[ad_1]

The correction in inventory costs could also be gathering steam, and the potential for a full blown liquidity disaster appears to be rising. The explanation could also be that a number of huge gamers in business actual property have lately defaulted on billions of {dollars}’ price of loans.

Final week, on this area, I wrote: “One thing occurred to the markets round Valentine’s Day which might reverse the current uptrend.” Properly, the pattern is more and more wobbly, and we’re getting new data which can clarify a minimum of a part of what’s taking place.

Actual Hassle in Actual Property

The warmer-than-expected PCE (Private Consumption Deflator) knowledge grabbed the headlines. However it appears that evidently its arrival on the scene could also be extra of a catalyst for an already churning dynamic available in the market than the trigger for the renewed promoting on 2/24/23.

Suppose business actual property defaults.

Over the previous couple of weeks, on this area, I’ve reported that a number of main actual property traders have confronted growing difficulties. I’ve additionally famous that it’s potential that these and different business property REITs which have had issues with foreclosures might have been promoting U.S. Treasury bonds with the intention to elevate money to fund operations, as their money move dries up because of rising vacancies.

I’ve famous that Brookfield’s LA default (highlighted in prior hyperlink) has been properly reported, whereas the even greater Blackstone (BSX) can also be having its share of issues together with Starwood (STWD). Brookfield’s (BAM) CEO Bruce Flatt is looking the L.A. default insignificant, whereas citing demand for premium area world wide, in locations like Dubai, as greater than sufficient to offset the L.A. points for the corporate.

Six Bullish Indicators {that a} Brief-Time period Backside Could also be Brewing

The creep up in U.S. Treasury bond yields of late has been because of regular promoting from a number of gamers. The query that issues most for traders is who’s doing the promoting and why. Up to now, it is not clear. However, for now, issues appear to have calmed down. And this pause has had a relaxing impact on the inventory market, which can be a worthwhile short-term buying and selling alternative.

The promoting in bonds might have come too far too quick, given the obvious rolling over of yields, on 3/3/23, as I talk about beneath. Thus, it follows that, if so, then a short-term rebound in shares is extra doubtless than not.

Consequently, there are six short-term indicator reversals within the works for the inventory market. And in the event that they maintain, they may assist increased inventory costs. I describe them intimately beneath. The primary one is the pulling again of the U.S. Ten 12 months be aware yield beneath 4%. The opposite 5 are associated to the technical motion within the inventory market, together with market sentiment, the motion in main inventory indexes, liquidity indicators, and the market’s breadth.

In the meantime, though not out of the woods fully, homebuilder shares may very well have another worth surge, as spooked patrons who’ve pulled again their horns because of the current climb in rates of interest might return, as they concern that charges will rise once more within the not too distant future.

I’ve lately added a number of new picks together with actionable choices to my mannequin portfolio. Test them out with a free trial to my service right here.

Is Starwood the Canary within the Coal Mine?

I will talk about the homebuilders beneath. However first, a bit extra on business actual property.

Traders are clearly shedding confidence in firms that spend money on business actual property. As an illustration, take the response to actual property big Starwood’s (STWD) lately reported better-than-expected outcomes. Usually, you’d count on some form of rally because of the excellent news. But, as an alternative of a transfer increased, the inventory’s worth largely went nowhere. That implies that confidence within the sector, even in firms which are holding their very own, is beginning to erode considerably.

Starwood delivered $140 million in earnings, a 53% year-over-year enhance based mostly on $456 million in revenues, additionally a nifty 56% 12 months over 12 months enhance. CEO Barry Sternlicht shed some gentle on the standing of the business market, noting that the multifamily market is “stable” whereas the business market is “bifurcated.” He additionally added that the U.S. workplace market is being hampered by the “work at home” dynamic, whereas noting that the remainder of the world is not this fashion anymore.

Maybe the comment that ought to have eased traders’ fears was Sternlicht’s remark about Starwood’s publicity to workplace properties is simply 13% of its whole portfolio, whereas including that the corporate has “nearly no publicity” to New York and San Francisco, the place the workplace markets are struggling greater than different areas. He additionally famous that workplace markets in states like Texas are doing a lot better.

As an alternative, traders appeared to give attention to Sternlicht’s feedback concerning the Fed, the place he famous that the Fed is not prone to deliver inflation again to 2% with out some form of miracle occurring.

The inventory had a token bounce 3/1/23, however nearly instantly rolled over and resumed its downward path — solely to then rebound as soon as bond yields reversed on 3/3/23. We’ll see how this develops. Actually, the inventory is oversold. Thus, if bond yields take a breather, the shares might bounce for a number of days to weeks.

At this level, although, it might pay to look elsewhere, because the Accumulation Distribution (ADI) and On Stability Quantity (OBV) indicators will not be providing a lot hope, as ADI’s current bounce, a sign of quick overlaying, has been overshadowed by the worsening On Stability Quantity (OBV). Placing the 2 collectively, sellers are taking the chance to extend their promoting into the non permanent rise in costs because of quick sellers abandoning the inventory.

You possibly can take a look at each lengthy and quick actual property and homebuilder picks right here with a free trial to my service.

Why the 4% Yield on the U.S. Ten 12 months Notice May Assist Homebuilders within the Brief Run

The primary doubtlessly bullish signal of a turnaround within the markets is the motion in bond yields.

For a number of weeks, I have been writing concerning the U.S. Ten 12 months be aware yield (TNX) and the essential 4% yield space. Properly, final week, 4% TNX crossed above the important thing line within the sand for a few days earlier than reversing. What which means is that each one market rates of interest which are tied to TNX might once more reset increased within the subsequent week or so, a minimum of briefly, because of the lag impact.

Among the many most important charges are these associated to mortgages. Already, we have seen the troubles in business actual property because of increased charges. Extra lately, we have seen homebuilder shares roll over, as traders issue extra decreases in present residence gross sales, and even new residence gross sales which rebounded in January when TNX fell to almost 3.5%.

Now, we’ll should see if this was the highest for the present transfer or whether or not yields will rise additional after a pause. With payroll knowledge due on 3/10 and CPI due out on 3/14, something is feasible.

You possibly can see that mortgage charges have already retraced most of their current drop and that, as soon as once more, the 7% yield is inside attain. We’ll see what occurs to those charges and what the response from potential residence patrons is that if there’s a slight pullback in charges. My guess is that we’ll see extra motion on the housing entrance within the quick time period as homebuyers attempt to lock in present charges earlier than the Fed raises charges once more.

The homebuilder sector (SPHB) had been pretty regular compared to different areas of the inventory market, however the transfer above 4% on TNX is had a noticeable unfavorable impact on the sector. Not surprisingly, although, as quickly as TNX pulled again from the 4% space on 3/3/23, homebuilder shares rebounded.

That is not likely shocking as a result of, for homebuilders and for sellers of present houses, the current and aggressive rise in mortgage charges created a panic situation. Thus, the potential for a brief reversal in charges could also be helpful within the quick time period. Certainly, if these patrons who lately pulled again their bids because of increased charges concern that even increased charges are coming within the not-too-distant future, it’ll doubtless spur a lift within the homebuilders shares.

For an in depth clarification of methods to handle your portfolio throughout a liquidity disaster, watch this Your Day by day 5 video.

5 Technical Indicators Which Level to Brief Time period Backside

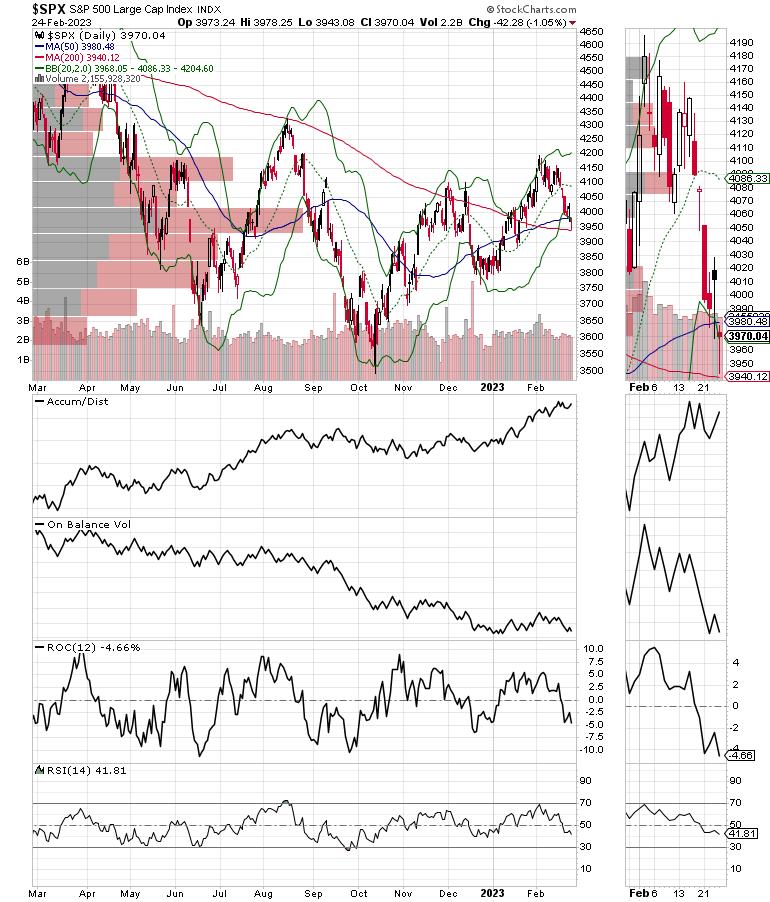

The technical setting for shares improved on 3/3/23 as bond yields reversed their current climb and the NYAD, SPX, NDX, VIX, and XED all delivered some optimistic motion. Nevertheless, if there’s going to be a significant quick time period rally, these 5 indicators want to carry.

The New York Inventory Trade Advance Decline line (NYAD) broke beneath assist at its 20-day shifting common final week and located assist simply above its 50-day shifting common. That is actually encouraging, as is the shut for NYAD above its 20-day shifting common.

In the meantime, the S&P 500 (SPX) bounced again above the the 4000 space after discovering assist at its 200-day shifting common. That is additionally bullish.

The Nasdaq 100 Index (NDX) additionally discovered assist at its 200-day shifting common, including to the quick time period bullish situation.

Including to the sigh of aid, the CBOE Volatility Index (VIX) rolled over, signaling that bearish sentiment is pulling again.

When VIX rises, shares are likely to fall, as rising put quantity is an indication that market makers are promoting inventory index futures with the intention to hedge their put gross sales to the general public. A fall in VIX is bullish, because it means much less put possibility shopping for, and it will definitely results in name shopping for, which causes market makers to hedge by shopping for inventory index futures, elevating the chances of upper inventory costs.

Liquidity lastly stabilized, because the Eurodollar Index (XED) has discovered new assist at 94.75 after breaking beneath 95, which had been a dependable assist stage. Normally, a steady or rising XED may be very bullish for shares.

You possibly can study extra about methods to gauge the market’s liquidity in this Your Day by day 5 video.

To get the most recent up-to-date data on choices buying and selling, take a look at Choices Buying and selling for Dummies, now in its 4th Version—Get Your Copy Now! Now additionally out there in Audible audiobook format!

#1 New Launch on Choices Buying and selling!

#1 New Launch on Choices Buying and selling!

Excellent news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 movies) and some different favorites public. You will discover them right here.

Joe Duarte

In The Cash Choices

Joe Duarte is a former cash supervisor, an lively dealer, and a widely known unbiased inventory market analyst since 1987. He’s writer of eight funding books, together with the best-selling Buying and selling Choices for Dummies, rated a TOP Choices Ebook for 2018 by Benzinga.com and now in its third version, plus The All the pieces Investing in Your 20s and 30s Ebook and 6 different buying and selling books.

The All the pieces Investing in Your 20s and 30s Ebook is out there at Amazon and Barnes and Noble. It has additionally been beneficial as a Washington Submit Shade of Cash Ebook of the Month.

To obtain Joe’s unique inventory, possibility and ETF suggestions, in your mailbox each week go to https://joeduarteinthemoneyoptions.com/safe/order_email.asp.

Joe Duarte is a former cash supervisor, an lively dealer and a widely known unbiased inventory market analyst going again to 1987. His books embrace the most effective promoting Buying and selling Choices for Dummies, a TOP Choices Ebook for 2018, 2019, and 2020 by Benzinga.com, Buying and selling Evaluate.Internet 2020 and Market Timing for Dummies. His newest best-selling guide, The All the pieces Investing Information in your 20’s & 30’s, is a Washington Submit Shade of Cash Ebook of the Month. To obtain Joe’s unique inventory, possibility and ETF suggestions in your mailbox each week, go to the Joe Duarte In The Cash Choices web site.

Be taught Extra

Subscribe to Prime Advisors Nook to be notified at any time when a brand new publish is added to this weblog!

[ad_2]