[ad_1]

From electrical switches and photo voltaic panels to chemical-producing catalysts, silver is an integral part in lots of industries. It’s malleable and ductile, making it good for jewellery and silverware. Silver can be one of many world’s finest conductors of electrical energy, permitting its use in digital elements and micro-electronic gadgets.

Its distinctive properties make it practically unimaginable to substitute and its makes use of span a variety of purposes. Nearly each laptop, cell phone, vehicle and equipment accommodates silver. The valuable metallic is in demand for a lot of inexperienced applied sciences: electrical automobiles use nearly twice as a lot silver as inner combustion engines; photo voltaic panels comprise it, and their set up is rising. 5G/cell phone know-how makes use of silver.

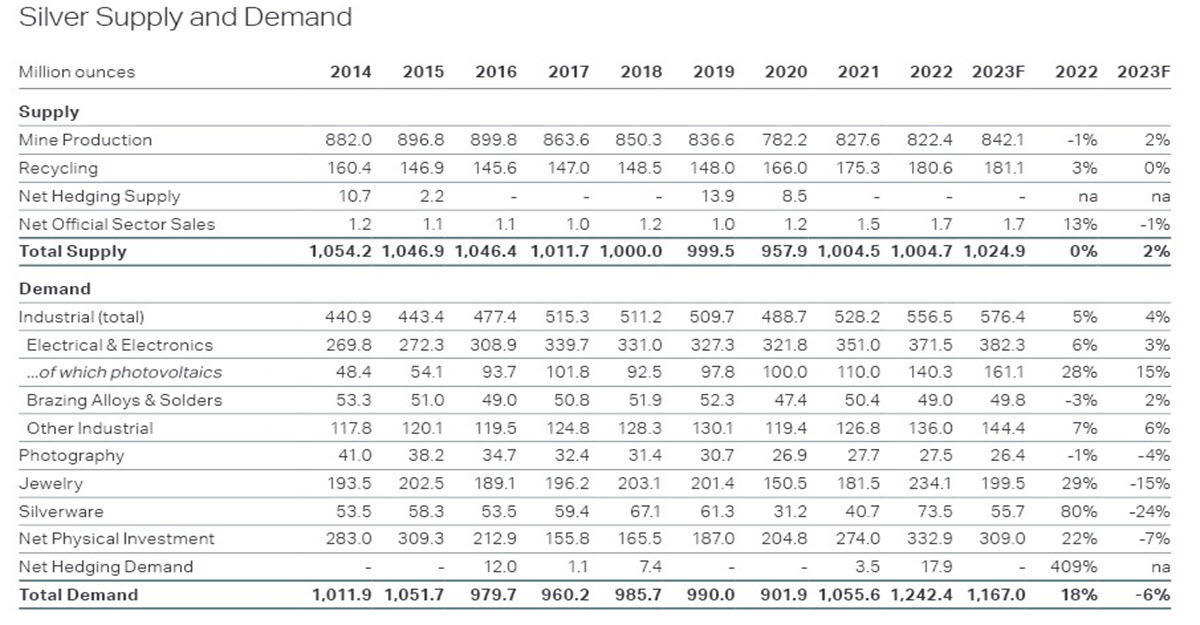

This development in industrial demand ought to assist the silver worth going ahead: in 2022 it was a whopping 556 million ounces. But additionally Funding demand for bodily XAG – which fluctuates yearly – grew 18% to 332 million ounces final yr (regardless of the most important annual decline in ETF holdings). Above is a desk displaying provide and demand for the valuable metallic, courtesy of The Silver Institute.

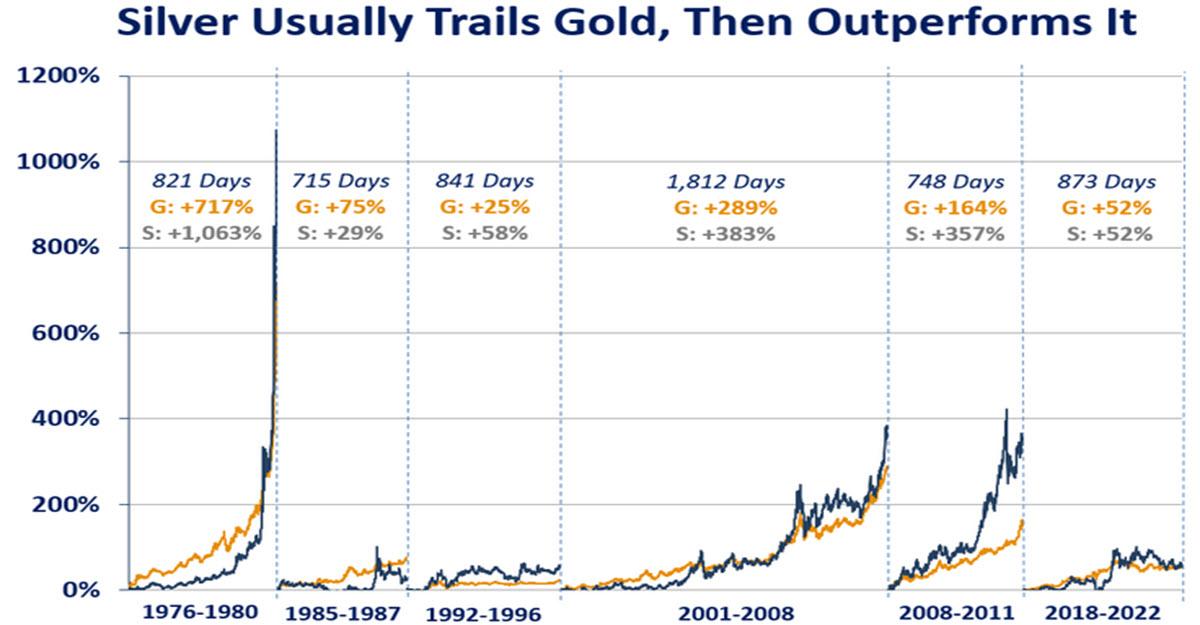

By way of worth actions and volatility, silver has a powerful relationship with gold – amongst others -although it tends to have a moderately larger Beta (it strikes extra, throughout some bull markets as much as 2.5x instances extra).

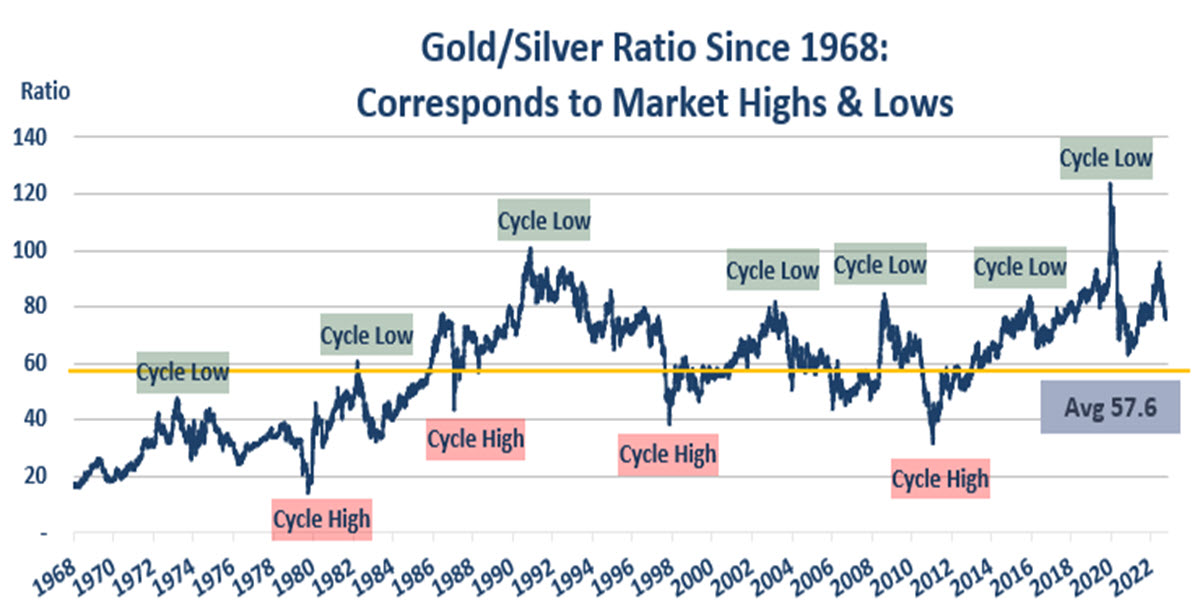

The Gold/Silver ratio – which we will see beneath – is known and sometimes thought-about: it’s merely the ratio between the 2 metals and has averaged 57.6 during the last 55 years (gold is many instances dearer than its shiny little cousin). Over the past 5 years each time it has touched the 90 zone it has been strongly rejected: it at present stands at 83.72 after having touched 91.4 at first of March. This can be a degree 45% larger than the 57.6 common.

Technical Evaluation

From a technical perspective, it has caught our eye as a result of, like gold however maybe extra clearly, it’s now attacking the descending trendline which started in April 2023: the response might be attention-grabbing, as in the mean time it’s tough to attract indications from indicators resembling RSI (47.86) or Transferring Averages (the worth is between MA50 and MA200, <$1 aside); if the worth is definitely pushed down, the realm of $21.55 aprox might be an necessary goal and assist, having already been such in 2021 and 2022. Not an excessive amount of decrease, near $21, passes the attainable bullish development of this very long run pennant.

If the downtrend had been to be breached there would in all probability be room even as much as round $24.50 to start out and possibly as much as $25.30 within the mid-term.

However each the 10-year actual rates of interest are at new highs within the 1.815% space and the dynamics of the Gold/Silver ratio in all probability go in opposition to this second risk regardless of the promising demand dynamics.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]