[ad_1]

1. Preface

My article is extra appropriate for knowledgeable merchants to learn, because it primarily covers the essential ideas of the market, with out a lot superior content material or buying and selling particulars. It is because I hope that learners have impartial studying spirit, and may take up the data I present into their very own system, actively discover the underlying core of buying and selling and practice their very own pondering and statement talents.

Please don’t ask me for apprenticeship coaching. In my opinion, so long as you perceive the ideas, anybody can grow to be their very own trainer.

Similar to the premium-discount idea, the precise PD zone shouldn’t be divided by the higher and decrease 50% of the wave, it really has a extra particular place. However does this imply that the ICT concept shouldn’t be good? No! Any data has a means of development from fundamental to superior. Within the introductory stage, in contrast with the profound system like E=mc2, a crude mechanical clarification is sort of a metaphor, which is simpler for us to grasp. If the learner stops on the major stage and overinterprets, they may fall right into a entice stuffed with errors.

Merchants engaged in enterprise capital work will need to have essential pondering expertise. Don’t deal with any concept as reality, as a result of there is no such thing as a mathematical concept that’s good. All theories are like Plato’s cave, irrespective of how near the essence and reality of the market, they’re derived from restricted observations and logical deductions, and can’t totally signify actuality. Do not cease on the concept itself, as a result of because of the relationship of dissemination and curiosity, the theories which have been printed can solely be major or intermediate theories.

If you attain this level, please do not be indignant or discouraged. With out the purple capsule, the savior can not get up from the matrix. With out the essential concept, it’s troublesome for us to get out of the useless finish. If the essential ideas of the market are in comparison with eggs, we are able to eat them on to fulfill starvation, or hatch them into chicks, after which the chicks will lay countless eggs. It could be tougher to hatch eggs, however it’s simpler than laying eggs out of skinny air. I’m glad and grateful that I acquired an egg and efficiently hatched a hen that may lay golden eggs.

The little golden hen comes from an egg, however it’s fully completely different from the egg – that is what I actually hope you may get.

2. Studying Toolbox

- Frequent Abbreviations for SMC Idea

|

Abbreviation Used |

Full Title or Alias (there could also be many aliases for a similar idea) |

|

M |

Month-to-month |

|

W |

Weekly |

|

D |

Day by day |

|

HTF |

Larger Time Body |

|

LTF |

Decrease Time Body |

|

IMB |

Imbalance (FVG, LV, LG) |

|

SH |

Cease Hunt |

|

SSL |

Promote Aspect Liquidity |

|

BSL |

Purchase Aspect Liquidity |

|

BOS |

Break of Construction (BMS) |

|

MS |

Momentum Shift (CHoCH, Change of Character) |

|

H |

Excessive (Month-to-month/Weekly/Day by day Excessive: MH/WH/DH) |

|

L |

Low (Month-to-month/Weekly/Day by day Low: ML/WL/DL) |

|

$ |

Liquidity, Liquidity Pool, EQH/EQL |

|

OB |

Order Block (POI/POA/Provide and Demand Zone) |

|

P/D |

Premium/Low cost |

|

SMC |

Sensible Cash Idea |

|

EQH/EQL |

Equal Excessive/Equal Low |

|

4H/1H/15m |

4 hours/1 hour/quarter-hour |

|

EX$ |

Exterior Liquidity |

|

IN$ |

Inside Liquidity |

|

LI$ |

Liquidity Inducement |

|

HH, LL |

Larger Excessive, Decrease Low |

|

HL, LH |

Larger Low, Decrease Excessive |

|

S2B |

Promote to Purchase |

|

B2S |

Purchase to Promote |

- Simple Tutorial for Multi-Time Body Replay

Replaying the market is part of chart studying coaching. With out skilled replaying instruments, most charting software program can solely replay a single timeframe.

If situations permit, you’ll be able to put money into skilled replaying software program akin to Replay Grasp or open a premium account on TradingView to carry out market replays.

On this article, I’ll share my easy technique on use a small software program with MT4/MT5 to attain a greater expertise of multi-timeframe market replay (pleasant for lazy individuals like me).

Organising Cowl:

First, search and obtain “Cowl”, a subtitle masking software program that’s small and light-weight and doesn’t require set up.

We are going to use Cowl to masks the fitting aspect of the MT4/MT5 chart window to allow annotations on the chart (annotations can nonetheless be made with out Cowl, however they could be blocked by the chart edge when annotating the newest candlestick).

Subsequent, let’s arrange Cowl:

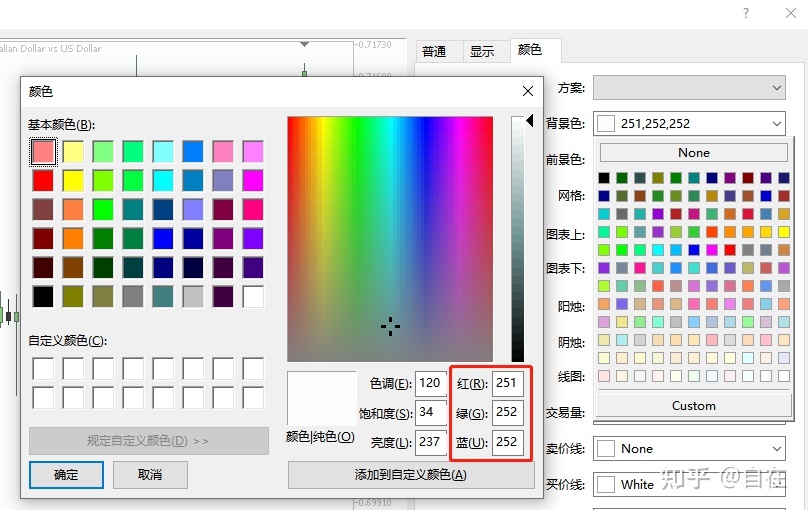

First, modify Cowl’s shade to match your MT5 background shade. If you do not know the colour worth, you’ll be able to press F8 or right-click on the buying and selling chart and choose Properties -> Colours -> Background shade, then open the dropdown menu and choose Customized. Fill the colour worth contained in the purple field within the determine under into Cowl’s shade setting (additionally by right-clicking on Cowl).

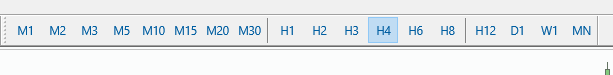

Modify the scale of Cowl by dragging it to the approximate place proven under. Then, right-click on Cowl and depart solely the Prime most choice checked, uncheck all different choices.

Your chart ought to now seem like the next determine, with the newest candlestick not being lower off and the right-side candlesticks being fully lined (after unchecking the scaling choice, the shadow a part of the highest determine additionally turns into a strong Cowl).

Exit after which reopen Cowl. This step is essential to verify if Cowl continues to be in the identical place earlier than closing.

If the place and state haven’t modified, you need not modify it once more (some choices can be routinely checked upon launch, you’ll be able to ignore them).

If Cowl routinely returns to the middle of the display, repeat step 2, modify it once more, after which exit and re-enter.

Organising MT4/MT5:

1.Flip off the choice for automated scrolling of the chart.

2.Within the lower-left nook of the chart window, discover a small triangle button that may be dragged to find out the place the chart place begins.

3.Drag the triangle button to the fitting to align with the middle of the final candlestick (positioned on the left of Cowl).

4.Subsequent, it’s important to click on on all of the timeframes you intend to view to forestall worth from leaping on to the top when switching timeframes. (Word: in case you do not swap timeframes for a very long time, worth knowledge can be reloaded, and it’ll leap on to the top).

For this instance, we’ll solely use M1, M15, H4 timeframes.

Market Replay

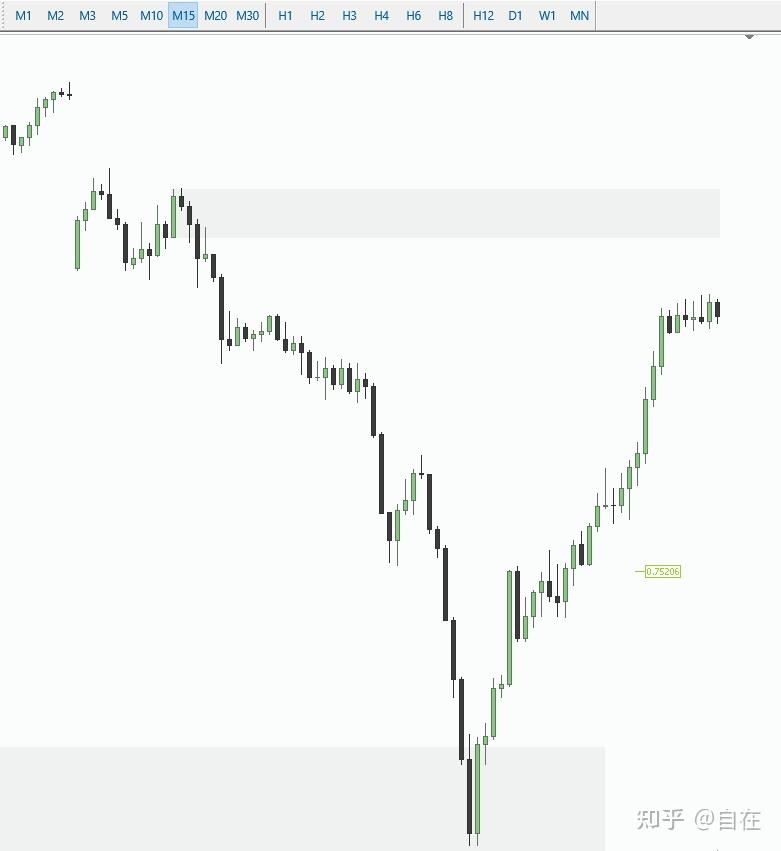

H4

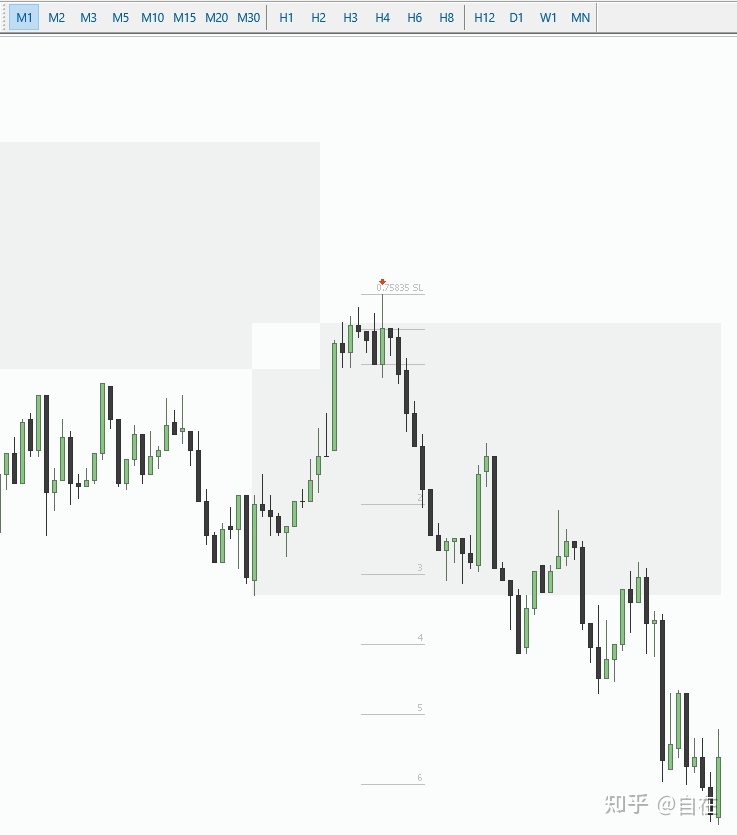

The market surroundings is in a bullish pattern, and there was a latest momentum reversal. Nevertheless, a robust rebound occurred on the demand order block (OB) under.

Anticipate the value to fall under the provision OB above, and the goal is aimed on the pinbar closing under.

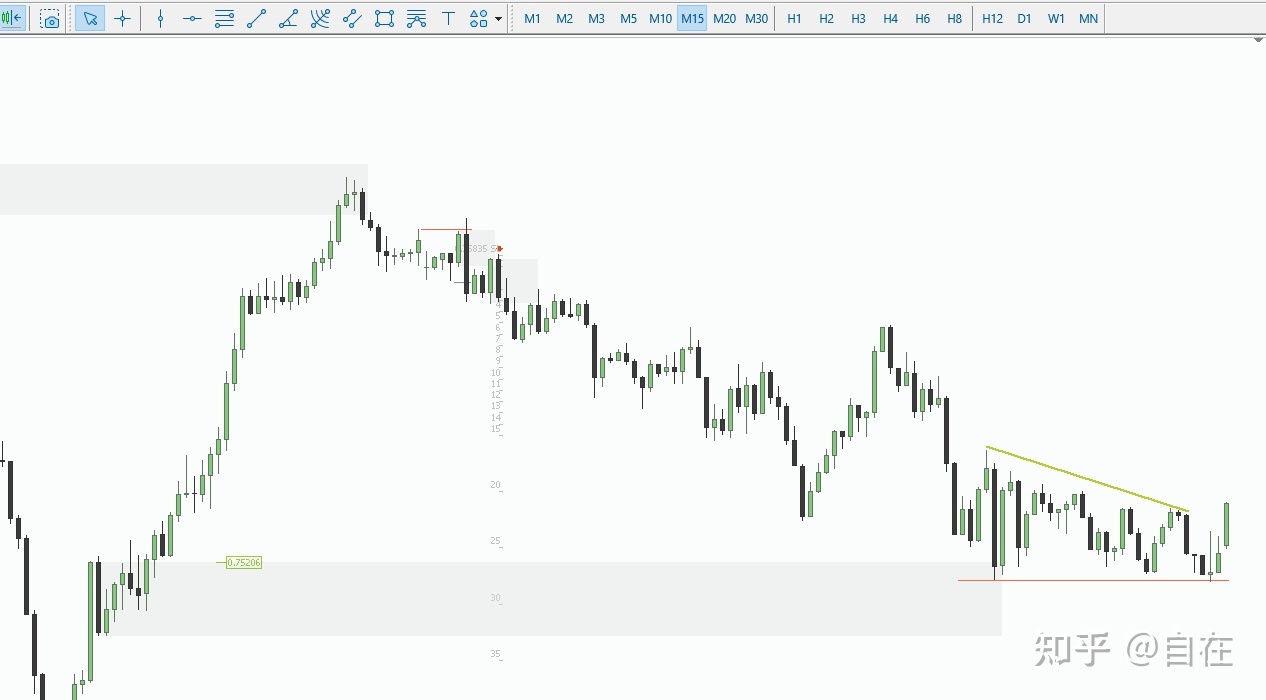

M15

Swap to M15 timeframe, and the chart will straight show the value as proven within the determine under. You can find that the value has retreated for 4 hours, which is regular.

It is because the 4-hour candlestick that opens at 4 o’clock accommodates costs between 4:00-20:00.

The 15-minute candlestick solely consists of costs between 4:00-4:15.

For those who do not perceive, it is okay. For the aim of reviewing, it is all the time higher to maneuver the value to the left fairly than to the fitting.

Press the F12 key on the keyboard and manually transfer the candlesticks one after the other to the 20:00 level, which is the place the H4 chart is positioned (the fitting arrow key on the keyboard can swap 4 candlesticks at a time, which is appropriate for resetting the value, however not beneficial for replay evaluation).

Subsequent, we’ll observe the value habits when it enters the higher OB, however there was no clear reversal sign till the top of the day.

At 1 a.m. the following day, the value broke by the latest structural low, confirming the LH. The awaited buying and selling alternative has emerged. Mark the OB on the M15 chart and swap to a smaller timeframe for statement.

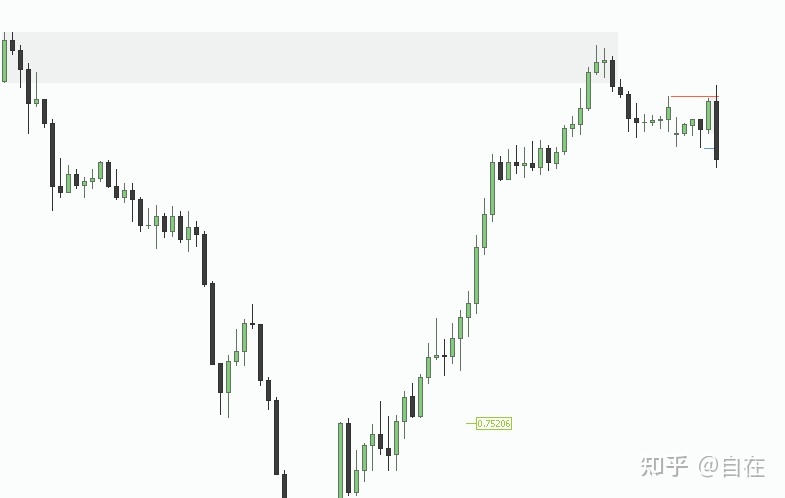

M1

Switching to M1, press F12 or the fitting arrow key to scroll 15 candles to convey the value to the identical location as M15.

You may see a robust momentum imbalance on this 15-minute chart, indicating that the value is unlikely to return to the LTF OB stage above.

Earlier than coming into the OB, there was a downward entice to build up BSL.

When the value breaks above the earlier excessive and enters the OB vary, it may be seen as a B2S, however we have to await the upward momentum to be exhausted after which a reversal happens.

For sturdy momentum tendencies, restrict orders might not all the time be stuffed. In such instances, a breakout order could be positioned on the low level of the final bullish candlestick shadow (MT5 can use a Promote Cease Restrict order to promote at a restrict worth under the present worth to forestall slippage and typically avoid wasting factors).

Add an entry mark right here and proceed to look at the value motion.

As soon as the partial take-profit is hit, enter the holding section the place you’ll be able to swap between completely different timeframes to seek out entry alternatives (take note of the PD construction of shopping for low and promoting excessive), and observe worth actions till the value reaches the anticipated goal or exhibits a transparent reversal sign on the HTF OB.

As well as, it’s endorsed to often verify the H1 timeframe and verify the H4 timeframe each few hours throughout platform time. It is essential to notice that in excessive liquidity intervals within the European and American markets, there could also be vital reversals. If time permits, we’ll write an article particularly discussing timing-related methods.

As soon as the goal place is reached, begin a brand new spherical of statement.

[ad_2]