[ad_1]

People are calling the FED opening swap strains on your complete US Banking deposit base to the tune of $17.6 trillion as QE infinity. Moody’s lower its outlook on the banking system to unfavorable, saying that it’s a quickly deteriorating working surroundings. The market although, usually centered on one factor: CPI.

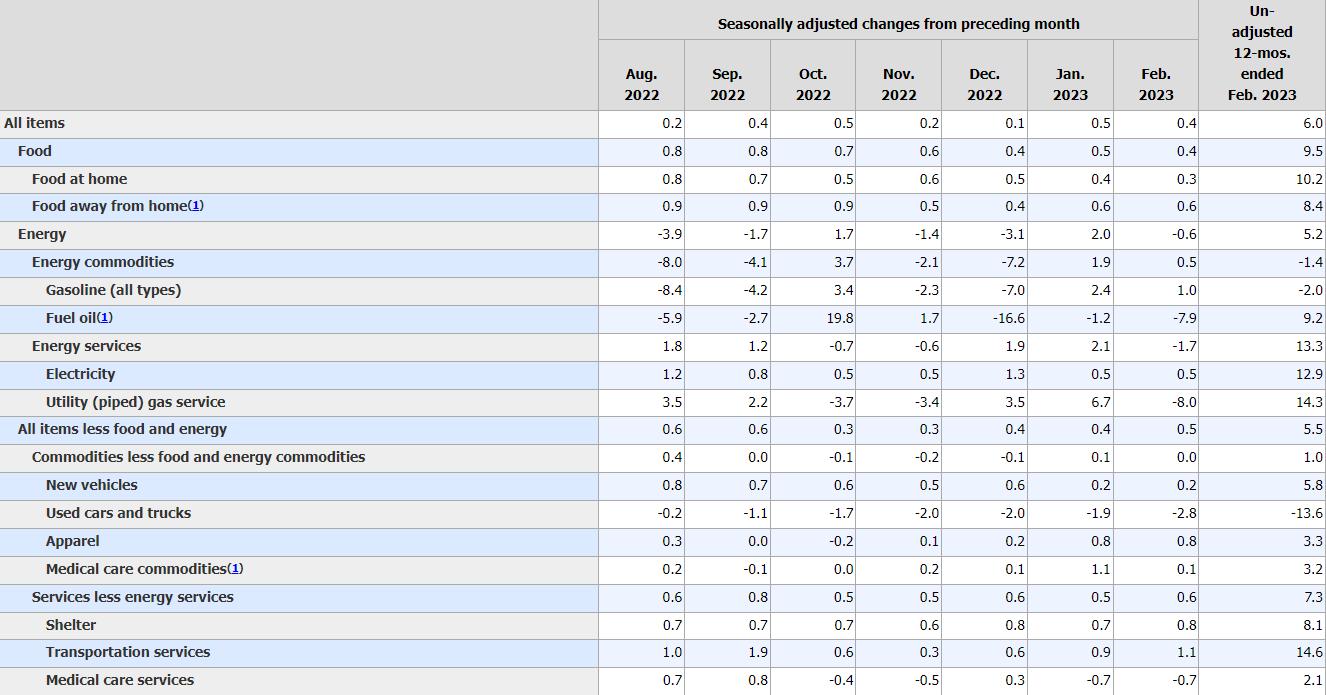

CPI got here in as anticipated, 6.0% and softer. Core CPI although got here in 5% increased. The chart exhibits you the areas of inflationary development versus decline. Nonetheless, the metals shone throughout.

Our GEMS International Macro or International ETFS Shares Macro and Sectors mannequin signaled a purchase in gold final week. Now, gold miners, based mostly on the energy of this sector, signaled. Monday’s Each day reported on the explanations to look at the gold to silver ratio.

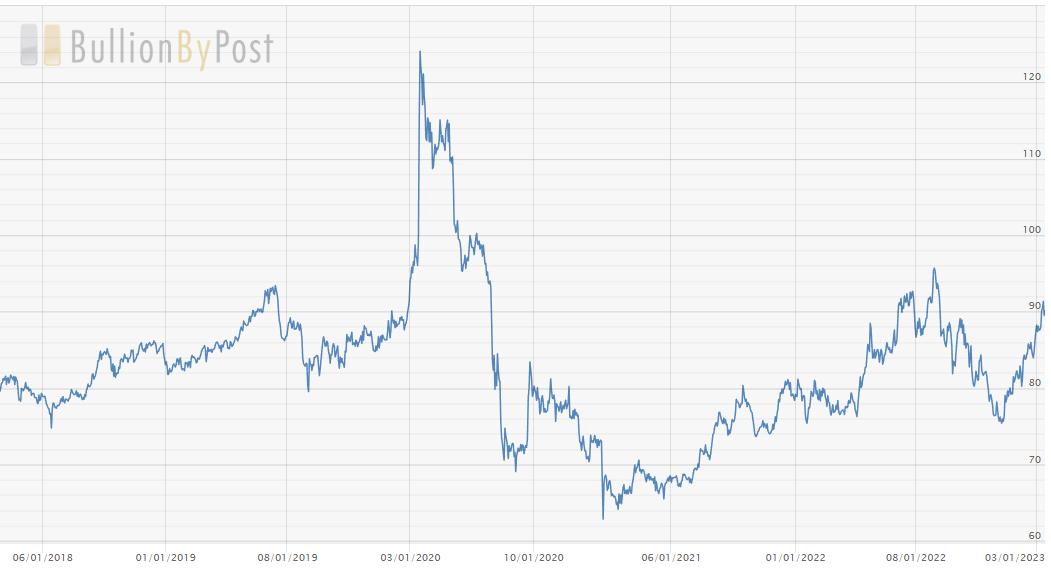

A 5-year historic have a look at the gold to silver ratio exhibits a transfer over 90 (bullish) whereas our Management indicator exhibits silver performing equally with gold. That tells us that the dear metals are on the point of roar.

Even with oil costs falling in the present day, GDX held steadfast, and is now outperforming the SPY. Momentum has a constructive divergence the place the purple dots usually are not inline with the 50-DMA (blue line). In the meantime, the worth sits beneath its 50-DMA, but effectively above the 200-DMA or in a warning part (enchancment from a distribution part). Ought to the worth clear the 50-DMA in value, the part then returns to bullish.

Mish within the Media

Mish sees alternative in Vietnam, is buying and selling SPX as a spread, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole focus on particular inventory suggestions and Fed expectations on TD Ameritrade.

Mish joined the March 10 closing bell protection on Yahoo! Finance, which you’ll be able to see at this hyperlink!

Mish goes by way of the macro by way of key sectors and commodities on this look on CMC Markets.

Mish joins Mary Ellen McGonagle (of MEM Funding Analysis) and Erin Swenlin (of DecisionPoint.com) on the March 2023 version of StockCharts TV’s The Pitch.

Mish talks ladies in finance for Worldwide Ladies’s Day on Enterprise First AM.

Mish focuses on protection shares on this look on CNBC Asia.

Mish factors out a Biotech inventory and a Transportation inventory to look at if the market settles on Enterprise First AM.

Mish joins Maggie Lake on Actual Imaginative and prescient to speak commodities and setups!

Examine Mish’s article concerning the implications of elevated sugar costs on this article from Kitco!

Whereas the indices stay vary certain, Mish exhibits you many rising tendencies on the Wednesday, March 1 version of StockCharts TV’s Your Each day 5!

Mish joins Enterprise First AM for Inventory Selecting Time on this video!

See Mish sit down with Amber Kanwar of BNN Bloomberg to debate the present market situations and a few picks.

Click on right here to look at Mish and StockCharts.com’s David Keller be a part of Jared Blikre as they focus on buying and selling, recommendation to new traders, crypto, and AI on Yahoo Finance.

In her newest video for CMC Markets, MarketGauge’s Mish Schneider shares insights on the gold, the S&P 500 and pure gasoline and what merchants can count on because the markets stay blended.

Coming Up:

March sixteenth: The Closing Bar with Dave Keller, StockCharts TV, and Twitter Areas with Wolf Monetary

March twentieth: Madam Dealer Podcast with Ashley Kyle Miller

March twenty second: The RoShowPod with Rosanna Prestia

And down the highway

March twenty fourth: Opening Bell with BNN Bloomberg

March thirtieth: Your Each day 5, StockCharts TV

March thirty first: Competition of Studying Actual Imaginative and prescient “Portfolio Physician”

April 24-26: Mish at The Cash Present in Las Vegas

Could 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): 390 stays extremely pivotal, particularly on a closing foundation.

- Russell 2000 (IWM): Calendar vary help stage at 172.00, resistance 180.

- Dow (DIA): 310 help, 324 resistance.

- Nasdaq (QQQ): 290 the 50-DMA help, 294 the 50-WMA resistance.

- Regional Banks (KRE): Examined close to the 50 resistance stage and closed simply barely above 44 help.

- Semiconductors (SMH): 240 pivotal support–strongest, but nonetheless beneath the 2-yr biz cycle.

- Transportation (IYT): Confirmed Distribution Part and weak close–under 219 means hassle.

- Biotechnology (IBB): 126.50 shifting common resistance.

- Retail (XRT): 60 huge help, 64 huge resistance.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary info and schooling to hundreds of people, in addition to to massive monetary establishments and publications corresponding to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the High Inventory Decide of the 12 months for RealVision.

Subscribe to Mish’s Market Minute to be notified at any time when a brand new submit is added to this weblog!

[ad_2]