignored. In precise buying and selling, solely the momentum and freshness of the provision and demand zones should be thought of.

Momentum Energy:

The candlestick leaving the provision and demand zone will need to have robust and clean momentum. It may be within the type of a niche, momentum candlestick, or a collection of candlestick. Whether it is leaving the provision and demand zone with overlapping candlestick, it signifies no imbalance and it’s troublesome for the value to return to this space.

We hope that the value has robust momentum when leaving the provision and demand zone, however when it returns to the zone, if the momentum remains to be robust, then we should be cautious that the provision and demand zone has been damaged by.

Due to this fact, when the value returns within the type of a V-shaped reversal, the most effective method is to desert this provide and demand zone.

The momentum of the value returning to the provision and demand zone needs to be the other of that when leaving, and it must return in a clean, step-by-step or small wave-like method.

MACD can be utilized as an indicator of momentum energy for judging provide and demand zones.

Freshness:

In contrast to assist and resistance, provide and demand has a time-sensitive and usage-based nature.

It’s because each time the value touches a provide and demand zone, there’s an order matching course of that concurrently consumes market orders and pending orders in that space.

Due to this fact, we primarily concentrate on the closest and untouched provide and demand zones relative to the present value.

If a provide and demand zone has been examined as soon as, when it’s retested for the second time, one ought to be sure that their place is in a zero-risk state. As for the third time…if the value can nonetheless retest the zone for a 3rd time, then it’s best to desert that offer and demand zone and watch for a brand new alternative.

An efficient provide and demand zone additionally has a requirement for the timeliness of value returning to it.

For instance, for a buying and selling cycle of lower than quarter-hour, the value ought to return to the provision and demand zone inside about 24 hours; for a buying and selling cycle of half-hour to 4 hours, the value ought to retest the zone inside 20 days; for a day by day buying and selling cycle, the value ought to return to the zone inside 3 months.

A protracted-untested provide and demand zone is now not recent when it comes to timeliness, so it’s best to not use it immediately.

Technique assessment:

- Select the course primarily based on the construction

- Discover the start line of value imbalance by deciding on the breakout construction of the provision and demand zone

- Select an acceptable provide and demand zone drawing technique because the entry and cease loss zone

- Decide the standard of the provision and demand zone and determine whether or not to hold a restrict order and watch for entry

Follow query:

Follow discovering provide and demand zones in several timeframes and completely different devices. Observe profitable and unsuccessful circumstances, and analyze the patterns after discovering a number of hundred of them.

Reference:

- ^When somebody sells to you once you need to purchase, and somebody buys from you once you need to promote, it means there’s enough liquidity. Conversely, when there’s inadequate liquidity. Usually, liquidity is nice throughout consolidation, whereas it’s decrease throughout developments.

- ^It will also be translated as “Rally-Base-Drop/Drop-Base-Rally/Rally-Base-Rally/Drop-Base-Drop”, however the base could not at all times transfer flat. Typically the pullback could also be deep, and typically it could reverse immediately. Due to this fact, understanding the bottom as “flat” can mislead inexperienced persons.

[ad_2]